PPI Report Uncertainty

During the morning session on Monday, the bulls tried pushing higher, but the uncertainty of the PPI report inspired the profit-takers to reduce risk heading into the close. As a result, the indexes whipsawed, leaving behind shooting star patterns near price resistance levels but creating no technical damage to the charts. However, big-name earnings reports from HD and WMT and the reaction to the producer prices will likely create significant pre-market volatility. Unfortunately, we’ve yet to discover that it will inspire the bulls or the bears!

While we slept, Asian markets mostly rallied despite disappointing Chinese activity data as Hong King surged 4.11%. However, European markets are taking a more cautious stance this morning, trading flat as they wait on inflation data. On the other hand, U.S. futures push for a bullish open in the pre-market pump ahead of the producer price numbers that will likely set the tone for the day.

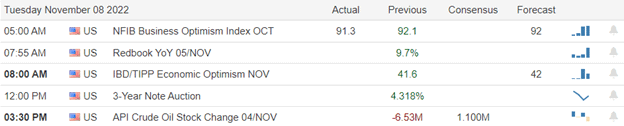

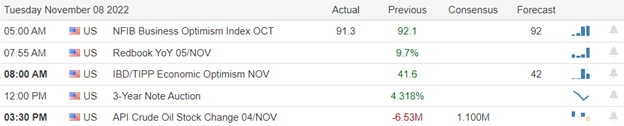

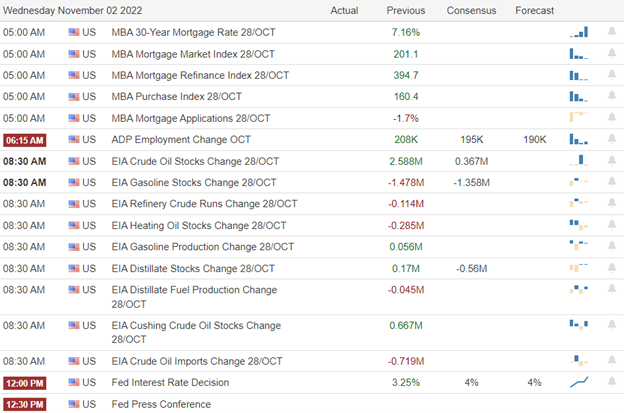

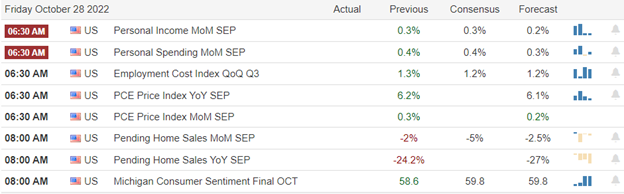

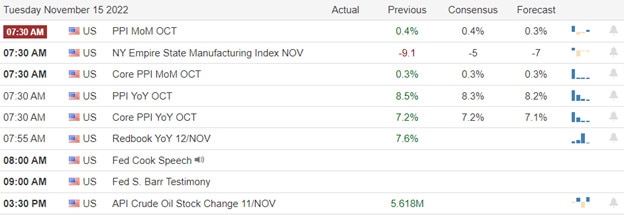

Economic Calendar

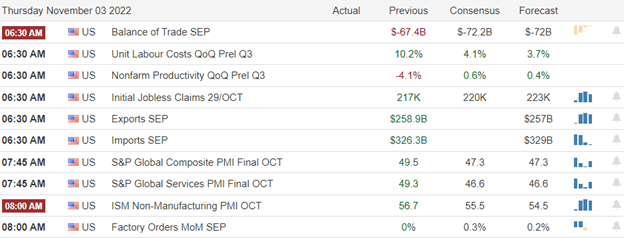

Earnings Calendar

We have about 20 companies confirmed on the Tuesday earnings calendar. Notable reports include HD, WMT, ARMK, AAP, ENR, AQUA, HUYA, DNUT, SE, & TME.

News & Technicals’

Americans grew more worried about inflation in October, with fears emanating primarily from an expected burst in gasoline prices. A New York Fed survey showed inflation expectations for the year ahead rose to 5.9%, while the three-year outlook increased to 3.1%. Home prices were expected to rise by 2%, tied for the lowest since June 2020. Home Depot reported third-quarter earnings on Tuesday, beating analyst expectations. The retailer reported revenue increased by nearly 6% to $38.87 billion. Wall Street is watching how rising costs and other macroeconomic headwinds affect the retailer.

Last week, when it filed for Chapter 11 bankruptcy protection, FTX indicated that it had more than 100,000 creditors. But in an updated filing Tuesday, lawyers for the company said: “In fact, there could be more than one million creditors in these Chapter 11 Cases.” In addition, over the past 72 hours, the lawyers wrote that FTX has been in contact with “dozens” of regulators in the U.S. and overseas.

At the 2022 Web Summit tech conference, startup founders and investors warned fellow entrepreneurs it was time to rein in costs and focus on fundamentals. “The multiples last year are not the same as this year,” said Guillaume Pousaz, CEO of London-based payments firm Checkout.com. Instead, multibillion-dollar unicorn companies will collapse in “spectacular failures,” Par-Jorgen Parson, partner at venture capital firm Northzone, told CNBC.

Monday’s price action tried to put on a brave face early in the day, but the uncertainty of the PPI report brought out the profit takers. Although the Dow swung more than 400 points from high to low, leaving behind shooting star patterns on all the index charts. That said, the move showed respect for overhead resistance, index charts suffered no technical damage despite the volatility. How things go from here will depend on the reaction to the PPI report and the earnings results from WMT and HD. We should plan for substantial pre-market gyrations; the results likely set the day’s tone. Will it be the bulls or the bears that find inspiration? Buckle up; we are about to find out!

Trade Wisley,

Doug