Bulls Look to Run As Payroll Data Ahead

On Thursday, the large-cap indices gapped modestly lower (down 0.21% in the SPY and down 0.24% in the DIA) while the QQQ opened flat (down just 0.05%). The Bears followed through in the SPY and DIA, taking price on a rollercoaster ride down to the lows of the day at about 12:10 pm. Meanwhile, QQQ also sold off but only until 10:30 am when a choppy sideways wave action lasted the rest of the day and left price up off the lows but still below the open. SPY and DIA followed the QQQ starting at 12:10 pm. This action left us with indecisive, black-bodied candles in all three indices. The QQQ printed a Spinning Top, while the two large-cap indices were just black candles with a larger lower wick than the upper wick.

On the day, nine of the 10 sectors were in the red with Financial Services (-1.55%) leading the way lower on regional bank concerns while Utilities (+0.58%) held up better than the other sectors. At the same time, the SPY lost 0.71%, DIA lost 0.82%, and QQQ lost 0.35%. VXX climbed 4.89% to 42.06 and T2122 dropped back down into the oversold territory at 10.02. 10-year bond yields climbed slightly to 3.373% while Oil (WTI) was flat on the day at $68.65 per barrel. So, Thursday was an undecided day with a modest gap down (follow through on Wednesday’s Fed news) in the large caps. This led to choppy, mildly bearish action the rest of the day across the market. This all happened on just less than average volume in all three major indices.

In economic news, April Exports increased to $256.20 billion (compared to a March value of $250.90). At the same time, April Imports fell to $320.40 billion (versus the March reading of $321.50 billion). As a result, the April Trade Balance fell to $64.20 billion (from March’s $70.60 billion but still above the forecast of $63.30 billion). In terms of quarterly data, Q1 Preliminary Nonfarm Productivity fell significantly more than expected at -2.7% (as compared to a forecast of -1.8% and the Q4 final value of +1.6%). This was in large part caused by a significantly higher than anticipated Q1 Preliminary Unit Labor Costs of +6.3% quarter-on-quarter (versus a forecast of +5.5% and a Q4 final number of +3.3%). Meanwhile, Weekly Initial Jobless Claims were just about as expected at 242k (compared to a forecast of 240k and a prior week’s value of 229k). Then after the close, the Fed Balance Sheet was reported lower at $8.504 trillion (versus the previous reading of $8.563 trillion or a $59 billion reduction). At the same time, Bank Reserves held with the Federal Reserve grew to $3.166 trillion versus a previous value of $3.132 trillion).

SNAP Case Study | Actual Trade

In stock news, JNJ’s spinoff IPO KVUE (the largest IPO in a long time) climbed on Thursday in its first day of trading. The IPO was launched at $22.00 and closed at $25.53 (+17%) which gives it a market cap of $48 billion. (JNJ still holds a 91.9% stake in the company.) Elsewhere, Bloomberg reported that MSFT is working with AMD and helping finance the chipmaker’s expansion into AI processors. At the same time, a German outlet reports that TSLA is actually using batteries from Chinese firm BYD to build Model Y cars in Berlin. (This makes BYD the fourth external battery supplier for TSLA.) Elsewhere in Europe, Reuters reports that UBS is considering an IPO to spin off the former Swiss banking operations of CS. Meanwhile, AFLYY (Air France – KLM) is in talks with APO seeking a $550 million cash injection. In Asia, Taiwan announced that LMT had informed the country that deliveries of 66 new F-16V fighters ($8 billion sale) will be delayed due to LMT supply chain issues. The first deliveries had been scheduled for Q4 of 2023. Finally, the CEOs and other executives of MSFT and GOOGL met with the President and Vice President Thursday. The companies were told they have a legal responsibility to ensure their products are safe (related to AI inclusion to their products). The two-hour meeting offered no specific guidelines, rules, laws, or threatened fines. However, the White House did announce a $140 million investment into the National Science Foundation allowing it to launch seven AI research institutes focused on different aspects of Artificial Intelligence.

In stock legal and regulatory news, US appeals court judges seemed to take SBUX’s side in the coffee chain’s appeal of its loss of an NRLB case that found the company hurt or sought to hurt union organizing efforts by firing seven leaders of the organizing efforts in Memphis, TN. The judges seemed to ignore the fact that the company fired those people to kill the union effort, instead focusing on the fact that, even after the firings, the Memphis SBUX store did vote to unionize. Elsewhere, GM pleaded guilty to failing to take adequate safety precautions and thus causing the death of a worker in Canada. The company agreed to pay a $325,000 fine over the case. In France, the country’s antitrust agency told META it has two months to change its rules for ad verification partners to avoid being found to be taking unfair advantage of its dominant online advertising market position. At the close, it was announced that KR has agreed to pay West Virginia $68 million to settle claims related to lax oversight in the opioid epidemic in the state. Also after the close, AAPL complained that patent owner Arendi had revealed secrets (about how much AAPL paid to settle a patent infringement case) during a separate patent infringement case against GOOGL, violating a confidentiality agreement. AAPL has asked a court for unspecified damages over the disclosure.

In regional banking news, it was another bleak day in the market for those regional banks. PACW fell more than 50% on the Wednesday night news that it is “exploring its strategic options.” This opened the floodgates for the shorts to press the group leading WAL to fall 38% (on denied reports by the Financial Times that WAL is exploring a potential sale), FHN to drop 33% (this largely due to the premarket announcement that TD and FHN had called off their merger), and CMA to fall more than 12% for the day. Still, there were a few winners, on volume, among those regionals. SI was up 7% and BBD gained almost 2%. It should be noted that Reuters reported after the close that US federal and state officials are investigating potential “market manipulation” behind recent huge regional banking share moves.

After the close, AAPL, CNQ, OPEN, ED, EOG, SQ, RGA, BKNG, MSI, NCR, MCHP, LYV, CTRA, SEM, AMN, MNST, DASH, POST, COIN, MATX, CTNT, MTD, LYFT, CNXN, DBX, TDC, NOG, and KE all reported beats on both the revenue and earnings lines. Meanwhile, AIG, BCC, OTEX, COLD, BIO, and BGS all missed on revenue while beating on earnings. On the other side, LNT, FND, TXRH, TEAM, and DKNG all beat on revenue but missed on earnings. Unfortunately, GT, RKT, EXPE, BECN, TSE, TDS, USM, AND ERJ all missed on both the top and bottom lines. It should be noted that OPEN, TPC, LYFT, BIO, and ATSG all lowered their forward guidance while POST, FTNT, and DKNG raised their guidance.

Overnight, Asian markets were mixed. India (-1.02%), Shenzhen (-0.82%), and New Zealand (-0.67%) paced the losses. Meanwhile, Hong Kong (+0.50%), Australia (+0.37%), and Malaysia (+0.35%) led the gainers. In Europe, the bourses are mostly green at midday. The CAC (+0.47%), DAX (+0.79%), and FTSE (+0.40%) are leading the region higher in early afternoon trade. In the US, as of 7:30 am, Futures point to a gap higher to start the day. The DIA implies a +0.48% open, the SPY is implying a +0.66% open, and the QQQ implies a +0.65% open at this hour. At the same time, 10-year bond yields are back up to 3.407% and Oil (WTI) is up 2.65% to $70.38/barrel in early trading.

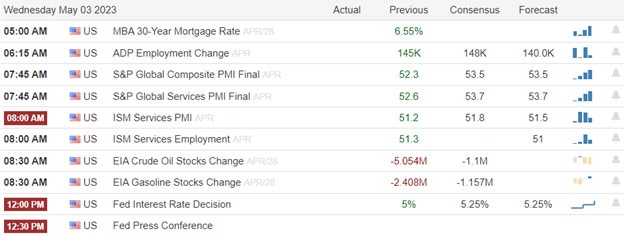

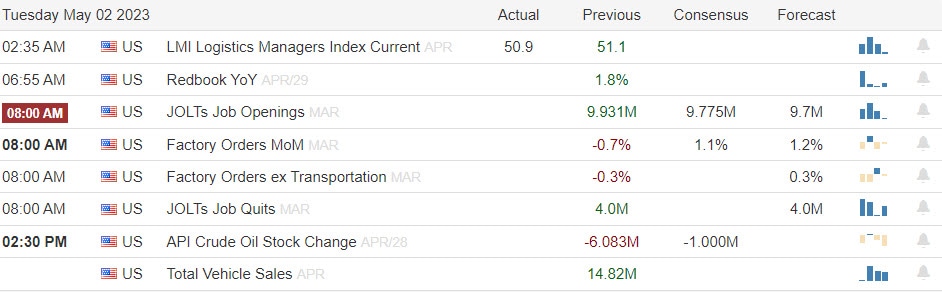

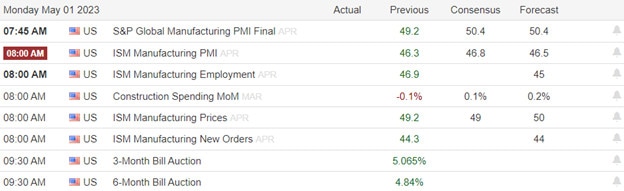

The major economic news events scheduled for Friday include April Average Hourly Earnings, April Nonfarm Payrolls, April Private Nonfarm Payrolls, April Participation Rate, and April Unemployment Rate (all at 8:30 am). The major earnings reports scheduled for the day include AES, AMC, AMCX, AEE, AXL, AMRX, BBU, BEPC, BEP, CLMT, CI, CNK, CNHI, D, ENB, EPAM, EVRG, FLR, FYBR, GLP, GTN, HUN, IEP, JCI, LSXMK, LSXMA, MGA, NMRK, OMI, PBF, PAA, PAGP, QRTEA, WBD before the open. Then, after the close, BAP reports.

So far this morning, CI, MGA, PBF, JCI, OMI, EVRG, EPAM, BEPC, BEP, CLMT, CNK, AMRX, PNM, and FSK have all reported beats on both the revenue and earnings lines. Meanwhile, HUN missed on revenue while beating on earnings. On the other side, FLR, AES, QRTEA, FYBR, and GTN all beat on revenue while missing on the earnings line. Unfortunately, WBD and UI missed on both the top and bottom lines. It is worth noting that OMI raised its forward guidance while EPAM and GTN lowered their guidance.

In miscellaneous news, Bloomberg reported Thursday evening that during April, six of every 10 small businesses reported hiring (or trying to hire) new employees. Related to earnings, as mentioned above AAPL beat on both lines on stronger-than-expected iPhone sales. However, this was the company’s second consecutive quarterly revenue decline. The report also showed a record for services including Apple TV+ and iCloud. The company also announced a $90 billion share buyback program.

With that background, it looks like the bulls are headed toward the T-line (8ema) in the large-cap indices while the QQQ has already tested and passed back above that level in premarket. Over-extension from the T-lines is not a problem and while T2122 is well into the oversold territory, it is not extremely extended. Don’t forget that we have preliminary April Payroll data this morning and that is likely to impact premarket and the open at the very least. Also, it’s Friday…payday…so pay yourself and get your account ready for the weekend news cycles.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service