Bears Look to Claw Back Ground This AM

Markets gapped lower at the open Friday and followed through to the downside until 11 am. From that point, all 3 major indices ground sideways the rest of the day. This left us with gap-down black candles with modest wicks on both ends. The SPY and the QQQ have failed their T-lines (8ema). However, the DIA managed right at the T-line. All 10 sectors were red with Technology, Basic Materials, and Consumer Cyclicals leading us lower.

On the day, SPY lost 1.34%, DIA lost 1.05%, and QQQ lost 1.95%. The VXX was flat at 21.16 and T2122 (4-week New High/Low Ratio) dropped like a stone, falling out of the overbought territory to the low mid-range at 35.71. 10-year bond yields rose sharply to 2.972% and Oil (WTI) was off a little less than a half of a percent to $90.09/barrel. This resulted in the first down week following the last 4 weeks being up.

In stock news, on Friday, BRKB was also granted permission to buy up to 50% of OXY (BRKB already owns just over 20% of the stock) and OXY shares closed up 8.48% on the news. Then on Saturday, it was reported that a jury ordered F to pay $1.7 billion in a Georgia rollover accident case from 2014. US Sec. of Transportation Buttigieg urged the 10 largest US airlines to do more to help stranded or delayed passengers following a large uptick in cancellations and delays this summer. AAL, DAL, UAL, LUV, JBLU, ALK, and SAVE were among the companies warned to do more or face stiff fines from the DOT. Elsewhere, a federal judge found SBUX guilty of firing 7 Memphis employees for seeking to form a union and has ordered SBUX to reinstate them. This is one of at least 3 federal cases brought by the National Labor Relations Board against SBUX (for the same illegal practice), which is desperately trying to stop unionization after 200 of its stores have recently unionized. Finally, Elon Musk was back on TWTR Sunday, saying that TSLA will hike the price of their “full self-driving” service by 25% on Sept. 5.

SNAP Case Study | Actual Trade

In personal computer tech news, AMD, NVDA, both now have a glut of current version graphics cards that they and their distributors need to unload very soon in order to make room for new models. The recent tremendous drop in Ethereum prices (which discouraged miners from buying as many cards on which to mine as they had in the past) is in part responsible. In addition, Ethereum will move to “proof of stake” (for the purpose of this blog just means you will no longer be able to mine Ethereum on a PC graphics card) by September 15. Regardless of the cause, AMD and NVDA are in a bind and clashing pricing on their current stock in order to unload it. AMD will announce its new line sometime 9/15-9/27 and will release the first 1-2 models of that lineup in October. At the same announcement, AMD will introduce its new 7000-series CPU lineup and the first of these will be for sale in November. INTC (which tried and failed to break into the graphics card business over the last year is also expected to announce new CPUs on 9/27, with the first of those models released for sale in December. The point is that all 3 companies are currently under tremendous pressure to discount graphics cards, more glut pressures are coming, and newer/faster models are on the horizon. In terms of CPUs, it appears AMD will beat Intel to market with their newest models by about 1-2 months, likely resulting in an increase in market share.

In China news, the PBOC made another surprise, but small, rate cut on Monday. The Chinese Central Bank lowered 1-year rates by 5 basis points and the 5-year by 15 basis points. Reuters reports leading analysts saying they expect China to continue cutting (10 basis points at a time) the remainder of the year. By themselves, rate cuts will have a supportive impact on China’s troubled real estate developers. However, the Beijing government is also planning a $29.2 billion package of “special loans” for the construction sector to help developers deliver unfinished projects and ease its national mortgage payment boycott movement (according to Bloomberg).

In technical analysis news, both the SPY and QQQ have gapped back down to test their 20sma as support in premarket. At this point, the SPY is holding that level and it looks like the QQQ is failing. The DIA has a way to go, but is headed that direction. Of course, the 20sma, 34ema, and 50sma are rising for all 3 major indices after weeks of rally. Markets seem focused on anticipating the Fed’s September action and as of this moment, Futures are pricing in a 61-basis-point hike. Unfortunately for traders, we will not hear from Fed Chair Powell until Saturday in Jackson Hole.

Overnight, Asian markets were mixed, even as China issued another surprise rate cut on Monday. Shenzhen (+1.19%), New Zealand (+0.68%), and Shanghai (+0.61%) led the gains. Meanwhile, India (-1.51%), South Korea (-1.21%), and Taiwan (-1.06%) paced the losses. In Europe, stocks are mostly in the red at mid-day. The FTSE (-0.24%) lags while the DAX (-1.71%) and CAC (-1.19%) lead the region lower. There are only two exchanges (Russia +1.19% and Norway +0.49%) showing green in that region in early afternoon trading. As of 7:30 am, US Futures are pointing toward a gap lower at the bell. The DIA implies a -0.85% open, the SPY is implying a -1.09% open, and the QQQ implies a -1.47% open at this hour. 10-year bond yields are just very slightly up to 2.975% and Oil (WTI) is starting the week up a half of a percent to $91.22/barrel.

There are no major economic news events scheduled for Monday. There are no major earnings reports scheduled for before the open. However, after the close, NDSN, PANW, and ZM report.

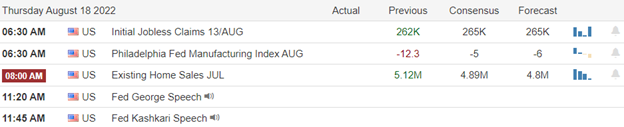

In economic news later this week, Tuesday we get Mfg. PMI, Services PMI, July New Home Sales, and the API Weekly Crude Oil Stocks Report. Then Wednesday, July Durable Goods Orders, July Pending Home Sales, Weekly EIA Crude Oil Inventories, and 5-year Bond Auction are reported. Thursday, we get a Q2 GDP Revision, Weekly Jobless Claims, and the Jackson Hole Central Banker Symposium begins. Finally, on Friday, we get July PCE Price Index, July Personal Spending, July Trade Goods Balance, , July Retail Inventories, Michigan Consumer Sentiment, and the Jackson Hole Central Banker Symposium continues with Fed Chair Powell Speaking.

In earnings later this week, on Tuesday we hear from BNS, DKS, DOLE, SJM, JD, BEKE, M, MDT, XPEV, AAP, CAL, INTU, LZB, JWN, SCSC, TOL, and URBN. Then Wednesday we get reports from EAT, CY, IIVI, WOOF, RY, ADSK, GES, NTAP, NVCA, CRM, SPLK, VSCO, and WSM. On Thursday we hear from ANF, BURL, CM, COTY, DG, DLTR, GFI, GOGL, HAIN, PTON, TD, DELL, FTCH, GPS, MRVL, ULTA, VMW, and WDAY. Finally, on Friday JKS reports.

Traders took profits Friday and seem in the same mood this morning. The main focus seems to be on being in front of what the Fed will do in September as the probability of a 75-basis-point hike is growing again after a brief period of 50bp expectation. In addition, Europe was spooked by Russia’s saber-rattling again when they announced a the end of last week that they “need” to shut off gas flow to Europe for 3 days of maintenance at the end of this month. This comes as Europe (and especially Germany) are desperately trying to fill storage tanks ahead of Winter. That announcement played a large part in Europe’s down start on Monday. With all of that said, the short-term trend is bearish, but the mid-term trend remains bullish and we are fast approaching a level of support from the June and Early August highs.

Remember that trading is our job. So, do the work and follow the process. Stick with your trading rules, trade with the trend, and take those profits when you have them. Demonstrate patience and wait for confirmation. Don’t be stubborn. If you have a loss, just admit you were wrong, respect your stop, and take the loss before it grows. When price does move in your direction, always move your stops in your favor (remember the “Legend of the man in the green bathrobe“…it is NOT HOUSE MONEY, it’s all OUR MONEY!). Lastly, remember that you get rich slowly and steadily in Trading…not by striking it rich on one or two trades. So, give up that lottery ticket mentality.

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: ETSY, NET, JNPR, FUTU, OXY, KMI, KHC, XOM, MRO, DVN, SDS, DXD, QID. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service