Monday’s price action delivers bearish reversal patterns but fails to follow-though, so on Tuesday, the market is dealt another full price action reversal by the bulls. The VIX continues to remain very elevated, and the Absolute Breadth Index continues to decline as infection rates rise in 39 states. Interestingly so-called safe-haven issues in the consumer defensive sector had a very good day yesterday, and gold and silver values continue to climb. Indeed an interesting dichotomy for traders to navigate.

Asian markets trade mixed but mostly higher overnight, with the NIKKEI closing up 1.59%. European markets are in the full-on bullish mode this morning, reacting to the hopeful vaccine news. US futures are leaping higher this morning on the same vaccine news and in reaction to the GS earnings. At the moment, the Dow futures suggest a gap up open of nearly 450 points.

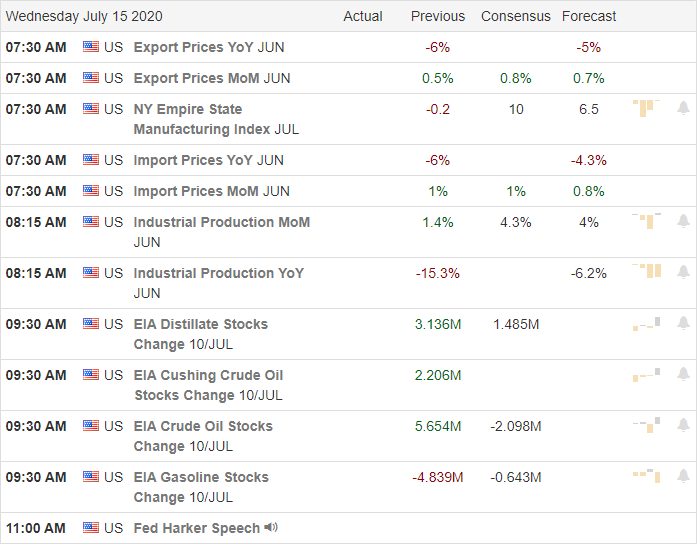

Economic Calendar

Earnings Calendar

On the hump day earings calendar, we have 27 companies reporting with our second round of big bank reports. Notable reports include AA, BK, GS, INFY, PNC, SNBR, USB, & UNH.

News and Technical’s

The game is on with 3rd quarter earnings with JPM reporting declining earnings results but, they beat the analyst’s estimates, so the stocks rallied. I suspect this will continue today as we progress through several significant bank reports this morning. A strong late-day rally pushed the Dow up 556 points reversing Mondays bearish reversal pattern that failed to follow through. Interestingly, Gold, Silver, and bonds rallied with the market as the Absolute Breadth Index continues to decline. The VIX pulled back below its 50-day average but remained elevated, closing the day above 29 handles and suggesting the wild price volatility is far from over. This morning futures point to a bullish follow-through in anticipation of earnings and a hopeful report from Moderna on a vaccine trial that produced a COVID-19 immune response.

Thirty-nine states now report rising infection rates with more than 65,000 new cases reported yesterday with more than 900 deaths. Adding to the tensions with China, the President yesterday signed a bill sanctioning them and ending Hong Kong’s preferential treatment status. China has, of course, already vowed retaliation but, as of now, has given no details as to what that might entail. Apple has won in EU courts, saying the company doesn’t have to pay nearly 15 billion in Irish taxes. Texas approves tax breaks for Tesla if they build the proposed 1.1 billion car plant near Austin. I suspect other states will soon join the bidding war for the construction. With less than 4-months to the presidential election, Joe Biden seems to be gaining momentum according to the latest poll. We can expect some market volatility as the race heats up, and the political rhetoric reaches a fevered pitch over the months ahead.

Trade Wisley,

Doug

Comments are closed.