Bad news at Boeing and a spreading coronavirus roused the bears for a 150 point Dow pullback yesterday, but the futures point to gap up open this morning as the relentless bulls keep buying with no regard to the extended prices and historically high price to earnings ratios. As we begin our biggest day of earnings reports this quarter, it looks like the lowered analyst’s estimates could continue to fuel the markets even higher. However, a word of caution. With stocks priced well beyond perfection compared to earnings growth, keep in mind just one stumble could trigger a quick reversal, so plan your risk carefully.

Asian markets shook off concerns of travel restrictions due to the spread of the coronavirus to close green across the board overnight. European markets are however, muted at this hour showing mixed and cautious trading. US Futures tossed caution to the wind rising sharply overnight and continue to point to a substantial gap up as ravenous bulls can’t seem to buy up high priced stocks fast enough.

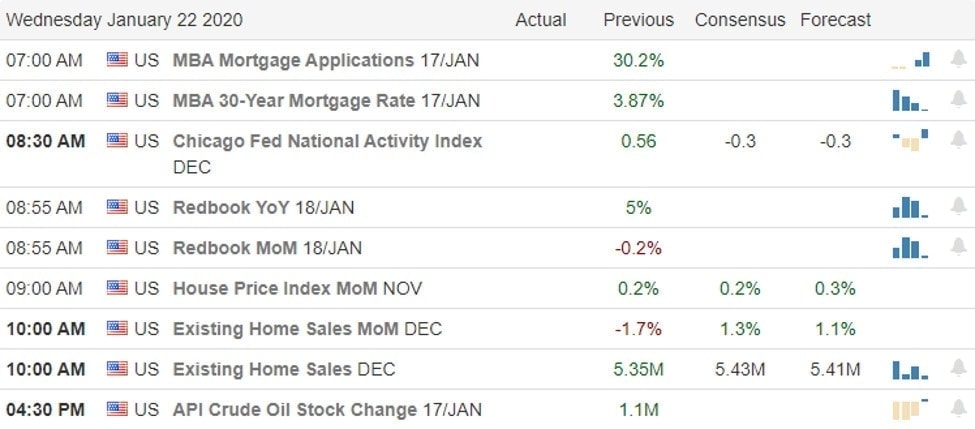

On the Calendar

On the Hump day earnings calendar, we have the largest number of reports so far this season, with over 80 companies fessing up to their quarterly results. Notable reports include ABT, ALLY, BKR, CTXS, FITB, JNJ, KMI, LVS, RJF, RCI, SLM, STLD, TER, & TXN.

Action Plan

A bit of nervousness about the coronavirus temporarily woke up the bears yesterday with concerns that this contagious and very deadly virus could damage the economy restricting travel around the world. Of course, the news that Boeing expects further delays before getting approvals to put the 737 Max back in the air aided in the selling yesterday after the company broke down below a key price support level. After the bell, NFLX posted better than expected earnings but disappointed on subscriber number particularly in the US and Canada. The initial price reaction was lower, but this morning NFLX is indicated modestly higher. IBM, after reporting five straight quarters of decline, finally found the right stuff to top analysts estimates as their acquisition of Red Hat helped them turn the corner.

Even with the 152 point decline in the Dow, yesterday index trends remain intact with no break of price supports in the daily charts. Futures have been in bullish mode all night long as we head into the biggest round of earnings so far this season. In an interview, the President proclaimed the Dow would be 10,000 points higher if not for the Fed and indicated he was in pursuit of another tax cut to help it along even more. Stay bullish but remember that many stocks are priced well beyond perfection. Any stumble could create a quick and substantial pullback so carefully plan your risk carefully and resist chasing stocks already running.

Trade Wisely,

Doug

Comments are closed.