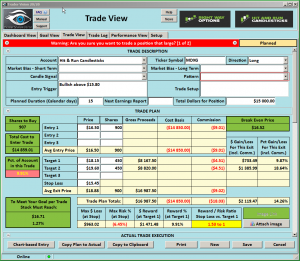

MDXG – Breakout From Consolidation

MDXG – Breakout from consolidation, after 3 months of consolidation MDXG broke out on strong volume. Support and Resistance held price captive but now looks Bullish. We are Bullish with price above $15.80

MDXG – Breakout from consolidation, after 3 months of consolidation MDXG broke out on strong volume. Support and Resistance held price captive but now looks Bullish. We are Bullish with price above $15.80

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

Trade Updates – Hit and Run Candlesticks

No new trades yesterday, still holding 1/2 SGMO for a 17% gain – adjusted stop to protect more of the profits.

Are you having trouble putting together a winning trade? Not sure what scans to use? So near to having multiple winning trades, but something always goes wrong. Maybe a couple hours with a trading coach could make all the difference in the world. Hit and Run Candlesticks has 4 trading coaches – Learn More about the Coaches

With on-demand recorded webinars, eBooks, and videos, member and non-member eLearning, plus the Live Trading Rooms, there is no end your trading education here at the Hit and Run Candlesticks, Right Way Options, Strategic Swing Trade Service and Trader Vision.

► CROX would be up 18.57 or $148.00 if you bought 100 shares when we posted to our members on July 26. Hit and Run Candlesticks members practice trade management and trade planning with Price and Candlesticks, The T-line, Trend, Trend Lines, Chart Patterns, Support, and Resistance.

► Eyes On The Market (SPY)

The lack of follow through above our $247.25 resistance line suggest the Bulls just aren’t ready to take on the resistance, which begs the question will they be ready before a test near the lower trend line.

I am very concerned about the price action of the ETF (IWM). The chart continues to signs of weakness and could drag us into a correction below the 200-SMA.

► What is a Trade Idea Watch-list?

A trade idea watchlist is a list of stocks that we feel will move in our desired direction over a swing trader’s time frame. That time could be one to 15 days for example. From that watch list, we wait until price action meets our conditions for a trade.

Rick’s personal trade ideas for the day MEMBERS ONLY

Start your education with wealth and the rewards of a Swing Traders Life – Click Here

Investing and Trading involve significant financial risk and are not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Comments are closed.