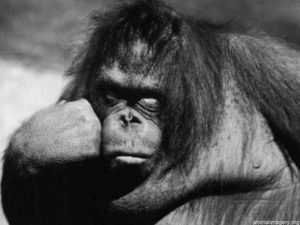

Earnings uncertainty.

Reading through weekend headlines there seems to be talking heads all over the spectrum. One will almost giddy with bullishness and the next profession extremely bearishness. Blah, blah, blah. Although they all seem so very self-assured, as to they’re correctness the truth is they are as uncertain as we all are and just talking up their positions. So what’s a retail trader to do with so much earnings uncertainty?

Reading through weekend headlines there seems to be talking heads all over the spectrum. One will almost giddy with bullishness and the next profession extremely bearishness. Blah, blah, blah. Although they all seem so very self-assured, as to they’re correctness the truth is they are as uncertain as we all are and just talking up their positions. So what’s a retail trader to do with so much earnings uncertainty?

Remember that Price is King! Focus on price action without bias, and directional clues will always present themselves is we patiently wait for them. Easier said than done. Especially for those caught up in the myth that they have the power to predict. I gave up the idea that I could predict years ago and dedicated myself to simply following price. It’s the institutions with their trillions of dollars that determine the direction of a stock. As retail traders, we can hitch a ride if we stop predicting and learn to follow price action. Supporting my family as a full-time trader for the last 13 years is a testament to that truth.

On the Calendar

On the Economic Calendar, this Monday the Chicago Fed National Activity Index kicks of the day at 8:30 AM Eastern and is not expected to move the market. However, the PMI Composite Flash at 9:45 AM and Existing Home Sales at 10:00 AM could easily move the market. First, the PMI expects a reading of 54.6 overall with manufacturing at 55.0 and services coming in at 54.5 according to consensus forecasts. Secondly, the Housing Starts consensus expects a slight decline to 5.528 million annualized units vs. the 5.540 April reading. After that, we have three bond events to wrap up the calendar day before noon on the east coast.

Today begins the heaviest week of earnings reports this season with just over 100 expected to report today. Before the bell, we will hear from HAL, HAS, KMB & OPB to name a few. After the bell, all eyes will be on GOOG, GOOGL, CNI & AABA.

Action Plan

With so many earnings reports this week, prepare for the possibility of big gaps, whipsaws and fast price action, particularly in the morning session. Thus far, earnings by in large, have come in pretty strong and analysts seem to expect positive results to continue. The big question is will it be enough to impress a nervous market with AAPL moving lower and 20-year treasuries moving up toward 3%. Futures markets have been under pressure most of the night as markets sold off around the world due to interest rate worries.

Currently, the Dow futures are trying to recover from overnight lows but suggest a flat to slightly bearish open. That, however, could quickly change as earnings reposts roll in this morning. We should plan for considerable earnings volatility and fast price action around the open for the rest of the week. Keep a very close eye on price action for directional clues.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/MRYXli-ru4I”]Morning Market Prep Video[/button_2]

Big Decision lies Ahead

A big decision lies ahead for the market. Currently, the indexes seem stuck between a rock and a hard place with moving averages trying to provide support and significant overhead price resistance trying to hold them down. Currently the bulls the and bears seem somewhat equally balanced, and both sides appear to be waiting for inspiration. With around 800 companies expected to report earnings next week, they may find the catalyst to needed to make a decision.

A big decision lies ahead for the market. Currently, the indexes seem stuck between a rock and a hard place with moving averages trying to provide support and significant overhead price resistance trying to hold them down. Currently the bulls the and bears seem somewhat equally balanced, and both sides appear to be waiting for inspiration. With around 800 companies expected to report earnings next week, they may find the catalyst to needed to make a decision.

The big question is who will gain the upper hand, the bulls or the bears? As we saw yesterday, just the hint that AAPL could miss on sales expectations sent the stock sharply lower. It obviously wouldn’t take much to embolden the bears producing another lower high in the index. However, if the earnings can continue to come in strong, it may provide the energy required to finally break-through resistance levels. As short-term traders, we must prepare for both possibilities just in case that big decision occurs next week.

On the Calendar

We have a very light Friday Economic Calendar with no market-moving reports. We have Fed speakers at 9:40 AM and 11:15 AM as well as the Baker-Hughes Rig Count at 1:00 PM to finish the day.

We also have a light day on the Earnings Calendar with only 25 companies expected to report. Among them CFC, CLF, GE, and HON.

Action Plan

We saw a bit more selling then I was hoping for yesterday, but at the end of the day, the bulls did make an effort to defend price supports. There was some significant pressure in the tech sector as AAPL sold off sharply on worries the company with fall considerably short of sales expectations. The fear of slowing mobile demand put pressure on the entire tech sector yesterday with the QQQ testing it’s 50-day average. The good news is the selling did not seem to ruffle market fears with the VIX showing very little interest in moving yesterday. Currently, the Dow Futures are suggesting a relatively flat open but as earnings come out this morning that could certainly change quickly.

I still think the market wants to take a little rest around the 50-day averages as we head into the weekend. Next week is a big week for earnings reports, and perhaps that will provide some directional inspiration. Some strong reports could provide just enough energy to the bull to attack overhead resistance. On the other have if earnings disappoint the bears could produce another lower high in the indexes and fail to hold the moving average support. Although I hope the bulls will prevail, I know that I must also prepare in the event the bears gain the upper hand. Consider that as you plan your risk heading into the weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/lzAotMqyxbQ”]Morning Market Prep Video[/button_2]

Consolidation?

After the wild whips, we have experienced over the last 30 days of trading a couple of small range days in the market sure seems boring. However, a little boring is just what the market needs to calm the nerves of traders and investors. In our fast-paced market, a resting consolidation above the 50-day average would be very healthy in my humble opinion. Consolidations in an index establish good support and resistance levels which in turn provide great stock entry or exit points for traders. They allow stocks currently trending a stable environment to move with deliberate price action and provide great setups for traders and investors alike.

After the wild whips, we have experienced over the last 30 days of trading a couple of small range days in the market sure seems boring. However, a little boring is just what the market needs to calm the nerves of traders and investors. In our fast-paced market, a resting consolidation above the 50-day average would be very healthy in my humble opinion. Consolidations in an index establish good support and resistance levels which in turn provide great stock entry or exit points for traders. They allow stocks currently trending a stable environment to move with deliberate price action and provide great setups for traders and investors alike.

I have to admit a long consolidation during earnings season would be quite rare and probably unlikely but after a month of daily overnight reversals, even a day or two of rest can create a lot of healing. So keep in mind a little boring price action can be a very, very positive thing if you’re a good technical analysis.

On the Calendar

We have a full Economic Calendar this Thursday, but only two reports are likely to move the market, and they both come out at 8:30 AM Eastern. Weekly Jobless Claims according to consensus will decline by 3000 to 230,000 as labor demand remains consistent and strong. The Philly Fed Business Outlook expects a slight pullback to a reading of 20.1 vs. the March number of 22.3 but remains near 50-year highs. Reports not expected to move the market, 9:45 Consumer Comfort Index, 10:00 Leading indicators, 10:30 Natural Gas Report, 4:30 Fed Balance Sheet & Money Supply as well several bond events. Also on the calendar, we have 3 Fed Speakers at 8:00 AM, 9:30 AM and 6:45 PM to round out the day.

On the Earnings Calendar, we have just over 100 companies reporting. Make sure to check reporting dates of companies you hold or planning to buy. Failure to do so can lead to very painful losses if you’re not prepared.

Action Plan

Yesterday was a nice resting day with indexes holding above 50-day moving averages but below important levels of resistance. The VIX is also reflecting a calmer market with the fear index between the 15 and 16 handles. Earnings which most often increases volatility has so far had the opposite effect as thus far reports have been strong, supporting current prices.

As I write this, the Dow Futures are pointing to a slightly low open but with so many earnings reports on the calendar that could easily change. After such a large recovery it would not be out of the question to see the market rest (consolidate) or experience a pullback as traders take profits in preparation for the weekend ahead. If we do pull back, it will be very important for the bulls to defend price supports and hold indexes around their 50-day averages. Failure to do so could easily encourage the bears to push for another leg lower. Continued strength in earnings reports will be very important to keep this rally alive. There are a lot very good looking charts right now but be careful not chase by buying at or near price resistance levels.

Trade Wisley,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/GbvZtzHsQ4A”]Morning Market Prep Video[/button_2]

Sweet Relief

What a great relief to see the bulls stepping up the plate once again. Just when it seems safe to jump in both feet keep in mind just how much the market has rallied. The Dow is now up now more than 1400 points since it’s low on April 2nd and is approaching a significant resistance level. Strong earnings reports can and may continue to spur the bulls higher, but it would be wise to prepare for the possibility pullback or consolidation.

A major problem that plagued me years was failing to give proper respect to price resistance. I would wait for so much confirmation that a stock or index was moving up that I was normally buying at or near price resistance. As a result, I would often get punished wasting not only capital but also crushing my trading confidence. If you currently suffer the same problem the fix is easy. Learn to buy when prices are reacting to price supports. Your win/loss ratio should improve and when you do get stopped our losses will typically be smaller.

On the Calendar

We have two potentially market-moving reports this Wednesday on the Economic Calendar. Today Fed member, William Dudley, speaks at 8:30 AM and at 3:15 PM today. The EIA Petroleum Status report is at 10:30 AM. They don’t forward forecast petroleum supplies, but the last reading showed a slight increase in supplies. The Beige Book comes out at 2:00 PM which is used by the FOMC as part of the decision making process on interest rates. Any indication of inflationary pressures rising could cause markets to react negatively. Winding up the calendar day at 4:15 PM is another Fed Speaker, Randal Queries.

The Earnings Calendar is picking up speed with 75 companies expected to fess up to their results today. Before the bell, we will hear from MS, ABT, and USB. After the bell AA, KMI, URI, and AXP are few of those slated to report.

Action Plan

After the morning gap, the indexes continued slowly pushing higher putting pressure on those holding short positions. The DIA slipped into an intraday consolidation while QQQ powered higher inspired by strong earnings reports. The good news is that all four of the major indexes closed above their 50-day averages and the current futures are showing some follow-through bullishness at the open today.

As good as that is there are still many challenges of resistance overhead, and we are starting to show a few signals of stress having moved so far so fast. I would not be surprised to see a little resting consolidation or profit taking pullback to begin at any time. Please understand I’m not suggesting bearishness, in fact, strong earnings could continue to inspire the bulls to keep pushing upward. As always choose stocks that are reacting to price supports and tends and be cautious of those at or near price resistance levels.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/sXgN5eMtMfU”]Morning Market Prep Video[/button_2]

Earnings

Earnings seem to be just what the doctor ordered as the bulls step up and show a willingness to follow-through. With significant technical damage to repair in the index charts, let’s hope a good earnings reports can continue to inspire the bulls to break through resistance levels. With all the political turmoil swirling about we must remain on our toes and have plans to manage the risk. The VIX is showing signs of improvement, and with the reduction of daily reversals, a swing traders edge is also returning.

Earnings seem to be just what the doctor ordered as the bulls step up and show a willingness to follow-through. With significant technical damage to repair in the index charts, let’s hope a good earnings reports can continue to inspire the bulls to break through resistance levels. With all the political turmoil swirling about we must remain on our toes and have plans to manage the risk. The VIX is showing signs of improvement, and with the reduction of daily reversals, a swing traders edge is also returning.

Keep in mind, repairing the technical damage in the index charts can be a challenging and choppy process. However, if volatility remains in check, then stock pickers with good technical skills will once again have the upper hand. Go Bulls!

On the Calendar

Today the Economic Calendar has two market-moving this Tuesday. First at 8:30 AM Eastern, Housing Starts according to forecasters will post solid gains in March of 1.264 million annualized starts while permits slip slightly to 1.315 million. Secondly at 9:15 AM the Industrial Production is expected to report a 0.4% gain overall with a 0.2% increase in capacity utilization climbing to 78%. The Fed has a lot to say today with four speakers at 9:15, 10:00, 11:00 and 1:40. The Redbook report at 8:55 and bond auction at 11:30 are very unlikely to move the market.

On the Earnings Calendar, we have a busy day of important reports with GS, JNJ, PGR, and UNH reporting before the bell. After the bell, we will hear from the likes of CSX, IBM, ISRG, and UAL. In total there are 50 companies expected to report results today.

Action Plan

I had mentioned a couple of weeks ago that earnings would likely be the best chance of settling market nerves and allow the market to pick a direction. So far that seems to have been correct with market finally showing signs of follow through without the daily flip-flop. Unfortunately, earnings commonly produce big opening gaps still making for a challenging trading environment, but the VIX is finally calming slightly.

Good earnings reports are just what the market needs right now as the indexes challenge the resistance of their 50-day moving averages and price action resistance levels. The Dow Futures currently indicate a gap up of nearly 150 points at the open moving the index back above the 50 SMA. The SPY and the QQQ will also attempt to breach this important average at the open today. Continue to expect fast price action and keep in mind the bears are not likely to give up easily, and the risk of intraday whipsaws still exist. With geopolitical issues continuing swirl overhead we can’t just throw caution to the wind. Have a well thought out plan for every trade.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/D2UBkFZ2hfs”]Morning Market Prep Video[/button_2]

Whipsaw

Once again the market is set for a pre-market whipsaw of more than 100 Dow points. Traders that entered short positions based on the bearish patterns below the 50-day average in the DIA, SPY, and QQQ may be forced to by to cover if the bulls remain strong after the open. Overnight whipsaws are incredibly difficult to trade unless you’re capable of picking a direction, placing your bet, closing your eyes and letting it ride. Tough to do and consequently times like this can chop a traders account to pieces.

Once again the market is set for a pre-market whipsaw of more than 100 Dow points. Traders that entered short positions based on the bearish patterns below the 50-day average in the DIA, SPY, and QQQ may be forced to by to cover if the bulls remain strong after the open. Overnight whipsaws are incredibly difficult to trade unless you’re capable of picking a direction, placing your bet, closing your eyes and letting it ride. Tough to do and consequently times like this can chop a traders account to pieces.

One way to handle such volatility is to plan trades of a smaller size to limit your risk. Placing a trade of half or even a quarter of your normal trade size can help a trader better deal with the whipsaws and fast price action. If the trade does move in your favor, you can always add to the position. If you find yourself trapped by an overnight reversal, you may still have to take a loss, but small losses are much easier to recover from and not as psychologically damaging. Remember trading is not a sprint, it’s a marathon.

On the Calendar

The Economic Calendar hits the ground running this Monday with four potential market-moving reports. The most important report, Retail Sales, is released at 8:30 AM Eastern which forecasters expect a 0.4% increase in the headline number with ex-auto sells less robust at 0.2%. Also at 8:30 AM is the Empire Stae Mfg Survey that consensus suggests will remain very strong with a reading of 18.2 in April while declining slightly.

At 10:00 AM Business Inventories are expected to show a 0.6% rise in February inventories remaining very strong. Also at 10:00 AM the Housing Market Index is expected to show home-builder confidence remains steady with a 70 print in April according to forecasters. Then at 4:00 PM, Treasury International Capital reports the demand for long-term U.S. Securities, but there is no forward-looking forecast for this report. We have one Fed Speaker at 1:15 PM and three bond events to round out this busy calendar day.

On the Earnings Calendar, there are 45 companies reporting today with SCHW and JBHT before the bell, but all eyes will likely focus on the first to of the FANG stocks to report, NFLX after the bell.

Action Plan

I have to admit to being a little disappointed that the strong earnings reports of C, JPM, and WFC were not enough to dissuade the bears from selling into the close on Friday. The potential of a Syrian military response by the U.S. proved stronger than these big banks beating on both the top and bottom line. The bearish engulfing candle patterns under the 50-day average certainly are a concern and if price action follows-through to the downside it would confirm a lower high in the current downtrend. However, the current futures are pointing to substantial gap up at the open as the bulls try to prevent follow-through selling.

With the Dow Futures suggesting another overnight reversal of around 150 points, price volatility remains high and difficult to trade. Traders currently holding positions should expect big price swings and whipsaws to continue as we challenge the strength of index resistance levels. Slipping into a wide range consolidation is certainly possible around the 50-day average. Plan your risk carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/8Qjqkf8DLVI”]Morning Market Prep Video[/button_2]

Earnings Season

With the analysis expecting a strong 2nd quarter earnings season there may finally get the catalyst need to pick a direction and stop all the flip-floping price action. If we do begin to recover the path ahead is filled with lots of resistance hurdles and political uncertainty it must continue to manage. However, a good round of earnings could do a lot to calm the nerves of traders and investors as long as inflation remains in check.

With the analysis expecting a strong 2nd quarter earnings season there may finally get the catalyst need to pick a direction and stop all the flip-floping price action. If we do begin to recover the path ahead is filled with lots of resistance hurdles and political uncertainty it must continue to manage. However, a good round of earnings could do a lot to calm the nerves of traders and investors as long as inflation remains in check.

Although earnings create is own brand of volatility it will mostly directed at individual stocks. Anything is possible, but my hope is the big daily swings will subside, but I would continue to expect frequent market gaps and fast price action as markets deal with resistance and react to the earnings reports. The fast price action could still be very challenging, but earnings may be the light at the end of the tunnel we have been waiting for to give an edge back to good stock pickers.

On the Calendar

The Friday Economic Calendar has three Fed Speakers at 7:30 AM Eastern, 9:00 AM and 1:00 PM to both open and close the calendar day. At 10:00 AM Consumer Sentiment is expected to soften slightly to 101.0 vs. March reading of 101.4, a 14 year high. Also at 10:00 AM the JOLTS report is also expected to ease but continue to show a strong labor demand at 6.143 million job openings. The 1:00 PM, the Oil Rig Count, is not expected to move the market.

Second quarter earnings season kicks off today with C, JPM, PNC, and WFC all reporting before the bell. Analysts are expecting very positive results from the banks showing substantial earnings growth.

Action Plan

With easing Syrian tensions, the bulls stepped up to the plate yesterday and displayed strength all the way through the close. With several big banks expected to kick off 2nd quarter earnings with strong results, do we dare hope for a bullish follow-through today? I can only guess, but if earnings come in as strong as expected, then I would venture an answer of yes, and it could finally help reduce market volatility.

Keep in mind; the index charts have a lot of overhead resistance they still have to overcome, and an armed conflict with Syria will continue to weigh heavy the mind of the market as we head into the weekend. If in fact, the market does spill off some of this extreme volatility then swing traders with good technical skills could find a target rich environment of discounted stocks. I wish you all a wonderful weekend.

Trade Wisley,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/_xkgjiX0Rmg”]Morning Market Prep Video[/button_2]

Threat of military conflict.

With 2nd quarter earnings just around the corner, I get the impression the market wants to go up but is tentative due to the threat of military conflict with Syria. Another consideration is the coming weekend. Will traders hold with the uncertainty of military action or will they prefer to exit positions much like we saw last Friday? As the CEO of your trading business, what will you do? Making the decision even harder is the daily reversals in the overnight futures prices. It’s a tough call.

With 2nd quarter earnings just around the corner, I get the impression the market wants to go up but is tentative due to the threat of military conflict with Syria. Another consideration is the coming weekend. Will traders hold with the uncertainty of military action or will they prefer to exit positions much like we saw last Friday? As the CEO of your trading business, what will you do? Making the decision even harder is the daily reversals in the overnight futures prices. It’s a tough call.

There are a lot of charts shaping up and forming good patterns, but with the market flipping direction on a daily basis it’s difficult to plan trades when your edge and slip away in the overnight session. If you do decide to trade it may be wise to take smaller than normal positions as a way to compensate for the uncertainty. If the market moves in your direction and actually follow through for more than just one day one could always add to the position. With the VIX stubbornly holding above a 20 handle expect volatility, whipsaws and fast price action to continue.

On the Calendar

We kick off Thursday with the weekly Jobless Claims at 8:30 AM Eastern which consensus expects to come in at 230,000 showing strong labor demand. Also at 8:30 AM is the Import & Export Prices which expects imports to show a modest increase of 0.2% with export prices up 0.3%. Nonmarket moving reports form Bloomberg Consumer Comfort Index, Natural Gas Report, 4-bond events, Fed Balance Sheet, Money Supply and a Fed speaker at 5:00 PM to finish up the calendar day.

On the Earnings Calendar, I see 24 companies are stepping up report results today. Remember 2nd quarter earnings officially kick off tomorrow with several big banks reporting.

Action Plan

Yesterday a gap down of about 200 points and this morning a gap up of more than 100 points is currently indicated in Dow Futures. The VIX continues to rest above a 20 handle and above its day moving average as sabers rattle between the US and Russia. With the uncertainty of conflict, oil prices continue to sharply rise which we will likely translate to higher prices at the pump very soon.

With the uncertainty, we should prepare for fast price action and quick reversals if military action begins. Let’s hope cooler heads prevail, and an armed conflict never occurs. These daily reversals are becoming tiresome, but perhaps we can get some relief with the kickoff of 2nd quarter earnings and see a direction maintained beyond a single day. However, with the weekend just around the corner, traders will have to decide if they want to hold with the threat of military conflict looming. It could be a bumpy ride.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/wjew5y0ouI0″]Morning Market Prep Video[/button_2]

Follow Through

Yesterday’s big bullish move was certainly encouraging. Obviously, the market has no trouble making big daily moves and has certainly proved that over the last couple weeks. Following through, on the other hand, seems to be a puzzle the market seems unable to solve. Yesterday the Dow gaped up nearly 300 points and managed to push higher closing up 428 on the day. However, with the Dow Futures currently indicating to a gap down of more than 200 points at the open follow through once again appears to be a major problem.

Yesterday’s big bullish move was certainly encouraging. Obviously, the market has no trouble making big daily moves and has certainly proved that over the last couple weeks. Following through, on the other hand, seems to be a puzzle the market seems unable to solve. Yesterday the Dow gaped up nearly 300 points and managed to push higher closing up 428 on the day. However, with the Dow Futures currently indicating to a gap down of more than 200 points at the open follow through once again appears to be a major problem.

To maintain a trading edge, most traders need at least one day of follow through in a stocks price action. Even during periods of normal market consolidations, good technical analysts can do very well. Unfortunately, when the market experiences big overnight gaps on a daily basis that changes direction almost every day maintaining an edge is nearly impossible. The good news is this very whippy price action will eventually end, and better days lie ahead. Protect your capital and wait for those better days when the market proves it can follow through or watch your account get chopped to pieces trying to fight the whip. The choice is yours.

On the Calendar

On the hump day, the Economic Calendar has four potential market move reports. At 8:30 AM Eastern the Consumer Price Index is expected to come in flat according to consensus. Core prices could see a modest 0.2% increase with the overall CPI rising to 2.1%. At 10:30 AM is the Petroleum Status Report which is not forecasted forward but has recently seen supplies decline supporting oil prices. Then at 2:00 PM we get to take a look at the minds of the FOMC with the release of the minutes which can obviously move the market. Also at 2:00 PM is the Treasury Budget which is expected to show a large deficit of 186 billion.

On the Earnings Calendar, we only have 11 companies reporting earnings. Notable before the bell is FAST and after the bell, BBBY step up to report.

Action Plan

We whip up one day and whip down the next, chopping up accounts and destroying the confidence of traders trying to fight it. After a nice gap up and run yesterday traders now face another overnight reversal with the Dow Futures pointing to more than a 200 point gap down. If you stand in a fire, then you have to accept the likelihood you will get burned. There is little to no edge for swing traders in this kind of whippy price action. As a result, I will continue to stand aside protecting my capital from being chopped up and waiting for an edge to return.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/kQFBCEMVDWE”]Morning Market Prep Video[/button_2]

A single Speech

What a difference a single speech can make during periods of political volatility. In what seems to be a dramatic policy reversal of trade the Chinese leader appeared to agree to all the Fair Trade points that have been made by the President. Let’s hope words actually translate into an enforceable agreement that finally levels the playing field. Clearly, this will take time, and there will still be considerable political jockeying, but at least for the moment, the market seems able to breathe a big sigh of relief.

All eyes will likely focus on the testimony in Congress by Mark Zuckerberg and what it could mean for the future of FB as well as other data-heavy tech business. I wouldn’t expect a quick resolution. In fact, we could easily see a lot of regulation and government over site in the months and even years to come. Needless to say, it could be a bit stressful for those holding FB as this process unfolds.

On the Calendar

The Tuesday Economic Calendar kicked off very early this morning with a Fed Speaker at 4:30 AM and the NFIB Small Business Optimism Index. The most important report today, PPI, comes out at 8:30 AM Eastern where consensus expects a modest increase of 0.1 in March however the high estimate is at 0.4%. Remove food and energy, and the expectation is for a gain of 0.2% with energy and trade services up 0.3%. Other reports not expected to move the market today are Redbook, Wholesale Trade, two bond auctions and another Fed Speaker at 6:30 PM.

The off Calendar testimony of Mark Zuckerberg at two Congress session will likely dominate the news today and could easily move FB stock and could affect another tech prices as well today.

On the Earnings Calendar, I see only 15 companies reporting earnings today, none of which are likely to move the overall market.

Action Plan

Yesterday produced a nasty whipsaw with the bulls moving the Dow up as much as 400 points only have the Bears come back in with a vengeance late in the day. Then after the close, China extended an olive branch essentially saying they plan to make huge concessions on trade which of course created yet another whipsaw in the overnight futures session. As I write this, Dow Futures are indicated to open sharply higher by more than 250 points. If the words actually translate into a fair trade deal with China, it could dramatically improve the overall economic outlook in the US. Let’s keep our fingers crossed.

With the big morning gap on fading trade concerns, a short squeeze could easily trigger pushing the indexes sharply higher. Keep in mind however that just one Tweet or poorly worded comment could send the indexes reeling so stay on your toes. Expect fast moving prices and whippy price action this morning as the market reacts.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/qf8cq2zmAdQ”]Morning Market Prep Video[/button_2]

Reading through weekend headlines there seems to be talking heads all over the spectrum. One will almost giddy with bullishness and the next profession extremely bearishness. Blah, blah, blah. Although they all seem so very self-assured, as to they’re correctness the truth is they are as uncertain as we all are and just talking up their positions. So what’s a retail trader to do with so much earnings uncertainty?

Reading through weekend headlines there seems to be talking heads all over the spectrum. One will almost giddy with bullishness and the next profession extremely bearishness. Blah, blah, blah. Although they all seem so very self-assured, as to they’re correctness the truth is they are as uncertain as we all are and just talking up their positions. So what’s a retail trader to do with so much earnings uncertainty?