Volume at Price Indicator

In this E-learning session we covered the Trading Earnings and answering questions.

Good morning everyone everyone. Due to a short term internet outage I didn’t have the time to write the full blog today. However we must stay focused on price action and expect the market will either be pushed or pulled by the big round of earnings today.

Notable earnings include CMG, ARCH, BIIB, BYD, CNC, DFS, FITB, HAS, IRBT, JBLU, KMB, LMT, MCD, NAVI, NEE, NVS, NUE, PG, PHM, RRC, RF, SHW, SIX, SKX, TXN, TRU, TRV, UTX, UPS & WHR.

We also have the potential market-moving Existing Home Sales numbers at 10:00 AM Eastern today. Consensus is expecting a slight decline.

You can watch the Morning Market Prep with the link below and I wish you all a great day everyone!

Monday saw a strong gap up in the SPY, QQQ and especially IWM. (DIA did not get the memo.) After that gap, the SPY and QQQ had a nice day, but the DIA just treaded water and the IWM may have printed a Shooting Star candle (subject to confirmation). In supporting roles, the Transports (IYT) and Semiconductors (SMH) also both put in very strong candles. As a result, the uptrend remains intact. It looks as if the Bulls want to at least test those all-time highs again.

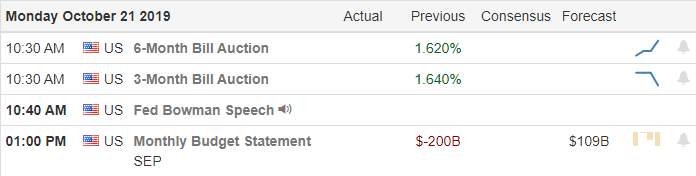

Earnings season will really be the focus for the remainder of the week. In fact, there are too many major reporters to list individually today. However, suffice it to say we’ll see more industrials and Consumer names this week. The only economic news on the day will be a Fed speaker (Bowman).

Overnight, Asian markets were up, but European markets are mixed at this point. As of 7:30 am, U.S. futures were flat to slightly green across the major indices. It looks like PG is going to gap up and HAS to gap down on earnings this morning.

If earnings remain strong, this should stay a bullish market. (Assuming no unexpected bad news, of course.) However, in recent months trading has been very volatile and “whippy.” So, be sure to use caution, take profits along the way and trade your plans.

Ed

For Your Consideration: These trade ideas for your swing-trading consideration. Long – AAPL, KLAC, MCHP, CM, ABBV, HES, NRG, JBL, TPR, WU, GME Short – LSCC, LDOS, SBUX, CME, BLL, MYL, MDT, HEI . Trade smart, take profits along the way and trade your trade. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Though trade and Brexit issues continue to plague the market with uncertainty, this week’s ramp-up of 4th quarter earnings will draw all the attention. As we begin to hear results from industrial’s , multi-nationals, and big tech let’s hope they can follow the lead of the big banks producing earnings that support or bolster current prices. Trouble at BA and JNJ will need some strong results out of companies such as CAT that reports this week to counterbalance the index. As always, with earnings, anything is possible, so remain flexible and focused on price action for clues.

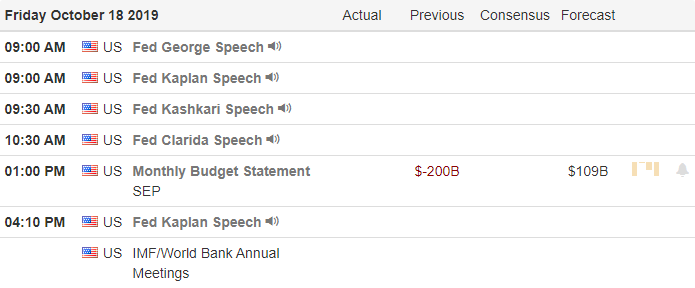

Asian markets closed the day cautiously green across the board amid Brexit uncertainties while European indexes shrug off concerns putting on a brave face with all indexes trading modestly bullish this morning. US Futures ahead of earnings reports and a quiet economic calendar currently indicate a slightly bullish open having declined slightly from overnight highs. Ready or not, the earnings ramp-up volatility begins.

The Monday Earnings Calendar has over 60 companies expecting to report results today. Notable reports include ACC, CE, TACO, ELS, HAL, LOGI, PETS, AMTD, & ZION.

Friday proved to be an interesting day of price action after learning that BA may have misled the FAA and that and that JNJ may have been selling baby power with trace amounts of asbestos. With both companies included in the Dow average, the index had a very tough day falling 255 points by the close. The Brexit uncertainty also likely played a hand in the reduction of risk as we headed into an expected vote. Unfortunately, we now know that the Prime Minister was forced to ask for an extension and postponed the divorce deal vote. Now we wait to find out if the EU officials will grant the extension with the deadline rapidly approaching.

Looking over the technicals, the DIA took the brunt of the damage on Friday, but all in all, the indexes held above important price support levels and their 50-day averages. Futures have softened slightly from overnight highs, but at the time of writing, this report suggests a modestly bullish open this morning. With 4th quarter earnings ramping up and several market-moving reports on the economic calendar with week price action volatility is likely, and anything is possible. Let’s hope as industrials, and big tech begin to report they can follow the lead of the big banks with better than expected results.

Trade Wisely,

Doug

Friday saw a gap down, followed by indecisive, but generally bearish trading. This came in the face of more strong earnings reports (earnings were very strong all week). The major exceptions to the indecision were JNJ, BA, and NFLX which got hammered on nasty news items or post-earnings blues. The offsets of good earnings, bad news for big names and the wait for an expected Brexit Deal resolution drove a “wait and see” attitude among traders. However, the negative day did break the recent uptrend, at least in the DIA and QQQ.

Despite expectation, on Saturday the Brits kicked the can down the road again. Parliament approved an amendment to the “new Brexit deal” bill, which meant that passing the actual deal would only mean actual approval AFTER all the nitty-gritty detail bills are also passed. So, the PM canceled any vote on the deal itself. This left him legally required to ask for another extension from the EU. Instead, the PM sent an “unsigned letter” requesting an extension, along with a second “signed letter” asking that no extension be granted. (A Court will decide Monday whether that means the PM is in Contempt of Court for the disingenuous extension request.) Either way, the EU is now planning to stall on a reply in hope that PM Johnson can get the deal approved before they reply. This all leaves more indecision for markets.

Other weekend news of note is that a Goldman-Sachs banker was arrested for insider trading and on the plus side, Chinese Vice Premier Liu said there had been substantial progress in the US-China Trade Talks.

Monday’s economic calendar is basically empty, with a light week overall. However, earnings are in full swing with many reports. Among these are HAL before the open and CDNS, CE, and ZION after the close.

Overnight, Asian markets were mixed, but European markets are in the green at this point. As of 7:30 am, U.S. futures were all pointing to 0.30% gap higher across the major indices.

Remember to be careful chasing. If earnings remain strong, this should be a bullish market. However, in recent months trading has been very news-driven. So, be sure to use caution, take profits along the way and trade your plans.

Ed

For Your Consideration: These trade ideas for your swing-trading consideration. Long – DE, DG, NKE, BBY, CM, NRG, WU Shirt – BHGE, DD, SBUX, VRSK, WEC, FIS, ACN. Trade smart, take profits along the way and trade your trade. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

In this combined HRC & RWO Member E-Learning we discussed the how planning, discipline and rules are necessary if your to have a productive win/loss ratio

Price action over the last few days has been quite choppy, but technically there may be a silver lining forming in the index charts. As price continues to challenge overhead resistance a nice resting consolidation appears to be forming. After all the wild price swings, a consolidation above 50-day averages allows the averages time to catch up, providing bullish support to prices. Of course, political unrest and earnings could easily bring back the wild volatility, but for now I see this consolidation as productive and bullish.

During the night China reported their economy grew less than expected at 6 percent, closing Asian markets mixed but mostly lower. European markets are trading very cautiously this morning ahead of crucial Brexit vote coming this weekend that, according to reports, may not have the support needed to be successful. US Futures also indicate a flat and cautious open ahead of earnings reports and an uncertain weekend vote.

On the Friday Earnings Calendar, we have 37 companies as we wrap of the first week of 4th quarter earnings. Notable reports today include AXP, CFG, KO, KSU, MAN, SLB, STT, SYF, & VFC.

Once again, the Bulls tested resistance levels on the news of a draft Brexit agreement, but a decline in Housing Starts tempered their enthusiasm. This morning we have learned that the draft agreement has a tough challenge ahead and could fail in Parliament according to a preliminary headcount. China reported last night it’s economy grew slower than expected in the third quarter at 6 percent.

Although the market seems to be struggling with overhead price resistance with all the political uncertainties that continue to disrupt market sentiment, technically, there may be a silver lining forming in price action. After such a strong rally higher is looks as if the indexes are settling into a consolidation, allowing long-term averages time to catch up and building a platform that has the potential to be very bullish. Of course, earnings and politics will have a lot say about future direction, but as of now the bulls seem very determined. As we head into the uncertainty of the weekend, plan your risk carefully.

Trade Wisely,

Doug