My expectation of a hurry-up and wait day turned into a big surprise as the market surged higher in the last hour of trading, with investors chasing risk with market-moving data the rest of the week. Oddly, at the same time, the fear spiked as the VIX spiked to 25 handles, with the SPY and QQQ suffering from anemic volume. Clearly, the appetite for speculative risk is alive and well despite the FOMC’s efforts to bring valuations down. I’m not confident that’s a good thing with a world recession on the horizon. Expect big price moves with morning gaps and possible intraday whipsaws with all the data coming our way the rest of the week.

Asian markets traded with mixed results as China relieves pandemic travel restrictions. European moved higher this morning with all eyes on U.S. inflation data. U.S. futures so tremendous confidence in the pending CPI number and the coming FOMC decision extending Monday’s buying surge, suggesting a gap up ahead of the data. Plan for considerable price volatility as the market reacts.

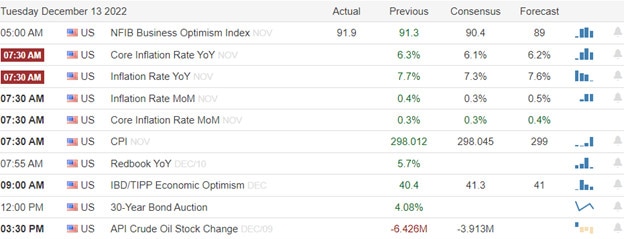

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include ABM, CNM, & PLAB.

News & Technicals’

Following his arrest in the Bahamas on Monday, FTX founder Sam Bankman-Fried faces the potential of a lengthy prison sentence. FTX collapsed last month following a liquidity crunch at the crypto exchange. “It is inconceivable to me that the Justice Department would have charged this case unless they were confident they could extradite him,” Renato Mariotti, a former federal prosecutor, told CNBC. In addition, FTX CEO John J. Ray III plans to tell the House Financial Services Committee on Tuesday that the cryptocurrency exchange under Sam Bankman-Fried had “unacceptable management practices.” Ray said in his remarks that FTX went on a “spending binge” from late 2021 through 2022 when approximately ”$5 billion was spent buying a myriad of businesses and investments, many of which may be worth only a fraction of what was paid for them.” He also said, “loans and other payments were made to insiders in excess of $1 billion.”

Binance, the world’s largest cryptocurrency exchange, said Tuesday it is pausing withdrawals of the stablecoin USDC while it carries out a “token swap.” Changpeng Zhao, CEO of Binance, tweeted on Tuesday that the exchange is seeing an increase in withdrawals of USDC. The move comes as investor concerns grow about Binance’s stability following the collapse of rival exchange FTX as well as a report of a potential criminal investigation from the U.S. government.

Without question, Monday was a big surprise for me as the bulls raced forward, heading into the very uncertain data points of the CPI and the FOMC rate decision. The bullishness was again focused on the Dow while the SPY and QQQ continued to suffer from anemic volume. As the indexes surged the last hour of the day, the VIX simultaneously spiked to 25 handles suggesting fear expanded during the rush to buy. An extraordinary occurrence, indeed, that one might infer only increased the danger as we wait for the market moving reports. One thing that seems evident after yesterday’s surge is that wild speculation still exists despite the Fed’s efforts to tamp it down. I’m not sure that’s a good thing facing a worldwide recession in 2023. Fasten your seat belts tightly for the next few days are likely to include significant opening gaps and big point whipsaws, so plan your risk carefully!

Trade Wisely,

Doug

Comments are closed.