SPY Pushed to Record On Strong Earnings

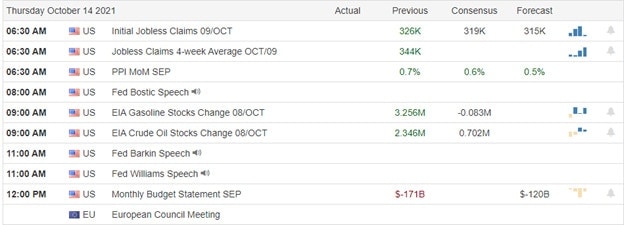

Markets opened slightly lower on Thursday and then waffled around while the bulls found their footing. However, by mid-morning a slow, steady rally was underway that ran all the way into the close. This marked the 7th straight higher close in the SPY and gave us a new all-time high close. DIA just missed both marks while printing a Hanging Man-type candle. Meanwhile, the QQQ printed a Bullish Engulfing candle. On the day, SPY gained 0.28%, QQQ gained 0.61%, and DIA lost 0.02%. The VXX fell 3% to 21.22 and T2122 backed off just a bit but it remains deep in the overbought territory at 92.8. 10-year bond yields rose again to 1.69% and Oil (WTI) fell almost a percent to $82.66/barrel.

During the day, cryptocurrencies took a hit as an algo ran amuck on one of the major exchanges. Binance reported that one of their institutional traders suffered an error in their algorithm. This caused massive selling which drove the price of Bitcoin from $65,000 down to $8,200 (down 87%) before immediately snapping back. So, it was similar to the stock market flash crash from 2010. At the time of Thursday morning’s crash, $40 million of bitcoin was traded on the Binance exchange.

After the close, INTC and WHR both missed on revenue but handily beat on earnings. INTC in particular decried the chip shortage for hurting its personal computer business. Meanwhile, CMG, SIVB, CE, and RHI all beat on both lines. However, SNAP missed on both lines and got crushed in post-market trading. Analysts are expecting the SNAP miss to read through to other online advertising platforms as the company specifically cited the AAPL opt-in vs opt-out privacy policy as impacting ad revenue.

So far this morning, the strong earnings continue as DHR, MMC, IQV, TSCO, KEY, DGX, IPG, SNA, VLO, LUV, AAL, and ALK have all posted beats on both the top and bottom lines. However, ALLE and T both missed on revenue while beating on earnings.

Overnight, Asian markets were mixed in modest trading. Singapore (+0.52%), Hong Kon (+0.42%), and Thailand (+0.36%) led to the upside. Meanwhile, India (-0.35%) and Shanghai (-0.34%) paced the losers. However, in Europe markets are strongly green across the board at mid-day. The FTSE (+0.54%), DAX (+0.85%), and CAC (+1.11%) are typical of the spread across the continent, but many of the smaller exchanges are following the French lead in early-afternoon trading. As of 7:30 am, US Futures are pointing toward a mixed, modest opening. The DIA is implying a +0.21% open, the SPY implies a +0.12% open, and the QQQ implies a -0.16% open at this hour. 10-year bond yields are down slightly and Oil (WTI) is up two-thirds of a percent in early trading.

The major economic news scheduled for release on Friday is limited to Mfg. PMI and Services PMI (both at 9:45 am), Federal Budget Balance (2 pm), and a couple of Fed speakers (Daly at 10 am and Chair Powell at 11 am). Major earnings reports scheduled for the day include AIMC, AXP, ALV, CLF, DSKE, GNTX, HCA, HON, RF, ROP, SLB, STX, and VFC before the open. There are no reports after the close.

Once again the bulls have refused to yield. So far, it looks like they are going to continue that drive toward blue-sky at the open today. With that said, we certainly appear to be working on borrowed time. It is not very often that you see this many white candles and green closes in a row. So, be careful. In particular, some traders might be looking to take profits after the run and heading into the weekend. So, be prepared for a pullback or at least a rest. As mentioned in recent days, don’t be chasing the rally. Let the market (and trade) come to you and trade carefully.

The weekend is upon us. So, think about how you want your portfolio to be adjusted ahead of the weekend news cycle. Take profits, hedge, and/or move stops as appropriate. You’re not missing anything if you don’t chase new positions. Remember it takes twice as long to recover losses, so the first rule of making big money is not losing big money. It is discipline and good trading rules that will win in the long run. And that includes consistently taking profits when you have them. Focus on your trading process and on managing the things you can control (while not worrying about things you can’t influence). Finally, watch your current positions before looking to add new trades.

Ed

Swing Trade Ideas for your consideration and watchlist: No trade ideas for Friday. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service