Potential Topping Patterns

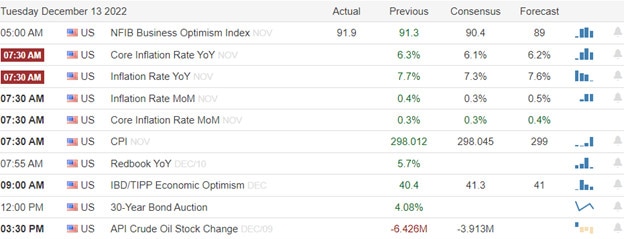

The bulls pushed hard, but overhead price resistance found bears waiting and willing to fight back, leaving some potential topping patterns behind. Jerome Powell’s comments this morning will likely cast the deciding vote on whether the bulls matain the Friday consolidation breakout or if the bears regain the upper hand. With a pending CPI report and big bank earnings just around the corner, speculation and uncertainty are high so brace for considerable volatility in the days ahead. Anything is possible!

During the night, Asian markets closed the day mixed with an eye on Jerome Powell. European markets trade modestly bearish across the board this morning, weighing inflation concerns and pending Fed comments. U.S. futures point to a gap as we wait to find out if the FOMC plans to stay on the hawkish path, bucking all the talking heads trying to promote the pivot narrative. Brace yourself for wild price action likely in the days ahead.

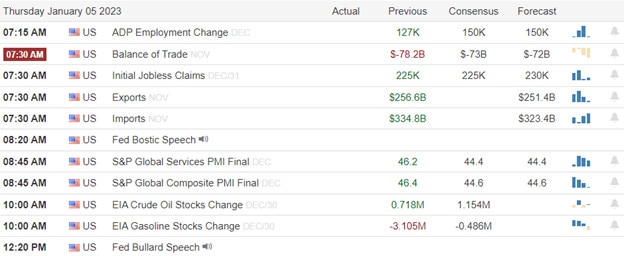

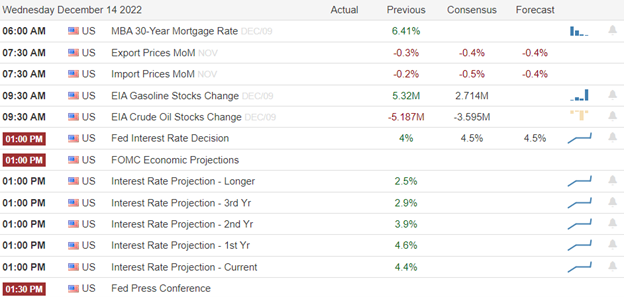

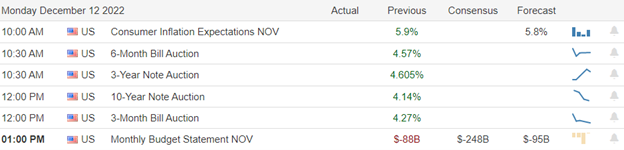

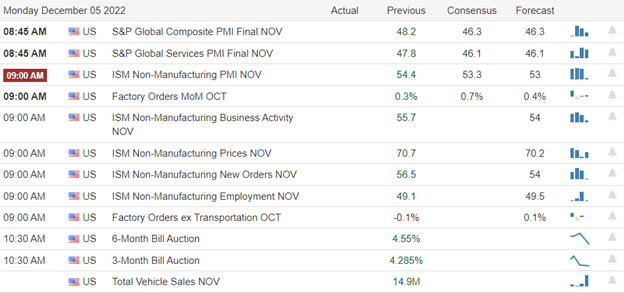

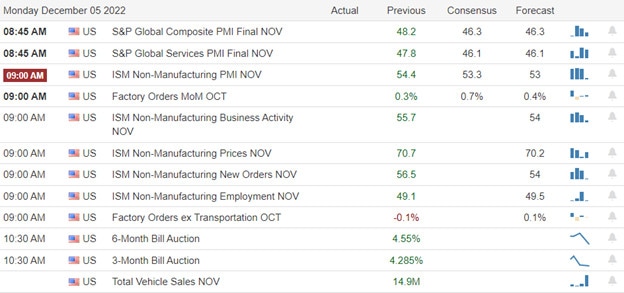

Economic Calendar

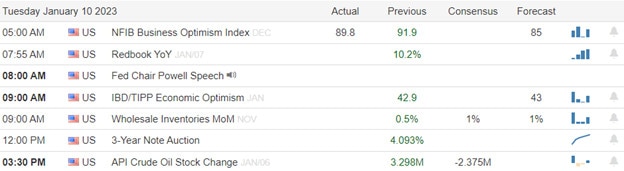

Earnings Calendar

We have just five confirmed reports this Tuesday, but only a couple of them are somewhat notable such as ACI and BBBY.

News & Technicals’

The global investment bank is letting go of as many as 3,200 employees starting Wednesday, according to a person with knowledge of the firm’s plans. That amounts to 6.5% of the 49,100 employees Goldman had in October, which is below the 8% reported last month as the upper end of possible cuts. However, other investment banks are adopting a “wait and see” attitude: If revenues are tracking below estimates in February and March, the industry could cut more workers, said a person familiar with a leading Wall Street firm’s processes.

According to an email obtained by CNBC, Disney CEO Bob Iger told hybrid employees on Monday they must return to corporate offices four days a week starting March 1. Iger’s four-day-per-week stipulation is relatively strict compared with other large companies, many of which have opted for two or three mandated in-office days for hybrid employees. Moreover, it comes less than two months after he returned to the company’s helm.

CNBC’s Jim Cramer told investors to stay away from tech stocks, even after their gains on Monday. “These short-term sector rotations like we saw today — they’re irrelevant because they can’t last. Think renters, not owners. The fundamentals, now they last,” he said.

The bulls followed through on Monday but faded into the afternoon, leaving behind some worrisome potential topping patterns at price resistance. Earnings uncertainty and worries about higher rates inspired the bears to push back as we wait on a Jerome Powell speech this morning. Will he continue to sound hawkish disappointing traders that talking heads continue to push the narrative of a Fed pivot? We will soon find out and should expect substantial price volatility as the market reacts to his comments. Past that, we won’t have much for the market to react to as we wait on the Thursday CPI and the start of big bank earnings. Nevertheless, speculation remains high, so plan your risk carefully.

Trade Wisely,

Doug