Friday relief rally? Not so much.

The hopes of a relief rally began in the last 30 minutes of trading on Friday si facing a sharp reversal at the open today. Although we have a light earnings calendar to begin the week, we face another inflation reading with CPI coming out Wednesday and PPI on Thursday. It will also be a hectic week of earnings reports that have not been much help to the bearish sentiment as the nasty tax of inflation changes consumer habits. Though we are due relief, the bear market conditions will likely keep volatility high and price action challenging, so plan your risk carefully!

Asian markets have had a rough night, with the Hong Kong falling 3.81%, followed by the Nikkei down 2,53%, even as China’s trade data came in better than expected. European markets traded decidedly bearish this morning, seeing nothing but red across the board as the impacts of inflation grow. Finally, with a big day of earnings data, the U.S. futures point to a substantial gap, likely to set a new 2022 low as bear sentiment grows.

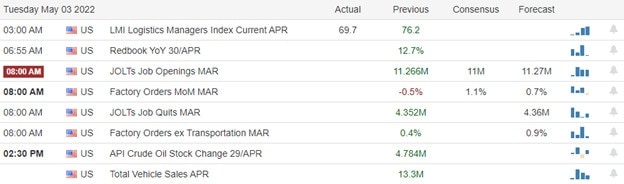

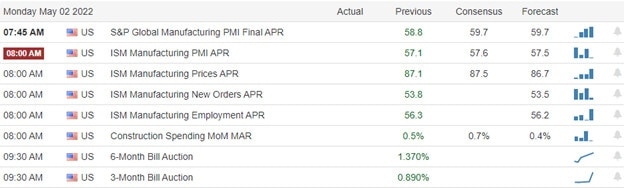

Economic Calendar

Earnings Calendar

We have another busy day on the earnings calendar to begin a new trading week. Notable reports include DDD, ACM, AMC, BNTX, BLNK, APRN, BRMK, COTY, CURLF, DUK, ELAN, ENR, GERN, GSL, GDRX, GRPN, IAC, LMND, RIDE, MGY, MBI, MCHP, NVAX, PLTR, PRTY, PETS, PUBM, RNG, SPG, SDC, TDUP, TRUE, TSN, UPST, VECO, VRM, WOW, XPO, & ZNGA.

News & Technicals’

Uber will slash spending on marketing and incentives and treat hiring as a “privilege,” CEO Dara Khosrowshahi said in an email to staff on Sunday. “It’s clear that the market is experiencing a seismic shift, and we need to react accordingly,” Khosrowshahi said. He added that Uber will now focus on achieving profitability on a free cash flow basis rather than adjusted EBITDA. Russia commemorates one of the most important events on its national calendar — Victory Day — marking the Soviet Union’s victory over Nazi Germany in World War II. Putin claimed Russia’s invasion of Ukraine had been necessary because the West was “preparing for the invasion of our land, including Crimea.” Evoking that victory in his speech Monday, Putin urged the Russian army toward victory in Ukraine, saying there was a duty to remember those who defeated Nazism. Bitcoin continued to slide after a broader stock sell-off in the U.S. last week sent the cryptocurrency market into a frenzy and prompted the cryptocurrency to plummet by roughly 10%. The world’s largest digital currency by market value was lower by about 3% at 33,594.50 early Monday, according to data from Coindesk. The drop comes after the blue-chip Dow Jones Industrial Average lost more than 1,000 points on Thursday and the Nasdaq fell 5%, losses that marked the worst single-day drops since 2020. Disney’s theme parks have rebounded from massive pandemic-related operating losses in a little over a year. While not all international theme parks are fully reopened, domestic parks have seen strong ticket sales and foot traffic thanks to new rides and park expansions. Tech innovations have made the theme park experience and operations smoother for guests and cast members. Disney reports quarterly results Wednesday. Treasury yields continue to rise in early Monday trading, with the 5-year pricing at 3.09%, the 10-year surging to 3.9%, and the 30-year jumping to 3.29%.

Although we have caught a slight relief in the selling during the last 30 minutes of trading Friday, hopes of a follow-through look rather dim this morning. As painful as this may seem, this process is necessary to bring prices back into balance after the money printing party of the last several years. The T2122 indicator suggests we are in an oversold condition, but with prices continuing to rise, the consumer is struggling with the insidious tax of inflation. Though indexes are down into bear market teratory, we may have more selling in the coming months, with the SP-500 still 59% above the historical average. The good news is that when this is over, there will be great stocks at bargain prices because Mr. Market tends to overcorrect as bearish sentiment piles on in the same way we overextend when over-exuberance is at work. Don’t fight the trend; move with it and know that better times follow.

Trade Wisely,

Doug