T-Line Bullish Engulf PDCE Bullish Over $54.95

T-Line Bullish Engulf

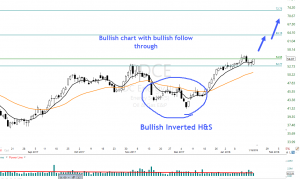

PDCE printed a T-Line Bullish Engulf Friday using the November highs as support. PDCE recently painted a successful Bullish Inverted Head and Shoulders that helped get them to the current position. PDCE is a Bullish chart and will become attractive above $54.95. To learn more about entries join us in the member’s area or consider a trading coach.

PDCE printed a T-Line Bullish Engulf Friday using the November highs as support. PDCE recently painted a successful Bullish Inverted Head and Shoulders that helped get them to the current position. PDCE is a Bullish chart and will become attractive above $54.95. To learn more about entries join us in the member’s area or consider a trading coach.

Today At 9:10 AM ET. We will demonstrate live how PDCE could be traded using our Simple Proven Swing Trade Tools

► Learn the Power Of Simple Trading Techniques

On January 10, we shared SRNE and how to use the trading tools listed below to profit from SRNE. Yesterday the swing profits would have been about 23% or $350.00 with 300 shares. Using our Simple, Proven Swing Trade Tools and techniques to achieve swing trade profits.

[button_2 color=”blue” align=”center” href=”https://hitandruncandlesticks.com/events/” new_window=”Y”]Events Calendar • Hit and Run Candlesticks • Right Way Options • Trader Vision • A Look Ahead • TradeHAwk[/button_2]Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning

► Eyes On The Market

Despite the government shut down in the wind, the SPY ETF closed at a record level Friday. As the shut down became real, the futures didn’t seem too concern. It’s now Monday morning, the government is shut down, and the futures are down a little but not bad. When the bulls are strong, they are strong! The trend is still bullish and intact. However, would not be surprised to see chop until the 3rd graders in Washinton grow up.

The VXX short-term futures closed Friday still inside the January 16th candle and above the T-Line. The bulls/buyers have been working with the last 12 bars to construct a bottom. Not fully constructed and still venerable a bottom still being constructed.

Rick’s Swing Trade ideas – MEMBERS remember to log into the members’ blog for the trade ideas – Member Login

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************