Happy day, the bulls returned to work on Monday, finding inspiration in the pullback of bond yields and the declining dollar. However, it was not all sunshine and roses with the bearish ISM report and the sharply declining construction spending. Though the relief rally was overdue, keep in mind downtrends remain intact, as well as significant overhead resistance, so the feeling the bottom may be in is premature. Stay focused on price, and remember, the bulls still have a lot to prove before we sound the all-clear signal.

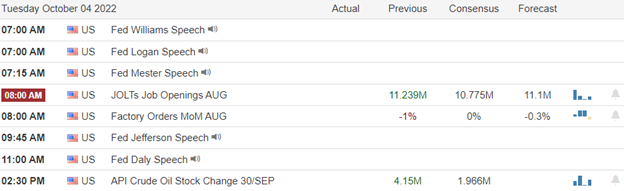

Asian market closed mixed after a smaller than expected Australian rate hike, though the Nikkei surged nearly 3%. European markets leap higher this morning as they celebrate the needed selling relief. Ahead of factory orders, the JOLTS report, and a parade of Fed speakers, U.S. futures point to a huge gap up open despite the tremendous economic uncertainties. Watch for the possibility of a pop and drop as we test the downtrend and overhead resistance levels.

Economic Calendar

Earnings Calendar

We have just four confirmed reports on Tuesday. They are AYI, NG, SAR, and SGH.

News & Technicals’

Monetary and fiscal policies in advanced economies — including continued interest rate hikes — could push the world toward a global recession and stagnation, the UN Conference on Trade and Development (UNCTAD) said on Monday. A global slowdown could potentially inflict worse damage than the financial crisis in 2008 and the Covid-19 shock in 2020, warned the UNCTAD in its Trade and Development Report 2022. “We still have time to step back from the edge of recession. Nothing is inevitable. We must change course,” said UNCTAD Secretary-General Rebeca Grynspan. North Korea fired a ballistic missile over Japan for the first time in five years on Tuesday, prompting a warning for residents to take cover and a temporary suspension of train operations in northern Japan. Speaking to reporters shortly afterward, Prime Minister Fumio Kishida called North Korea’s actions “barbaric” and said the government would continue gathering and analyzing information.

Manhattan apartment sales fell 18% in the third quarter, putting the brakes on New York’s real estate comeback. However, the figure last fell in the fourth quarter of 2020 and marks a turnaround for the nation’s largest real estate market. Brokers say the drop marks a return to normalcy after the artificially high sales of 2021. There are growing fears of a housing market crash in the U.K. after a swathe of tax cuts announced by the government sent interest rate expectations soaring, driving up lending rates for homebuyers. As a result, several banks suspended mortgage deals for new customers, and many have now returned to the market with significantly higher rates. Oxford Economics estimates that if interest rates remain at the levels currently being offered, house prices are approximate “30% overvalued based on the affordability of mortgage payments.”

With the U.S. dollar declining and bond yields easing slightly, the bulls finally found the inspiration to rally Monday despite the declining ISM and Construction spending numbers. It’s a welcome relief from the short-term oversold condition of the indexes. However, the indexes remain in downtrends, and we have yet to challenge the significant overhead resistance levels, so be careful in assuming this is an all-clear buy signal. While yesterday’s big point move raises hope of a market bottom, we still have an inflation problem and a Fed showing no signs of pivoting. Today we will get a reading on factory orders and the JOLTS report with another parade of Fed speakers. With the dollar falling, keep a close eye on commodity prices that typically rally during currency weakness which could quickly add pressure to the fight against inflation. With earnings season just nine days away, volatility is likely to remain high, especially if we continue to get downgrades and earnings warnings.

Trade Wisley,

Doug

Comments are closed.