The wild-eyed bullish charge slowed the last couple days as early rally’s struggled to hold onto the highs. However, the bears seem to be in hibernation with little to no willingness to even test index price supports. Trends remain bullish as we head into the biggest day earnings reports this week. The impeachment trial in the Senate seem to be little more than a distraction during the spreading coronavirus is stealing the media attention from the political drama. As earnings roll out anything is possible so stay focused on price and plan your risk carefully.

Asian markets closed seeing only red as China locked down two cities attempting to slow the spread of the virus that has now infected nearly 600. European markets keeping an eye out for an ECB decision and new worries about trade with the US currently have their indexed mixed but mostly lower this morning. Even the US Futures are displaying caution this morning with mixed but slightly bearish results ahead of a big day of earnings reports.

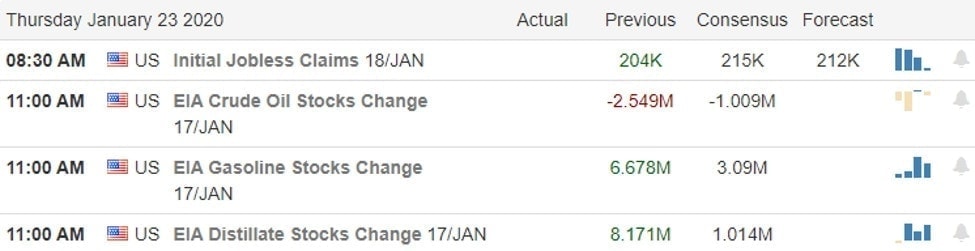

On the Calendar

We have our biggest day of earnings reports this week and the 1st quarter reports with more than 100 companies in the hot seat today. Some of the notables include AAL, CMCSA, DFS, ETFC, FCX, INTC, ISRG, JBLU, KEY, KMB, MTB, ORI, SWKS, LUV, TRV, UNP & VFC.

Action Plan

The little rally yesterday ended the day little changed with the Dow closing down less than 10 points. Although the indexes appear overbought and stretched away from key moving averages, the bears seem to be hibernating with little to no interest in attacking at the moment. During the night, China put 2 of its cities on lockdown as the coronavirus continues to spread with nearly 600 confirmed cases and 17 deaths so far. As a result, Asian markets were red across the board as the fear spread amongst investors. European markets are trading flat to slightly bearish this morning as they wait and ECB decision and the worry of trade issues rising after tough Presidential talk.

Overall index trends remain bullish and thus far, no daily price support levels have breached. To find anything remotely bearish in the indexes, you have to look at 15 min. charts to see downtrends possibly developing. With a big of earnings reports, anything is possible but futures are trading mixed to slightly lower this morning choosing a little caution rather than the wild-eyed bullishness we have experienced the last several weeks. I would not be at all surprised to see a surge of volatility this morning as earnings roll out.

Trade Wisely,

Doug

Comments are closed.