Last Updated: April 7, 2017

If you ask me, the best names for candlestick patterns are the ones that spark your imagination. The Falling Window is a perfect example. When you hear that creative title, you can imagine a window dropping or sliding or even melting to the ground like one of Dalí’s clocks. Perhaps surprisingly, the lovely name refers to a very simple (but still significant) price action. To discover the formation and value of the Falling Window candlestick pattern, please scroll down.

Falling Window Candlestick Pattern

Formation

In the world of Japanese candlesticks, a Window is a space between the real bodies of two candles in which the shadows do not overlap in any way.

To put it quite simply: a Falling Window candlestick pattern refers to a price gap in a downward trend. That’s it. No frills or embellishments. A simple “gap down.” It must occur as the price trend is falling, and it always acts as a bearish signal. This continuation pattern is very common, though it isn’t as prevalent on charts with longer time scales. Because it is so ordinary, it’s important that you pay attention to each particular Falling Window’s characteristics. Those details can help you determine how significant the signal is and whether it’s worthy of your attention.

A gap up signal exists as well, of course, and it is known as a Rising Window candlestick pattern.

Meaning

So what is this pattern trying to say? Well, the signal shows a space between the previous candle’s low and the current candle’s high. This dip in price conveys the current strength of the bears, and it suggests that the downtrend will continue.

Yes, a Falling Window is essentially a gap down, but why pass up the opportunity to use its evocative formal name? It can also be called a Western Gap. This signal acts as a bearish continuation pattern most of the time, but for assurance, it’s always best to wait for confirmation. To better understand the signal, examine its size. As you might have guessed, a large gap conveys a dramatic fall in price. A small gap is not as significant.

Examine the two candles following the Falling Window when they appear. If they don’t close the window or fill the gap (this includes their shadows), a Downside Tasuki Gap pattern may have occurred. To qualify, the first and second candle must be bearish and the third must be bullish. This means that following the strong downtrend (emphasized by the gap down), there was a pause as the bulls attempted to force the price up. However, they failed in their attempt and the downtrend can be expected to continue.

Examples

Although we doubt you will have much trouble identifying the Falling Window candlestick pattern in actual charts, it never hurts to practice your skills before you step onto the field. Review the examples below, searching for the Falling Windows on your own before you resort to the handy red arrows. We will also explore a Rising Window signal, a Downside Tasuki Gap, and how a Falling Window can mark a point of resistance.

EXAMPLE 1:

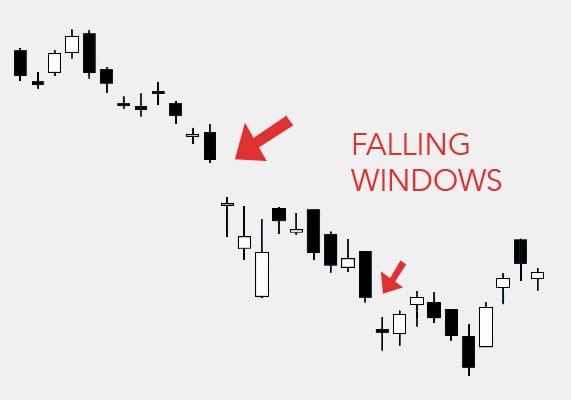

In this first example, you can spot two Falling Windows. The first gap is quite large, leaping down to a doji and showcasing the strength of the bears. The downtrend continues after that, and another Falling Window pops up. It, too, is followed by a doji. However, unlike the first example, this Falling Window leads to a short uptrend.

EXAMPLE 2:

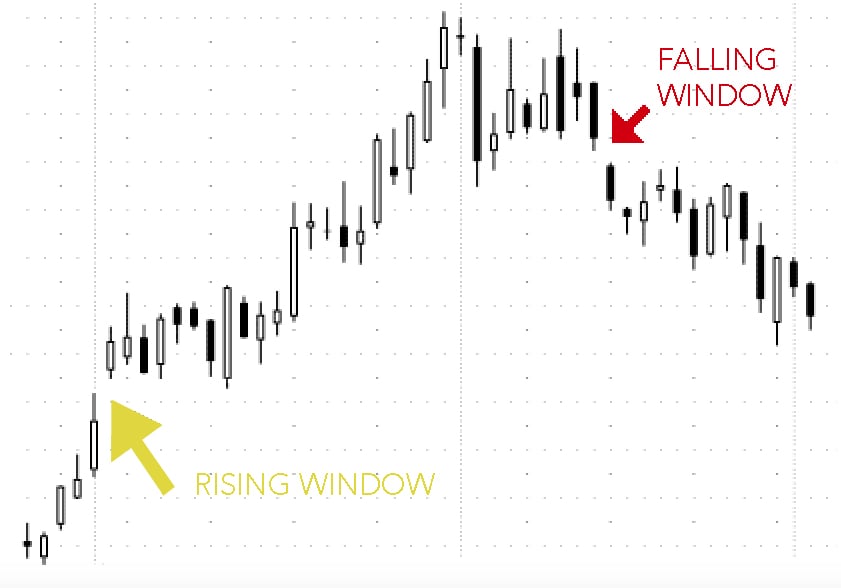

Our second example provides an opportunity to review the Rising Window signal as well. When we enter the chart, the bulls hold the reins. In the midst of the uptrend, a Rising Window forms. Strong and powerful, the bulls continue the upward movement. When the bears finally seize control, they’re able to form a Falling Window candlestick pattern. And again, as expected due to the signal, the bears soldier on and sustain the downtrend.

EXAMPLE 3:

With this third example, we want to explore how a Falling Window can mark a point of resistance. During the course of this downtrend, three Falling Windows materialize. The determined bears continue to push the price down each time. However, the bulls aren’t sitting around. After each gap down, they attempt to raise the price back up. But as you can see, indicated by the blue lines, the Falling Windows mark a place of resistance whenever the bulls try to force the price higher. The first attempt ends in a Tweezer Top, the second ends in a Bearish Engulfing pattern, and the third ends in a Dark Cloud Cover pattern. The bears simply refuse to let the bulls succeed in pushing the price above these Falling Windows.

EXAMPLE 4:

Finally, in our last example, you’ll notice a Falling Window about two-thirds of the way into the chart. The downtrend has barely begun before it gaps down, revealing the bears’ strength.

Since the Falling Window is an exceedingly simple signal, it often pops up within other candlestick patterns. In this case, it appears within a Downside Tasuki Gap. How can you tell? Four criteria convey this fact: (1) a downtrend is occurring, (2) the bearish candle gaps down to another bearish candle, (3) a bullish candle opens within the previous candle’s body, and (4) the bullish candle closes within the gap. The Downside Gap Tasuki illustrates the bulls’ weakness; they cannot raise the price above the gap.

– – – – –

Although it’s quite a minor signal in the grand scheme of things, give the Falling Window the respect it deserves. When it is found in combination with another bearish candlestick pattern and you can confirm its presence as well, the Falling Window can provide noteworthy guidance. It may be falling on the charts, but we hope it’s rising in your estimation!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.