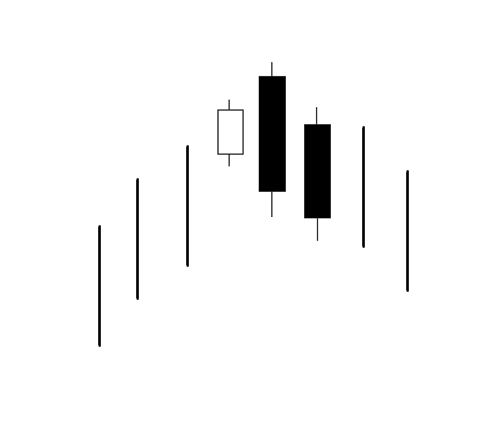

Any trader worth his or her salt knows that, when relying on a forecast provided by Japanese candlesticks, it is always best to wait for confirmation. By watching what happens right after a signal pops up, you can verify the reliability of the pattern. Thus, if you can afford to hold your horses for another trading period, you can increase your confidence and peace of mind before making your trade. Some signals, like the Three Outside Down candlestick pattern, are built upon the concept of confirmation. After all, when it comes down to it, the Three Outside Down is just a confirmed Bearish Engulfing signal.

Three Outside Down Candlestick Pattern

Formation

If you know what a Bearish Engulfing pattern looks like, you can easily guess the appearance of the Three Outside Down by adding a confirming candle to the end. However, to be clear, these are the criteria that define a Three Outside Down candlestick pattern:

First, an uptrend must characterize the market. Second, a small white (or green) candle must appear, continuing the uptrend. Third, a longer black (or red) candle must “engulf” the prior candle. This means that the top of its body will be above the prior candle’s body, and the bottom of its body will be below the prior candle’s body. Fourth and finally, another black (or red) candle will follow, confirming the sudden downtrend.

The opposite of this pattern (a confirmed Bullish Engulfing) is known as a Three Outside Up.

Meaning

For a Three Outside Down pattern to occur, the bulls must control the market. The first day of the signal continues the uptrend, though the progress is minimal (resulting in a small candle). However, the bears refuse to accept the upward movement of the market. Although the next day opens above the previous day’s candle, the bears quickly and forcefully seize control of price. They push the price below the previous day’s low, engulfing the prior candle (and creating a Bearish Engulfing signal). You could choose to act at this point, but most investors will wait for confirmation in the form of another bearish candlestick with a lower close (i.e., a Three Outside Down candlestick pattern).

A strong Three Outside Down will have the following characteristics as well:

- Long candles (especially the engulfing candle)

- Strong uptrend at the onset

So when you spot a Bearish Engulfing pattern, know that you don’t have to act immediately. With a little patience, you can catch sight of a Three Outside Down signal instead. Its one extra candle may provide the confirmation you need to make a bold, assertive, and coolheaded move. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.