For all the talk of long days – “I had such a long day at work!” – no one ever seems to talk about short days. A short day zips by in a flash. Often this sort of fleeting day occurs when the day is like any other, “business as usual.” You may feel like you’re on autopilot, going through the motions without much thought or passion. In the world of Japanese candlesticks, however, a Short Day candlestick is a simple signal composed of just one candle. Like the Doji and the Long Day, it isn’t very important on its own. Nevertheless, it can play a part in larger and more influential patterns.

Short Day Candlestick

Formation

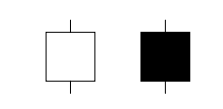

The Short Day candlestick is one of the easier signals to spot; it is composed of a single candle, after all, and its name describes its appearance. So let’s keep it short and sweet: the Short Day is made up of a single candle with a short body. It can be bearish (with a black or red body) or bullish (with a white or green body), and it can appear anywhere on a candlestick chart.

The only defining characteristic of the Short Day candlestick is its length. So how short does a candle have to be in order to qualify as “short”? There isn’t a specific number, so you will need to evaluate the candle’s length in relation to all the candles on the chart. By reviewing the past two to three weeks of trading, you can get an illustrative sample. In addition, the candle must open and close inside the range of the preceding candle to qualify as a Short Day signal.

Meaning

In a bullish pattern, the bottom of the candlestick body represents the open and the top represents the close. In a bearish pattern, the bottom of the candlestick represents the close and the top represents the open. In either case, no matter which way the price moves, a Short Day pattern conveys that the price didn’t progress very far during the course of the trading interval. This means that the buyers and sellers are generally in agreement regarding the price of the stock.

As we mentioned in the introduction, a Short Day candlestick isn’t typically used as a trade entry or exit. Instead, it is encompassed within larger patterns, providing these signals with more relevance. For example, you can find Short Day candlesticks within the following signals, amongst others:

Short, simple, and versatile, the Short Day candlestick is common but not particularly noteworthy on its own. Wait until you spot it amongst a crowd, acting as a part of a larger pattern, before you make your move. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.