Bulls Bang-out more New Records!

The bulls bang-out more new records pushing GOOGL into the 1 trillion market cap club and price to earnings growth hits the highest level since Bank of America started recording the metric in the ‘80s. How much further can you go? That’s anyone guess, but as retail traders, we must guard ourselves against getting caught up in the exuberance over-trading or chasing trades already up several days in their bull run. With a 3-day weekend approaching, it may be wise to take some profits and reducing risk in case sentiment happens to shift over the weekend.

Asian markets closed the trading week, seeing green across the board after China reported their economy grew as expected. European markets have also reached out to new record highs this morning in reaction to the big gains in the US and China news. This morning US Futures continue to climb, suggesting a modest gap up open ahead of earnings and economic reports.

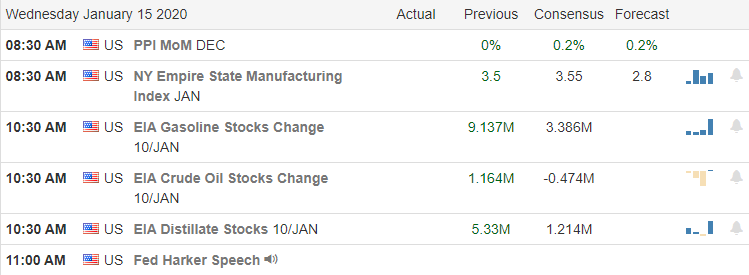

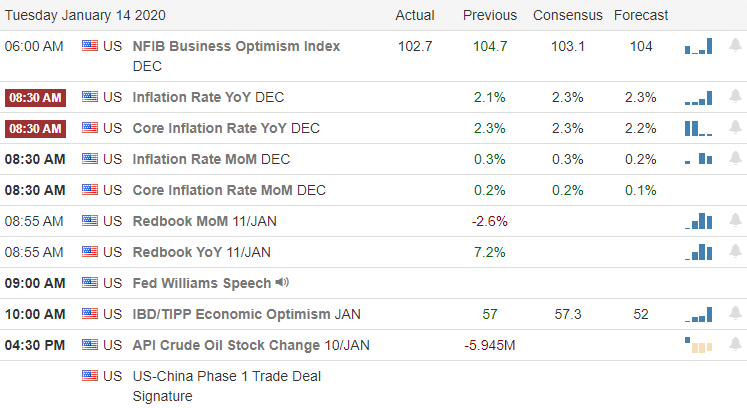

On the Calendar

On the Friday earnings calendar, we have 21 companies reporting results. Notable reports include CFG, FAST, JBHUT, KSU, RF, SLB, & STT.

Action Plan

More new records attained as the bulls continue to surge higher with wild abandon. Bank of America reported that Price to Earnings Growth is now 1.8 hitting the highest level since they began recording the number in the ’80s. For reference, a reading 1.0 PEG is considered an overbought condition. That said, nothing seems to stop the bulls from stretching this rally that pushed GOOGL to a 1 Trillion market cap during yesterday’s bullish session. With a three-day weekend approaching, futures currently suggest another gap up open and more record highs today with no sign of slowing down just yet.

Trading such an overbought condition requires a strong adherence to your trading rules. It’s very easy with all the bullish exuberance to get caught up, tossing caution to the wind and over-trade. I have no idea when the tide will change, but believe me when it does; you don’t want to be over-invested because the reversal can be swift and extreme. Stick to your rules, size your trades properly, don’t chase stocks well into their run or when they are testing price resistance levels, have an exit plan if you’re wrong and remember to take some profits along the way! I wish you all a wonderful 3-day weekend.

Trade Wisely,

Doug