Bank Earnings and Stimulus Plan Details

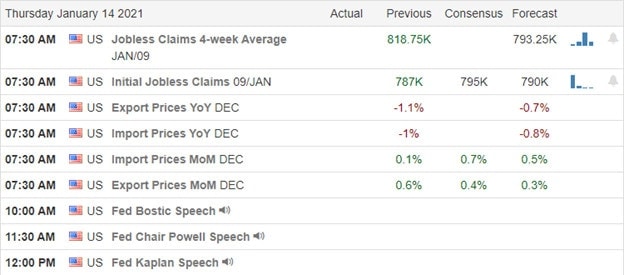

On Thursday, Jobless Claims shot up unexpectedly to almost 1 million, but markets did not care. All three major indices opened flat, but then sold off a bit most of the day. As a result, the SPY and DIA both printed Bearish Engulfing candles, while the QQQ put in a black candle. On the day, DIA lost 0.19%, SPY lost 0.35%, and QQQ lost 0.53%. Interestingly, the IWM was up 2% and closed at an all-time high close. VXX gained just over a percent to 16.68 and T2122 fell slightly, but remains in the overbought territory at 89.97. 10-year bond yields spiked on expectations of the Biden stimulus plan closing a 1.129% and Oil (WTI) rose 1.5% to $52.72/barrel.

After hours, President-elect Biden released his $1.9 trillion stimulus plan. The plan includes another $1,400 direct payment (raising the December $600 to $2,000). It also calls for extending $400/week federal unemployment benefits through September, as well as raising the federal minimum wage to $15/hour. Other key points include $350 billion for state and local government aid, $170 billion aid for schools, $50 billion for Covid testing and $20 billion for vaccinations. One expected item that was missing was a $10,000 student loan forgiveness plan.

As he leaves office, President Trump continues to escalate tensions with China. This time by adding more Chinese companies to the federal blacklist (prohibited from doing business in the US and from US investment) including the largest Chinese smartphone maker Xiaomi and massive oil company CNOOC. Some tariffs have been in place as of January 1st, impacting things such as the price of computer graphics cards. Oxford University estimates the impact of the trade war will be about $1.6 trillion over the next 5 years, but did not break down the split between the world’s two largest economies. Reuters did report that it may result in up to 732,000 fewer US jobs being created by 2022.

Related to the virus itself, US infections remain very high, but may show signs of easing just a bit. The totals have risen to 23,848,410 confirmed cases and 397,994 deaths. This comes as we average just over 243,000 new cases and just over 3,400 deaths per day. (Extremely high, but less than just a few days ago.) In addition, in an effort to ramp up vaccinations, baseball stadiums and convention centers are being transformed into large-scale vaccination centers across the country. President-elect Biden has called for a doubling of the pace (we currently give about 500,000 shots per day and he wants 100 million in 100 days).

Globally, the numbers rose to 93,637,684 confirmed cases and the world has now broken the 2 million death mark as confirmed deaths are now at 2,004,815 deaths. As a reference, the world is averaging 715,000 new cases and over 13,500 new deaths per day. Ireland reports that half of its total cases have come in the last 2 weeks. While the number is a drop in the bucket relative to the US, that trend should be alarming. France imposed new travel restrictions. German PM Merkel proposed another total national lockdown (they are already in a partial one), but is being fought by German states and business groups. In Asia, perhaps just coincidentally, China reported its first COVID-19 death in 5 months and a renewed outbreak in the Northwest of the country, on the same day WHO experts arrived in Wuhan to investigate the virus source.

Overnight, Asian markets were mixed but leaned to the red side. Shenzhen (+0.27%) and Shanghai (+0.27%) again paced gainers. Meanwhile, South Korea (-2.03%), India (-1.10%) and Thailand (-1.11%) led the losses. In Europe, so far today markets are red across the board. Among the big 3 bourses, the FTSE -0.90%), DAX (-1.05%), and CAC (-1.14%) are all leading the way lower, but losses are over three-fourths of a percent across the continent. As of 7:30 am, US futures are down slightly as well. The DIA is implying a -0.41% open, while the SPY implies a -0.32% open, and the QQQ is flat, implying a -0.06% open.

The major economic news for Friday includes Dec. Retail Sales, Dec. PPI, and NY Fed Empire State Mfg. Index (all at 8:30 am), Dec. Industrial Production (9:15 am), and Nov. Business Inventories and Mich. Consumer Sentiment (both at 10 am). Major earnings reports on the day include C, JPM, PNC, and WFC before the open. There are no major earnings reports after the close.

As we head into a long weekend and with the FBI reporting warnings of more pro-Trump attacks possible in all 50 state capitols as well as 3 serious threats to the US Capitol, do not be surprised to see hedging or profit-taking action Friday. 3 days is a long time to hold much risk in this kind of environment. Besides, it’s Friday…and Friday is payday. So, don’t forget to take some money off and pay yourself.

Lock in those profits (base hits are the way we build consistency) and stick with your discipline. As always, follow the trend, respect both support and resistance, and don’t chase the moves you have missed. Focus on the overall market, the specific chart, and your own trading process. Remember, trading is a long-term game. We don’t have to try to get rich every day.

Ed

Swing Trade Ideas for your consideration and watchlist: GILD, MPC, FUBO, INSP, XBI, OSTK, PSX. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service