Caution

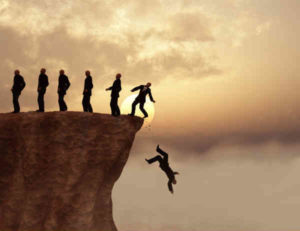

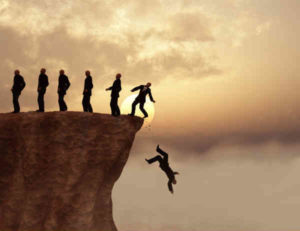

Lately, I repeatedly mentioned the necessity of caution with the current market condition. It’s a message that traders never like to hear, but that doesn’t make it any less true. Currently, the futures are pointing to a gap down on nearly 400 points. A brutal reminder that the market will punish those trading a bias rather than heeding the warnings in the price action of the chart.

Lately, I repeatedly mentioned the necessity of caution with the current market condition. It’s a message that traders never like to hear, but that doesn’t make it any less true. Currently, the futures are pointing to a gap down on nearly 400 points. A brutal reminder that the market will punish those trading a bias rather than heeding the warnings in the price action of the chart.

Obviously, volatility will be extremely high this morning. Expect very fast price action this morning with huge intraday whipsaws. Early panic could easily lead to additional selling this morning. Don’t chase this gap down short and don’t assume that buying this dip will be a profitable gamble. Let’s hope cooler heads prevail, but this kind of massive technical damage will likely take a long time to repair.

On the Calendar

There are no expected market-moving events on the Tuesday economic calendar. We have the Redbook@ 8:55 AM, Fed Speaker at 9:30 AM, Richmond Fed Mfg. Index at 10:00 AM, three Bond events between 11:30 AM and 1:00 PM, with four more Fed Speakers @ 1:30 PM, 2:15 PM, 615 PM and at 8:00 PM to close the calendar day.

On the Earnings Calendar, there are 139 companies reporting earnings today. I highly recommend that you check all current and proposed positions against the earnings calendar. With the current high volatility of the market failing to do so could prove to be an expensive lesson.

Action Plan

Last Friday I warned of a possible pop and drop. Yesterday I suggested the same possibility and to watch for very high volatility. I have intentionally used the phrase “be careful” several times in the morning videos when going over the index charts pointing out the potential stumbling blocks. Yesterday I received criticism for doing so and was accused of trying to politically correct. I’m not sure how my expression of caution is considered politically correct, but my read of the price action seems to have been correct.

I’m writing this not because my feeling were hurt or that I’m angry about the criticism. I bring it up because it’s a lesson on bias, and how that effect a trader. We may not like what the price action is telling us, but that doesn’t make it any less accurate. Every trader has the choice to move with the market or fight it. It’s been my experience that only one of those choices allows you to say in the game and grow your account over the long-term. With the futures suggesting nearly a 400 point gap down today, I suspect those that choose to fight the market will once again have to suffer the consequences of defiance.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/zn-4NObYEZk”]Morning Market Prep Video[/button_2]

Turbulent Price Action

Put your tray table in the upright and locked position, fasten your seat-belts low and tight across your lap because traders should expect some turbulent price action this week. With nearly 900 companies stepping up to report in the midst of a market correction could be volatility’s definition of the perfect storm. Expect very fast price action and daily market gaps as just a couple of the challenges traders will face.

Put your tray table in the upright and locked position, fasten your seat-belts low and tight across your lap because traders should expect some turbulent price action this week. With nearly 900 companies stepping up to report in the midst of a market correction could be volatility’s definition of the perfect storm. Expect very fast price action and daily market gaps as just a couple of the challenges traders will face.

Asian and European markets are bullish thus the US Futures are pointing to a gap up open this morning. Is this confirmation of higher lows in the indexes or a prelude to another nasty whipsaw? Only time will tell but be careful chasing the morning gap. Wait for proof that buyers step in supporting the gap and as always have a plan to manage the risk before you enter. If you don’t feel you have an edge, then protect your capital and don’t trade. Trading is a marathon, not a sprint.

On the Calendar

We start Monday with a light Economic Calendar and no expected market-morning reports throughout the day. The Chicago Fed National Activity Index kicks off the day at @ 8:30 AM Eastern. We have two Bill Announcements @ 11:00 AM and two Bill Auctions at 11:30 AM to end the calendar day.

Traders will need to stay very alert and flexible this week as the 4th quarter earnings season kicks into high gear with nearly 900 companies reporting. Today there are 77 expected to fess up to their result today with the most notable being CADE, HAL, HAS, IQV, KMB, ONB, PETS, PHG, PII, SALT, TCF.

Action Plan

Market correction jitters coupled with nearly 900 earnings reports this week will likely create a very challenging price action this week. Morning gaps, fast price action, high volatility, head fakes, whipsaw, and earnings reports are just a few of the issues traders may have to deal with this week. While very quick day traders may find this kind of market very much their liking, swing traders may find it very difficult to find or maintain an edge.

Asian markets closed sharply higher across the board last night with Shanghai rallying over 4 percent. European markets are also decidedly bullish this morning, up nearly half a percent. As a result, the current US Futures are suggesting a gap up of more than 75 points Dow points at the open. Although it’s encouraging the indexes could be putting a higher low we also must give respect to the price resistance that rejected last Tuesdays big rally. Anything is possible so buckle up everyone it could be an exciting yet very bumpy ride!

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/xyQNho_qKhI”]Morning Market Prep Video[/button_2]

Price is King

Although we have access to a plethora of fancy indicators on your charting platform simply technical analysis of price action support, resistance, and trend still rule supreme. Price is King! Tuesday’s, big rally pushed the major right into price resistance levels. Yesterday, resistance did its job preventing a follow move higher, and the clues to that possibility were evident to those that study price.

Although we have access to a plethora of fancy indicators on your charting platform simply technical analysis of price action support, resistance, and trend still rule supreme. Price is King! Tuesday’s, big rally pushed the major right into price resistance levels. Yesterday, resistance did its job preventing a follow move higher, and the clues to that possibility were evident to those that study price.

If your struggling, try cleaning up your charts and work on the fundamentals of technical analysis. All those colorful charts sure look impressive but if it’s not making you money, what’s the point of cluttering a chart with them? We only make money when the price moves so put more effort into reading price, and your trading will likely improve. After all, if your account is proving to you that what your doing now isn’t working then its time to make a change don’t you think?

On the Calendar

The Thursday Economic Calendar begins with the Weekly Jobless claims at 8:30 AM Eastern. According to consensus estimates are expected to come in at 215,000 vs. 214,000 last week. Also at 8:30 AM is the Philly Fed Business Outlook Survey which expects a slight pullback to 20.0 in October vs. the 22.9 reading in September. After that, Leading Indicators @ 10:00 AM, EIA Natural Gas report @ 10:30 AM, 6-bond events @ 11:00 AM, 30-yr TIPS Auction at 1:00 PM, with the Fed Balance Sheet and Money Supply coming in @ 4:30 PM. We have Fed Speakers at 9:00 AM and 12:15 PM today as well.

On the Earnings Calendar, we have the biggest day this week with 82 companies reporting. Make sure you’re checking reporting dates before entering positions, with about 900 companies reporting next week traders will need to stay focused.

Action Plan

I don’t know if your like me but when the market is tossing about and I have little to no edge to trade, I tend to get a bit frustrated and bored. That’s a dangerous combination of emotion for a trader! Taking bad risks simply to have something to do can cause a lot of damage to a traders account. So what’s a trader to do? Here are few suggestions that always help me.

Clean up watch lists, work on your charting and trading platform to gain efficiency and learn new skills. Study, new chart and candlestick patterns digging into the price action of the charts to improve your recognition skills. Do a detailed review of past losing trades looking for mistakes that you can avoid in the future. Learn that new a new trading strategy you’ve been putting off or do a deep dive into the details of the indicators you use. Turn on your paper trade system and practice your price action skills or perhaps develop a new skill such as placing OCO & and conditional orders. That’s just a few ideas off the top of my head that make times like this more productive, and in the long run make you a better more well-rounded trader.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/G8NR9yivJ-g”]Morning Market Prep Video[/button_2]

Maintain an Edge

Trading during the volatility of a major selloff is always challenging but double up on the volatility adding in an earnings season, and traders will likely find it very difficult to maintain an edge. Trading without an edge is gambling with the house odds stacked heavily against you. Gambling can certainly be exciting at the beginning but keep in mind at the end of the day there are no medals for bravery in the market.

Trading during the volatility of a major selloff is always challenging but double up on the volatility adding in an earnings season, and traders will likely find it very difficult to maintain an edge. Trading without an edge is gambling with the house odds stacked heavily against you. Gambling can certainly be exciting at the beginning but keep in mind at the end of the day there are no medals for bravery in the market.

Trading is a marathon, not a sprint and if you expect to win you have to stay disciplined to a plan. If the market is open, many traders feel the pressure that they have to trade, but trading just for the sake of trading is a business model for losses. If you have an edge, then by all means trade! If you don’t have an edge and stand aside, you protect your capital. Losing can certainly be character building, but the winner will be the one that traded wisely growing the account trading only when they had an edge. Who would you prefer to be?

On the Calendar

The Wednesday Economic Calendar starts early with the MBA Mortgage Applications report at 7:00 AM Eastern. The market-moving Housing Starts at 8:30 AM expects a slight decline in starts to 1.216 million while at the same time permits are rising to 1.272 million according to consensus estimates. !0:30 AM brings the EIA Petroleum Status Report with a Fed Speaker to follow at 12:10 PM. Then we will get a little insight into what the FOMC thinks when they release the last meeting minutes at 2:00 PM.

On the Earnings Calendar, we have 63 companies. As earnings season continues to ramp up, make sure you are planning all your trades having checked them against the earnings calendar.

Action Plan

After such a blowout report by NFLX yesterday afternoon, Asian markets closing bullish across the board and European markets mostly positive, US Futures are pointing to a modest decline at the open. After rising 547 points in the Dow yesterday, I view only a slight pullback as a substantial win this morning. However, as the indexes rush back up into major resistance levels, we need to watch for potential pullback and failures.

Earnings season and how companies report will add a significant challenge for swing traders. Volatility will remain high and we significant overnight index reversals are certainly possible greatly diminishing the swing traders edge. However, this could be a very good environment for day traders capable of handling very fast price action. Standing aside and waiting for your edge to return is a very viable solution to this problem. You have nothing to prove by fighting the market and will gain no honor in doing so. That is, of course, easier said than done so if you do decide to trade, consider smaller positions and a willingness to remain flexible and take profits faster in this volatile environment.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/ioeOjrBQ0wY”]Morning Market Prep Video[/button_2]

Market gaps and overnight reversals

With the ramp of 4th quarter earnings season coupled with high volatility of the recent selloff, expect daily market gaps and possible overnight reversals to make swing trading very challenging over the coming weeks. Fast morning price action with whipped up emotion as result roll-out will likely produce a lot of head fakes whipsaws in the intra-day price action.

With the ramp of 4th quarter earnings season coupled with high volatility of the recent selloff, expect daily market gaps and possible overnight reversals to make swing trading very challenging over the coming weeks. Fast morning price action with whipped up emotion as result roll-out will likely produce a lot of head fakes whipsaws in the intra-day price action.

Avoid gambling and be very picky about the trade setups you take during this period. Always check current holdings and stocks your interesting in purchasing against upcoming earnings reports. Plan trades carefully that always include an exit plan if your wrong to avoid emotional decision making in the heat to the moment. Consider reducing position sizes as a method of controlling risk during just high volatility events and be willing to scale out of positions or take profits sooner amidst wild price action. If I stock happens to gaps in your favor, remember that gaps are gifts, take and be grateful for what the market has given you.

On the Calendar

The Tuesday Economic Calendar begins at 8:55 AM with the Redbook Report. The most likely market-moving report of the day is Industrial Production at 9:15 AM which expects a 0.2 gain with manufacturing also up 0.2 percent. The Housing Market Index and the JOLTS report are both at 10:00 AM. Housing according to consensus is expected to remain flat with a reading of 67 while forecasters see job openings in the JOLTS report holding steady at 6.905 in August. We have two-Bond Auctions at 11:30 AM with the Treasury International Capital report at 4:00 PM.

On the Earnings Calendar with 4th quarter earnings ramping up, we have several notable today. Before the bell, BLK, JNJ, GS, MS, PGR & UNH are among those reporting. After the bell, CSX, IBM, LRCX, NFLX, & UAL are some of the big names reporting.

Action Plan

Following a day of disappointingly choppy price action where the Dow lost 89 points the early morning futures are suggesting a substantial gap up at the open. As frustrating as it is to be getting overnight gap reversals I think we had better try to get used to it as we enter the ramp up to 4th quarter earnings season. Asian markets were mixed but mostly higher overnight while European markets are modestly higher this morning.

Expect volatility to remain high and always be careful not to chase morning gaps. As I mentioned yesterday, the market internals suggests a bounce or reversion to the mean after such a sharp selloff. I think the most telling of earnings reports today will be when NFLX releases its numbers after the bell today. The beleaguered Tech Sector could sure use a win, but there is a significant concern that the so-called FANG stocks may see troubled waters ahead. Let’s hope the fears are unfounded because of a poor report from NFLX could add insult to injury in the techs.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/xnKw-KDVNjw”]Morning Market Prep Video[/button_2]

Predictions

I always find it amazing how a market selloff brings out a litany of talking heads with predictions of new highs or outlooks of gloom and doom as if they have the power to see the future. It’s honestly laughable because most of them are just talking up their positions. I submit to you that listening to all that noise is unproductive and very likely damaging to your trading success.

I always find it amazing how a market selloff brings out a litany of talking heads with predictions of new highs or outlooks of gloom and doom as if they have the power to see the future. It’s honestly laughable because most of them are just talking up their positions. I submit to you that listening to all that noise is unproductive and very likely damaging to your trading success.

No one cares about your money more than you. The talking heads care only about their money just like you and me. The truth is they are working to take our money from us just as much as we want to take money from them! It may sound harsh, but that’s the truth about the market. Let them blather on making ridiculous predictions but don’t waste your time. Learn to read price action, step up and make your own decisions and hold you’re accountable for the results. That is now and has always been, the path to success. Let’s turn off the noise, dump the predictions, roll up your sleeves and get to work.

On the Calendar

The Retail Sales report gets the new trading week started at 8:30 AM Eastern and is the most likely market-moving event on the Economic Calendar. Consensus estimates expect a bounce back in September with a 0.6 percent increase with ex-autos up only 0.4 percent. Also at 8:30 AM is the Empire State Mfg. The survey which expects steady and growth with a reading of 19.3 in October vs. 10.0 in September. 10:00 AM brings the Business Inventories report which consensus sees a 0.5 increase for August. After that, we have two Bill Announcements at 11:00 AM and two Bill Auctions at 11:30 AM to wrap up the calendar day.

On the Earnings Calendar, we have 22 companies reporting results as the 4th quarter earnings season ramps up. Most notable before the bell are BAC and SCHW. After the bell, look for JBHT as the most notable of the afternoon.

Action Plan

Those picking up positions as the market rallied into the close on Friday are likely a little disappointed this morning seeing the Futures once again under pressure. Asian markets all closed down about 1.5% overnight while European markets are currently printing mixed results. US Futures have recovered some of the overnight lows but as I write this currently point to 100 point gap down at the open.

T2108 and T2122 suggest a short-term oversold condition so keep eyes on price action looking for clues of a rally and a reversion to the mean. Please understand this in no way means a rally will happen today so don’t rush in anticipation. Wait for price action clues! Remember volatility is likely to remain very high which means we need to prepare for head fakes, whipsaws, and fast price action which could make any rally challenging to enter.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/a3qL5gep864″]Morning Market Prep Video[/button_2]

Overnight Bounce

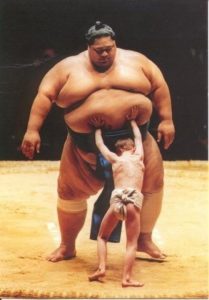

The wild ride continues with futures indicating a huge overnight bounce off of yesterday closing low. Also, huge in the hearts and minds of trader will be the Fear-Of-Missing-Out and the desire to revenge trade to get their money back. Unfortunately, with the Dow indicating a bounce well over 300 points at the open you will have to have an iron constitution willing to chase into a market likely to whip violently.

The wild ride continues with futures indicating a huge overnight bounce off of yesterday closing low. Also, huge in the hearts and minds of trader will be the Fear-Of-Missing-Out and the desire to revenge trade to get their money back. Unfortunately, with the Dow indicating a bounce well over 300 points at the open you will have to have an iron constitution willing to chase into a market likely to whip violently.

The market will recover but it will likely weeks if not months to repair the technical damage this selloff created. Just study the February selloff as an example. While it’s true, there are bargain prices; you will have to earn them only if you have the willingness to hold the position though substantial whip. Fourth-quarter earnings will also add a complication to this process so carefully plan your risk as we head into the weekend.

On the Calendar

Import/Export Prices top the Economic Calendar this Friday at 8:30 AM Eastern. Consensus expects import prices by 0.2 percent while export prices rise 0.3 percent in September. Consumer Sentiment is expected to ease slightly in September to 99.5 according to consensus estimates. We have three Fed speakers today with Evans @ 9:30 AM, Bostic @ 12:30 AM, and Quartes @ 10:30 PM. Also, we have Baker-Hughes Rig Count at 1:00 PM, but it’s unlikely to move the market.

Fourth Quarter earnings officially get started today. Among the eleven companies reporting today the most notable are C, JPM, PMC, FRC, and WFC which all report before the bell.

Action Plan

After another day of heavy selling, the Futures are pointing to a substantial gap up this morning following rallies in both Asian and European markets. Part of the inspiration is coming from the new that the US and China are once again setting down at the trade negotiations table. Let’s hope we see some progress this time! Keep in mind the preliminary futures could move around significantly this morning as several of the big banks report before the bell.

With such a huge gap at the open, it may, unfortunately, be very difficult to profit unless you were a buyer at the close yesterday. Remember volatility is likely to remain very high so expect some very whippy price action. Entering this morning will not be for the faint of heart. Plan that you will likely have to be willing to sit through some rough price action and deep whipsaws. However, if you have the stomach for an intense roller-coaster ride, there may be some opportunities to pick up great stock at bargain prices as we bounce from such and extreme short-term oversold condition. Carefully plan how much risk you are willing to hold through the weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/jd6abNirFSM”]Morning Market Prep Video[/button_2]

Going on Sale

Stocks are going on sale! I have been expressing concern over the last few weeks that fewer and fewer stocks were holding the market up. I have mentioned several times over the last several of months about a rotation into defensive sector stocks as well. Consequently, I have been expecting a pullback in the market, but I admit to being completely surprised by the panic and the magnitude of the selling we experienced yesterday!

Stocks are going on sale! I have been expressing concern over the last few weeks that fewer and fewer stocks were holding the market up. I have mentioned several times over the last several of months about a rotation into defensive sector stocks as well. Consequently, I have been expecting a pullback in the market, but I admit to being completely surprised by the panic and the magnitude of the selling we experienced yesterday!

The best move for most swing traders is to stand aside and let it happen while keeping your capital safety tucked away in your account. Technical damage like this will take a long time to repair, and the fast price action and high volatility will make profiting very challenging even for the most experienced traders. As bad as it may seem at the moment keep in mind that this is a good thing. Stocks are going on sale and if we patiently wait there will eventually be great deals for us when it’s over.

On the Calendar

A busy Thursday on the Economic Calendar but with a major selloff underway, I’m not sure anyone will pay much attention to the details. Possible market moving reports are, 8:30 AM Eastern CPI & Jobless Claims, Natural Gas Report at 10:30 AM, Petroleum Status Report at 11:00 AM, Treasury Budget at 2:00 PM and the Fed Balance Sheet at 4:30 PM. There are also four Bond Events between 11:00 AM and 1:00 PM ant the Money Supply report at 4:30 PM.

On the Earnings Calendar, we have 12 companies reporting. Most notable are DAL and WBA which both report before the bell.

Action Plan

I said yesterday that a test of recent lows was not out of the question but holy cow I didn’t expect it would trigger such a massive run for the door. The VIX pretty much says it all having spiked 43.95% yesterday as fear turned to outright panic. The selling spread around the world like wildfire as Asian markets plunged and European markets sharply lower this morning. The pain continues this morning with US Futures pointing to gap down of more than 200 Dow points at the open.

So what is a retail trader to do in the midst of such technical damage? The only thing we can do, protect your capital and let it happen! Don’t fight it, and don’t try to predict it or your likely to have you’re head handed to you! The implied volatility increase in options will make them very challenging to trade. Market Makers will widen the bid/ask spreads and when a rally does occur I the IV will collapse making it very difficult to profit even if you are exactly right on direction and timing. The good news is selling of this magnitude will likely get at least this first leg of the correction over soon. Unfortunately, extremely high volatility is likely here to stay for the near future.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/hxi1tdoOQnw”]Morning Market Prep Video[/button_2]

Temporary Stalemate?

Asia modestly higher overnight and European markets modestly lower the US Futures seem to have reached a temporary stalemate suggesting a flat open. I’m expecting an oddly slow and choppy morning with both the bulls and bears struggling to find inspiration. With the 4th quarter earnings season perhaps they are simply content to wait with the potential interest rate increase impacts starting to weigh heavily on the mind of the market.

Asia modestly higher overnight and European markets modestly lower the US Futures seem to have reached a temporary stalemate suggesting a flat open. I’m expecting an oddly slow and choppy morning with both the bulls and bears struggling to find inspiration. With the 4th quarter earnings season perhaps they are simply content to wait with the potential interest rate increase impacts starting to weigh heavily on the mind of the market.

Certainly, a rally to test resistance is possible, but there seems to be an equal chance that a retest of recent lows. Stay very focused on price action as a stalemate like this can suddenly spring to life and is very susceptible to head fakes and whipsaws. With earnings season just around the corner, we should expect higher volatility to stick around for several weeks. Plan your risk carefully.

On the Calendar

Hump-day on Economic Calendar begins with the Mortgage Applications at 7:00 AM Eastern. At 8:30 PM the PPI at 10:00 AM expects a rise of only 0.2 percent for the September headline number. We have the Atlanta Fed Business Inflation Expectations as well at Wholesale Trade number at 10:00 AM. A 3-yr Note Auction @ 11:30, Fed Speaker a@ 12:15 PM, 10-yr Note Auction @ 1:00 PM, and another Fed Speaker at 6:00 PM to close the calendar day.

On the Earnings Calendar, we have eight companies reporting the most notable, FAST, stepping up before the bell today.

Action Plan

A very choppy day yesterday as the market seemed content to consolidate near recent lows as the market becomes increasingly concerned about the effects of the FOMC rate hikes. I think the bigger concern is that Earnings Season begins next week and companies have a lot of live up to at current valuations. As a result, increased volatility is likely over the next few weeks with big morning gaps and challenging price action.

With Asian markets having closed modestly higher across the board overnight and European markets currently down across the board, US Futures seem a bit confused as to what to do this morning. As I write this, the Dow Futures are currently dead flat. Perhaps the PPI number at 8:30 AM Eastern will give the market some inspiration, but as of now, I’m planning for a very slow and choppy morning. After that its anyone’s guess.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/eEEpZhtnFNM”]Morning Market Prep Video[/button_2]

A Piling on of bad news.

When the market starts to turn lower, it always seems to attract a piling on of bad news. Yesterday, after the close, the IMF lowered world growth estimates siting trade disruptions. As a result, Asian and European markets reacted lower, and consequently, the US Futures are suggesting another gap down punishing those that held overnight. The buy the dip crowd will likely feel some pain this morning.

When the market starts to turn lower, it always seems to attract a piling on of bad news. Yesterday, after the close, the IMF lowered world growth estimates siting trade disruptions. As a result, Asian and European markets reacted lower, and consequently, the US Futures are suggesting another gap down punishing those that held overnight. The buy the dip crowd will likely feel some pain this morning.

Don’t rule out the possibility of a test of yesterdays but with any luck, the bulls will find the energy to hold a higher low and establish a safer entry point than just blindly buying the dip. Expect volatility to remain high with challenging price action that could include substantial whipsaws and head fakes. Be very careful and remember you don’t have to the trade every day to be a successful trader and remember cash is a position.

On the Calendar

The Tuesday Economic Calendar kicks off early with the NFIB Small Business Optimism Index at 6:00 AM Eastern. At 8:55 AM we will hear from the Redbook report, we have a Fed speaker at 10:00 AM, four Bill Auctions between 11:30 AM and 1:00 PM. Late this evening we have Fed speakers at 9:15 PM and 10:35 PM Eastern.

We have only four companies reporting earnings today. Before the market, we have AZZ & HELE with CNBKA & IDT reporting after the close of trading today.

Action Plan

Yesterday played out about as expected ending the day with hope as the Bulls came in chanting “buy the dip.” I truly dislike that phrase! It encourages irresponsibility and gambling as traders jump blindly into trades with no thought to the fact their action could be absolutely wrong! Those that blindly jumped yesterday before the close will obviously feel the error of their ways with the futures pointing to a gap down of more than 100 points this morning.

After the close yesterday, the IMF lowered world growth estimates siting trade disruptions. Emerging Markets which have been in a downtrend for most of the year will remain under pressure according to the IMF due to there weakening currency against the US Dollar. After the morning gap down expect some whippy price action and don’t rule out the possibility of a pullback to test yesterdays low. If tested, I think there is a high probability it will hold as support at least for the short-term. The very best scenario is if the Bull step in holding a higher low and a willingness to demonstrate follow-through buying. A pullback that holds a higher low and provides a lower risk entry? Where have I heard that before? Your choice, enter with a plan or blindly buy the dip.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/9SLjhHJa5vc”]Morning Market Prep Video[/button_2]

Lately, I repeatedly mentioned the necessity of caution with the current market condition. It’s a message that traders never like to hear, but that doesn’t make it any less true. Currently, the futures are pointing to a gap down on nearly 400 points. A brutal reminder that the market will punish those trading a bias rather than heeding the warnings in the price action of the chart.

Lately, I repeatedly mentioned the necessity of caution with the current market condition. It’s a message that traders never like to hear, but that doesn’t make it any less true. Currently, the futures are pointing to a gap down on nearly 400 points. A brutal reminder that the market will punish those trading a bias rather than heeding the warnings in the price action of the chart.

Put your tray table in the upright and locked position, fasten your seat-belts low and tight across your lap because traders should expect some turbulent price action this week. With nearly 900 companies stepping up to report in the midst of a market correction could be volatility’s definition of the perfect storm. Expect very fast price action and daily market gaps as just a couple of the challenges traders will face.

Put your tray table in the upright and locked position, fasten your seat-belts low and tight across your lap because traders should expect some turbulent price action this week. With nearly 900 companies stepping up to report in the midst of a market correction could be volatility’s definition of the perfect storm. Expect very fast price action and daily market gaps as just a couple of the challenges traders will face. Although we have access to a plethora of fancy indicators on your charting platform simply technical analysis of price action support, resistance, and trend still rule supreme. Price is King! Tuesday’s, big rally pushed the major right into price resistance levels. Yesterday, resistance did its job preventing a follow move higher, and the clues to that possibility were evident to those that study price.

Although we have access to a plethora of fancy indicators on your charting platform simply technical analysis of price action support, resistance, and trend still rule supreme. Price is King! Tuesday’s, big rally pushed the major right into price resistance levels. Yesterday, resistance did its job preventing a follow move higher, and the clues to that possibility were evident to those that study price. Trading during the volatility of a major selloff is always challenging but double up on the volatility adding in an earnings season, and traders will likely find it very difficult to maintain an edge. Trading without an edge is gambling with the house odds stacked heavily against you. Gambling can certainly be exciting at the beginning but keep in mind at the end of the day there are no medals for bravery in the market.

Trading during the volatility of a major selloff is always challenging but double up on the volatility adding in an earnings season, and traders will likely find it very difficult to maintain an edge. Trading without an edge is gambling with the house odds stacked heavily against you. Gambling can certainly be exciting at the beginning but keep in mind at the end of the day there are no medals for bravery in the market. With the ramp of 4th quarter earnings season coupled with high volatility of the recent selloff, expect daily market gaps and possible overnight reversals to make swing trading very challenging over the coming weeks. Fast morning price action with whipped up emotion as result roll-out will likely produce a lot of head fakes whipsaws in the intra-day price action.

With the ramp of 4th quarter earnings season coupled with high volatility of the recent selloff, expect daily market gaps and possible overnight reversals to make swing trading very challenging over the coming weeks. Fast morning price action with whipped up emotion as result roll-out will likely produce a lot of head fakes whipsaws in the intra-day price action. I always find it amazing how a market selloff brings out a litany of talking heads with predictions of new highs or outlooks of gloom and doom as if they have the power to see the future. It’s honestly laughable because most of them are just talking up their positions. I submit to you that listening to all that noise is unproductive and very likely damaging to your trading success.

I always find it amazing how a market selloff brings out a litany of talking heads with predictions of new highs or outlooks of gloom and doom as if they have the power to see the future. It’s honestly laughable because most of them are just talking up their positions. I submit to you that listening to all that noise is unproductive and very likely damaging to your trading success. The wild ride continues with futures indicating a huge overnight bounce off of yesterday closing low. Also, huge in the hearts and minds of trader will be the Fear-Of-Missing-Out and the desire to revenge trade to get their money back. Unfortunately, with the Dow indicating a bounce well over 300 points at the open you will have to have an iron constitution willing to chase into a market likely to whip violently.

The wild ride continues with futures indicating a huge overnight bounce off of yesterday closing low. Also, huge in the hearts and minds of trader will be the Fear-Of-Missing-Out and the desire to revenge trade to get their money back. Unfortunately, with the Dow indicating a bounce well over 300 points at the open you will have to have an iron constitution willing to chase into a market likely to whip violently. Stocks are going on sale! I have been expressing concern over the last few weeks that fewer and fewer stocks were holding the market up. I have mentioned several times over the last several of months about a rotation into defensive sector stocks as well. Consequently, I have been expecting a pullback in the market, but I admit to being completely surprised by the panic and the magnitude of the selling we experienced yesterday!

Stocks are going on sale! I have been expressing concern over the last few weeks that fewer and fewer stocks were holding the market up. I have mentioned several times over the last several of months about a rotation into defensive sector stocks as well. Consequently, I have been expecting a pullback in the market, but I admit to being completely surprised by the panic and the magnitude of the selling we experienced yesterday! Asia modestly higher overnight and European markets modestly lower the US Futures seem to have reached a temporary stalemate suggesting a flat open. I’m expecting an oddly slow and choppy morning with both the bulls and bears struggling to find inspiration. With the 4th quarter earnings season perhaps they are simply content to wait with the potential interest rate increase impacts starting to weigh heavily on the mind of the market.

Asia modestly higher overnight and European markets modestly lower the US Futures seem to have reached a temporary stalemate suggesting a flat open. I’m expecting an oddly slow and choppy morning with both the bulls and bears struggling to find inspiration. With the 4th quarter earnings season perhaps they are simply content to wait with the potential interest rate increase impacts starting to weigh heavily on the mind of the market. When the market starts to turn lower, it always seems to attract a piling on of bad news. Yesterday, after the close, the IMF lowered world growth estimates siting trade disruptions. As a result, Asian and European markets reacted lower, and consequently, the US Futures are suggesting another gap down punishing those that held overnight. The buy the dip crowd will likely feel some pain this morning.

When the market starts to turn lower, it always seems to attract a piling on of bad news. Yesterday, after the close, the IMF lowered world growth estimates siting trade disruptions. As a result, Asian and European markets reacted lower, and consequently, the US Futures are suggesting another gap down punishing those that held overnight. The buy the dip crowd will likely feel some pain this morning.