Sunday Look at Week Ahead

Better than expected jobs numbers, solid earnings, strong consumer spending, and an accommodative FOMC continues to melt-up the indexes this morning. Tariffs and trade seem to no longer be of concern as the bulls continue to stretch the indexes higher breaking records along the way. However, I want to offer up a word of caution as we gap to new highs this morning. The SPY and QQQ are stretched a long way from their 50-day averages and remember that sometimes gap up opens produce pop and drop patterns. Be careful not to chase, keeping in mind gap up opens is a great time to take some profits.

Overnight Asian markets closed mixed but mostly higher on optimism of a huge Asian Pacific trade deal expected in 2020. European markets are bullish across the board this morning on renewed trade optimism, and the US Futures are in full-on beast mode ahead of earnings and economic reports. Currently the Dow is expected to gap more than 125 points breaking above price resistance to make a new record high at the open.

We have a massive week of earnings reports this week, with more than 1600 companies reporting. We get started with more than 200 reports today. Notable reports include UBER, AAN, AWR, APLE, WTR, BHC, CC, CDE, ED, RACE, FE, FRPT, GCI, GRPN, HTZ, MAR, MOS, PXD, PBPB, PRU, O, SHAK, S, SYY, & UAA.

The bulls are in beast mode this morning, and the DIA is likely to join its compadres the SPY and QQQ with a new record breakout as long as it doesn’t stumble before the open. As always I will be watching the open closely, but I will not chase the move with the fear of missing out. Instead, I will focus on the price action making sure buyers will show up to support the gap. Big gap up opens can often produce the dreaded pop and drop pattern, so waiting a few minutes won’t hurt anything and may, in fact, provide an opportunity to take some profits. Gaps are gifts!

Friday’s big rally pushed the T2122 indicator near the bearish reversal zone, and this morning’s gap could stretch the indexes right to the top. One thing that gives me a little pause this morning is that BA is looking to gap up even-through weekend news suggests there could be further delays getting the 737 Max back in the air. However, if earning’s continue to roll in strong and the Factory Orders number is good, we could rip higher squeezing out any remaining short-hands. We have had much better earnings than the market expected with strong consumer buying, and an accommodative FOMC the melt-up could easily continue to stretch the indexes higher.

Trade Wisely,

Doug

Strong earnings and an unexpectedly strong jobs report caused a gap up and strong day as the bulls ran hard. The SPY and QQQ closed at new all-time highs. Meanwhile, the DIA is closed near its all-time highs and the IWM also had an extremely bullish day (closing at the high since May). The bulls were certainly running Friday.

Over the weekend, the CEO of MCD was fired (had an affair with an employee) and it was reported that Warren Buffett is now holding 10 times his normal amount of cash. (This may indicate he just feels many stocks are over-valued up at all-time highs.) The ATP (an Asian Trade pact similar to NAFTA, but excluding the US), which was created because President Trump decided to pull out of a similar pact the US had started and was close to having in place, took another step toward ratification (expected next year). Finally, the Saudis announced Sunday that Aramco, the world’s most profitable company, will be listed (as expected) on the Saudi stock exchange in December.

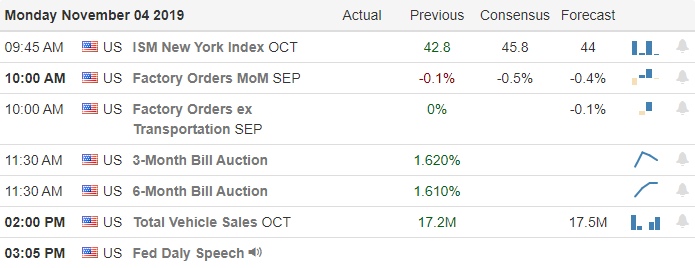

Monday’s economic calendar is limited to September Factory Orders at 11 am, but even though we are now past the half-way point, earning continue. In a pre-market report, UA posted a beat. However, CNBC reports US is also under Federal Investigation for Accounting fraud.

Overnight, Asian markets were green. In Europe, markets are also bullish at this point. As of 7:30 am, U.S. futures were green, looking for about a gap up of between 0.4% and 0.5%.

It certainly appears the bulls want to continue their strong run from Friday. China Trade War twists and turns, as well as more earnings, remain ahead. However, the bulls have the bit in their teeth early this Monday Morning.

Ed

Swing-Trade Trade ideas for your consideration. Long – FLS, ITW, PM, MHK, AMP, ALK, LUV, INTC, PG, INFO, RF, MS, BBT, TSM, C, BF.B, OLLI, DE, BERY, STX. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Although it was disappointing to see the bearish price action yesterday, the end of day rally indicated the bulls are still in control as price supports proved strong. Of course earnings will play a big role this morning; the majority of the attention of the market will likely turn to the big economic reports to find inspiration. We have had a very event-driven but with more than 1600 companies expected to report next week there will no time to take a break. Plan your risk into the weekend accordingly.

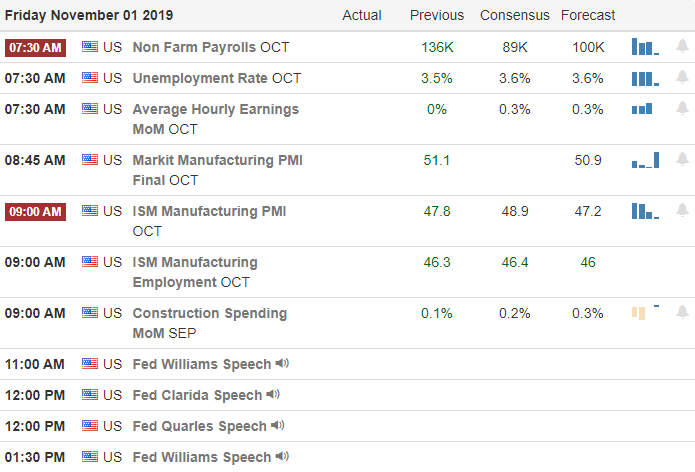

During the night, Asian markets close their trading week mixed but mostly higher after their government expressed long-term trade concerns. However, European markets see modest gains across the board this morning. US Futures are also showing bullishness this morning, pointing to a modest gap up ahead of the Employment Situation number and earnings results. Keep a close eye on the ISM Mfg. number at 10 AM Eastern as it may prove to be the biggest market-moving report of the day.

We get a little break on the Friday Earnings Calendar with just over 100 companies reporting. Notable reports include ABBV, BABA, LNG, CVX, D, XOM, LYB, NWL, STX, X, and WPC.

Yesterday’s price action was disappointing after China’s unfavorable comments regarding trade. However, a late-day rally saved the index charts from technical damage, and the bulls remain in control. Although we have a significant day of earnings, the major focus will be in the Employment Situation report and the ISM MFG number that may prove to be the biggest market-moving numbers of the day.

As we head into the uncertainty of another weekend, remember to take some profits. Although we seem to have kicked the Phase 1 trade deal and Brexit down the road and have the FOMC behind us, we can’t become complacent in this very news-driven market. With all the major indexes holding support and well above their 50-day averages, I remain bullish though somewhat cautious as prices work to prove support. Remember, we have a very big week of earnings, with more than 1600 companies expected to report, so rest up this weekend the coming week will require us to be at our best.

Trade Wisely,

Doug

Despite strong earnings Wednesday night and premarket on Thursday, markets could not overcome bad news out of the Trade War. Reports out of China say they won’t budge on the major issues (subsidies to companies, industrial policy and Intel. Property), don’t trust President Trump to keep any deal and doubt any long-term agreement can be done while he is in office. Meanwhile, the White House says they still expect to sign the phase one agreement (just to not make things worse) on the same schedule as before the Chile Conference was canceled.

The net result was that the bears had control of the markets all day on Thursday. The four major indices ended up printing Hanging Man type candles. The good news is that all four also managed to climb back above Support by day end. Also, after the close Thursday, ANET, FTNT, QRVO, and WU all reported beats.

Friday’s economic calendar includes Oct. Nonfarm Payrolls (8:30 am) and ISM Mfg. PMI (10 am). There will also be several FOMC speakers in the afternoon (which will probably have no impact this quickly after the Fed Statment). However, earnings are still likely to be the driver with AIG, ABBV, BRKB, CBOE, CL, D, XOM, LYB, NWL, PCG, STX, SRE and CVX all among those reporting before the bell today.

Overnight, Asian markets were mixed. In Europe, markets are also mixed, but mostly green at this point. As of 7:30 am, U.S. futures were green, looking for about a one-third of a percent gap up.

China Trade fears remain front and center as of Thursday. However, earnings remain generally strong, with a few exceptions. Remember this is Friday (payday). So take some off the table where you can. Be cautious as there are many earnings still to go, likely more twists in the Trade War saga and two days ahead when you can do nothing about a report (or tweet) if you are long or short.

Ed

Normally, we have no trade ideas for Fridays. However, in honor of the Open House, here are some Swing-Trade Trade ideas for your consideration. Long – PM, PCAR, PNR, PKG, NEE, INTC, APH, INFO, TSM, PPG, BF.B, DE. Short – MLM, BA, IBM, DRI. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

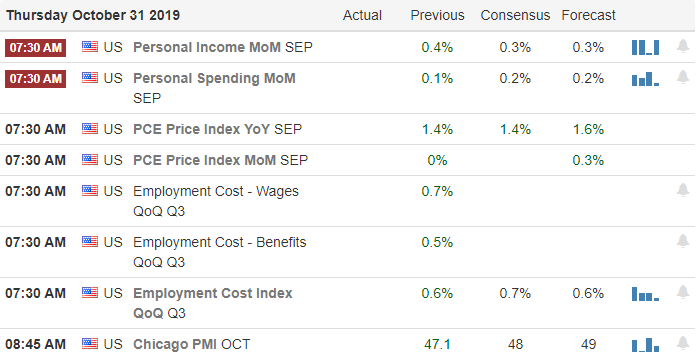

Lower rates and strong earnings reports inspire the bulls to reach out to new record highs in the SPY. Not only that, but both the SPY and QQQ successfully tested and held the support level of the recent breakout. Well done, bulls! Unfortunately, trade war uncertainty once again raised its ugly head during the night, tempering the bullish sentiment as we head toward today’s open that chalked full of enough earnings and economic calendar events to keep everyone guessing, what comes next?

Asian markets closed mixed but mostly higher after reporting their 6th straight manufacturing decline. European markets see only red this morning with rising doubts about the trade war deal. US Futures have slightly improved this morning from overnight lows but continue to point to a modestly bearish open due to trade war concerns. With the Employment Situation and ISM number on Friday, we should not be surprised to see a choppy day of price action as we wait.

The Thursday earnings calendar is a busy one, with nearly 340 companies expected to report results. Notable reports include MO, AMCX, AMT, ADM, CAR, AVP, BLL, APRN, BMY, CHD, CI, CLX, COR, DNKN, DD, EL, EXC, FCAU, FTNT, GLPI, HFC, IP, IRM, KHC, MELI, NNN, RMAX, SNY, SIRI, STOR, TRI, W, WU, WWE, XYL, and YETI.

We have and interesting set of circumstances facing the market this morning. A rate cut that the market wanted, good earnings reports yesterday, and another big day of them today, but the futures are reacting negatively to downbeat comments on trade from China. China was in the news for a second time last night, stating their manufacturing activity shrank for the 6th straight month due to trade war pressures. Congress is expected to vote today on the rules they will follow in the impeachment process, which is likely to be a distracting and firey side show of political gamesmanship.

Technically speaking, yesterdays price action turned out to be very bullish with the SPY and QQQ testing and proving to hold breakout support. Although the DIA still has a lot of work to do before it reaches new record highs, the bulls showed strength holding the downtrend breakout as support after a quick test. Trade war worries add another wrinkle in an already busy day full of earnings events and possible market-moving economic reports. If that’s not enough to keep the market guessing, remember, we still have the Employment Situation, and the ISM reports on Friday morning. Waiting on those could produce some choppy price action after the morning rush as we wait.

Trade Wisley,

Doug