Last night the U.S. House passed a bill to suspend the debt limit and fund the government through early December. Futures markets responded with a sharp reversal from overnight lows despite the bill’s steep challenge in the Senate. Consider that carefully as you approach today’s opening gap up ahead of an FOMC decision. The pop and drop has become a regular occurrence the last couple of weeks, so stay focused and avoid chasing into the gap. After the morning rush of energy, don’t be surprised if the price becomes choppy while we wait on the Fed.

Overnight Asian markets traded mixed but mostly higher as investors watch the fallout of the Evergrande default. However, European markets have a relief rally in mind seeing green across the board. The U.S. points to a bullish gap-up open after a debt ceiling suspension and ahead of the Federal Reserve decision on a taper. So, let’s hurry up and wait!

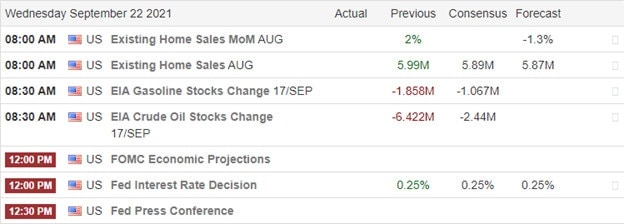

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have just nine companies listed. Notable reports include BB, GIS, FUL, KBH, & SCS.

News & Technicals’

The House passed a bill last night that would temporarily fund the government and suspend the debt limit. However, the legislation will face a challenge in the Senate, as Minority Leader Mitch McConnell says Republicans will vote against raising the debt ceiling. If not approved, the government would shut down on Oct. 1, and the U.S. would be unable to pay its bills sometime in October if Congress does not pass legislation addressing both issues. The Fed’s September meeting has been widely anticipated since the central bank is expected to signal that it’s close to announcing the taper of its bond purchase program. But the focus of markets will be squarely on what the Fed now forecasts for interest rates and inflation. According to Jamie Dimon, the top uncertainty for the Fed is the path of inflation. Dimon said that if those hot inflation figures continue into December, U.S. policymakers may have to admit that at least part of the price increases are here to stay. Treasury yields are again falling this morning, with the 10-year dropping 8 basis points to 1.3328% and the 30-year falling 11.5 basis points to 1.8685%.

Another gap up open that closed the day lower kept the VIX elevated into the Tuesday close. However, after the House suspended the debt ceiling and temporarily funded the government until early December, the futures rallied off of overnight lows, pointing to another attempt to pump the market this morning. With the debit suspension facing a substantial challenge in the Senate and facing an FOMC decision on taper, one has to wonder if we’re setting up another pop and drop this morning. The index chart technicals showed little to no improvement yesterday, and I suspect after a morning burst of energy, prices will become choppy as they wait for the Fed. We never know how the market will react to their decision, so remain focused and flexible, prepared for whatever comes our way.

Trade Wisely,

Doug

Comments are closed.