Activity Does Not Equal Results

Member E-Learning discussing the traders win/loss ratio and that quality trades is more important than a quantity of trades.

Member E-Learning discussing the traders win/loss ratio and that quality trades is more important than a quantity of trades.

In this E-learning class to talked the how important it have goals and a plan to take profits if you want consistency in your trading.

Large-caps opened flat on Wednesday and then proceeded to put in a sideways, but bearish grind all day. The QQQ gapped up four-tenths of a percent and after a bit of roller coaster action rallied mildly most of the day. The SPY printed a Hanging Man candle while the QQQ printed a Spinning Top candle. On the day, SPY lost 0.15%, DIA lost 0.56%, and QQQ gained 0.61%. The VXX fell over 3.5% to 17.39 and T2122 rose deeper into the overbought territory at 96.93. 10-year bond yields were unchanged at 0.882% and Oil (WTI) rose to $45.24/barrel.

Bitcoin traders got a nasty shock after the close Wednesday. After reaching its all-time high during the trading day, after-hours Bitcoin fell nearly $3,000. No apparent cause for the plunge is known at this point. However, CNBC reports that most cryptocurrency experts do not feel this volatility will have long-term implications and they still expect it to reach $20,000 soon (which after this drop is 18% away).

AZN faced more scrutiny on Thursday when more details about their Phase 3 trial were released. It turns out that the mistake, which led to data implying a 90% efficacy rate, was based on a manufacturing problem. AZN mistakenly only put half doses of the vaccine in thousands of vials. Rather than scrap or remanufacture the product, AZN and Oxford University made the decision to just administer the half doses to a younger group of volunteers. So, while the 1.5 dose regimen did show it was 90% effective (versus 62%when 2 doses were administered to older volunteers), the data is skewed and the AZN quality control is in question. Worse yet, AZN and Oxford did not disclose this in their original statement. Instead, they just said 1.5 doses was 90% effective and on average the vaccine was 70% effective. Still, the vaccine was formally referred to the UK Medicines Regulator for assessment of fitness for approval.

On the virus front itself, infections continue to rage as the US. Despite a relative respite on the holiday (only 108,289 new cases) the US totals have risen to 13,249,447 confirmed cases and 269,597 deaths. The 7-day average of new cases to 179,923 while deaths are averaging deaths rise to 1,712/day. The Pentagon has instituted new restriction and protocols are cases climb on bases and ships.

Globally, the numbers rose to 61,448,892 confirmed cases and the confirmed deaths are now at 1,440,531 deaths. In Europe, Russia reported a new record high in cases Friday, and Germany topped 1 million cases as it reported its worst day of deaths. In Asia, Japan saw its second-highest new case count to date while South Korea saw the same, (with Wednesday being the record high day).

Overnight, Asian markets were mixed again, but this time leaned to the green side. Shanghai (+1.14%) led the gainers by far while Australia (-0.53%) paced the losses. In Europe, we see a similar mixed picture so far today. The FTSE (-0.39%), DAX (+0.28%), and CAC (+0.052%) lead the way. As of 7:30 am, US futures are pointing to a modestly higher open. The DIA is implying a gain of 0.21%, the SPY a gain of 0.21%, and the QQQ to a slight gap higher (+0.35%).

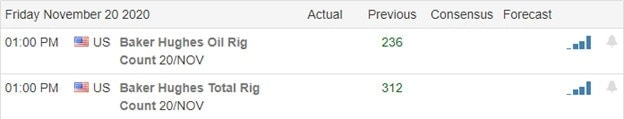

There are no major economic news events Friday. There are also no major earnings reports on the day. However, remember that today is a half-day, with markets closing at 1 pm.

Expect a light and perhaps volatile day as many traders enjoy a four-day weekend. Also, remember that this is Friday. So, book some profits and/or place some hedges in front of the weekend. As always, respect the trend, support/resistance, and price action. Don’t chase moves you have missed (there will be another opportunity) and stick with your trading rules. Our job as traders is consistency, not hitting home runs,

Ed

Swing Trade Ideas for your consideration and watchlist: No Trade Ideas for a short Friday. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Vaccine fueled recovery hopes helped to inspire the bulls to new record-breaking levels creating headlines around the world. Massive rallies in energy, financials, and consumer staples have created impressive reversal patterns in the charts and suggest the move may have become a bit parabolic in the short-time. Expect volume to decline rather sharply today after the deluge of economic data as traders head out for holiday plans. Consider your risk carefully as we head into the shutdown and what typically is a choppy light volume market condition on Black Friday and the Cyber-Monday shopping distractions.

Asian markets closed mixed but mostly higher overnight while European markets slip slightly lower, resting after yesterday’s sharp rally. As we wait for a massive morning of potential-market moving economic data, the futures are taking a wait and see approach indicating a modestly lower open. Stay safe and have a Very Happy Thanksgiving, everyone!

On the eve of the Thanksgiving shutdown, we have a relatively light day of earnings calendar. Notable reports include DE & FRO.

A pre-holiday surge set new records lifting the Dow above 30,000, enjoying the blue sky above with IWM. Energy, financials, and consumer staples sectors were the big winners, while some tech giants struggled to find buyers. Focused on vaccine recovery, hopes the bulls maintain solid control of the index trends, and there seems no price too high that they are willing to pay. Reaching the 30,000 goal was very important for the institutions. As reported on CNBC, this new threshold could draw in new investors from the sidelines with hopes that more stocks will participate in the next leg. However, there are those worried that the market is heating up to an unstainable level. One thing for sure, as the pandemic continues to impact business and the expectation of higher taxes on the horizon, traders will have to remain nimble.

Today is a massive deluge of potentially market-moving data. As of now, U.S. Futures point to a slightly lower open as if taking more of a wait and see approach this morning. Although 2020 is far from typical, it would be wise to keep in mind that volume usually shrinks quickly ahead of the holiday as traders hit the roadways and airports. Light volume choppy price action and be expected during the short session on Black Friday often extends into the following week with shoppers focused on Cyber-Monday deals. No doubt this has been a challenging year, but we still have so much to be thankful for in this great country of ours. Please take a moment during this holiday to remember those that serve in the military, our first responders as well as the health care professionals on the front lines keeping us safe.

Trade Wisely,

Doug

Markets gapped higher, but mixed amounts on Tuesday. The QQQ jumped up four-tenths of a percent, the SPY eight-tenths of a percent, and on the day that the Dow broke 30,000, the DIA gapped up a full percent. We then saw a follow-through rally the rest of the morning. However, markets spent that afternoon grinding sideways, even with large position-covering volume the last 10 minutes of the day. VXX lost a percent to 18.05 and T2122 held in place deep in overbought territory at 95.84. 10-year bond yields rose again to 0.882% and oil popped 4% to $44.86/barrel as optimism (or relief from uncertainty) over a government transition seemed to buoy markets in the morning.

Mortgage rates dropped again this week to 2.92%. This move was cheered by borrowers as mortgage applications climbed 4% for the week (19% increase from the same week in 2019). However, it was refinancing (71% of the applications) that caused most of this activity. Refinance applications were up 79% year-on-year and at the highest level since April.

From the “better to be lucky than good sometimes” file, a sidebar to the recent AZN vaccine news. It turns out the 90% efficacy rate was only achieved under younger patients. More interestingly, that dosage was only stumbled upon by mistake. AZN made a systemic error and only gave half doses to a large group of volunteers. This was only discovered because they reported far fewer side effects than expected. So, rather than throw out the data and start again, AZN continued and just gave those volunteers a full dose a month later. It turns out that this 1.5 dose regimen was over 25% more effective than the full 2 doses…at least in younger patients. The CDC is reviewing the AZN data and hoping to find ways to increase efficacy or reduce side effects in the similar PFE and MRNA vaccines.

On the virus front itself, infections continue to rage as the US. This surge has raised the US totals to 12,958,805 confirmed cases and 265,986 deaths. The 7-day average of new cases to 178,692 while a spike in deaths (2,194, the highest since the start of May) saw the average deaths rise to 1,657/day. Meanwhile, the HHS is conducting a test of the vaccine distribution networks in hope of heading off problems when an approved vaccine is available.

Globally, the numbers rose to 60,240,061 confirmed cases and the confirmed deaths are now at 1,417,858 deaths. Hong Kong is seeing another rise in cases as new restrictions are to begin. The WHO says that Europe is still the epicenter, accounting for 44% of new cases and 49% of deaths the past week. This came as Germany reported another new record daily high in cases.

Overnight, Asian markets were mixed again, but this time leaned to the red side. Shenzhen (-1.74%), Shanghai (-1.19%), and India (-1.51%) paced the losses. Malaysia (+1.22%) and Thailand (+1.01%) were far and away the larges gainers. In Europe, we see a similar mixed picture so far today. The FTSE (-0.69%), DAX (-0.18%), and CAC (+0.03%) lead the way, but the continent’s exchanges range from -0.94% to +0.81%. As of 7:30 am, US futures are also pointing to a mixed open. The DIA is implying a flat open (-0.05%), the SPY a 0flat (+0.08%) open, and the QQQ to a slight gap higher (+0.38%).

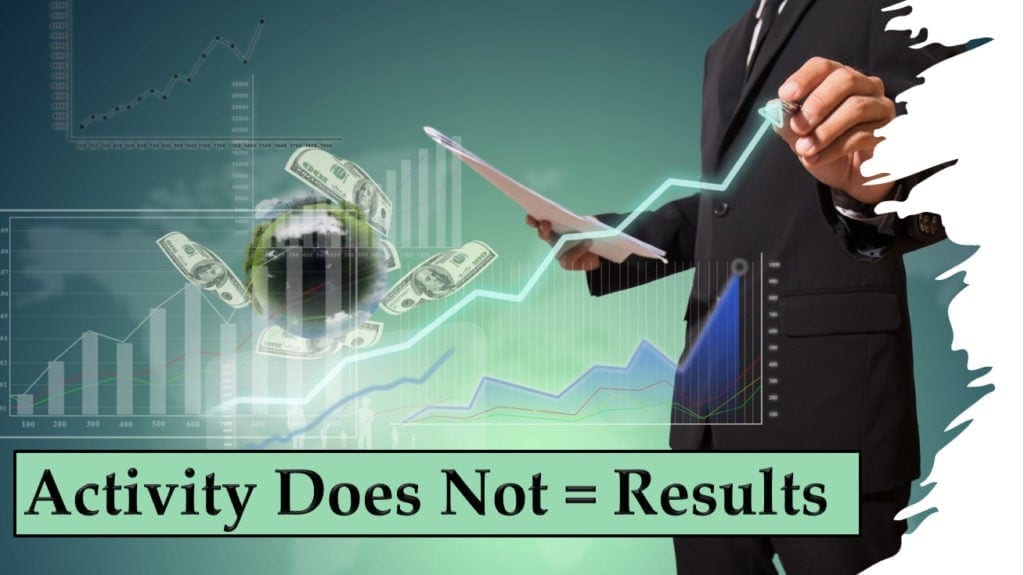

There is a large amount of economic data today. Oct. Durable Goods, Q3 Employment Cost Index, Q3 GDP Price Index, Oct. Trade Balance, Oct. Retail Inventories, and Oct. Core PCE Price Index (all at 8:30 am), Oct. PCE Price Index, Oct. Personal Spending, Univ. of Michigan Consumer Sentiment, and Oct. New Home Sales (all at 10 am), and Crude Oil Inventories (at 10:30 am). Major earnings reports are limited to DOOO and DE before the open. There are no earnings reports after the close.

All the data makes the open uncertain at this point. However, remember many traders may already be headed to the door for a long weekend. So, low-volume volatility is quite possible, As always, respect the trend, support/resistance, and price action. Don’t chase moves you have missed (there will be another opportunity) and stick with your trading rules. Our job as traders is consistency, not hitting home runs,

Ed

Swing Trade Ideas for your consideration and watchlist: WRK, DFS, IP, DAR, PWR, XLB, USB, MTCH, SBUX, BA. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

The transition begins, and the U.S futures celebrate the decision surging higher this morning even as states add a blizzard of new restrictions to battle the pandemic. With a holiday shutdown just around the corner, it may be wise to consider the big gap up this morning as a gift and opportunity to profit and reduce heading into the holiday. Remember, volume typically begins to decline as traders head out for vacation plans.

Asian markets were mostly bullish overnight, with the NIKKEI surging a whopping 2.5% amid vaccine hopes. European indexes trade decidedly bullish this morning, and the U.S. futures point to a substantial gap up with a Dow 30,000 target within striking distance. Please keep in mind volume typically declines quickly, heading onto a holiday. That said, it may be challenging to maintain the bullish momentum.

We have a busy day on the earnings calendar, with retail reports a significant focus on Tuesday. The notable reports include ANF, BBY, DKS, GPS, DLTR, JWM, AEO, ADI, ADSK, BURL, EV, HRL, HPQ, SJM, J, MDT, MOV, TIF, & VMW.

I must admit this wild bullishness continues to surprise me even as more restrictions go into place around the country trying to curb the pandemic. That said, I also have to say I am enjoying the profits the relentless push toward higher. The moral of the story, read the price action, follow the trends, and most importantly, gratefully take the gains the market provides in time like this. Futures are pointing to a gap up open, apparently celebrating that President Trump has begun the process to ensure a smooth transition. Though he vows to continue the legal challenges, the market seems to have voted this was the right thing to do. Biden’s choice, Janet Yellen, to lead the Treasury also boosted the market higher yesterday afternoon, supporting the decision. Though all the warm and fuzzy bullish is fantastic, let’s forget we have a holiday shutdown just around the corner and blizzard pandemic restrictions likely to impact businesses. As a result, it may be wise to take advantage of the morning gap by taking profits and reducing risk heading into the holiday. Remember, gaps are gifts, but the money is not yours until you take the gain and tuck it safely away in your account.

On the technical front, the indexes remain in bullish trends but keep in mind the current rally will have to deal with the price resistance created in the last three weeks. Only the IWM has thus far been able to enjoy the blue sky breakout, so watch closely for the possibility of profit-taking near resistance on the DIA, SPY, and QQQ. The T2122 indicator will show an extreme short-term overbought condition at the open as well. Don’t let greed prevent you from making a profit!

Trade Wisely,

Doug

Markets gapped about a half percent higher at the open Monday on good vaccine news from AZN. However, a sharp selloff about 10am lasted an hour and a slow recovery brought the major indices back to close near the gap-ups. SPY and QQQ both printed indecisive Doji or Spinning Top type candles on the day, while DIA was a little more bullish, but still had quite a bit of wick. On the day DIA gained 1.16%, SPY gained 0.62%, and QQQ was dead flat. The VXX lost 1.24% to 18.37 and T2122 rose further into overbought territory at 95.55. 10-year bond yields rose to 0.859% and Oil gained a percent to $42.91/barrel on vaccine-recovery hopes.

President-elect Biden announced several of his cabinet nominees. The key name for markets is that Biden will nominate former Fed Chair Yellen as his Sec. of Treasury. Financial pundits claim the markets like this nomination. This comes hours before the GSA announced Monday night that the formal transition process can now begin (despite President Trump’s ongoing spate of lawsuits they hope would nullify election results and delay the process). Futures rose on the GSA news.

CNBC reports that the top Democrat on the House Judiciary Committee, Rep. Neguse, has called for hearings on regulatory approach (such as the FTC) to approving “big pharma” mergers. Specifically cited were the ABBV acquisition of AGN and the merger of PFE and MYL. This news comes in the wake of the committee’s year-long investigation into big tech (AMZN, AAPL, FB, GOOG) anti-trust practices. However, at this point, it is preliminary and yet to be determined if a full investigation is warranted.

On the virus front itself, infections continue to rage as the US. This surge has raised the US totals to 12,778,924 confirmed cases and 263,701 deaths. The 7-day average of new cases to 176,434 while the average deaths rose to 1,577/day. This surge has put a large strain on the healthcare system nationally. One example is Cleveland Clinic (a major Hospital Network in the Cleveland area) reported 970 caregivers are out due to the virus, triple the number from just 2 weeks ago.

Overnight, Asian markets were mixed. Japan (+2.50%) and Australia (+1.26%) led gainers. Meanwhile, Thailand (-1.32%) and Malaysia (-1.20%) passed the losers. In Europe, markets are generally green, with just two small-market exceptions, Denmark (-1.22%) and Switzerland (-0.22%). However, in general Europe seems to like the news of the official US transition with the 3 major bourses being typical with the FTSE (+0.99%), DAX (+0.92%), and CAC (+1.19%). As of 7:30 am, US futures are pointing to a mixed gap higher. The DIA is implying a 0.90% gap up, the SPY a 0.60% gap up and the QQQ just a 0.21% “gap” higher.

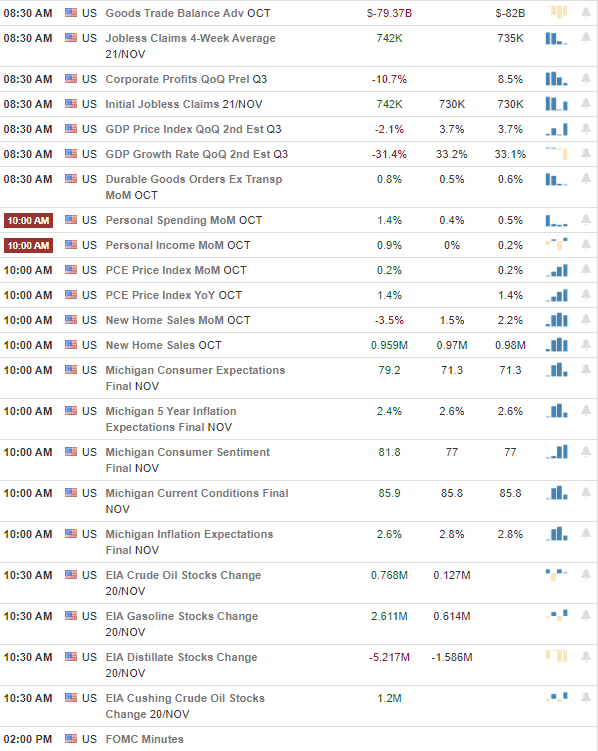

The major economic news for Tuesday is limited to Conf. Board Consumer Confidence (10 am), and 3 Fed Speakers (Bullard at 11 am, Williams at noon, and Clarida at 12:45 pm. Major earnings reports include ANF, ADI, BBY, BURL, DKS, DLTR, DY, HRL, SJM, J, MDT, and TIF before the open. Then after the close AEO, ADSK, DELL, GPS, HPQ, JWN, VMW report.

As we draw nearer to the holiday break, we may see less volume. However, there is plenty of major earnings today, especially in the retail space. That said, those are backward-looking and we do have the big Black Friday and Cyber Monday retail events coming in days. Also, remember that we have been range-bound for a couple of weeks and the very short-term trend has been a pullback with all-time high resistance above and some support just below.

As always, respect the trend, support/resistance, and price action. Don’t chase moves you have missed (there will be another opportunity) and stick with your trading rules. Our job as traders is consistency, not hitting home runs,

Ed

Swing Trade Ideas for your consideration and watchlist: PEIX, DK, WLL, LUV, SCHW, FORM. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Futures point to a bullish open shrugging off 20-straight days of more than 100,000 pandemic infections, focused on the latest vaccine news and hopes of more deficit spending. The big round number of a 30,000 Dow just around the corner will have the institutions working hard to get that headline. The only thing that stands in their way is pandemic news and some emerging evidence of a slowing economy as a result. Volume typically begins to decline sharply, heading into the Thanksgiving shutdown as traders head out for travel plans. This year could be very different with considerable sensitivity to news events.

Asian markets traded mostly higher overnight, with airline shares declining sharply due to virus concerns. European markets point to modest gains this morning on hopes of that vaccines will soon become available. U.S. Futures once again point to a bullish open ahead of earnings and the PMI Composite at 9:45 eastern time. Buckle up it could be a wild week.

On the Monday earnings calendar, we have under 25 companies reporting quarterly results. Notable reports include A, AMBA, DQ, KFY, NTNX, URBN, & WMG.

After 20 straight days of more than 100,000 pandemic infections, U.S futures are once again in rally mode this morning, focused on new vaccine news and hopeful stimulus deal by the end of the year. President Trump’s flurry of lawsuits appears to have not been effective in turning over evidence of fraud. However, he has yet to concede as Biden moves forward to announce some Cabinet selections as early as this week. With mounting economic restrictions, evidence of a slowing economy, and a holiday shutdown, anything is possible this week. I fully expect the institutions to continue their push for a Dow 30,000 headline, but with pandemics weighing on investors’ minds, it could be a choppy process with whipsaws and large morning gaps. We usually see a sharp decline in volume beginning Tuesday afternoon as traders head out for holiday destinations. However, nothing about this year is normal, so stay focused and flexible.

Though we saw a little bearish activity toward the end of last week, the index trends remain bullish. We may still need more consolidation to digest the colossal vaccine move, but as long key price supports hold, the bulls have the upper hand. Expect price volatility to continue and news-driven sensitivity as we slide toward the holiday. Remember there will be a lot of focus on Black Friday and Cyber Monday shopping, so it’s possible we could see low volume choppy price action for a few days, so plan your risk accordingly.

Trade Wisely,

Doug

Stocks opened flat in the SPY and QQQ, but the DIA gapped down about four-tenths of a percent. After a little sideways roller-coaster action, all 3 major indices sold off late to end the day lower. The only signal printed on the day was Bearish Harami in the QQQ. For the day SPY and QQQ both lost 0.68% and DIA was down 0.95%. The VXX was flat at 18.60 and T2122 rose again in the overbought territory to 92.25. 10-year bond yields fell significantly again to 0.824% and Oil (WTI) gained a percent to close at $42.17/barrel. For the week the large-caps were both down about eight-tenths of a percent while the QQQ was indecisive and off just two-tenths of a percent.

On Saturday the FDA authorized emergency use of the REGN monoclonal antibody treatment (similar to part of what was given President Trump) after a study on non-human primates indicated benefit. On Sunday, White House Vaccine Czar Slaoui told reporters the first vaccinations could take place in mid-December. However, he also said the best-case hope is to get the first of two jabs done for up to 20 million of the priority people before year end, with widespread availability in later Q1 or Q2, and getting to children by mid-year 2021.

Then overnight, AZN reported that its vaccine was about 70% effective on average. (It was trialed in 2 dosages; one was 62% effective and the other 90% effective. Both require two injections, on month apart.) While less effective than the two US vaccines, the AZN vaccine does not require anything more than typical refrigeration (30-40 degrees F) which makes it far easier to distribute and administer than the US vaccines. And finally, MRK announced it plans to acquire privately-held OncoImmune, which is in late-stage clinical trials of a drug that shows promise as a respiratory treatment for Covid-19 patients.

On the virus front itself, infections continue to rage as the US. This surge has raised the US totals to 12,590,220 confirmed cases and 262,711 deaths. The 7-day average of new cases to 172,789 while the average deaths rose to 1,547/day. 47 states are in the White House Task force’s “red zone.”

Overnight, Asian markets were mostly green, with Japan (-0.42%) the lone holdout. Thailand (+2.24%), South Korea (+1.92%), and Taiwan (+1.18%) led gainers, but the rally was broad. There is a similar situation in Europe so far today, with just a handful of red on the board. Among the big 3 bourses, the FTSE is flat (+0.02%), while the DAX (+0.50%) and CAC (+0.41%) are up at this point in their morning. As of 7:30 am, US futures are pointing to a green start to the day. The DIA (+0.59%), SPY (+0.51%), and QQQ (+0.29%) are all pointing to positive opens.

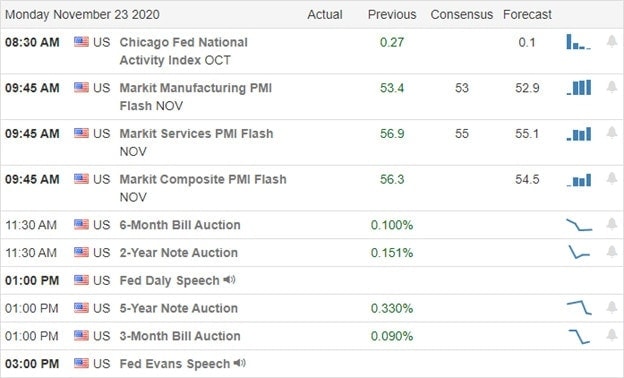

The major economic news for Monday is limited to Nov. Mfg. PMI and Nov. Services PMI (both at 9:45 am) and a single Fed speaker (Daily at 1 pm). The only major earnings report before the open is WMG. However, after the close, A, CBT, CENT, CENTA, and URBN report.

The holiday-shortened trading week appears to be kicking off with the bulls in charge. However, remember that we have been range-bound for a couple of weeks and the very short-term trend has been a pullback with all-time high resistance above and some support just below.

With more positive vaccine and treatment news, obvious expectations would be for a rally. However, Mr. Market seldom does exactly what the consensus expects. We have a couple of days off, Black Friday and Cyber Monday all just ahead. So, there’s also the possibility of hedging or lightening up in front of those events. Just be careful.

As always, maintain discipline with your trading rules and don’t chase. Respect the trend, support/resistance, and price action. Our job as traders is consistency, not hitting home runs,

Ed

Swing Trade Ideas for your consideration and watchlist: KIRK, NOVA, PLUG, BOOT, TLRY, NIO, EYE, LABU, WK, APPS, TUP, CLF, DSS. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

The tug-of-war continues between the bulls hoping for a spring recovery and the bear’s concerns of the business impacts getting through a severe pandemic winter. Infection rates hit a new record yesterday, and at the same time, the Treasury has decided to end some programs in the CARES act by the end of the year, drawing criticism from the FED. Treasury yields are falling this morning in reaction. As the weekend and a short trading week due to the holiday, traders will have some tough decisions to make as they plan their risk forward.

Asian markets closed on Friday mixed but with The SHANGHAI and HIS modest posting gains. European markets are trying to shake off virus concerns this morning, showing modest gains across the board. The U.S. trade mixed but are well off the overnight lows as they try to look past the Treasury decision, infection numbers, and more state restrictions ahead of the holiday. Expect the news-driven sensitivity to continue.

We have a lighter day this Friday with less than 20 companies fessing up to quarterly results. Notable reports include BKE, DXLG, FL, HP, HIBB, & JKS.

The Treasury Dept. is looking to extend a handful of the Federal Reserve programs used to get the markets through the pandemic’s early days. However, they have also decided to end several other programs that expire at the end of the year. The action has drawn some negative feedback from the Fed, which believes the programs should continue. A decision coming on the same day that the U.S set a new record infection rate of more than 185,000 new cases reported. Treasury yields are falling this morning in reaction. Another disagreement is raising eyebrows in treating the infection as the WHO urges doctors not to use Gilead’s remdesivir, breaking ranks with the FDA, stating “no evidence” it improves survival rates. In other news, both Pfizer and BioNTech have requested emergency authorization from the FDA for their vaccines. I suspect the tug-of-war will continue between the bulls hoping for a spring recovery and the bears looking at the impacts of rough winter.

Yesterday’s early selloff found enough bulls to defend the morning lows but fell a bit short of inspiring confidence. The bullish index trends still exist, as does the short-term extended appearance of the charts. With a very light day on the economic calendar and just a handful of notable earnings reports, we can expect the market to be highly sensitive to the news cycle today. As this tug-of-war continues, plan your risk carefully as we slide into the weekend ahead of the Thanksgiving shutdown.

Trade Wisely,

Doug