Jobless Claims Lead the News

The bulls refused to give back any more ground as they can smell those all-time highs just a quarter percent above in the SPY. So, stocks gapped up 0.80% and rallied in a volatile way all day long, closing in the top 20% of their range. On the day, SPY closed up 1.36%, DIA up 1.00%, and QQQ up a hefty 2.52%. As those numbers show, money flooded back into those high-tech, mega-cap FAANG stocks, especially TSLA on the follow-through to its stock split. VXX was down sharply to 25.50 and T2122 also dropped a touch to 91.94 (still well into the overbought territory). 10-year bond yields rose again to 0.67% as money chased risk and Oil (WTI) rose $42.59/barrel.

On the virus front, in the US, the numbers show we now have 5,360,488 confirmed cases and 169,135 deaths. The news cases Tuesday were 54,345, which is just under the 7-day average. However, again the 1,386 deaths were well above the average. The only real news on this front is concern over the data quality. The number of tests done in the most infected states (FL, TX, CA) have fallen in the last two weeks, as the national average number of daily tests has fallen 19% in that time. This reduction takes place even while the percent positive results has increased over that time. In addition, another group of three dozen public health advisors sent a letter to HHS extremely concerned about the Federally mandated change in data collection procedures and mechanisms causing inaccuracies.

Globally, the number of cases rose to 20,836,339 confirmed cases and 747,865 deaths. In Asia, China announced today that chicken (or perhaps its packaging) imported from Brazil tested positive for the virus. India reported 67,000 new cases, which was a record high for that country. Meanwhile, in Europe, France saw its largest increase in daily cases since May 6.

Overnight, Asian markets were mixed again, but this time lean to the green side of flat. The winners were led by Japan (+1.78%) and Singapore (+1.28%). The only loser of note was Australia (-0.67%). Elsewhere the Asian market could best be described as just on the green side of flat. In Europe, markets are broadly in the red so far today. The FTSE leads the losses (-1.14%), but everywhere except Russia (+0.46%) sees some red at this point in the day. In the US, as of 7:30 am futures are pointing to a flat open. The Nasdaq futures are just on the green side, while the SPY and DIA futures are just on the red side of break-even.

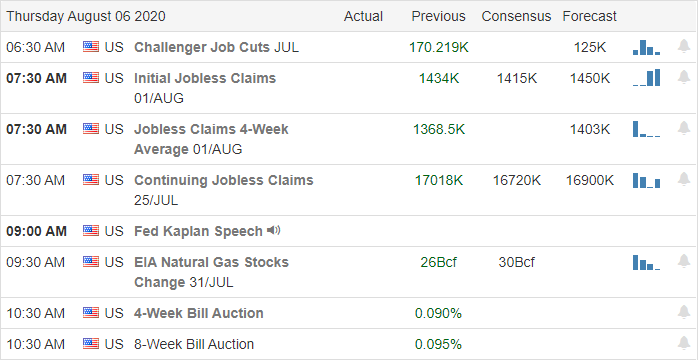

The major economic news for Thursday is limited to July Import / Exports and Weekly Initial Jobless Claims (both at 8:30 am). Major earnings are limited to ENS, NTES, and WCC before the open. Then after the close AMAT, BIDU, and IQ report.

The SPY sits just below its all-time high. It seems likely the bulls won’t give into a pullback before it tastes those sweet new highs. So, be careful betting on shorts until that has been accomplished. However, despite Tuesday’s black candle, markets remain quite extended. So, longs carry a fair bit of risk here too.

All we can do is either lighten up positions, tighten up stops or pay extra attention to any trend reversal. Stick with your trading rules and execute them with discipline. Don’t predict reversals or chase missed-moves, and don’t be greedy. Take your profits along the way. Remember, our job is to achieve trade goals consistently, not to hit the lottery.

Ed

The Daily Swing Trade Ideas for today: PHM, KHC, MAS, CL, FAST, DHI, EBAY, FTV, SWKS, KLAC. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service