All about the Mid-Term

All about the Mid-Term

Everywhere I look I see another talking head trying to predict the outcome of the mid-term election. To be honest, that’s far easier to do that than trying to predict how the market will react to the results! What I can say with 100% certainty is that no one knows what that reaction will be and trying to trade it is straight up gambling. As traders, we all gamble from time to time but let’s be honest with ourselves and have our eyes wide open if you choose to do so today.

Everywhere I look I see another talking head trying to predict the outcome of the mid-term election. To be honest, that’s far easier to do that than trying to predict how the market will react to the results! What I can say with 100% certainty is that no one knows what that reaction will be and trying to trade it is straight up gambling. As traders, we all gamble from time to time but let’s be honest with ourselves and have our eyes wide open if you choose to do so today.

It’s highly likely the market will gap Wednesday morning substantially. Which means all trades held through the close today are at a higher than normal risk. If you do decide to add risk today, I suggest you keep the positions small to minimize the losses if your guess of the market reaction is incorrect. Also, keep in mind that you don’t have to play the guessing game! There is no shame in standing aside protecting your capital and waiting to trade the reaction when you have a better edge.

On the Calendar

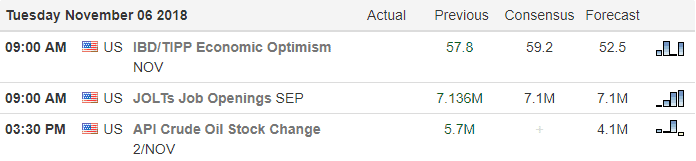

On the Earnings Calendar, we have more than 350 companies reporting today. Keep checking and stay focused on the number of reports grows even more through Thursday.

On the Earnings Calendar, we have more than 350 companies reporting today. Keep checking and stay focused on the number of reports grows even more through Thursday.

Action Plan

Asian markets caught a bit of bounce last night but by the close finished mixed. European markets, however, are all slightly bearish this morning and that sentiment seems to have translated directly to the US Futures market. Although futures are currently suggesting a modestly lower open, that could easily change due to all the earnings reports. I would normally expect a considerable amount of volatility but with the market waiting on mid-term election results price action may be choppy and subdued.

While many are trying to predict the election outcome its impossible to know how the market will react. However, react it will, and likely with a big gap up or down on Wednesday morning increasing the risk of every position we hold. Carefully consider that risk if you plan to enter new positions today or carry any positions into the close today. As a result, it’s very unlikely that I will be trading today except for the possible quick intraday trade to take advantage of volatility and stave off the boredom of an election day market.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/_1Bf7zJWxqo”]Morning Market Prep Video[/button_2]

This morning the US Futures are trying to put on a brave face before the mid-term election indicating a bullish open. While the water may seem calm on the surface, there is likely significant turbulence lurking just below. Futures were lower most of the night so don’t rule out the possible test of the overnight lows during the day.

This morning the US Futures are trying to put on a brave face before the mid-term election indicating a bullish open. While the water may seem calm on the surface, there is likely significant turbulence lurking just below. Futures were lower most of the night so don’t rule out the possible test of the overnight lows during the day.

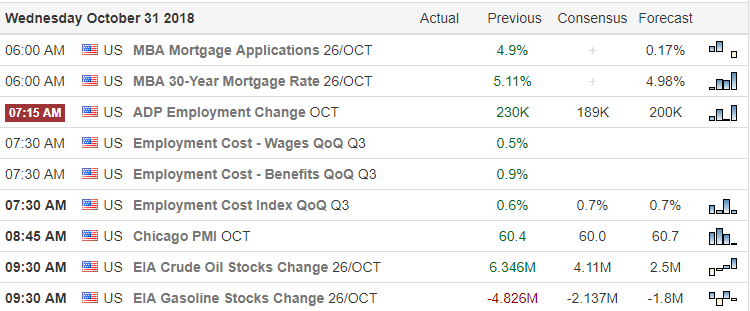

Markets are once again gaping higher this morning as this wild ride of volatility continues. With nearly 450 companies reporting earnings today and a busy economic calendar, anything is possible. Price resistance did its job yesterday rejecting the days high. This mornings gap brings the price right back up to those same price resistance levels. I intend to very cautious this morning and will watch price action closely to see if this gap is actually going to be supported by buyers.

Markets are once again gaping higher this morning as this wild ride of volatility continues. With nearly 450 companies reporting earnings today and a busy economic calendar, anything is possible. Price resistance did its job yesterday rejecting the days high. This mornings gap brings the price right back up to those same price resistance levels. I intend to very cautious this morning and will watch price action closely to see if this gap is actually going to be supported by buyers. Bullishness in the Asian and European market has the US Futures suggesting the first possible follow-through rally in nearly a month! Certainly exciting to see but as the indexes challenge price resistance levels, we can’t rule out the possibility of profit-taking. As a result, traders will need to say on their toes focused on price action and aware of the current market volatility.

Bullishness in the Asian and European market has the US Futures suggesting the first possible follow-through rally in nearly a month! Certainly exciting to see but as the indexes challenge price resistance levels, we can’t rule out the possibility of profit-taking. As a result, traders will need to say on their toes focused on price action and aware of the current market volatility.

Without a doubt, yesterday was an ugly ride, but it also revealed a possible silver lining. Where was the silver lining? In the last 15 minutes of the day, we experienced a huge bounce that can only occur when the big institutions finally step in to snap up the bargains and defend the lows. We still need proof of that with a follow-through rally today. Make no mistake, if this is a short-term bottom the price action will still be very challenging to trade.

Without a doubt, yesterday was an ugly ride, but it also revealed a possible silver lining. Where was the silver lining? In the last 15 minutes of the day, we experienced a huge bounce that can only occur when the big institutions finally step in to snap up the bargains and defend the lows. We still need proof of that with a follow-through rally today. Make no mistake, if this is a short-term bottom the price action will still be very challenging to trade. I see a lot of conversation in the press, and across social media using the term oversold. While that might be true, oversold does not automatically translate into bullishness or a reason to rush into risk! Take a close look at the daily charts, and you will see there is currently nothing in the price action that should engender confidence that the bulls are ready to take control. Remember the fear of missing out is an emotion and not a valid reason to buy!

I see a lot of conversation in the press, and across social media using the term oversold. While that might be true, oversold does not automatically translate into bullishness or a reason to rush into risk! Take a close look at the daily charts, and you will see there is currently nothing in the price action that should engender confidence that the bulls are ready to take control. Remember the fear of missing out is an emotion and not a valid reason to buy! It would appear that after the very disappointing earnings results from AMZN and GOOG that the so-called FANG has a cavity. Indeed a very big cavity that spread its pain all around the world. Both, Asian and European market are both lower this morning. US Futures indicate that yesterday’s 400 point Dow rally will be completely wiped out this morning with an ugly gap down open.

It would appear that after the very disappointing earnings results from AMZN and GOOG that the so-called FANG has a cavity. Indeed a very big cavity that spread its pain all around the world. Both, Asian and European market are both lower this morning. US Futures indicate that yesterday’s 400 point Dow rally will be completely wiped out this morning with an ugly gap down open. The news-driven selloff seems to have finally reached a capitulation point yesterday. Sadly those that sold yesterday afternoon had also to suffer the indignity of seeing the futures bounce strongly almost immediately after the closing bell. Although we should expect volatility to remain very high with very fast and challenging price action, I think we have reached the point where institutions and value buyers will begin to support current prices.

The news-driven selloff seems to have finally reached a capitulation point yesterday. Sadly those that sold yesterday afternoon had also to suffer the indignity of seeing the futures bounce strongly almost immediately after the closing bell. Although we should expect volatility to remain very high with very fast and challenging price action, I think we have reached the point where institutions and value buyers will begin to support current prices. Yesterday’s wild price fluctuations may have left many traders with a nasty case of whiplash. Unfortunately, it looks like the volatility is here to stay and with more than 200 companies reporting earnings today and more than 300 tomorrow, anything is possible.

Yesterday’s wild price fluctuations may have left many traders with a nasty case of whiplash. Unfortunately, it looks like the volatility is here to stay and with more than 200 companies reporting earnings today and more than 300 tomorrow, anything is possible.