Frustrating Chop Zone

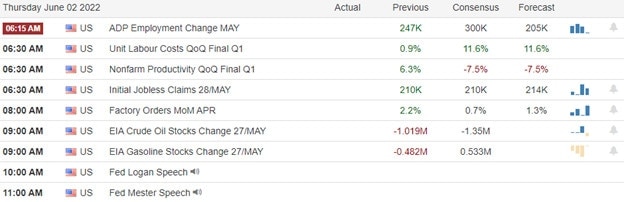

The wide-ranging frustrating chop zone continues with a gap down open met with a low volume rally to keep us guessing as to what comes next. With the Fed GDP tracker hinting at recession, a global growth downgrade, and a new record high of $4.95 a gallon gas price, the entire world is waiting for the read on CPI Friday morning. Today we have Mortgage Applications, the Petroleum Status Report, and a rising 10-year bond auction with just enough earnings reports to keep traders on their toes. Can the bulls follow through, breaking the chop zone, or will the bears reengage to keep the chop zone active? We will soon find out.

Asian markets surged higher overnight, with the very volatile HSI leading up 2.24% at the close. However, European markets see red across the board after Credit Suisse warned of a likely earnings miss next quarter. U.S. futures point to a bearish open as the morning reversals continue as we wait on the Friday CPI. Prepare for another day of weak volume price volatility where anything is possible.

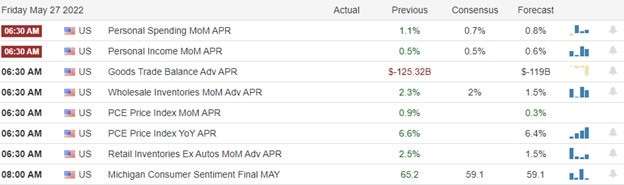

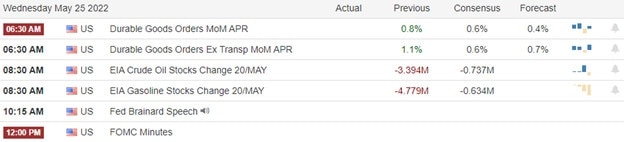

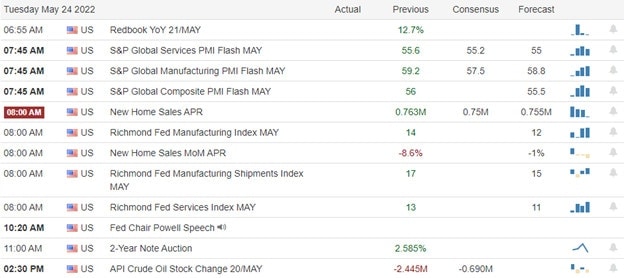

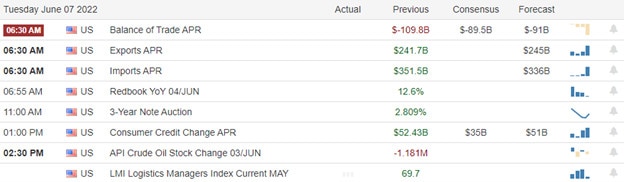

Economic Calendar

Earnings Calendar

We have less than 20 confirmed reports on the Wednesday earnings calendar, with many of them very small-cap companies. Notable reports include ABM, CPB, DAKT, FIVE, GEF, JILL, OLLI, STRM, THO, & VRA.

News & Technicals’

The Atlanta Federal Reserve’s GDPNow tracker points to an annualized gain of just 0.9% for the second quarter, down from an estimated 1.3% increase less than a week ago. With first-quarter growth down 1.5%, a second consecutive quarter of negative growth meets a rule-of-thumb definition for recession. The National Bureau of Economic Research, the official arbiter, says a recession can include two straight negative GDP prints, but that’s not necessarily the case. The European Union in late May moved to impose an oil embargo on Russia after agreeing the previous month to also stop coal purchases from the country. The bloc has been heavily dependent on Russian fossil fuels, and cutting some of these supplies overnight will have a significant economic impact. Credit Suisse said despite the trading revenues benefiting from the spike in volatility, the impact of these conditions, combined with “continued low levels of capital markets issuance” and widening credit spreads, have “depressed the financial performance” of the investment bank in April and May. This is “likely to lead to a loss for this division and a loss for the Group in the second quarter of 2022,” the trading update said. While inflation for the 19-member euro area hit another record high in May, a rate hike would only come in July as the ECB first needs to formally end its net asset purchases, according to its forward guidance. The ECB will also publish new staff projections for growth and inflation. And market participants are likely to closely monitor the 2024 inflation print as this constitutes the ECB’s medium-term price target. Cryptocurrencies are a “threat to the safety of our payment schemes,” Anne Boden, CEO of U.K. digital bank Starling, warned Tuesday. Regulators are concerned about the financial system becoming more entwined with the volatile world of crypto. Roughly $400 billion has been erased from the combined value of all cryptocurrencies in the past month. Treasury yields traded higher early Wednesday, with the 10-year pricing at 3.01% and the 30-year moving to 3.15%.

The indexes remain stuck in a frustrating chop zone with just two more trading days until we get a read on inflation that may provide us a directional resolution. Though the bulls managed a mighty recovery, printing some bullish engulfing patterns yesterday, the volume was noticeably weak and possibly untrustworthy signals. Overhead resistance levels remain intact, much to the disappointment of the bulls. In addition, global growth received a downgraded yesterday, and the Fed’s GDP tracker suggests the U.S. is on the brink of recession. Oil and gas continue to trend higher as we hit another record high in the national gas price of $4.95. Though some talking heads are trying to make light of the rising energy prices, the consumer is forced to make some tough spending decisions that are not likely to bode well for 2nd quarter earnings results. I suspect we have a rough summer of trading ahead of us!

Trade Wisely,

Doug