Clearly, we still have a lot of challenges ahead for the economy, but last week I believe we experienced a substantial shift in institutional sentiment. Volume has grown in this relief rally, unlike the head-fake of the July/August surge upward with declining volume. However, the extreme point swings will continue to make this market very dangerous as we still face worldwide economic challenges and substantial geopolitical pressures. Perhaps a mix of long and short positions may be appropriate to hedge the uncertainty path forward.

Asian markets closed the day mixed but mostly lower, with a very volatile session in Hong Kong tech names. This morning, European markets trade with modest bullishness as bond yields and currencies continue to fluctuate. U.S. futures suggest a little rest for the bulls after the last week’s wild run-up that could trigger a bit of profit-taking to begin the week. Nevertheless, traders should continue planning for challenging price volatility as the bulls and bears duke out near substantial overhead resistance levels.

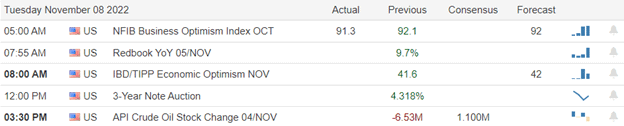

Economic Calendar

Earnings Calendar

Although we have a lot of companies listed on the Monday earnings calendar, many are unconfirmed or tiny small-cap names. Notable stocks include ACM, LI, JJSF, OTLY, TSEM, TSN, VVV, & WEBR.

News & Technicals’

Germany is open to strengthening ties with China but is not “stupid,” according to the country’s Economy Minister and Vice-Chancellor. The comments come after German Chancellor Olaf Scholz made a controversial solo trip to China to meet President Xi Jinping. A stronger dollar over the year has weighed heavily on many emerging market currencies. CNBC spotlights the performance of Ghana’s cedi, the Cuban peso, the Zimbabwean dollar, and more. The Zimbabwean dollar has lost a staggering 76.74% of its value against the dollar since January.

The investment cases for America’s largest automakers are increasingly diverging around electric and autonomous vehicles. For example, GM is diversifying as much as possible around its emerging battery and self-driving vehicle businesses while expanding to offer electric vehicles by 2035. Ford recently disbanded its autonomous vehicle business to concentrate on nearer-term technologies and EVs.

According to a source, Alameda Research, a trading firm founded by Sam Bankman-Fried, was trading billions of dollars from FTX accounts and leveraging the exchange’s native token as collateral. The source says that many employees and outside auditors were unaware that FTX did not have enough money to match customer withdrawals. Three sources familiar with the company told CNBC that FTX’s missteps blindsided them and that only a small cohort knew about the potential misuse of customer deposits.

Though we still have many challenges ahead for the economy, we experienced a substantial shift in sentiment to the buy side last week. The July/August rally suffered from a lack of volume, but this time volume continues to grow to suggest a promising institutional change. That said, we still have a lot of work to do, and the price action volatility will continue to make swing trading challenging as we face layoffs, worldwide recessionary economic impacts, and geopolitical tensions. As a result, a mix of long and short positions may be appropriate but plan carefully for sudden large point swings that will challenge even the most experienced trader.

Trade Wisely,

Doug

Comments are closed.