As this frustrating range-bound consolidation continues, we can thank our friends down under for the possibility of the second day of bullishness as Australia cuts interest rates to just 75 basis points. Of course, we can’t rule out the possibility of a pop and drop pattern by the end of the day, but at least for now the bulls seem inspired to follow-through on yesterday’s rally. With the uncertainty of 4th quarter earnings and China trade negotiations scheduled in the new 2-weeks, I wouldn’t be all surprised to see the price action remain choppy and range-bound.

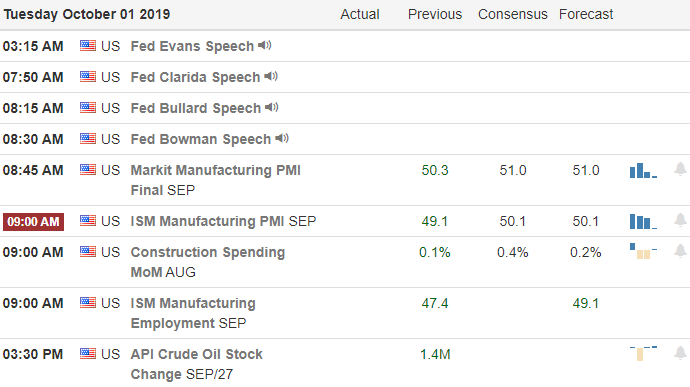

Overnight Asian markets recovered from early bearishness to close mostly higher in reaction to the Australian rate cut. European markets are not sharing in the bullishness currently flat to mostly lower this morning. US Futures point to a modestly bullish open ahead of PMI, ISM, Construction spending reports as well as a parade of Fed speakers. It would seem October will continue to face considerable uncertainty and likely to remain news-driven with enough daily gaps and overnight reversals to keep traders guessing, What comes next?

On the Calendar

The Tuesday Earnings Calendar says we will hear from just seven companies reporting results. Notable reports include MKC and SFIX.

Action Plan

We can thank Australia for slashing its interest rates to a new record low of just 75 basis points inspiring the possibility of a seconded day in a row of bullish price action. During the night, Asian markets were struggling until the rate cut but closed the trading day mostly higher on the news. US indexes remain locked in a choppy range-bound consolidation that but except for the QQQ’s have successfully held their 50-day morning averages. On the whole, I would have to count that a win for the bulls considering all the swirling uncertainty the market faces.

With 4th Quarter earnings just 2-weeks away, it’s sadly possible; the market could continue in this choppy and challenging consolidation. With Washington politics in utter chaos and pending China Trade negotiations set to begin in a couple of weeks, we should expect October to remain a challenging news-driven market with enough gaps and overnight reversals to test the discipline of even the most experienced traders.

Trade Wisely,

Doug

Comments are closed.