Market Took Powell News Hard Friday

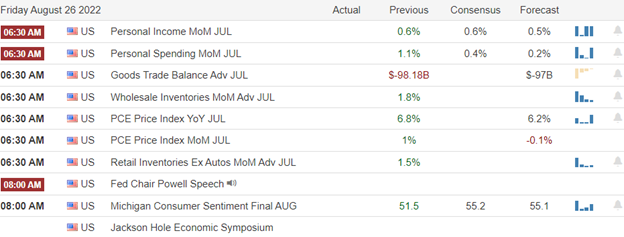

Friday was a day of reckoning for markets are all 3 major indices opened flat and traded that way until Fed Chair Powell began to speak. However, when he did begin to speak, it was immediately apparent that Powell was not going to tell the Bulls what they had hoped to hear (that inflation was coming down and the Fed could ease up on the tightening). So, we saw massive volatility in the 10 minutes after Powell started speaking and then a brutal selloff the rest of the day (especially from 10am -11am) from that point. This gave us a huge Bearish Engulfing signal in the DIA and just big, ugly black candles in the SPY and QQQ. Obviously, all 3 major indices failed their T-lines (8ema) during the day, but all 3 are also now extended well below those 8ema levels.

All 10 sectors are well into the red with Technology, Consumer Cyclical, and Industrials leading the way lower on a risk-off day. On the day, SPY lost 3.38%, DIA lost 3.07%, and QQQ lost 4.10%. The VXX has gained over 2.25% to pop back up to 20.15 and T2122 has fallen all the way from overbought to well oversold at 7.87. 10-year bond yields pulled back to be slightly down (after rising overnight) at 3.028% and Oil (WTI) was down 0.5% to $92.99/ barrel. Basically, the Bulls wanted Powell to tell them that the Fed can take its foot off the gas on tightening, but instead he was adamant that the rate increases will continue, and higher rates will persist “for some time.” In fact, he told us to expect some pain ahead with higher interest rates, slower growth, and softer labor markets all required to bring down inflation. Basically, that was a gut punch for the traders who have been chasing growth.

In China stock news, Beijing and Washington reached a preliminary deal that will allow SEC officials to review the audit documentation of 163 businesses that the SEC identified at high risk of US trading prohibition. This is a good first step in avoiding the delisting of those companies from the NYSE and NASDAQ exchanges. Some of those major tickers potentially saved include BABA, JD, BIDU, PDD, NIO, YUMC, PTR, EDU, etc.

SNAP Case Study | Actual Trade

In food/agriculture/consumer news, a new forecast revision released Friday shows that drought and heatwaves have slashed US corn yield expectations for the fall. The revisions are now expecting more than a 4% yield reduction versus last year, taking the crop total down to 2019 levels. This does not sound like a huge issue, but add to that some very similar climate change problems in Europe and China, as well as the Russian invasion taking 20% of Ukrainian cropland out of production. The end result will be shortages and higher food prices expected toward year-end. Corn, Soybeans, and Wheat are the primarily-impacted grains with Beef, Hog, and Chicken meats impacted in turn (all are heavily grain fed). This will have a big impact on consumer defensive input prices and consumer inflation this year. However, the problem may well be made worse in 2023 because the Russian aggression has also cut natural gas supplies, lowering global fertilizer production (as much as 50% for Nitrogen-based fertilizer). This is expected to lower next year’s crop yields globally an unspecified, but very significant amount as well. (Global crop yields have dramatically increased ever since the early 1970s. This has kept food expenses a low percentage of the consumer’s budget, and freed up money for all sorts of previously unfeasible consumer spending (especially in North America and Europe). This all happened on the back of very cheap and widely-available nitrogen-based fertilizers. If that paradigm changes, you can bet consumer spending habits will also need to change…therefore reshaping stock market leadership. (All grain using tickers and as a result, the consumer spending on non-essentials will be hit significantly.)

In legal news, on Friday, a judge rules that MMM cannot use bankruptcy to avoid liability over selling defective earplugs to the US military. MMM was down 12% on the news. On Saturday, META agreed in principle to an undisclosed settlement of a lawsuit in US Federal Court seeking damages for allowing third parties (such as the infamous Cambridge Analytica) to access uses private data. Finally, also on Saturday, the USDOT temporarily waived truck driver hours of service restrictions. This came after a fire took an Indiana BP refinery offline Wednesday causing the need for much more fuel trucking in the Midwest.

In market trends, Bloomberg reports that “meme stocks” are here to stay. In a weekend survey of 522 investors, two-thirds expect the speculative meme stock phenomenon to be here to stay (based on easy/rapid internet communications). Elsewhere, Reuters reports that funds are heeding Powell’s Friday message and sticking to the old “Don’t fight the Fed” mantra. At this point, traders have amassed the largest short position on 3-month Fed Rate Futures, having doubled in the last month and gained 100,000 contracts Friday. (Traders are betting short-term bonds will fall in value as yields and interest rates rise.) In short, markets believed Chair Powell and expect more bear market pain.

So far this morning, PDD reported beats on both the top and bottom lines. Meanwhile, CTLT missed on revenue while beating on earnings. CTLT also lowered its forward guidance when it reported.

Overnight, Asian markets were deeply in the red. Japan (-2.66%), Taiwan (-2.31%), and South Korea (-2.18%) led the region lower as Asia played catch-up to the North American route from Friday. In Europe, we see the same story (with the lone exception of a green Russia +0.67%) at mid-day. The FTSE (-0.70%), DAX (-1.24%), and CAC (-1.90%) are leading the wave of red across that region in early afternoon trade. As of 7:30 am, US Futures are pointing toward a significant gap lower to start the week. The DIA implies a -0.87% open, the SPY is implying a -0.94% open, and the QQQ implies a -1.13% open at this hour. In addition, 10-year bond yields are up sharply to 3.11% and Oil (WTI) is up a half of a percent in early trading.

There are no major economic news events scheduled for Monday. The major earnings reports scheduled for the day include CTLT, HTHT, and PDD before the open. Then, after the close, HRI and YY report.

In economic news later this week, on Tuesday we get Conf. Board Consumer Confidence, July JOLTs, and a Fed speaker (Williams). Then Wednesday we see ADP Nonfarm Payrolls, Chicago PMI, EIA Crude Oil Inventories, and another Fed speaker (Mester). On Thursday Weekly Initial Jobless Claims, Q2 Nonfarm Productivity, Q2 Unit Labor Costs, PMI Mfg., and ISM Mfg. PMI are reported. Finally, on Friday we get Aug Avg. Hourly Earnings, Aug. Nonfarm Payrolls, Aug. Participation Rate, Aug. Unemployment Rate, July Factory Orders.

In earnings later this week, Tuesday we hear from BIDU, BMO, BBY, BIG, FUTU, IQ, AMRK, CHWY, CRWD, HPE, HPQ, and PVH. Then Wednesday we get reports from BF.A/B, CHS, DBI, DCI, and EXPR. On Thursday, FLWS, CPB, CIEN, GCO, GMS, MOMO, HRL, OLLI, PDCO, SAIC, SIG, TTC, WB, AVGO, JOAN, and LULU report. Finally, Friday there are no major reports.

Friday is a prime example of what happens when the market really wants to hear something. Mr. Market can really throw a tantrum when he doesn’t get what he wants/expects. However, we need to remember that the base case of markets is that they overreact, overreact to the overreaction, and then react again. That is what causes the unmistakable stairstep, zig-zag, or wave movements of price. So, at this point, we are back in a bear market…but we are over-extended to the downside in the short term. That doesn’t mean we have to rest or relief rally today…but it raises the probabilities. Just be wary of chasing gaps and run-away to the downside. Volatility is still high and traders have had a weekend to gather their wits and nerve since the unexpected bad news.

Demonstrate patience and wait for confirmation. Remember that trading is our job. So, do the work and follow the process. Stick with your trading rules, trade with the trend, and take those profits when you have them. Don’t be stubborn. If you have a loss, just admit you were wrong, respect your stop, and take the loss before it grows. When price does move in your direction, always move your stops in your favor (remember the “Legend of the man in the green bathrobe“…it is NOT HOUSE MONEY, it’s all OUR MONEY!). Lastly, remember that you get rich slowly and steadily in Trading…not by striking it rich on one or two trades. So, give up that lottery ticket mentality.

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: UXVY, SQQQ, SPXU, QID, PSQ, SNAP, MRVL, SNOW. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service