Relief Rally Hope?

Although the bears controlled the majority of Friday’s trading, the sharp end-of-day short-covering surge gave rise to some relief rally hope. Unfortunately, the window for the bulls to relieve selling pressure could be short-lived, considering the market moving economic reports throughout the week that may favor the bears. So, plan your risk carefully and expect price volatility to remain challenging as the possibility of recession looms.

Asian markets mostly rallied during the night, with the tech-laden Hong Kong exchange declining. European markets traded bullishly this morning, with the FTSE up more than 1%. U.S. futures also point to a bullish open with a light day of economic data with AAP and CRMT reporting after the bell today.

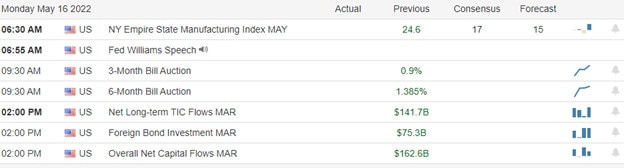

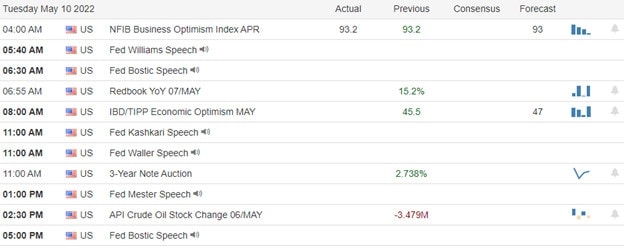

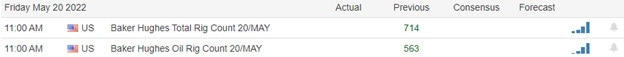

Economic Calendar

Earnings Calendar

We have almost 50 companies listed on the Monday earnings calendar, but most are unconfirmed. Notable reports include AAP, CRMT, NLS, NDSN, TRANS & XPEV.

News and Technicals’

The U.S. announced the Indo-Pacific Economic Framework with Asian partners, including Australia, Japan, and the Republic of Korea. It’s a comprehensive plan to help expand the U.S.′ “economic leadership” in the Indo-Pacific region. Notably, the IPEF is not a free trade agreement. Biden faces political pressure from both the left and right in the United States to avoid free trade deals. When asked at a joint press conference with Japanese Prime Minister Fumio Kishida whether the U.S. would be prepared to defend Taiwan if attacked, Biden replied: “Yes.” Taiwan’s foreign ministry thanked Biden for reaffirming U.S. support if Beijing invaded the island. However, Reuters reported that China’s foreign ministry said the U.S. should not defend Taiwan’s independence. According to federal data, an estimated 42,915 people died in motor vehicle traffic crashes in 2021, a 10.5% increase from 2020 and the highest rate since 2005. Experts say the increase stems from a combination of factors, including reckless or distracted driving and record levels of vehicle performance and weight. Compared to 2019, fatality rates have risen by 18%. On Monday, U.S. Commerce Secretary Gina Raimondo and Japan Trade Minister Koichi Hagiuda discussed “cooperation in semiconductors and export control.” Chips are integral to just about every piece of advanced electronics made, with industries from automobiles to home appliances dependent on them. The war in Ukraine is being fought both online and offline, with hackers on each side targeting the enemy’s national infrastructure. Over the last few weeks, major tech stocks have plummeted amid concerns of a global recession, but Sorrell believes Russia’s invasion of Ukraine could boost their revenues. Treasury yields rose in early Monday trading, with the 10-year climbing to 2.82% and the 30-year rising to 3.02%.

Friday’s trading completed the down-trending pattern by creating lower lows in the DIA, Spy, and QQQ but surged sharply upward in the last 30 minutes of trading, raising relief rally hope for the week ahead. Although the futures have pulled back from overnight highs, they indicate a bullish open this morning. With the economic calendar giving us a little break from the gloomy reports of late, the bulls may have a chance to push back, relieving at least some of the selling pressure. But, of course, the retail earnings reports could easily change the bullish mood if AAP and CRMT disappoint after the bell. However, the window for a rally could be short-lived with the likely market-moving data for New Home Sales, Durable Goods, FOMC minutes, GDP, and Personal Income & Outlay reports throughout the week. Traders should expect volatility to remain challengingly high. Continue to respect overhead resistance levels, whipsaws, and pop and drop patterns if the bulls find the energy to test them.

Trade Wisley,

Doug