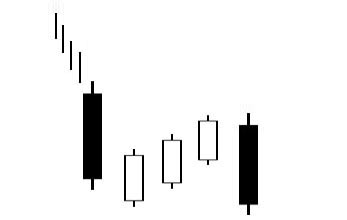

The Bearish Mat Hold candlestick pattern tells the story of powerful commanders (the bears) and weak but determined subordinates (the bulls). Although the bears are firmly in control, the bulls attempt to overturn their rule for three ineffective days. In the end, the bears win the fight, seizing the reins once more and allowing the downtrend to continue. Rare and complex but usually reliable, the Bearish Mat Hold deserves a spot in your arsenal.

Bearish Mat Hold

Formation

Like its brother, the Bullish Mat Hold, the Bearish Mat Hold signal is both rare and powerful. So if you think you’ve spotted it, take a moment to review its criteria to be sure you haven’t mistaken another pattern* for it:

First, a downtrend must be in progress. Second, the first day must be defined by a long black candlestick. Third, the second day’s candle must open below the low of the first day (a gap down) and produce a small white candle. Fourth, two more short candles should follow on the third and fourth days: the first can be black or white, but the second must be white. These candles should remain below the high of the first day. Fifth, the pattern must end with another long black candlestick on the fifth day. This candle should establish a new low (below the low of the first day).

* The pattern most likely to be mistaken for the Bearish Mat Hold is the Falling Three Methods signal. Although similar in formation, there is one crucial difference. In a Bearish Mat Hold, the first white candle opens below the previous day’s low. In a Falling Three Methods pattern, the first white candle opens above the previous day’s low, and all three white candles are contained within the first day’s body.

Meaning

At the onset, the bears are controlling the market, steadily pushing the price lower and establishing a downtrend. Following the first day, however, in which the bears significantly lower the price (creating a long black candle), the bulls experience a resurgence. Although the second day begins below the first candle, the price is pushed slightly up by closing time. In the following two days, the bulls retain control of the reins, making two more slight upward pushes. Although somewhat weak (and perhaps losing control on the third day), they are persistent. However, on the fifth and last day, the bears take control once more. They depress the price to such an extent that the day ends at a low point (below the low of the first day).

The bulls attempted to steal control, but they didn’t have the power to orchestrate a reversal. The bears will continue to command the price movement, and the downtrend will continue.

_____

Because the Bearish Mat Hold pattern is thin on the ground, you may be tempted to pounce on it whenever you spot it. Before you make any significant moves, however, remember to wait for confirmation in the form of a black candlestick with a lower close or a downward gap. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.