Though the premarket pump will try to engage, the fear of missing out today will likely become the classic hurry-up and wait with CPI and FOMC events ahead. Friday’s close adds to the uncertainty, with indexes hovering just above critical price support levels. Will the coming data inspire the hoped-for Santa Clause rally, or will Powell be the Grinch that stole Christmas? While today may prove to be a chop fest, as we wait, anything is possible in the days ahead. Expect some sudden and substantial price reactions as Christmas hope battles recession worries.

Asian markets started the week lower, led by selling in Hong Kong down 2.20% as investors wait on U.S. data. European markets also traded primarily lower this morning on the uncertainty of the inflation and rate decisions ahead. However, in the U.S., premarket futures try to put on a brave face with modest bullishness with index prices posied near essential support levels. Plan for a choppy, light day as we wait.

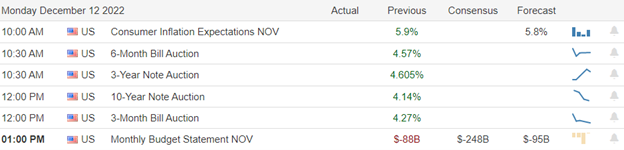

Economic Calendar

Earnings Calendar

Although we have a few notables, it will be a very light week on the earnings calendar. Notables for Monday include COUP & ORCL.

News & Technicals”

Rivian said Monday it was pausing plans to manufacture commercial electric vans in Europe and would “no longer pursue” the agreement it made with Mercedes-Benz. However, the U.S.-based electric vehicle manufacturer said it remains open to exploring future work with Mercedes-Benz “at a more appropriate time.” Mercedes-Benz said Rivian’s decision would not impact the timeline of its electrification strategy or the planned ramp-up of its new electric vehicle manufacturing site in Jawor, Poland.

Inflation has already peaked, but it will remain above pre-Covid levels in 2023, said David Mann, chief economist for Asia-Pacific, Middle East, and Africa at the Mastercard Economics Institute. “Inflation has seen its peak this year, but it will still be above what we had been used to pre-pandemic next year,” Mann told CNBC’s “Squawk Box Asia” on Friday. He said it’ll take a few years to return to 2019 levels.

Before founding Crypto.com, Kris Marszalek was involved in multiple ventures that collapsed, including one where suppliers claimed they could not access their earnings. Over a decade ago, their manufacturing company paid Marszalek and his business partner millions of dollars months before it entered bankruptcy. In a tweet thread published ahead of this story, Marszalek wrote, “startups are hard” and “you will fail over and over again.”

Although we see a little premarket bullish blustering today is likely to be nothing more than a classic hurry-up and wait for the Tuesday CPI and the Wednesday FOMC. I would expect some early price gyrations that will devolve into an understandable choppy price day with the uncertainty ahead. Technically speaking, there is a lot at stake as the major indexes, with the indexes closing very near critical support levels last Friday. If the CPI and FOMC decision inspires the bulls, we could see a Santa rally begin. However, if the reports inspire the bears and support levels break under the pressure, Powell may be seen as the Grinch that stole Christmas. Anything is possible, so position yourself carefully, avoiding overtrading your bias because the price moves are likely to be sudden and substantial in reaction to the coming data.

Trade Wisely,

Doug

Comments are closed.