With the world is watching and inquiring minds wait in anticipation for the release of the Employment Situation number and how it will impact today’s open. Can it provide the bullish inspiration needed to follow-though on the hopeful bullish hammer patterns left behind yesterday, or will is disappoint adding fuel to the fire of a slowing US economy? How we end this trading week will greatly depend on this key metric and will shape how the market opens today.

Asian markets were mixed overnight as Hong Kong imposes emergency law as anti-China protests continue to disrupt the city. As of the writing of this report, European markets are mixed but mostly higher, but expect that also greatly fluctuate depending on the result of the US Employment numbers this morning. US Futures are currently pointing to a lower open, but that’s likely to change significantly after the 8:30 AM release of the Employment number. Buckle up; it could be a volatile end to a week of technically damaging and tumultuous price action.

On the Calendar

On Friday’s Earnings Calendar, we have just five companies reporting results today with none that would say are market-moving or particularly notable.

Action Plan

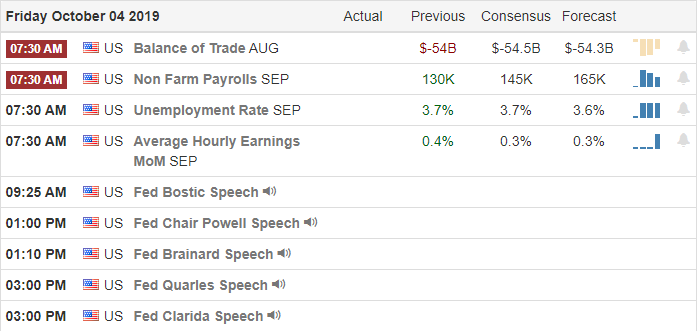

Our last notable earnings report for the week, COST, slightly beat on estimates but seems to have disappointed investors that were hoping for a strong showing for the quarter. Interestingly that single report seemed to influence the trading of the overnight futures. Protests continue to have damaging impacts on Hong Kong after the city declared emergency law last night. This morning’s total focus of the market focus on the Employment Situation number that comes out an hour before the market open. The consensus is expecting 145K jobs with a low range of 120k and upper range of 179k. Of course a surprise beat or miss of the key metric could have a profound impact on how the market opens today.

Yesterday the Dow briefly dipped below it’s 200-day moving average while the SPY and QQQ managed to bounce before reaching this key support. Unfortunately, the IWM is well below the 200-day average and will soon display the death-cross with the 50-day dipping below its 200-day. All the indexes experienced a nice bounce rally yesterday leaving behind hammer candle patterns seen as potential bullish. However, if price action is unable to follow through to the upside today the significance and hopefulness of the hammer pattern diminishes dramatically. Thus, there is a lot at stake for the Employment Situation report, and the world is watching.

Trade Wisely,

Doug

Comments are closed.