Market Uncertain and Crypto Struggles

Markets opened flat on Tuesday and proceeded to sell off the first hour of the day. From that point, the large-cap indices ground sideways, and the QQQQ rallied before grinding sideways. Another selloff the last half-hour took us out down off the highs. As a result, the QQQ printed a Doji (at an all-time high close) while the SPY printed a black candle that stayed above the 8ema (and lows of the consolidation range of the last week) and the DIA was the weakest of the group printing an ugly black candle that closed not far up off the lows. On the day, SPY lost 0.34%, DIA lost 0.76%, and QQQ gained 0.14%. The VXX rose about 2.4% to 25.53 and T2122 dropped but remains in the mid-range at 41.48. 10-year bond yields were up sharply to 1.371% and Oil (WTI) fell 1.3% to $68.38/barrel. Perhaps this reflected the Saudi oil price cut from Sunday.

After having reached almost $53,000 on Monday night, Bitcoin fell hard Tuesday. The largest cryptocurrency closed down over 11% to $46,354. This came as El Salvador became the first to begin using Bitcoin as legal tender in the country. Oddly, that country bought only about $20 million worth of Bitcoin, even though it has a GDP of over $27 billion. Bitcoin-related stocks such as MSTR and COIN also took heavy hits on the day. COIN also announced this morning that the SEC has notified it that the regulator intends to sue the company over an interest-earning product the company has planned to launch as soon as next week.

Late in the afternoon Tuesday, F announced it had hired the AAPL executive that has been leading the “Apple Car” project. Doug Field was also a former TSLA executive (led the development of the TSLA Model 3) and is slated to become the “Chief Advanced Technology and Embedded Systems Officer” at F as part of the company’s turnaround effort. While AAPL confirmed Doug Field’s exit, they still refuse to confirm the existence of the project and analysts say this would be a blow to the AAPL project that is supposedly now focused on software to support autonomous driving, having abandoned the idea of becoming an auto-maker itself.

Mortgage rates remained unchanged this week (3.03% for a 30-year fixed, conforming loan). This saw loan demand fall as home refinance applications were down 3% for the week (4% lower than a year ago). New home purchase applications were flat last week, but down a full 18% from a year ago.

Overnight, Asian markets were mostly red in Asia. Indonesia (-1.41%), Singapore (-1.27%), and Taiwan (-0.91%) saw the largest losses. Meanwhile, Japan (+0.89%) and Malaysia (+0.89%) were the only real gainers on the day as China remained flat. In Europe, with Russia the only outlier, the rest of the continent is in the red at mid-day. The FTSE (-0.45%), DAX (-0.62%), and CAC (-0.32%) are typical of the continent, but a couple of the small exchanges are down a full percent in early afternoon trading. As of 7:30 am, US Futures are pointing toward another flat open. The DIA is implying a -0.02% open, the SPY implying a -0.01% open, and the QQQ implying a -0.05% open at this hour. 10-year Bond yields are also just on the red side of flat, but Oil (WTI) is up 1.3% in early trading.

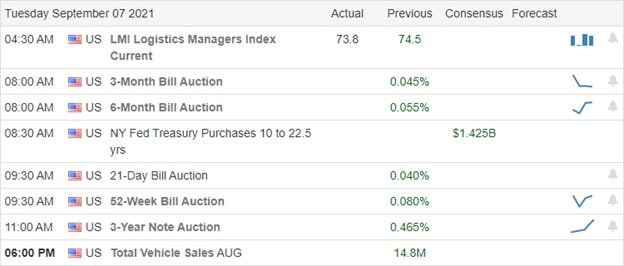

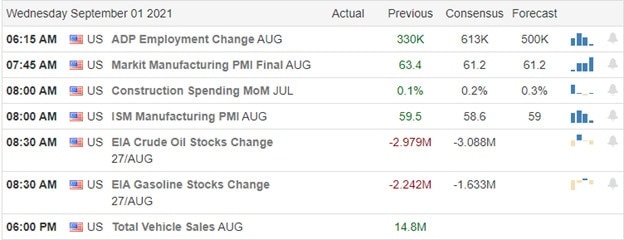

The major economic news scheduled for release on Wednesday is limited to July JOLTs (10 am), 10-year Bond Auction (1 pm), Fed Beige Book (2 pm), and a Fed Speaker (Williams at 1:10 pm). The major earnings reports scheduled for the day include KFY and REVG before the open. Then after the close, ABM, CPRT, GME, LULU, and RH report.

Markets seem to be uncertain at the moment. With inflation fears, a diminishing economic growth rate, and a lack of clarity around both the taper timeline and the fiscal spending/taxation plans, traders appear to be waiting on more direction. Hopefully, some of that will become more clear the next few days with several Fed speakers on tap. In the meantime, beware of volatility and a waffling market. The mid-term trend remains bullish, but we are in a clear consolidation in the SPY and QQQ, while the DIA is pulling back and testing its 50sma in premarket trading.

Remember that the trend is your friend until it ends. So, don’t try to predict market direction changes. However, you should also consider whether market conditions are right for your trading. They say a rising tide lifts all ships, but it’s not a great idea to be out there rowing against the tide when you have a choice. You don’t have to trade every day.

As always, manage your existing trades before you go chasing any new ones. Concentrate on the process and on managing those things that you can control, while not worrying too much about the things you can’t control. Good trading rules and discipline is what separates long-term success from failure in trading. However, above all, consistently take profits when you have them. A good trader just won’t let greed turn their winners into losers.

Ed

Swing Trade Ideas for your consideration and watchlist: CPB, XSPA, PENN, AMC, RIG, EDU, PDD, CLOV, VIPS, NKLA, TELL, HSIC, GOGL. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service