The bulls squeaked out a win on Wednesday, defending index price support levels in an otherwise mostly choppy day despite the declining Durable Goods and Pending Home Sales. This morning’s uncertainty will be the latest reading on GDP and Jobless Claims before the talking heads at Jackson Hole circulate a lot of hot air. So, expect some volatility as they put their particular spin on the market and the overall economic conditions. We also have our most important day of earnings this week to keep us on our toes and provide inspiration to the bulls or bears. Let’s get ready to rumble!

Asian markets rebounded while we slept, with the Hang Seng surging a whopping 3.63% by the close, even with expectations of a Hawkish Fed statement at Jackson Hole. Likewise, European markets trade cautiously in a choppy morning session with eyes on Jackson Hole. Nevertheless, futures point to a bullish open with a full day of talking head spin, a busy earnings calendar, and pending market-moving economic reports before the bell. However, anything is possible by the open depending on the pre-market data’s reaction.

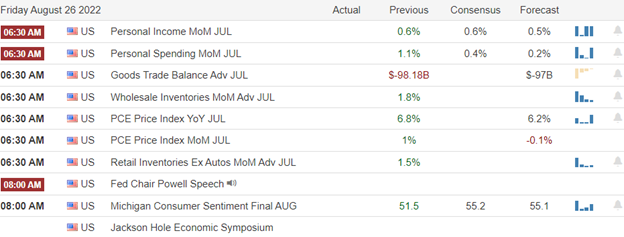

Economic Calendar

Earnings Calendar

We have a more hectic day on the Thursday earnings calendar with about 60 companies listed but less than 30 confirmed. Notable reports include ANF, AFRM, BURL, COTY, DELL, DG, DLTR, FTCH, GPS, HAIN, HIBB, MRVL, OLLI, PTON, SAFM, TITN, TD, ULTA, VMW, & WDAY.

News and Technicals’

According to an internal memo on Wednesday, Amazon is shuttering its telehealth service, known as Amazon Care. Amazon Care launched in 2019 as a pilot program for employees in and around the company’s Seattle headquarters. However, it’s unclear how much traction Amazon Care had gained. Sony on Thursday raised the recommended retail price of its PlayStation 5 games console in several international markets citing the global economic environment, including high inflation. The Japanese gaming giant said that the price hikes are effective immediately except in Japan, where they will begin on Sep. 15th. Sony is not raising the price of the PS5 in the U.S. Energy consultancy Auxilione estimates the price cap, currently at £1,971 a year, could climb to as high as £6,089 next April as Britain’s cost-of-living crisis worsens. Around one in seven working adults in the U.K. worked from home between April 28th and May 8th. However, that number could decrease as bills surge, according to Sarah Coles, the senior personal finance analyst at Hargreaves Lansdown. Nvidia reported second-quarter earnings that missed Wall Street expectations for revenue and earnings per share. The disappointing report aligned with Nvidia’s preliminary earnings two weeks ago. Nvidia said that the miss was because of lower sales of its gaming products, primarily graphics cards for PCs facing “challenging market conditions.” Salesforce beat quarterly expectations but came short on guidance for the current quarter and the full fiscal year. The enterprise software maker is raising prices on Slack after acquiring the team communications app last year. Salesforce said its board approved $10 billion on the company’s first buyback program. Treasury yields dip slightly ahead of Fed comments at Jackson Hole, with the 12-month at 3.26%, the 2-year at 3.37%, the 5-year at 3.19%, the 10-year at 3.09%, and the 30-year at 3.30%.

Despite declining Durable Goods and Pending Home Sales., the bulls won another mostly choppy day Volume remained noticeably anemic as the bulls worked to hold price support levels in the index charts. Although NVDA and CRM disappointed after the bell, names like ADSK and NTAP jumped higher on a mixed afternoon of earnings results. Today begins the Jackson Hole Symposium, so expect a glut of talking heads hitting the news cycle to put their particular spin on the market and economic condition. However, before all that hot air gets circulated, we will get a reading on GDP and Jobless Claims to add a dose of uncertainty before the open. As you plan forward, remember we have the Fed’s favorite measure of inflation, the PCE, coming out Friday morning before the Jerome Powel comments at 10 AM Eastern.

Trade Wisley,

Doug

Comments are closed.