Earnings Season Kicks Off

Monday was a blah day in markets as traders seemed to wait on the next news. Regardless of the cause, all four major indices put in indecisive Doji candles just South of Friday’s close. This was done on VERY light volume. Perhaps traders are waiting on the earnings season that kicks off today.

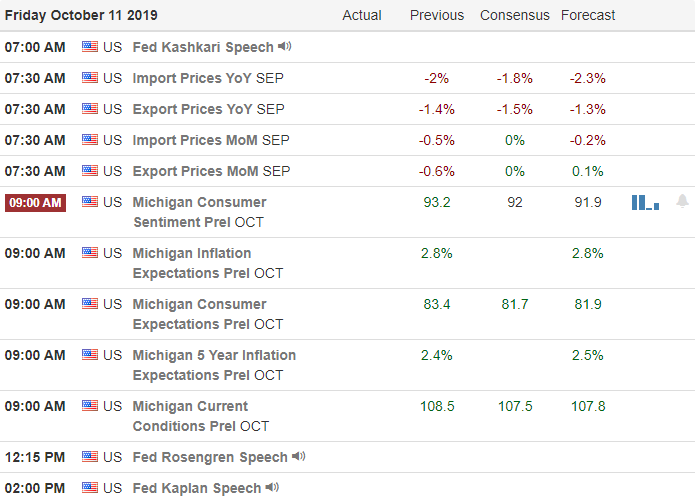

Overnight, the US applied sanctions on Turkey in a belated attempt to avoid looking like we abandoned the Kurds. However, Turkey is such a small trading partner that I doubt this impacts markets. Today’s economic calendar only the Empire State Manufacturing Index and a handful of Fed speakers. Neither is likely to drive markets unless there is a major surprise. What very well may drive markets are earnings as we hear from C, GS, JPM, WFC, BLK, JNJ, UNH (among others) all before the Open and UAL and JBHT after the close.

Asian and European markets were both mixed overnight. However, as of 7:30 am, US futures are pointing toward a gap up of 0.40%.

Remember to be careful picking bottoms or chasing gaps. As Rick says, a profit trader’s job is to take their bites out of the middle of the sandwich. Leave the crusts for knife-catchers and Top-pickers who won’t be around long. So, be careful until the recent tendency toward “gaps and whiplash” has worked itself out.

Ed

For Your Consideration: Trade ideas for your swing trading watchlist. Short: SHAK, SBAC, SBUX, LDOS, SMPL, PG, YUM – Long: DOCU, HCP, SYY, MPC, AIV, LEN, BF.B, NWL Trade smart, take profits along the way and trade your trade. Stocks we mention and talk about are not recommendations to buy or sell.

✅ SMS text alerts and reminders?👈

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service