Another Heavy Earnings Week Starts

Markets diverged at the open again Friday with the QQQ gapping down a quarter of a percent, the SPY opening flat, and the DIA gapping up by four-tenths of a percent. Still, at that point, all 3 major indices got in lock-step as the short squeeze was on. We saw a strong rally until 11:15 am and then a slower rally continuing the rest of the day, closing near the highs, in all three of those indices. This action gave us large, white, Bullish Engulfing candles in both the SPY and QQQ as well as a gap-up, white near Marubozu candle in the DIA. It’s worth noting that the DIA is getting quite extended from its T-line (8ema) and had also broken up through its 200sma by the close. Meanwhile, SPY broke its 50sma while the QQQ has not quite made it to that test.

On the day, nine of the 10 sectors are in the green. Technology (+2.78%) and Comm. Services (+2.62%) led the market higher while Basic Materials (-0.27%) was the down sector. The SPY gained 2.35%, DIA gained 2.51%, and QQQ gained 3.06%. At the same time, VXX fell 2.34% to 17.93 while T2122 is very much overbought at 95.99. 10-year bond yields remain up slightly to 4.016% and Oil (WTI) was down 0.99% to $88.19/barrel. Overall, it was a strong bull day (short squeeze?) in the recent uptrend. It also led to a second straight week of gains in the DIA, SPY, and QQQ.

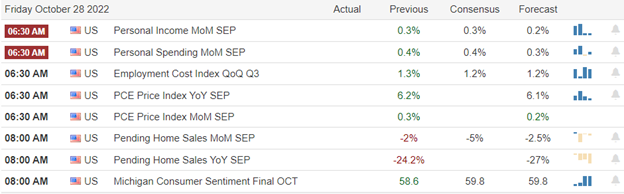

In economic news, September PCE Price Index (a favorite Fed indicator) remained steady versus the August readings at +0.3% month-on-month and +6.2% year-on-year. However, September Personal Spending came in higher than expected at +0.6% (as compared to +0.4% forecast but in line with the August reading of +0.6%). Meanwhile, the Michigan Consumer Sentiment came in slightly improved at 59.9 (versus the 59.8 forecasted and the previous reading of 59.8). This would all seem to indicate that while inflation remains high, it may have stopped rising, and in either case, the consumer has not slowed down buying and at least has not had a decline in mood. Finally, the Sept. Pending Home Sales fell much more than forecast at -10.2% (compared to a -5.0% forecast and the August reading of -1.9%). This obviously corresponds to the interest rate sensitivity of home buyers that would be locking in 30-year debts.

SNAP Case Study | Actual Trade

In stock news, Bloomberg reported Friday that APO, BX, and KKR are now under investigation for antitrust activities through their influence on the boards of various companies in which they hold major stakes. Across the pond, an Italian court has decided to suspend making a decision on an AMZN request to annul the $1.12 billion fine imposed by Italy’s antitrust watchdog agency. This suspension will last until an EU Court rules on the case. Elsewhere, the EU antitrust regulators ordered ILMN to keep Grail a separate entity pending the handing down of an order to prohibit the merger. (The EU ordered the deal blocked on Sept. 6.) Back in the US, BBBY said Friday it is reviewing a data breach to determine what data had been accessed by hackers earlier this month. GM paused its advertising on TWTR as Musk has loosened restrictions on speech and trolls are testing the new limits during the weekend with posts that would have previously drawn a ban.

In miscellaneous news, on Friday Canada implemented restrictions on foreign entities with at least partial state ownership participating in Canadian “strategic minerals” projects. (The rules were clearly aimed at blocking Chinese companies from taking on positions in mining operations related to rare earths, lithium, cobalt, nickel, and even copper.) The mega-cap, safety play stalwarts have been killing it recently. XOM, UNH, PEP, MRK, MCD, LLY, TMUS, AMGN, CI, and HUM are just some of the big boys that all closed at all-time highs Friday. Finally, Bloomberg reported Sunday that economists at GS now expect the Fed interest rates to peak at 5% (25 basis points higher than their previous predictions), but that the peak will come in March 2023 (earlier than previous predictions). GS said they expect Fed hikes to end with 75 basis points this week, 50 basis points in December, and then 25 basis point hikes in both February and March.

In late-breaking news, RTX paid a former employee (whistleblower) $1 million on Sunday after he reported the company for submitting false GPS data to the Air Force and the company punished him for the revelation. Abroad, Luiz Inácio Lula da Silva (known as Lula of the Social Democrat “Worker’s Party”) won the hard-fought runoff election for President of Brazil Sunday. At the same time, wheat prices jumped 6% as Russia continues to stop Ukrainian grain exports on false “need more inspection” pretexts and over the weekend said it will end the deal to allow those exports as of Nov. 1. Finally, the European Statistics Office announced overnight that Eurozone inflation has hit a record 10.7% in October.

So far this morning CNA, GPN, JELD, SXC, and L have all reported beats on both the top and bottom lines. Meanwhile, XPO reported a miss on revenue while also beating on earnings.

Overnight, Asian markets were strongly green with the exception of China. Hong Kong (-1.18%), Shanghai (-0.77%), and Shenzhen (-0.05%) were the only red in the region. At the same time, New Zealand (+1.88%), Japan (+1.78%), and India (+1.27%) led the region higher. In Europe, exchanges are mixed at midday. The FTSE (+0.11%), DAX (+0.17%), and CAC (-0.03%) lead on volume while most smaller exchanges are showing slightly more significant, yet still modest moves in early afternoon trade. As of 7:30 am, US Futures are pointing toward a down start to the week. The DIA implies a -0.50% open, the SPY is implying a -0.58% open, and the QQQ implies a -0.79% open at this hour. 10-year bond yields are back up to 4.046% and Oil (WTI) is down 1.67% to $86.43/barrel in early trade.

The major economic news events scheduled for Monday is limited to Chicago PMI (9:45 am). The major earnings reports scheduled for the day include ARLP, CAN, GPN, HWM, NSP, JELD, ON, PEG, SAIA, and XPO before the open. Then after the close, ACHC, AFL, AWK, ANET, CAR, BCC, CHE, CINF, CIVI, CLW, CNO, CVI, FLS, GT, HLF, HOLX, KMT, LEG, VAC, NXPI, RRX, SBAC, STRL, SYK, and WMB report.

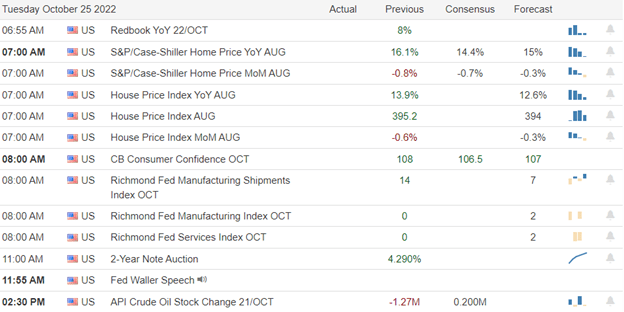

In economic news later this week, on Tuesday, Mfg. PMI, ISM Mfg. PMI, September JOLTs Job Openings, and API Weekly Crude Oil Stocks are reported. On Wednesday, we get ADP Nonfarm Employment, EIA Crude Oil Inventories, FOMC Statement, Fed Rate Decision, and FOMC Press Conference. Then on Thursday, Imports/Exports, September Trade Balance, Weekly Initial Jobless Claims, Q3 Nonfarm Productivity, Q3 Unit Labor Costs, Services PMI, Sept. Factory Orders, Oct. ISM Non-Mfg. PMI report. Finally, on Friday, we get Avg. Hourly Earnings, Oct. Nonfarm Payrolls, Oct. Participation Rate, and Oct. Unemployment Rate.

This is a huge earnings week as on Tuesday, AJRD, AGCO, AME, ARCB, ARNC, BP, CTLT, CNP, CIGI, ETN, ECL, LLY, EPD, FOXA, BEN, IT, HSIC, IDXX, INCY, KKR, LCII, LEA, LDOS, LGIH, LPX, MPC, TAP, MPLX, NEM, PFE, PSX, SEE, SPG, SIRI, SON, SONY, SUN, SYY, TRI, BLD, TM, UBER, WAB, WAT, WEC, XYL, ZBRA, AMD, ABNB, AMCR, AIG, ANDE, AIZ, BXC, BFAM, CZR, CWH, CAKE, CHK, CRUS, CLX, CRK, DVN, EIX, EA, ET, ENLC, EXR, FMC, THG, PEAK, LBTYA, LFUS, MTCH, MCK, MDLZ, OI, OKE, PARR, PRU, PSA, RNR, REZI, SCI, SKY, SMCI, TA, UNVR, UNM, VRSK, VOYA, WU, and YUMC report. Then Wednesday, ATI, APO, AVNT, BLCO, BDC, EAT, BR, CHRW, CDW, FUN, CVE, CRL, CLH, CEQP, CVS, EMR, ENTG, ETR, EL, EXPI, RACE, FYBR, GNRC, GSK, HZNP, HUM, JLL, MKL, MLM, NYT, NMR, DNOW, ODP, OMI, PARA, PSN, PGR, RITM, ROK, SABR, SMG, SBGI, SITE, SHOO, TT, TRMB, UTHR, VSH, VMC, YUM, ZBH, ALB, ALGT, ALL, ATUS, AFG, APA, ACA, EQH, BBSI, BKNG, CPE, CF, CHRD, CTSH, CLR, CCRN, CW, EBAY, EQIX, EQX, ETSY, ES, FLT, FTNT, GFL, HST, HHC, ICLR, IR, KMPR, KD, LHCG, LNC, LUMN, MRO, MATX, MET, MGM, MKSI, MOD, NUS, NTR, OPAD, PK, PDCE, PAA, PAGP, PTC, QRVO, QCOM, QDEL, O, RCII, ROKU, RYI, SIGI, SUM, SLF, SU, RUN, RIG, TSE, TTMI, TPC, VSTO, WCN, WTS, WERN, WES, WSC, YELL, and Z report. On Thursday, GOLF, ADT, WMS, AER, APD, ALIT, ABC, APG, APTV, ARW, AAWW, BALL, BALY, GOLD, BHC, BCE, BRKR, CQP, LNG, CI, COMM, COP, CROX, CMI, DSEY, DNB, SATS, EPAM, ESAB, EXC, FIS, FOCS, GIL, GTN, GPRE, HII, H, INGR, NSIT, IBP, ICE, IRM, ITT, JCI, K, KTB, MAR, MD, MRNA, MODV, MUR, NGD, OGN, PZZA, PH, BTU, PTON, PENN, PNW, PWR, REGN, QSR, RCL, SRE, SPR, STLA, SRCL, TRGP, TPX, TX, TEVA, VNT, W, WCC, WLK, ZTS, AGL, AL, ATSG, AEE, COLD, AMGN, AMN, TEAM, AVB, BECN, SQ, CVNA, CVCO, CE, COIN, CODI, ED, CTRA, CTVA, BAP, CWK, DASH, DBX, DXC, NVST, EXAS, EXPE, FND, FRG, GDDY, IHRT, ILMN, LYV, MTZ, MELI, MTD, MCHP, MNST, MSI, ZEUS, OTEX, OPEN, PYPL, CNXN, PBA, KWR, RGA, RKT, SEM, SVC, SWKS, SM, SBUX, TDS, TS, TWLO, USX, VTR, and WBD report. Finally, on Friday, ADNT, AES, AMCX, AXL, AMRX, BEP, CAH, CNK, D, DUK, ENB, EOG, EVRG, FLR, GTES, GLP, HSY, HUN, IEP, KOP, LAMR, LSXMA, MGA, PBR, PPL, SYNH, TEF, TIXT, and VST report.

Again this week, the flood of earnings reported continues. Even so, traders remain very nervous after AMZN’s forecast of a grim holiday season coming and AAPL’s poor iPhone sales (although the company beat on both lines). With that said, don’t expect prices to gap and run the same way. You have to look no further than Friday to see the gap down, reversal, and strong bull move shown in the SPY and QQQ. So, be cautious, and don’t be in a hurry to get your positions on until the market settles. Remember that rotation continues to be in play among sectors and asset classes (capitalization). With the Fed meeting again this week (futures say we will definitely get another 0.75% hike, but whispers hope for softer language from Chair Powell), we may see some “wait and see” in the market the next 2.5 days.

The trend remains bullish across the market indices and today’s premarket action is looking for a gap back inside of Friday’s candle. Extention from the T-line (8ema) is not a factor in any of the major indices at this point. However, T2122 says we are still deeply overbought. With that said, it does look like the DIA could use some rest. High volatility and intraday reversals seem to be the norm. So, if you can’t handle the short-term pain of a whipsaw, it may be time to pursue more cautious trading strategies (options spreads for example), including remaining hedged, quick, and/or small.

Don’t be stubborn. If you have a loss, just admit you were wrong and take it before it grows. And when price does move in your direction, always move your stops in your favor (remember the “Legend of the man in the green bathrobe“…it is NOT HOUSE MONEY, it’s all OUR MONEY!). Also, keep in mind that trading is not a hobby. It’s a job. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Lastly, remember that you get rich slowly and steadily in Trading…not by striking it rich on one or two trades. So, give up that lottery ticket mentality.

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: ETHE, GDX, GOOG, FCX, AMAT, CHWY, AAPL, AI, AMZN. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service