Bulls Less Worried After WHO

After a rocky start (likely on coronavirus epidemic fears), markets rebounded in the afternoon to close near their highs Thursday. The SPY (up 0.25%) and the QQQ (up 0.32%) both closed at new all-time high closes, while the DIA closed slightly lower (down 0.09%), dragged lower chiefly by TRV, even after beating earnings expectations. The VXX also fell to 13.49 and the T2122 remains in mid-range at 50.74.

In the afternoon, the World Health Organization said it was a bit too early to consider the coronavirus a public health emergency worldwide, saying it remains a “local” Chinese emergency for now. As mentioned above, this seemed to help markets. However, this story continues to lead global news as China has locked down (quarantined) more cities each with millions of inhabitants (at least 40 million at this point) and banned public transportation in those areas. They have also banned the annual Lunar New Year celebration events that had been scheduled in Beijing.

While apparently most of the 26 deaths from this virus have so far been elderly patients with pre-existing ailments, the concerning news Thursday was that some of the confirmed cases have shown no fever. This is significant because the only screening tool available at the moment is measuring the temperature of travelers. So, any cases not showing a fever would slip through transport hub screening undetected.

In the US, the main story continues to be the impeachment trial. The House Managers (Prosecution) wrap up their pre-determined 3-days of presentation on Friday. The President’s Counsel then begins their presentation Saturday, with the speculation now being it will be shorter since the facts don’t seem to be disputed.

For markets, earnings still hold major sway as INTC posted a big beat (after rallying the last couple days, almost as if that was expected). Others posting beats after the close included DFS, TEFC, SIVB, SWKS, and ISRG. On the other side, ASML and RJF both posted misses.

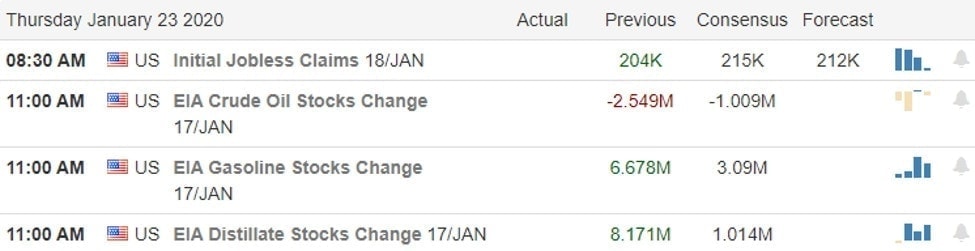

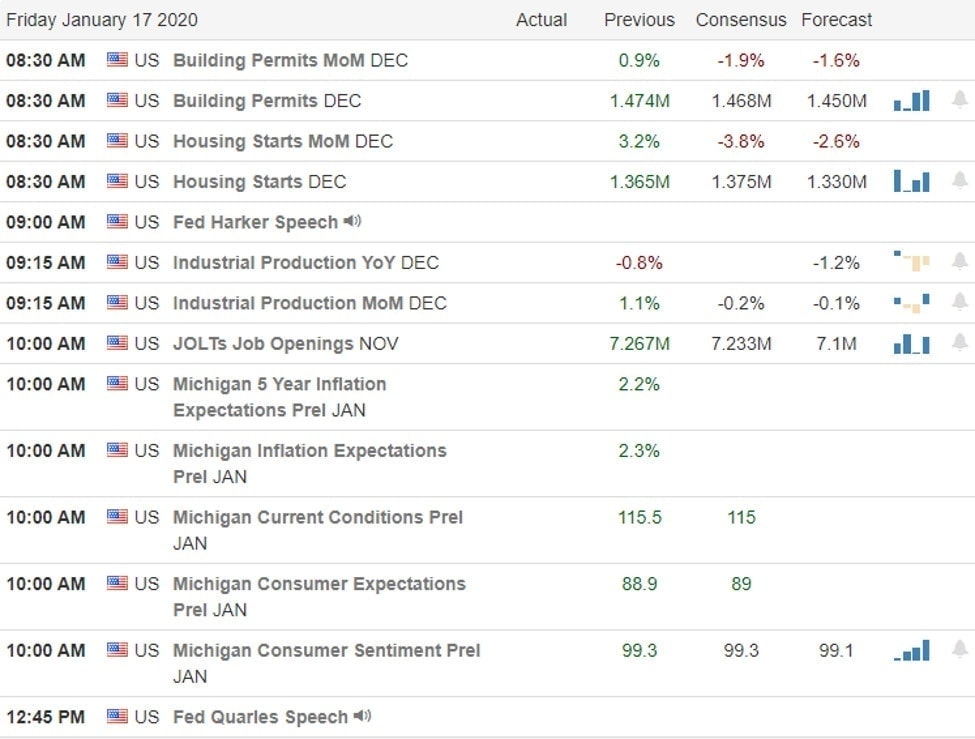

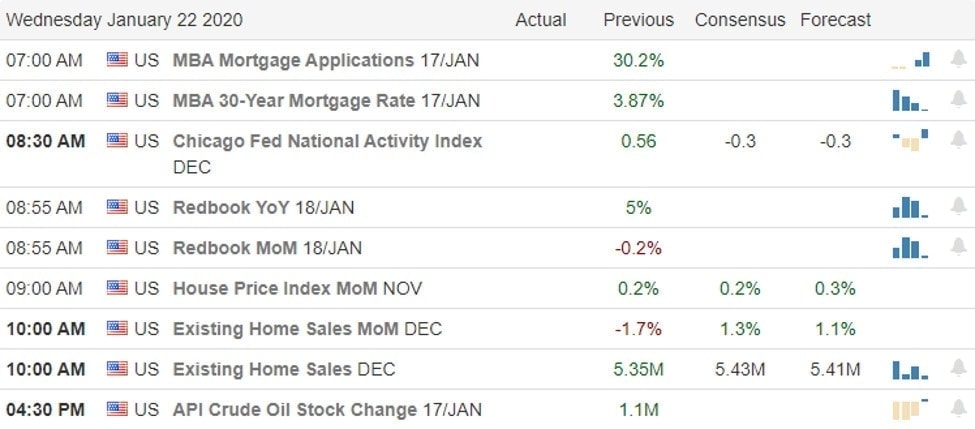

On Friday, the major economic news is limited to Jan. Mfg. and Services PMIs (both at 9:45 am). Major earnings reports are limited to APD, NEE, and WAT before the open, as well as AXP and SYF after the close.

Overnight, Asian markets were in the green. In Europe, markets are mixed, but mostly in the green at this point in their day. As of 7:45 am, once again U.S. futures are pointing to another gap higher of between a quarter and a half a percent.

The bulls remain resilient as the trend continues higher. Still, the charge is not head-long, perhaps with some combination of fear over Coronavirus, Impeachment, weekend news leading to a little caution. Regardless, the trend remains intact. So, while caution is warranted, don’t fight the trend. Look for long opportunities, hedge your risks, keep taking profits and move your stops to protect yourself. Above all, wait for the trade to come to you…plan your trade and trade your plan.

Ed

No Swing Trade Ideas for your consideration and watchlist on Friday. Remember to take profits and hedge your risks. It’s a long way to Monday with at least political and health headline risks in play. Trade smart, take profits along the way and trade your plan. Also, don’t forget to check for upcoming earnings. The stocks/etfs we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service