Although the big bullish bounce on Wednesday raised hopes of a relief rally, the real question is, can the bulls follow through a second day, or was it just a dead cat bounce? A lot will depend on how the market reacts to the GDP and Jobless Claims numbers before today’s bell. Sadly the Wednesday push upward didn’t seem to translate into bullishness in Asian overnight or European markets this morning. Keep in mind that with the uncertainty of 4th quarter earnings just around the corner, its possible we’ve entered a wide-ranging chop zone as we wait.

Asian markets struggled to pick up on the bullish love felt in the U.S., closing the day mixed. European markets see red across the board as the BOE intervention quickly fades. With some name earnings reports, GDP, and Jobless Claims ahead, the U.S. futures look to take back a big chunk of yesterday’s rally at the open. However, a lot could change depending on the reaction to the economic data. Expect another wild morning of whipsaws and reversals.

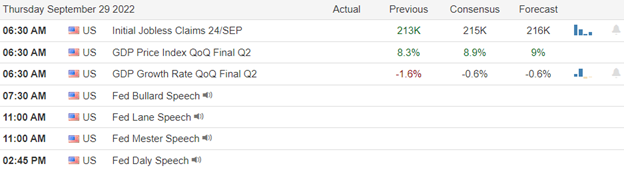

Economic Calendar

Earnings Calendar

The Thursday calendar is a light one, with just nine confirmed reports. Notable reports include BBBY, MU, NKE, KMX, RAD, & WOR.

News & Technicals’

Beneath all the clamor of Russia’s invasion of Ukraine and the efforts to tamp down inflation, investors are passing over a huge story in China, Jim Chanos said. The nation faces a deepening crisis caused by multiple factors, resulting in the worst plunge in home sales since China started allowing private property sales in the late 1990s. CNBC’s Jim Cramer said Wednesday’s rally would likely reverse course as soon as a Federal Reserve official reminds Wall Street of its hawkish stance against inflation. “The moment some Fed-head explains the obvious, today’s gains will disappear because they’re incompatible with the Fed’s attempts to control inflation,” he said.

Pension fund panic led to the Bank of England’s emergency intervention. To prevent an “unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy, the FPC said it would buy gilts on “whatever scale is necessary” for a limited time. Central to the Bank’s extraordinary announcement was panic among pension funds, with some of the bonds held within them losing around half their value in a matter of days. Analysts are hoping that a further intervention from Westminster or the City will help assuage the market’s concerns, but until then, choppy waters are expected to persist.

The Wednesday bounce raised hopes for a relief rally, but the real question is, can it follow through for a second day? A lot will depend on how the market reacts to the GDP and Jobless Claims numbers before the bell. While it was nice to get some selling relief, there was no substantive improvement in any chart technicals and changes, nothing in the FOMC inflation-fighting stance. That said, I still hope for a bit more relief to set up short trade positions, but with 4th quarter earnings uncertainty just around the corner, we may have just set the chop range of price action while we wait. The pullback in the U.S. dollar was a big help to the Wednesday rally, but I wouldn’t hold my breath thinking that it continues unless other countries get serious about fighting inflation.

Trade Wisely,

Doug

Comments are closed.