A sharp rally followed by a nasty reversal selloff leaving behind bearish candle patterns and more questions than answers heading into 3rd quarter earnings. The VIX closed above a 32 handle showing a level of uncertainty not generally associated with new record highs. I suspect the volatility will remain quite high, making the navigation through earnings season quite challenging even for very experienced traders. Stay sharp and plan for just about anything in the days ahead.

Asian markets saw modest losses across the board even as their June trade data beat expectations. European markets are trading lower this morning as concerns of the spiking pandemic infections weigh on investor sentiment. US Futures again find the energy to pump up in the premarket trying to ignore yesterdays selling damage as earnings season begins. Anything is possible, so stay focused and flexible.

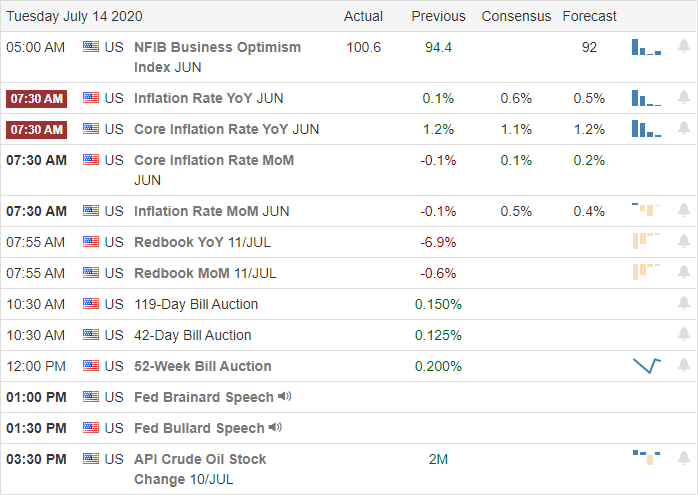

Economic Calendar

Earnings Calendar

Today we officially kick-off 3rd Quarter earnings with 14 companies fessing up to quarterly results. Notable reports include JPM, AMX, C, DAL, FAST, & WFC.

News and Technical’s

I’m guessing yesterday turned out to be a bit painful after the significant index gains quickly reversed after the Governor of California announced a sweeping roll-backs due to a 28% increase in infections. Two of the largest California school districts will not reopen favoring distance learning in an attempt to protect students and teachers from the virus. I had mentioned the possibility of a pop and drop pattern, but the way this reversal played out was strickly the sensitivity of the market to the news. Interestingly as the market rallied yesterday, the Absolute Breadth Index continued to decline. However, as soon as the selling began, the Breadth Index rallied with the selloff. I believe that a large portion of that problem is that just 5-companies now command a full 25% of the entire SP-500 weight. An imbalance that could become a significant problem should profit-taking take hold in the five heavyweights. Yesterday may have been a preview of what could happen if that should come to pass.

Technically speaking, the flash selloff yesterday adds a bit of complication to the look of all the index charts as we begin 3rd quarter earnings. The DIA left behind a nasty shooting star pattern that once again failed the 200-day average. It would appear ahead of earnings they bulls are pushing to test the 200 once again as resistance at the open. The SPY left behind a bearish dark cloud cover pattern failing to hold the break of the early June island reversal pattern. The NASDAQ was the first index to have reversed yesterday from a very extended run leaving behind a bearish engulfing pattern on the QQQ. IWM finished the day with a dark cloud cover pattern, and the VIX ended the day printing a reversal that broke above its 50-day average closing above a 32 handle. With the VIX so elevated and facing an uncertain earnings season traders should expect challenging price volatility. Stay focused, and flexible as anything is possible in the days ahead.

Trade Wisely,

Doug

Comments are closed.