Nasty Whipsaw

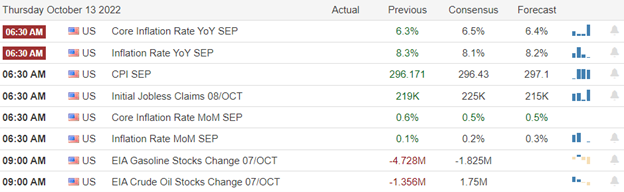

The bulls tried to get upside price action going, but all at once, the bears returned with a vengeance producing a nasty whipsaw to punish the dip buyers. As a result, the QQQ closed at a new 2022 low, while the other indexes managed to hold Monday’s low. Before the bell today, we will get the Producer price report and then deal with the FOMC minutes this afternoon. In addition, we will have to keep a close on rising bond yields and fluctuating currency after the BOE deadline warning to pension plans. Finally, no matter the market reaction, keep in mind the CPI numbers come out before the bell Thursday, so plan your risk carefully!

Asian markets traded mixed as the Yen continued to weaken to 146 to 1 against the dollar. European market trade mixed in a choppy session, waiting for U.S. inflation data. However, the U.S. futures push for a bullish open ahead of the PPI number. How the market reacts after the number is anyone’s guess. Perhaps the futures premarket pump will signal a relief rally, or perhaps they are just trying to put lipstick on a pig.

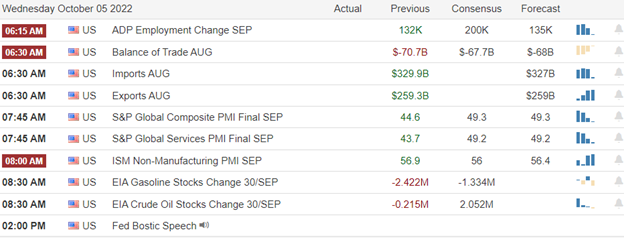

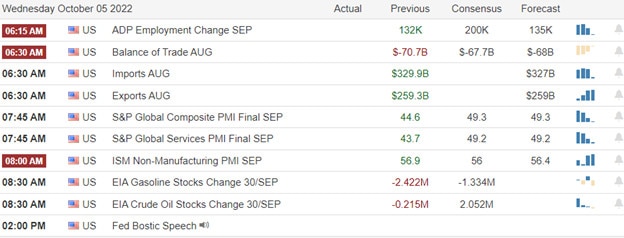

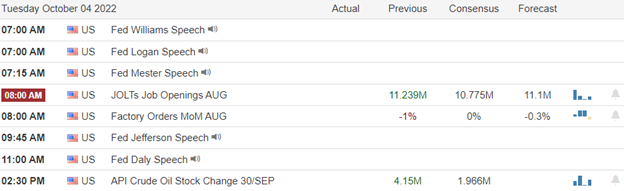

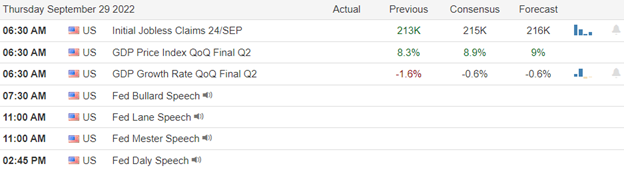

Economic Calendar

Earnings Calendar

With the official kickoff of 4th quarter earnings beginning tomorrow, we have another light day of reports. Notable reports include PEP & DCT.

News & Technicals’

Tobias Adrian, director of monetary and capital markets at the International Monetary Fund, told CNBC Jamie Diamon’s call that U.S. stocks could tumble another 20% was “certainly possible.” He said sentiment had so far held up relatively well, but a shift in this could spark a further downturn. Adrian also warned financial stability risks are very elevated, with the global economy in a “very, very stressed moment.” Sridhar Ramaswamy, who led Google’s advertising business from 2013 to 2018, has launched a Web3 company called nxyz. Nxyz trawls blockchains and their associated applications for data on things like NFTs and crypto wallets and then streams it to developers in real time. The company raised $40 million in a funding round led by crypto-focused venture fund Paradigm, with additional backing from Coinbase, Sequoia, and Greylock.

The U.S. Department of Commerce introduced sweeping rules to prevent China from obtaining or manufacturing key chips and components for supercomputers. Analysts said that this is likely to hobble China’s domestic chip industry. In addition, Washington’s export rules could touch other parts of the supply chain that use American technology, highlighting the wide-ranging nature of the latest restrictions.

Unbelievable

“I don’t think there will be a recession. If it is, it’ll be a very slight recession. That is, we’ll move down slightly,” Biden told CNN’s Jake Tapper in a Tuesday interview. On Monday, JPMorgan Chase CEO Jamie Dimon told CNBC there would likely be a recession in six to nine months. In September, the U.S. central bank raised benchmark interest rates by three-quarters of a percentage point —the Fed’s third consecutive hike. Treasury Secretary Janet Yellen said the U.S. is doing well amid global economic uncertainty. Yellen said the U.S. economy has slowed after a strong recovery, but job reports indicate a resilient economy. The Treasury Secretary reiterated that lowering inflation is a priority of the Biden administration.

Yesterday proved to be another choppy day as the bulls finally pushed off the lows only to have the bears produce a nasty whipsaw, driving indexes down in a quick move. The QQQ made a fresh 2022 low after the BOE set a deadline for pension plans to make adjustments as central bank interventions end. Today we face the latest reading on Producer Prices, more Fed speak, and we will get the minutes of the last FOMC meeting. I think the market is looking for any hope to relieve the short-term oversold condition of the indexes. Still, traders must remain aware of the currency liquidity issues and bond yield gyrations. As you make trading decisions, remember we get the CPI number before the bell on Thursday and begin the 4th quarter earnings with the big bank reports. Plan for a heavy dose of price volatility.

Trade Wisely,

Doug