As we begin a new quarter, inflation remains unacceptably high, and everyone wonders what will break first. The economy or the FOMC’s hawkish stance? Today the FOMC has called an emergency meeting. One has to wonder if we are again on the brink of a banking or liquidity crisis. Stay alert for price gyrations as news comes out. The official kick-off of 4th quarter earnings is only 10-days away, so keep an eye out for possible downgrades and warnings with the consumer-facing some difficult decisions as prices continue to rise. The overnight reversal and intraday whipsaws will likely continue, so plan your risk carefully.

Asian markets closed mostly lower, with oil rising and the Hang Seng falling to its lowest level in 11 years. European markets trade primarily lower this morning as Credit Suisse declines sharply. However, as I write this report, the U.S. futures have recovered from overnight lows, pointing to another gap as another premarket pump hopes to inspire the bulls. Watch for the possible pop and drop with so much price resistance above despite the short-term oversold condition.

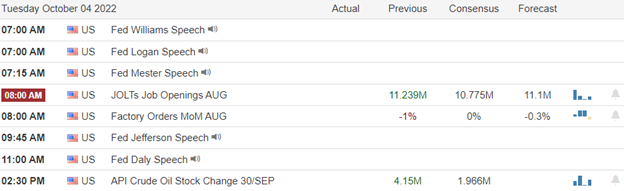

Economic Calendar

Earnings Calendar

There are no confirmed earnings reports for today.

News & Technicals’

Shares of Credit Suisse plunged nearly 10% in Europe’s morning session after the Financial Times reported that the Swiss bank’s executives are talking with its major investors to reassure them amid rising concerns over the Swiss lender’s financial health. Spreads of the bank’s credit default swaps (CDS), which provide investors with protection against financial risks such as default, rose sharply Friday. They followed reports the Swiss lender is looking to raise capital, citing a memo from its Chief Executive Ulrich Koerner. The U.K government reverses planned tax cuts due to currency fluctuations. It represents a major and humiliating U-turn for new Prime Minister Liz Truss, who was insisting that she was “absolutely committed” to the cut as recently as Sunday. She also revealed the decision was taken by Kwarteng and had not been announced to her whole cabinet.

Markets entered a dangerous new phase in the past week, in which statistically unusual moves across asset classes are commonplace. According to Mark Connors, former Credit Suisse global head of risk advisory, surging volatility in what are supposed to be among the world’s safest fixed income instruments could disrupt the financial system’s plumbing. He said that could force the Fed to prop up the Treasury market. Doing so will likely force the Fed to halt its quantitative tightening program ahead of schedule. The other worry is that the whipsawing markets will expose the weak hands of asset managers, hedge funds, and other players who may have been overleveraged or taken on unwise risks. As a result, margin calls and forced liquidations could further roil markets.

Monthly consumer prices grew by 3.08% and annually by 83.45%. The domestic producer price index was up 4.78% from the previous month and a whopping 151.5% year on year. Inflation for the country of 84 million people has soared in the last two years, particularly as Turkish President Recep Tayyip Erdogan insists on continuing to cut interest rates rather than raise them — deviating from the conventional way of controlling inflation. “My biggest battle is against interest. My biggest enemy is interest. We lowered the interest rate to 12%. Is that enough? It is not enough. This needs to come down further,” Erdogan said during an event in late September.

As we begin a new quarter, indexes remain in a short-term oversold condition, and as of the Friday close, the bears left all but IWM at fresh 2022 lows. Moreover, with the official start of the 4th quarter earnings 10-days away and the mid-term election only 35 days, there is a lot of uncertainty about what comes next. Adding to the concern, the FOMC has called an emergency meeting for today. Could we be on the brink of another banking or liquidity crisis? China is also making concerning moves that may soon trigger a selloff in the dollar to stabilize the Yuan. With so much uncertainty, traders must be ready for just about anything. As a result, overnight reversals and news-inspired intraday reversals are likely to continue. Watch for reports of earnings downgrades and warnings from companies of potential top or bottom line misses as consumers face some complex decisions heading into the winter. September was challenging, but we have not seen full-on panic, so perhaps October will bring us some selling relief.

Trade Wisely,

Doug

Comments are closed.