Member e-Learning 11-1-23 – Rick

Market Liked Chair Words and Earnings

Markets started the day higher Wednesday with SPY gapping up 0.23%, DIA gapping up 0.16%, and QQQ gapping up 0.21%. After that open, QQQ led the way immediately rallying while the SPY took 15 minutes before following and DIA actually recrossed its opening gap before following in the rally that continued until 11 a.m. for all three. At that point, all three major index ETFs traded in a long sideways trough that lasted until the Fed Chair Powell’s press conference. However, once Powell spoke the Bulls were off to the races again in a sharp rally that lasted until 3:40 p.m. only to be very slightly blunted by profit-taking the last 20 minutes. This action gave us gap-up, large white candles in the SPY and QQQ as well as a white-bodied Spinning Top in the DIA. All three major index ETFs crossed back above their T-line (8ema) with SPY now located just below its 200sma. All of this happened on above-average volume in the DIA and QQQ and average volume in the SPY.

On the day, all 10 sectors were again in the green with Utilities (+1.57%) way out front leading the way higher and Consumer Defensive (+0.11%) lagging behind the other sectors. At the same time, the SPY gained 1.05%, DIA gained 0.67%, and QQQ gained 1.74%. The VXX fell 4.35% to close at 22.43 and T2122 climbed again to the center of its mid-range at 52.09. 10-year bond yields dropped to end the day at 4.747% and Oil (WTI) fell to close at $80.90 per barrel. So, it seems the Bulls liked the ADP precursor to the October Payrolls data and popped markets at the open and for the first part of the day. Then we saw hand-wringing and waiting on the widely expected Fed decision. However, when Fed Chair Powell told markets we were in a goldilocks scenario, the Bulls ran again only taking profits in the last minutes of the day.

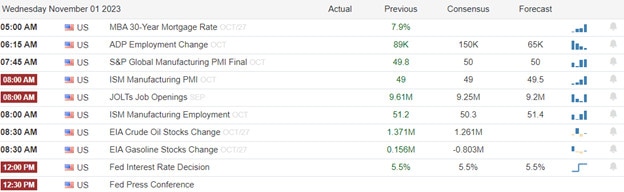

The major economic news reported Wednesday included the October ADP Nonfarm Employment Change, which came in lower than expected at 113k (compared to a 150k forecast but still higher than the September reading of 89k). Later the S&P Global Mfg. PMI was reported in line with what was predicted at 50.0 (versus a forecast of 50.0 and slightly better than the September 49.8 value). At the same time, the October ISM Mfg. PMI came in lower than anticipated at 46.7 (compared to a forecast of 49.0 and a September reading of 49.0). October ISM Mfg. Employment was reported lower than expected at 46.8 (versus a forecast of 50.3 and well down from the September 51.2). Meanwhile, Sept. JOLTs Job Opening remains stronger than predicted at 9.553 million (compared to a forecasted 9.250 million and even higher than the August value of 9.497 million). Later EIA Crude Oil Inventories rose but by less than anticipated at +0.774 million barrels (versus a forecast of +1.261 million barrels and the prior week’s +1.371 million barrels number). Then, as almost universally expected, the FOMC held the Fed Funds rate at 5.50%.

In his post-decision press conference, the key takeaways from Fed Chair Powell were that the US economy is strong, he is hesitant to advocate for a December rate hike, he is unwilling to commit to not hiking, and high treasury yields help but he was unwilling to say specifically how much they help. In general, Powell implied that there is no hurry and things are going so well that we can wait and see. Powell said, “Recent indicators suggest that economic activity expanded at a strong pace in the third quarter.” When asked if the Fed is done raising rates, he said, “We’re not confident at this time that we’ve reached such a stance.” When pressed further about when the Fed will start cutting rates, he said “The question of rate cuts just doesn’t come up right now” adding “It’s fair to say the question we’re asking is should we hike more.” When Powell was asked about whether rising bond yields are supplanting the need for additional hikes, the Chair said those yields would need to be substantially higher before they bear on specific hike decisions. However, he added that higher Treasury yields “are showing through” to real-world borrowing costs (which helps discourage growth that is too strong) and “it remains to be seen” if persistently high yields could eliminate the need for more hikes down the road.

In stock news, NIO announced its October deliveries of 16,074 vehicles (up 3% from September and up 60% from October 2022). Competitor XPEV reported 20,002 cars sold (a whopping 31% increase versus September and a 292% increase over October 2022). However, XPEV only delivered 8,741 cars, which while a company record was obviously far below demand. LI (the other major Chinese EV competitor) delivered 40,422 cars in October (a 12% month-on-month increase and a 302% increase over Oct. 2022). At the same time, NDAQ announced it had acquired Adenza from Thoma Bravo for $10.5 billion. NDAQ said it expects Adenza to yield $80 million in cost-saving synergies and $100 million in long-term revenue increases. Later, SCHW announced it had laid off 5% – 6% of its headcount (between 1,795 – 2,154 jobs). By late morning, TM announced it is raising the wages and benefits of its US non-union workers in response to the UAW pay increases won from the Big 3 automakers. Later, Reuters reported that FUN and SIX are in merger talks. After the close, DIS officially announced it is acquiring the remaining one-third stake in Hulu from CMCSA. In the wide-expected deal, DIS will pay CMCSA $8.61 billion by December 1. Also after the close, CLX said it expects to rebuild dwindling customer inventories by the end of Q4. CLX has fallen way behind after an August cyberattack took its order fulfillment operation offline for more than a month starting in August. Finally, late Wednesday evening, DAL announced it is laying off “some” corporate workers in order to cut costs.

In stock government, legal, and regulatory news, in the UK, a court ruled the British equivalent of a $2 billion class-action lawsuit against AAPL can proceed for allegedly hiding defective batteries by throttling performance in millions of iPhones. In other European news, the EU announced a ban related to META’s handling of user data on FaceBook and Instagram. The ban (which may be finalized as soon as next week) would require META to explicitly ask for and receive user permission before using any personal information to deliver targeted advertising. This would be a huge blow to META, GOOGL, AAPL, AMZN, and other companies that sell targeted ads. Later a US Court of Appeals judge ordered the SEC to “fix” what he called defects in its rule on share buybacks. The rule (adopted in May) requires disclosure of share buyback data. The decision was a significant win for corporate lobbyists who had argued for keeping such data undisclosed. In late afternoon, the FDIC suspended the auction of assets of FBNC following the bank’s striking a deal with investors to pump $35 million into the delisted bank. After the close, a (now former) GS investment banker was sentenced to three years in prison for passing tips on mergers GS was working on to accomplice traders. Also after the close, the SEC announced it is investigating WFC related to conflicts of interest in its customer cash sweep choices. At the same time, the Dept. of Energy warned NFE that if any of its Altamira floating LNG project was actually located onshore in Mexico, the company needs to reapply for a new export permit. The project was expected to start shipping LNG this month. Elsewhere, the SEC filed charges SWI and its Chief Info. Security Officer alleging fraud and regulatory control violations related to the MOVEit cyberattack where Russian hackers compromised companies and Pentagon email addresses. Finally, the NHTSA announced late Wednesday that TM is recalling 1.85 million RAV4 SUVs over fire risks related to replacement battery installation defects.

After the close, AFL, ABNB, ALL, ATUS, AIG, AWK, APA, ACA, AVT, AXS, BXP, BFAM, BWXT, CPE, CWH, CLX, COKE, CW, DASH, EA, ET, ETSY, EXAS, GFL, HST, IR, MTW, MRO, MCK, MELI, MKSI, MOD, MDLZ, MUSA, PK, PYPL, QRVO, QCOM, QDEL, REZI, SCI, SBGI, SP, SUM, SMCI, WTS, Z, and ZG all reported beats on both the revenue and earnings lines. Meanwhile, ANSS, CAR, BKH, CHRW, CRC, CTSH, DXC, THG, PTVE, CNXN, PRU, RNR, RUN, TYL, WES, WMB, and WSC all missed on revenue while beating on earnings. On the other side, AFG, CHRD, ESTE, HLF, ROKU, SIGI, and WERN beat on revenue while missing on earnings. However, ALB, BALY, BMRN, CF, CAKE, EIX, NVST, EXEL, LNC, VAC, MET, NOG, NUS, NTR, PTC, RRX, SEDG, TS, and VSTO all missed on both the top and bottom lines. It is worth noting that ABNB, EXAS, HST, IR, PTVE, PYPL, QRVO, QCOM, and SMCI all raised their forward guidance. Unfortunately, ANSS, BXP, CTSH, VAC, NTR, PTC, and SEDG lowered their guidance.

Overnight, Asian markets leaned strongly to the green side. Only Shenzhen (-0.94%) and Shanghai (-0.45%) were in the red. Meanwhile, Taiwan (+2.23%), South Korea (+1.81%), New Zealand (+1.78%), and Thailand (+1.74%) led the rest of the region higher. In Europe, we see strong green numbers across the board at midday. The CAC (+1.77%), DAX (+1.51%), and FTSE (+1.26%) lead the region higher on volume with several of the smaller bourses up well more than the volume leaders in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing to a higher start to the day. The DIA implies a +0.37% open, the SPY is implying a +0.55% open, and the QQQ implies a +0.84% open at this hour. At the same time, 10-year bond yields a down slightly to 4.711% and Oil (WTI) is up more than 1.5% to $81.71 per barrel in early trading.

The major economic news scheduled for Thursday includes Weekly Initial Jobless Claims, Preliminary Q3 Nonfarm Productivity, and Preliminary Q3 Unit Labor Costs (all at 8:30 a.m.), September Factory Orders (10 a.m.), and Fed Balance Sheet (4:30 p.m.). The major earnings reports scheduled for before the open include GOLF, ADT, WMS, ATI, ALGT, AMR, AEP, APG, APTV, ARW, AVNT, BALL, GOLD, BHC, BAX, BCE, BDC, BWA, BR, CNQ, FUN, CVE, LNG, CI, CIGI, COP, COR, CPG, CROX, CMI, DLX, XRAY, DUK, LLY, ENTG, NVRI, EPAM, EXC, RACE, FOXA, GIL, DINO, HWM, HII, H, NSIT, ICE, IRM, ITRI, ITT, JLL, KBR, KTB, LAMR, DRS, MKL, MAR, MDU, MRNA, TAP, MUR, NVO, DNOW, NRG, OGE, OGN, PLTR, PZZA, PARA, PH, PBF, MD, PTON, PENN, PNW, PBI, PPL, PRMW, PWR, RCM, REGN, ROK, SPGI, SABR, SNDR, SEE, SHEL, SHOP, SO, STGW, TRGP, TFX, TPX, TRN, UPBD, VNT, WEN, WCC, WLK, and ZTS. Then, after the close, ACHC, ACCO, AES, AGL, ASTL, LNT, COLD, AMN, AAPL, TEAM, BECN, SQ, BKNG, CVNA, CVCO, COIN, CODI, ED, BAP, DKNG, DBX, EVH, EXPI, EXPE, FND, FTNT, GDDY, ACFI, LYV, MTZ, MCHP, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PBA, PXD, RGA, RKT, RYAN, SBAC, SEM, SWKS, SM, SWN, SBUX, SYK, and VTR report.

In economic news later this week, on Friday, Oct. Nonfarm Payrolls, Oct. Private Nonfarm Payrolls, Oct. Participation Rate, Oct. Unemployment Rate, Oct. Avg. Hourly Earnings, S&P Global Services PMI, S&P Global Composite PMI, Oct. ISM Non-Mfg. Employment, Oct. ISM Non-Mfg. PMI, and Oct. ISM Non-Mfg. Price Index are reported.

In terms of earnings reports later this week, on Friday, AMCXM AXL, BSAC, BLMN, BBU, BEPC, BEP, CAH, CBOE, CHD, CNK, CRBG, D, ENB, EOG, FLR, FWONK, FWONA, IT, GTES, IEP, KOP, LSXMK, LSXMA, MGA, OMI, PAA, PAGP, PRVA, QRTEA, QSR, SRE, TDS, TIXT, USM, WPC, and TSE report.

In miscellaneous news, BAC said Wednesday that its “Sell-Side Indicator” is at levels of extreme bearishness, which is bullish for stocks. (In essence, they are saying their proprietary indicator says the market is extremely oversold.) The indicator value implies a 15.5% return on the SPY in the next 12 months.

In miscellaneous news, BAC said Wednesday that its “Sell-Side Indicator” is at levels of extreme bearishness, which is bullish for stocks. (In essence, they are saying their proprietary indicator says the market is extremely oversold.) The indicator value implies a 15.5% return on the SPY in the next 12 months. Elsewhere, JPM CEO Dimon criticized the state of TX (and by extension the other GOP-led states of similar ilk) which has passed laws designed to punish banks for any policies that stop them from working with fossil fuel industries. Meanwhile, SBUX gave another hint that the economy remains strong. The coffee company reported same-store sales grew 8% mostly attributed to higher average purchases but also a 3% increase in customers.

So far this morning, FOX, GOLF, WMS, APTV, BAX, BR, BRKR, COR, CI, COP, CRTO, DLX, DFH, LLY, NVRI, EPAM, FOXA, GCI, GEL, DINO, HWM, HII, ITT, KTB, LAMR, MAR, TAP, MUR, NVO, PLTR, PBF, PENN, PWR, REGN, ROK, SPGI, SEE, SHOP, SBUX, TFX, VIRT, and VNT all reported beats on both the revenue and the earnings lines. Meanwhile, ADT, AEP, APG, AVNT, BALL, GOLD, BDC, BWA, CVE, XRAY, DUK, ENTG, H, ING, IRM, KBR, DNOW, NRG, OGE, PBI, PRMW, SHEL, SRCL, WEN, WLK, and ZTS all missed on revenue while beating on the earnings line. On the other side, EXC, PTON, RCM, and TRN beat on revenue while missing on the earnings line. However, CIGI, PZZA, MD, STGW, and TPX missed on both the top and bottom lines.

With that background, it looks like the Bulls are in full control in the premarket this morning. All three major index ETFs opened the early session higher and have put in large, white-bodied candles with little wick since then. All three of the major index ETFs are now above their T-line (8ema) and SPY is crossing back above its 200sma in the premarket. Keep in mind that all three still remain near correction territory, being down 6%-7% from their summer highs. So, the Bears remain in control of the longer-term trend while the Bulls have control this week. In terms of extension, none of the three major index ETFs are extended from their T-line while the T2122 indicator is back in its mid-range. So, there is room to run in either direction if the Bulls or Bears can find the momentum. This morning we seem to be getting energy from good earnings reports and Fed decision, statement, and comments yesterday. However, there is some news in the premarket and day that could give us volatility. So, be aware of that potential volatility.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Not in a Hurry to Raise

Markets continued the relief rally on Wednesday as investors chose to hear the FOMC is not in a hurry to raise rates and ignored pretty much everything else. Big tech had a great day as buyers inspired by AMD earned results pushed higher with the added benefit of bond yields pulling back. Today we have a massive day of earnings reports that will culminate with a report from Apple after the bell. The fear of missing out is kicking in the rally extends so remember to keep an eye on overhead resistance levels as economic reports roll in this morning. Whipsaws are possible with a gap open so plan your risk carefully.

Asian markets traded mostly higher overnight with only Shanghai just slightly lower even after their big stimulus efforts. European markets trade decidedly bullish seeing green across the board adding to the relief rally after Powell’s comments. U.S. futures ahead of earnings and economic report point to a gap up open with the tech sector leading the premarket surge. Buckle up for another day of volatility.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include AAPL, ACAD, ACCO, ACIW, ADT, ATI, SLGT, ALGM, AEP, AMH, APTV, ARW, TEAM, AVNT, BALL, BHC, BAX, BILL, SQ, BKNG, BWA, CNQ, CARS, LNG, CHUY, CRUS, CWEN, COHU, ED, COP, CROX, CUBE, CMI, CYBR, DOCN, BOOM, DKNG, DBX, DUK, LOCO, LLY, ENTG, EOG, EVH, EXC, EXPE, RACE, FIVN, FLWS, FND, FTNT, FOXA, FOXA, FOXF, FNKO, GIL, GDDY, HAE, HELO, HEP, HWM, HIII, HMN, HURN, H, IDA, ICE, IDCC, IONS, IRM, ITT, K, KN, LYV, MAR, MTZ, MERC, MCW, MRNA, TAP, MSI, MP, MUR, NRG, OGE, OMCL, OGN, PLTR, PZZA, PARA, PH, PCTY, PTON, PENN, PNW, PXD, PBI, PTLO, PPL, QLYS, PWR, RMAX, RGA, RYAN, SPGI, SBAC, SEE, SHAK, SHOP, SWKS, SO, SWN, SRC, SPXC, SBUX, SYK, SG, TPX, TRN, OLED, VTR, VIRT, WEN, WLK, WW, YELP, & ZTS.

News & Technicals’

Starbucks, the coffee giant, reported strong results for the fourth quarter of 2021, beating analysts’ expectations. The company’s net income attributable to the company rose to $1.22 billion, or $1.06 per share, up from $878.3 million, or 76 cents per share, a year ago. The company’s net sales increased by 11.4% to $9.37 billion. The company’s same-store sales, which measure the performance of its existing cafes, grew by 8%, driven by higher average spending and a 3% increase in customer traffic. The company attributed its success to its digital initiatives, menu innovation, and loyalty program. The company also raised its dividend by 10% and announced a new $20 billion share buyback program.

Shell, one of the world’s largest oil and gas companies, reported a lower profit for the third quarter of 2023 compared to the same period last year. The company earned $6.2 billion in the quarter, which was close to analysts’ expectations, but down from $9.45 billion in the third quarter of 2022. Shell attributed the decline to lower oil and gas prices, as well as weaker refining margins and chemical performance. Despite the lower profit, Shell announced a $3.5 billion share buyback program for the next three months, signaling its confidence in its cash flow and balance sheet.

Delta Air Lines, one of the largest U.S. carriers, is cutting some of its corporate and management staff as part of its efforts to reduce costs and improve efficiency. The company did not reveal how many employees will be affected by the layoffs but said they will not impact frontline workers such as pilots or flight attendants. Delta said the move is necessary to adjust to the changing market conditions and customer expectations. “While we’re not yet back to full capacity, now is the time to make adjustments to programs, budgets, and organizational structures across Delta to meet our stated goals — one part of this effort includes adjustments to corporate staffing in support of these changes,” the company said in a statement.

The Fed’s signal that it is not in a hurry to raise interest rates helped boost both U.S. and global stocks, as long-term bond yields fell sharply. The Treasury also announced that it will slow down the increase of its long-term debt sales, easing some of the pressure on the bond market. Moreover, weaker-than-expected jobs data suggested that the labor market recovery is still uneven. The 10-year Treasury yield dropped to its lowest level in 15 days, at 4.76%. Investors favored the tech giants inspired by the big rally in AMD. Today we have a massive round of earnings events that include the behemoth market mover Apple after the bell. On the economic calendar, the bulls or bears will look for inspiration in Jobeless Claims, Productivity and Costs, Factory Orders, and a few bond auctions to keep an eye on as yields continue to decline this morning. Remember, the fear of missing out is a powerful emotion so be careful chasing stocks into major resistance levels.

Trade Wisely,

Doug

Building on Monday’s Gains

Markets edged higher on building on Monday’s gains but momentum was weak with all the uncertainty facing the Wednesday market. Not only do we have three-quarters of a Trillion government funding debit raise announcement but we also have an FOMC decision and press conference so keep a close eye on bond yields that have been ticking higher this morning. Add in Mortgage Apps, ADP, PMI, ISM, Construction Spending, JOLTS, Petroleum Status, and the huge number of earrings today the statement, “challenging price action”, could be a massive understatement! Buckle up and be ready for just about anything.

While we slept Asian markets closed mostly higher with the Nikkei surging 2.42% while Hong Kong slipped slightly lower. European markets trade cautiously this morning chopping between gains and losses as they monitor the big day of data releases. However, U.S. futures suggest a bearish open ahead of all the market-moving earnings and economic reports likely to keep volatility high as traders react.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AFL, ABNB, ALB, ALKT, ALL, ATUS, AFG, AIG, AWK, APO, ASTE, ACA, CAR, AXTA, BALY, BHCO, BMRN, BXP, EAT, BLDR, CHRW, CRC, CWH, GOOS, CDW, CF, CAKE, CHEF, CLH, CTSH, CFLT, CLB, CVS, DIN, DASH, DD, DXC, ELF, EA, ET, ETR, EL, ETSY, EXAS, EXTR, FSLY, FWRG, GRMN, GNRC, GSK, HLF, HST, HPP, HUM, IDXX, IR, IIPR, IQV, JHG, KHC, LMND, LNC, LMND, LNC, MGY, MTW, MOR, VAC, MLM, MCK, MLNK, MET, MSTR, MDLZ, MUSA, NSA, NOG, NCLH, NUS, NTR, PGRE, PK, PYPL, PRU, PTC, QRVO, QCOM, RDN, RDWR, RYN, RVLV, ROKU, SMG, SCI, SIMO, SBGI, SITM, SEDG, RGR, SMCI, TEL, TT, TRMB, TYL, VRSK, W, WERN, WMB, WING, YUM, & ZG.

News & Technicals’

AMD, one of the leading chipmakers in the world, announced its third-quarter earnings on Tuesday. The company is known for making high-end graphics processing units (GPUs), which are essential for training and deploying generative AI models. Generative AI models are capable of creating new and realistic content, such as images, videos, texts, and sounds, based on existing data. AMD said that its AI GPU sales could surpass $2 billion in 2024, as the demand for generative AI applications grows. The company also said that it is investing in developing new and innovative AI GPUs that can deliver better performance and efficiency. AMD’s earnings report showed that the company had a strong quarter, with revenue up 54% year-over-year and net income up 68% year-over-year.

The Treasury Department will announce on Wednesday the details of its refunding, which is the process of issuing new debt to pay off the maturing debt. The refunding announcement will reveal the size and duration mix of the Treasury auctions, which are the primary way of selling government debt to investors. The refunding announcement is expected to attract more market attention than usual, as investors are concerned about the rising government borrowing and its impact on the interest rates and the economy. The Treasury Department gave a preview of its borrowing plans on Monday when it said that it will auction off $776 billion of debt in the fourth quarter of 2021. The market will be watching closely the actual sizes of the auctions and the maturities mix, which are the key variables that affect the supply and demand of Treasury securities. The Treasury Department has been increasing the issuance of longer-term debt, such as 10-year and 30-year bonds, to lock in low-interest rates and reduce refinancing risks. However, this also exposes the government to higher interest payments and inflation pressures.

The Bank of England (BoE) is expected to keep its interest rate unchanged at 4.5% on Wednesday after it stopped its streak of 14 consecutive rate hikes in September. The market is pricing in a high probability of a second hold, as the BoE faces a mixed economic outlook. The BoE has been raising its interest rate since 2020 to curb inflation, which reached 5.2% in August, well above the BoE’s target of 2%. However, the BoE also has to consider the impact of its monetary policy on economic growth, which slowed down to 0.4% in the third quarter, below the BoE’s forecast of 0.7%. Mike Riddell, an analyst at Allianz Global Investors, said that it was “striking that the market’s central case is for the BoE to not cut interest rates below 4% ever again.” He said that this implies that the market expects inflation to remain high and persistent and that the BoE will not be able to ease its policy in the future.

Equities rallied to close higher on Tuesday, building on Monday’s gains, but unfortunately, the momentum was weak as investors worried about the pending data. Bond yields retreated slightly yesterday but are once again ticking higher as the Treasury moves forward with a three-quarters of a Trillion debt raise to keep the government spending practices funded. Today we have a very big day of earnings events and the economic calendar is chalked full of potential market-moving reports to keep traders guessing. Although it is very unlikely the Fed will raise the rate today be prepared to hear hawkish talk from Jerome Powell suggesting their work is not done on inflation. Plan for considerable price volatility as the data is revealed.

Trade Wisely,

Doug

Public e-Learning 10-31-23 – John

Lots of Earnings and Fed Day

Tuesday was the second straight day with the Bulls in charge. All three major index ETFs opened flat before putting in a modest selloff the first 30 minutes of the day. At that point, the Bulls took over to lead a gradual and wavy rally that lasted the rest of the day. This action gave us white-bodied, Hammer-type candles. DIA crossed back up above its T-line (8ema), SPY is right at the T-line (just cents below), and QQQ is now close to retesting its own T-line. This happened on average volume in the DIA and less-than-average volume in the SPY and QQQ.

On the day, nine of the 10 sectors were again green with Healthcare (+0.90%) and Communication Services (+0.89%) leading the way higher and Basic Material (-0.03%) was the only sector in the red (barely). At the same time, the SPY gained 0.63%, DIA gained 0.38%, and QQQ gained 0.48%. The VXX plummeted another 6.42% to close at 23.45 and T2122 climbed up out of its oversold territory and into the mid-range at 38.60. 10-year bond yields rose to end the day at 4.924% and Oil (WTI) dropped another 1.14% to close at $81.35 per barrel.

The major economic news reported Tuesday included the Q3 Employment Cost Index, which came in a bit hot at +1.1% (compared to a forecast of +1.0% and a Q2 reading of +1.0%). Later, the October Chicago PMI came in a bit low at 44.0 (versus a 45.0 forecast and slightly less than the September value of 44.1). A few minutes later, the Conf. Board Consumer Confidence came in better than predicted at 102.6 (compared to a 100.0 forecast but a bit less than the 104.3 September reading). Finally, after the close, the API Weekly Crude Oil Stocks showed a modestly less-than-anticipated oil inventory build of 1.347 million barrels (versus a 1.601-million-barrel increase forecast but significantly larger than the prior week’s 2.668-million-barrel drawdown.

In stock news, JBL announced it has acquired INTC’s Silicon Photonics “pluggable optical transceiver” product lines for an undisclosed amount. At the same time, DOC and PEAK announced an all-stock merger that results in a $21 billion healthcare real estate company. (The company will trade under DOC when the deal closes in early 2024.) Elsewhere, TM announced it will invest an additional $8 billion in its existing NC EV battery plant, creating 3,000 new jobs. At the same time, BX and Vista Equity Partners announced they will jointly buy Australian firm Energy Exemplar. (Both firms will hold 50% in what sources say was a more than $1 billion valued Aussie firm.) Later, WE announced it had decided to withhold interest payments on roughly $6.4 million of its senior notes when they become due today (11/1). The company has a 30-day grace period but raised concern when it expressed “substantial doubt” about whether it can continue operations back in August. (However, after the close, sources told Reuters WE would file for bankruptcy as soon as next week.) By mid-afternoon, MSFT announced they had released a major Windows 11 update which includes the debut of Ai-powered Windows Copilot. At the same time, BNS sold its 20% interest in the financial services unit of Canadian Tire back to the retailer for $647 million. (BNS had paid $500 million for that stake in 2014.) Sticking North of the border, V and BMO announced a partnership to offer a new installment payment service to Canadian cardholders starting in 2024. Back in the US, shares of VRV spiked Tuesday following the announcement of an expanding partnership with LLY where LLY is acquiring the rights to multiple VRV gene editing products. At the same time, NVDA shared dropped almost 5% at one point on a Wall Street Journal article that reported the company would have to cancel $5 billion in Chinese orders to remain in compliance with US restrictions on selling advanced AI chips to China. Still NVDA stock recovered to close down less than 1%.

In stock government, legal, and regulatory news, TTM was awarded $1 billion by a three-member arbitration tribunal in India in the action they brought against Indian regional development authority. That authority had solicited TTM to buy land and build a plant in West Bengal India. However, regional authorities then forced TTM to return the land acquired for the plant and the company had to move the project to another region of the country. Later, a PA jury ordered MMTOF (Mitsubishi Motors) to pay just under $977 million in damages to a man who became quadriplegic in a vehicle rollover due to an allegedly defective seatbelt. Elsewhere, the Dutch consumer watchdog group is challenging the fees AAPL charges to dating app providers in Netherlands. Bloomberg reported this was part of a long-standing case against AAPL, with the authority having fined AAPL $53 million in 2021 for failure to comply with EU antitrust regulations. At the same time, Semafor reported Tuesday that MS is close to finalizing a settlement with the US Dept of Justice and SEC for between $500 million and $1 billion related to MS mishandling of private “block trading” stock sales. Later, NOK filed suit against AMZN and HPQ in multiple jurisdictions claiming unauthorized use of NOK’s video-related technologies in streaming devices and services. (NOK recently entered into a licensing deal with AAPL over the same technologies.) Late in the day, a group representing automakers (GM, TM, VLKAF, and HYMTF) announced that it opposes the proposed CLF acquisition of X. In a letter to FTC Chair Khan and Dept. of Justice Antitrust Chief Kanter, the group claimed it would reduce competition and cause increased steel prices in the US. Meanwhile, TSLA won the first US trial over allegations that its Autopilot feature led to a death. This was a major victory for the company although the company faces a number of very similar lawsuits. After the close, GOOGL announced it had settled claims from dating app MTCH which had claimed GOOGL had monopolized Android app distribution. This settlement leaves Epic Games as the sole plaintiff in the antitrust suit against GOOGL with jury selection set for this week and the trial scheduled to begin Nov. 6. At the same time, D was given approval from the US Dept. of Interior to build a 2.6-gigawatt offshore windfarm off the Virginia coast (the largest windfarm built offshore in the US). Finally, after the close, the FDA approved AMGN’s version of JNJ’s blockbuster psoriasis treatment Stelara.

After the close, AMD, AMCR, AIZ, CZR, CHK, HY, LFUS, MTCH, and MTH all reported beats on both the revenue and earnings lines. Meanwhile, EQH, LUMN, SKY, TX, and VOYA all beat on revenue while missing on earnings. On the other side, FSLR, MCY, LBTYA, OI, QUAD, SON, and UNM all missed on revenue while beating on earnings. However, BXC, ENLC, EQR, HUN, OKE, and YUMC missed on both the top and bottom lines. It is worth noting that LFUS, MTCH, MTH, and SON lowered their forward guidance while OKE raised its own guidance.

Overnight, Asian markets were mixed but leaned to the bullish side. Japan (+2.41%) was by far the biggest gainer after the Japanese government announced a stimulus package, followed by South Korea (+1.03%), and New Zealand (+0.87%). On the red side, India and Malaysia tied at -0.47% to pace the losses. Meanwhile, in Europe, we see a similarly mixed but a bit more bearish picture taking shape at midday. The CAC (-0.06%), DAX (+0.07%), and FTSE (-0.16%) lead the region on volume as nine of the 15 bourses in the region are modestly in the red while six are modestly in the green. In the US, as of 7:30 a.m., Futures indicate a down start to the day. The DIA implies a -0.33% open, the SPY is implying a -0.38% open, and the QQQ implies a -0.39% open at this hour. At the same time, 10-year bond yields are back down a bit to 4.903% and Oil (WTI) is up 1.68% to $82.41 per barrel in early trading.

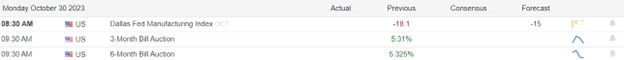

The major economic news scheduled for Wednesday includes ADP Oct. Nonfarm Employment Change (8:15 a.m.), S&P US Mfg. PMI (9:45 a.m.), ISM Oct. Mfg. Employment, ISM Oct. Mfg. PMI, ISM Oct. Mfg. Price Index, and Sept. JOLTs Job Openings (all at 10 a.m.), EIA Crude Oil Inventories (10:30 a.m.), FOMC Rate Decision and FOMC Statement (both at 2 p.m.), and the Fed Chair Press Conference (2:30 p.m.). On The major earnings reports scheduled for before the open include ALIT, APO, AXTA, BLCO, EAT, BIP, BLDR, CDW, CHEF, CLH, CVS, DRVN, DTE, DNB, DD, ETR, ESAB, EL, FTDR, FYBR, GRMN, HUM, IDXX, IQV, JHG, KMT, KHC, LPX, MLM, NMRK, NI, NCLH, PSN, QUAD, SGEN, SITE, SPR, SUN, SPWR, TEL, TRI, TKR, TT, TRMB, TTMI, UTHR, VRSK, W, and YUM. Then, after the close, AFL, ABNB, ALB, ALL, ATUS, AFG, AIG, AWK, APA, ACA, CAR, AVT, AXS, BALY, BMRN, BKH, BXP, BFAM, BWXT, CHRW, CRC, CPE, CWH, CF, CAKE, CLX, COKE, CTSH, CW, DASH, DXC, EIX, EA, ET, NVST, ETSY, EXAS, EXEL, GFL, THG, HLF, HST, IR, LNC, MTW, MRO, VAC, MCK, MELI, MET, MKSI, MOD, MDLZ, MUSA, NOG, NUS, NTR, PYPL, CNXN, PRU, PTC, QRVO, QCOM, QDEL, RRX, RNR, REZI, ROKU, SIGI, SCI, SBGI, SEDG, SUM, RUN, SMCI, TS, TYL, VSTO, WTS, WERN, WES, WMB, WSC, and Z report.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Preliminary Q3 Nonfarm Productivity, Preliminary Q3 Unit Labor Costs, Sept. Factory Orders, and Fed Balance Sheet. Finally, on Friday Oct. Nonfarm Payrolls, Oct. Private Nonfarm Payrolls, Oct. Participation Rate, Oct. Unemployment Rate, Oct. Avg. Hourly Earnings, S&P Global Services PMI, S&P Global Composite PMI, Oct. ISM Non-Mfg. Employment, Oct. ISM Non-Mfg. PMI, and Oct. ISM Non-Mfg. Price Index are reported.

In terms of earnings reports later this week, on Thursday we hear from GOLF, ADT, WMS, ATI, ALGT, AMR, AEP, APG, APTV, ARW, AVNT, BALL, GOLD, BHC, BAX, BCE, BDC, BWA, BR, CNQ, FUN, CVE, LNG, CI, CIGI, COP, COR, CPG, CROX, CMI, DLX, XRAY, DUK, LLY, ENTG, NVRI, EPAM, EXC, RACE, FOXA, GIL, DINO, HWM, HII, H, NSIT, ICE, IRM, ITRI, ITT, JLL, KBR, KTB, LAMR, DRS, MKL, MAR, MDU, MRNA, TAP, MUR, NVO, DNOW, NRG, OGE, OGN, PLTR, PZZA, PARA, PH, PBF, MD, PTON, PENN, PNW, PBI, PPL, PRMW, PWR, RCM, REGN, ROK, SPGI, SABR, SNDR, SEE, SHEL, SHOP, SO, STGW, TRGP, TFX, TPX, TRN, UPBD, VNT, WEN, WCC, WLK, ZTS, ACHC, ACCO, AES, AGL, ASTL, LNT, COLD, AMN, AAPL, TEAM, BECN, SQ, BKNG, CVNA, CVCO, COIN, CODI, ED, BAP, DKNG, DBX, EVH, EXPI, EXPE, FND, FTNT, GDDY, ACFI, LYV, MTZ, MCHP, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PBA, PXD, RGA, RKT, RYAN, SBAC, SEM, SWKS, SM, SWN, SBUX, SYK, and VTR. Finally, on Friday, AMCXM AXL, BSAC, BLMN, BBU, BEPC, BEP, CAH, CBOE, CHD, CNK, CRBG, D, ENB, EOG, FLR, FWONK, FWONA, IT, GTES, IEP, KOP, LSXMK, LSXMA, MGA, OMI, PAA, PAGP, PRVA, QRTEA, QSR, SRE, TDS, TIXT, USM, WPC, and TSE report.

In miscellaneous news, Reuters reported Tuesday evening that the Panama Canal will again cut its daily ship crossing slots due to drought. (Prolonged drought has seriously depleted the lakes used to fill the many locks used to make the transit across the canal. For example, October rainfall was the lowest for a month since 1950.) This reduction will be to 25 vessels per day with additional planned reductions to 18 per day over the next three months. These reductions will push up shipping costs (by cutting available vessels while some sit in the queue and by increasing transit distances and times to avoid the canal) and reduce the volume of global trade both immediately and over coming months.

In mortgage news, as rates remain high (relatively speaking), the proportion of demand looking for adjustable-rate mortgages popped nearly 10% this week. According to the Mortgage Brokers Assn. the national average rate for a 30-year fixed-rate loan actually fell from 7.90% to 7.86%. (Closing points also fell from 0.77 to 0.73 this week.) Even so, applications for a new home purchase loan fell 1%, and refinance loan applications fell 4% for the week. And among this smaller number of loan applications, the number looking for an adjustable-rate mortgage rose 10% to 10.7% of all mortgages.

So far this morning, AXTA, EAT, CHEF, CVS, DRVN, ESAB, FDP, GRMN, GNRC, HUM, JHG, KHC, LPX, LKNCY, PSN, SUN, TEL, TT, UTHR, and VRSK all reported beats on both the revenue and earnings lines. Meanwhile, BLCO, BLDR, CDW, DD, ETR, EL, IDXX, IQV, KMT, LML, NI, TRI, TRMB, W, and YUM all missed on revenue while beating on earnings. On the other side, SITE and SSRM beat on revenue while missing on earnings. However, APO, DTE, and TKR missed on both the top and bottom lines. It is worth noting that EAT, ESAB, NI, PSN, and TT all raised their forward guidance while EL lowered its guidance.

With that background, it looks like the Bears are in control in the premarket this morning. All three major index ETFs opened the early session lower and have put in smallish black-body candles since then. The DIA has now crossed back below its T-line while the SPY and QQQ moved back down away from their own 8emas. However, these are all Bearish Harami candles (meaning indecision leaning bearish) this morning. Keep in mind that all three remain near correction territory, being down 7%-9% from their summer highs. So, the Bears remain in control of the trend. In terms of extension, none of the three major index ETFs are extended from their T-line while the T2122 indicator is back in its mid-range. So, there is room to run in either direction if the Bulls or Bears can find the momentum. Today, that energy might come from the 10 a.m. news drop but it is more likely to come in reaction to the Fed or Fed Presser at 2 p.m. and 2:30 p.m. respectively. So, beware of volatility, even as the market has priced in a 97.2% probability the FOMC will hold rates steady. Words matter and we can expect a tweak to the FOMC statement as well as what Fed Chair Powell says in his remarks and answers this afternoon.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

EU Inflation Down, Mostly Good Earnings

The Bulls had the momentum pretty much all day Monday. The SPY and DIA gapped up 0.69% at the open while the QQQ gapped up 0.73%. All three of those major index ETFs followed through mildly for the first 30 minutes. At that point, the DIA led the way for a change, beginning a mild bullish trend at about 10:50 a.m. while the SPY and QQQ kept meandering until their own stronger rallies started at 1 p.m. and lasted until 3:30 p.m. Then all three have very modest selloffs the last 30 minutes of the day. This action gave us white-bodied candles in all three. The SPY and QQQ both printed larger-body Spinning Top candles while the DIA printed a large-body candle that retested and just backed down from its T-line (8ema). This happened on above-average volume in the DIA and modestly below-average volume in the SPY and QQQ.

On the day, nine of 10 sectors were green with communications Services (+1.77%) led the way higher while Energy (-0.05%) was the only sector in the red (barely). At the same time, SPY gained 1.20%, DIA gained 1.58%, and QQQ gained 1.13%. The VXX plummeted 7.46% to close at 25.06 and T2122 climbed but remains just inside the top end of its oversold territory at 18.25. 10-year bond yields rose to end the day at 4.888 and Oil (WTI) plummeted 3.58% to close at $82.48 per barrel.

There was no major economic news reported Monday.

In Autoworker contract talks and strike news, the Canadian Unifor strike against STLA was settled with a tentative deal within hours of the start of a Unifor strike. Later, the UAW announced it had reached a tentative deal with the last of the Big 3 Automakers (GM). Interestingly, GM says the 6-week strike cost is more than $400 million per week, which is more than double what F (who settled last Wednesday) said the strike had cost it. The 25% wage increase over four years that all three carmakers agreed to was the first significant wage increase for the UAW since 2008 when they gave up large amounts of wages and benefits to save the industry. The GM deal includes a 25% base pay increase through April 2028 which when coupled with cost-of-living increases will bring the top union wage to $42/hour by the end of the contract. It also reduced the time it takes a worker to reach the top tier of pay and brought two new GM business units under the deal. Finally, the deal increases retiree benefits which were major concessions made by the union back in 2008.

In stock news, Reuters reported Monday that AVGO expects its $69 billion purchase of VMW to close before its Nov. 26 deadline, despite continuing Chinese investigation of the deal over antitrust concerns. AVGO told Reuters that the Chinese scrutiny did not pose a legal impediment to closing the deal. At the same time, SAN announced it is set to unload $5.29 billion in “bad” real estate assets in order to shore up its balance sheet. Elsewhere, WMT announced it is investing $9 billion over two years to upgrade 1,400 stores (out of 4,717). 117 WMT stores featuring upgrades worth $500 million are set to open Friday. At the same time, F announced it is adding 15k TSLA chargers to its own vehicle charging network. (No timeline was given for the addition, but F now expects to offer 106,000 chargers in the US in early 2024.) Later, Reuters reported that GSK accounted for two-thirds of the RSV vaccines in the US since early September, dominating the only rival PFE. (GSK’s $280 shot is $15 cheaper than the PFE shot.) Analysts say there will be in the low hundreds of millions of RSV vaccinations in 2023. At the same time, Reuters reports that BP is actively seeking joint ventures in the US shale natural gas production space. This includes in the Permian Basis where XOM recently went big by buying PXD. Later, LITE announced it was doubling its cloud computing infrastructure by purchasing Cloud Light for $750 million. At the same time, ON announced it is laying off 900 workers due to an expected sluggish Q4, based on an expected slowing in electric vehicle demand. In Pharmacy news, workers at CVS and WBA began a 3-day walkout Monday demanding improved working conditions and more staff at the stores. (Essentially, the claim is that pharmacy companies are forcing pharmacists to do the work of two or more people, including delivering vaccine shots and answering health insurance questions in addition to their normal prescription filling duties.

In stock government, legal, and regulatory news, Reuters reported Monday that more than 14 progressive non-profit groups are pressing the US Dept. of Justice to step back from the “free pass” they perceive the Biden DOJ having given corporate offenders. (The Biden DOJ has implemented a “safe harbor” policy to entice corporate disclosure of their misconduct.) At the same time, the US Dept. of Transportation said a civil fine (or an unspecified amount) of LUV is warranted related to the December 2022 meltdown that caused 16,700 flight cancellations, causing major disruption to two million passengers. Later, EU antitrust regulators granted approval for HTHIY (Hitachi) to buy Thales’ GTS Railway Signaling unit for $1.80 billion. Meanwhile, CP was served a “transfer pricing order” by the Indian Income Tax Authority. Essentially, the order accuses CP of avoiding Indian taxes by transferring money across borders between CP divisions. Later, two US Senators (one from each party) asked the US Dept. of Transportation and the Consumer Financial Protection Bureau to take action on “troubling reports” about deceptive and unfair airline frequent flyer loyalty programs. Elsewhere, GOOGL CEO Pichai testified in the US antitrust lawsuit Monday. He acknowledged the importance to the company of making its search engine the default for phones, browsers, and laptops. Under cross-examination, Pichai granted that the company spends billions of dollars each year for such deals and noted that GOOGL “definitely sees value” from that default status program.

After the close, AGNC, AMKR, ACGL, ANET, CLW, CWK, CVI, MATX, MPWR, PEAK, PINS, PSA, PSMT, QGEN, SPG, THC, and WELL all reported beats on both the revenue and earnings lines. Meanwhile, KMPR, NEXA, and VFC both beat on revenue while missing on earnings. On the other side, RYI and VNO both missed on revenue while beating on earnings. However, CACC, FMC, LEG, and RIG missed on both the top and bottom lines. It is worth noting that AMKR and VFC lowered their guidance. At the same time, ANET, RYI, SPG, and WELL all raised their forward guidance.

Overnight, Asian markets were mixed but leaned slightly to the red side. Hong Kong (-1.69%), South Korea (-1.41%), and Taiwan (-0.92%) led the region lower. Meanwhile, in Europe, with the sole exception of Russia (-1.18%), we see green across the board at midday. The CAC (+0.97%), DAX (+0.52%), and FTSE (+0.57%) are leading the region higher in early afternoon trade. This came as Eurozone inflation dropped significantly in October to 2.9% (the lowest level in two years) and the Eurozone GDP declined 0.1% for Q3 (which was significantly better than forecast by economists). In the US, as of 7:30 a.m., Futures point toward another positive start to the day. The DIA implies a +0.38% open, the SPY is implying a +0.26% open, and the QQQ implies a +0.13% open at this hour. At the same time, 10-year bond yields are down to 4.829% and Oil (WTI) is up about two-thirds of a percent to $82.79 per barrel in early trading.

The major economic news scheduled for Tuesday includes Q3 Employment Cost Index (8:30 a.m.), Chicago PMI (9:45 a.m.), Conf. Board Consumer Confidence (10 a.m.), and API Weekly Crude Oil Stocks Report (4:30 p.m.). The major earnings reports scheduled for before the open include AGCO, ALLE, AME, AMGN, BUD, ARES, BCC, BP, CCJ, CAT, CEIX, DORM, ETN, ECL, EPD, BEN, GEHC, GVA, GPK, GPRE, HNI, HUBB, INCY, NSP, IGT, JBLU, LDOS, LGIH, MPC, MPLX, MSCI, PFE, PEG, ST, SIRI, SFM, STLA, SYY, BLD, UFPI, WEC, XYL, and ZBRA. Then, after the close, AMD, AMCR, AIZ, EQH, BXC, CZR, CGAU, CHK, ENLC, EQR, FSLR, HUN, HY, JBSS, LBTYA, LFUS, LUMN, MTCH, MCY, MTH, OI, OKE, SON, TX, UNM, VOYA, and YUMC report.

In economic news later this week, on Wednesday, ADP Oct. Nonfarm Employment Change, S&P US Mfg. PMI, ISM Oct. Mfg. Employment, ISM Oct. Mfg. PMI, ISM Oct. Mfg. Price Index, Sept. JOLTs Job Openings, EIA Crude Oil Inventories, FOMC Rate Decision, FOMC Statement, and the Fed Chair Press Conference are reported. On Thursday, we get Weekly Initial Jobless Claims, Preliminary Q3 Nonfarm Productivity, Preliminary Q3 Unit Labor Costs, Sept. Factory Orders, and the Fed Balance Sheet. Finally, on Friday, Oct. Nonfarm Payrolls, Oct. Private Nonfarm Payrolls, Oct. Participation Rate, Oct. Unemployment Rate, Oct. Avg. Hourly Earnings, S&P Global Services PMI, S&P Global Composite PMI, Oct. ISM Non-Mfg. Employment, Oct. ISM Non-Mfg. PMI, and Oct. ISM Non-Mfg. Price Index are reported.

In terms of earnings reports later this week, on Wednesday, ALIT, APO, AXTA, BLCO, EAT, BIP, BLDR, CDW, CHEF, CLH, CVS, DRVN, DTE, DNB, DD, ETR, ESAB, EL, FTDR, FYBR, GRMN, HUM, IDXX, IQV, JHG, KMT, KHC, LPX, MLM, NMRK, NI, NCLH, PSN, QUAD, SGEN, SITE, SPR, SUN, SPWR, TEL, TRI, TKR, TT, TRMB, TTMI, UTHR, VRSK, W, YUM, AFL, ABNB, ALB, ALL, ATUS, AFG, AIG, AWK, APA, ACA, CAR, AVT, AXS, BALY, BMRN, BKH, BXP, BFAM, BWXT, CHRW, CRC, CPE, CWH, CF, CAKE, CLX, COKE, CTSH, CW, DASH, DXC, EIX, EA, ET, NVST, ETSY, EXAS, EXEL, GFL, THG, HLF, HST, IR, LNC, MTW, MRO, VAC, MCK, MELI, MET, MKSI, MOD, MDLZ, MUSA, NOG, NUS, NTR, PYPL, CNXN, PRU, PTC, QRVO, QCOM, QDEL, RRX, RNR, REZI, ROKU, SIGI, SCI, SBGI, SEDG, SUM, RUN, SMCI, TS, TYL, VSTO, WTS, WERN, WES, WMB, WSC, and Z report. On Thursday we hear from GOLF, ADT, WMS, ATI, ALGT, AMR, AEP, APG, APTV, ARW, AVNT, BALL, GOLD, BHC, BAX, BCE, BDC, BWA, BR, CNQ, FUN, CVE, LNG, CI, CIGI, COP, COR, CPG, CROX, CMI, DLX, XRAY, DUK, LLY, ENTG, NVRI, EPAM, EXC, RACE, FOXA, GIL, DINO, HWM, HII, H, NSIT, ICE, IRM, ITRI, ITT, JLL, KBR, KTB, LAMR, DRS, MKL, MAR, MDU, MRNA, TAP, MUR, NVO, DNOW, NRG, OGE, OGN, PLTR, PZZA, PARA, PH, PBF, MD, PTON, PENN, PNW, PBI, PPL, PRMW, PWR, RCM, REGN, ROK, SPGI, SABR, SNDR, SEE, SHEL, SHOP, SO, STGW, TRGP, TFX, TPX, TRN, UPBD, VNT, WEN, WCC, WLK, ZTS, ACHC, ACCO, AES, AGL, ASTL, LNT, COLD, AMN, AAPL, TEAM, BECN, SQ, BKNG, CVNA, CVCO, COIN, CODI, ED, BAP, DKNG, DBX, EVH, EXPI, EXPE, FND, FTNT, GDDY, ACFI, LYV, MTZ, MCHP, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PBA, PXD, RGA, RKT, RYAN, SBAC, SEM, SWKS, SM, SWN, SBUX, SYK, and VTR. Finally, on Friday, AMCXM AXL, BSAC, BLMN, BBU, BEPC, BEP, CAH, CBOE, CHD, CNK, CRBG, D, ENB, EOG, FLR, FWONK, FWONA, IT, GTES, IEP, KOP, LSXMK, LSXMA, MGA, OMI, PAA, PAGP, PRVA, QRTEA, QSR, SRE, TDS, TIXT, USM, WPC, and TSE report.

In miscellaneous news, Reuters reported Monday that half of the S&P 500 have now reported earnings. So far, 77% of those have beaten expectations. Of those that have reported, Consumer Discretionary companies have been the biggest surprise, beating earnings expectations by an average 19% according to Refinitiv earnings data. Later, the US Treasury Dept. said it expects to borrow $776 billion in Q4, down $76 billion from its July estimate citing increased revenue estimates (a strong economy plus taxes deferred from CA and HI due to disasters means more tax revenue). In potentially related news, GS raised its long-term US economic growth estimates, saying that AI will boost productivity in the US more than it had previously expected. Elsewhere, as expected, after the close, AAPL announced three versions of its new M3 chip (based on the ARM architecture and TSM 3nm production process), a new iMac, and a new MacBook Pro at its “Scary Fast” product launch. (Macs accounted for only 11% of AAPL sales in 2022.) Finally, social media platform X (formerly Twitter) is now worth just 43% of what Elon Musk paid for it one year ago. While Musk paid $44 billion, stock awards just made to employees value the company at $19 billion.

In international news, Israeli PM Netanyahu again rejected growing calls for a cease-fire in their war against Hamas. At the same time, Chinese factory activity contracted and the Chinese services sector failed to expand (as had been expected) in October. This weaker-than-expected data is sure to lead to calls for more stimulus from Beijing. In Japan, the BoJ held rates steady (the only Central Bank with a negative rate) but made a tweak to permissible government bond yields. The BoJ claims this will give them more flexibility in shaping long-term yields. (The Yen fell lower on this news.)

So far this morning, ALLE, AMGN, BCC, CAT, FNMA, GEHC, GPN, GVA, GPRE, IGT, LDOS, MPC, PFE, ST, BLD, and XYL all reported beats on both the revenue and earnings lines. Meanwhile, AME, BUD, ETN, GPK, INCY, LGIH, MSCI, SIRI, and WEC all missed on revenue while beating on earnings. On the other side, MPLX, NBIX, and ZBRA all beat on revenue while missing on earnings. However, ARES, BP, CEIX, EPD, and JBLU missed on both the top and bottom lines.

With that background, it looks like the Bulls are again in control in the premarket this morning. The SPY and QQQ opened the early session lower, but have put in brong white-bodied candles to take price above the Monday close. Meanwhile, DIA opened the early session higher and ran up above its T-line (8ema) where the bears are pushing back to have a retest of that level. DIA does have the only significant wick (upper) of the three so far this morning. With that said, keep in mind at least two of the three remain below their T-line and also down 7%-9% from the summer highs. So, the Bears remain in control of the trend. In terms of extension, none of the three major index ETFs are extended from their T-line and while the T2122 indicator is still in its oversold territory, it is barely in that range. So, we may get additional relief from being oversold but the need is not nearly as bad as it was Monday morning.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

GM Still Out, AI Order As Fed Still Ahead

Markets opened higher on Friday, gapping up 0.39% in the SPY, opening dead flat in the DIA, and gapping up 0.87% in the QQQ. At that point, the DIA led the move lower, followed by an indecisive SPY, and finally a QQQ that was bullish the first two hours. By 11:30 a.m. all three were selling in a jagged fashion the rest of the day. This action gave us black-bodied candles in all three major index ETFs. The SPY and DIA only had lower wicks (based on the last wave being up the final 15 minutes. However, the QQQ printed a black-bodied Spinning Top Inside Day candle. All three remain well below their T-line (8ema). This happened on just above-average volume in the SPY and above-average volume in the QQQ and DIA.

On the day, eight of 10 sectors were red with Basic Material (+0.11%) and Technology (+0.07%) being the only ones to stay green while Healthcare (-1.89%) and Utilities (-1.83%) led the way lower. At the same time, the SPY lost 0.45%, the DIA lost a whopping 1.11% (led that way by CVX -6.72%), and QQQ gained 0.48%. VXX gained 3.32% to close at 27.08 and T2122 fell back into the low end of the oversold territory at 6.22. 10-year bond yields ended the day unchanged at 4.845% while Oil (WTI) rose 2.34% to close at $85.16 per barrel on Middle East war fears.

The major economic news reported Friday included the September PCE Price Index (year-on-year) of +3.4%, which was in line with the forecast and the August reading. On a month-on-month basis, this was +0.4% (compared to a forecast of +0.3% but in line with the August reading of +0.4%). Later, Michigan Consumer Sentiment came in better than expected at 63.8 (versus a forecast of 63.0 but down from the September reading of 68.1). At the same time, Michigan Consumer Expectations came in lower than predicted at 59.3 (compared to a forecast of 60.7 and the September value of 66.0). Meanwhile, the Michigan 1-year Inflation Expectation was very high at 4.2% (compared to a forecast of 3.8% and a September reading of 3.2%). Further out, the Michigan 5-year Inflation Expectation was in line with predictions at 3.0% (versus a forecast of 3.0% but up from the September value of 2.8%).

In Autoworker contract talks and strike news, following Wednesday’s settlement with F, the UAW held nearly non-stop negotiation sessions with STLA and GM on Thursday and Friday. Both the CEO of GM and the President of the UAW participated in the round on Friday. As of Friday evening, a deal was said to be close, as both companies agreed to the same 25% pay increase that F agreed to earlier but talks continued. At the same time, the union at F began returning to work Friday, ending the 6-week strike. (As a side note, F announced Friday that the strike had cost the company $1.3 billion.) Then on Saturday evening, the UAW announced it had reached a tentative deal to end the strike against STLA. (Reportedly, UAW President Fain had turned his focus to GM after focusing more on STLA on Friday.) However, by Saturday evening, GM was still refusing on issues F and STLA agreed. So, the UAW increased the strike by having 4,000 workers walk off the job at GM’s Spring Hill TN assembly plant (GM’s largest US plant). Early today, the Canadian Autoworker Union (Unifor) called a strike of more than 8.200 workers against STLA up North. (Unifor already reached deals with F and then after a 12-hour strike with GM. In last-minute news, STLA also settled with Unifor after about 12 hours of that strike.) In tangentially related news, back in the US, F said it was postponing a $12 billion investment in EV manufacturing expansions. GM had also delayed the opening of a second EV truck plant and canceled a joint project between itself and HMC aimed at making sub-$30k EVs for the global market.

In stock news, GM announced it had decided to suspend operations of all its Cruise driverless robotaxis amid safety concerns. At the same time, UPS announced it is buying the “Happy Returns” unit from PYPL. UPS said the purchase of Happy Returns and a previously announced deal to buy MNX Global Logistics will total more than $1 billion. Later, Reuters reported that merger negotiations between WDC and Japan’s Kioxia have stalled. At the same time, DUK announced it would build an end-to-end “Green Hydrogen” energy plant in FL. The plant will split water into hydrogen and oxygen using solar power to generate the electricity needed and is expected to be operational in 2024. Elsewhere, JPM announced that CEO Dimon will be selling 1 million of his 9.6 million shares of JPM in a strategic diversification move. Later VLKAF (Volkswagen) said it is cutting 2,000 jobs and has pushed back the release of its Porsche Macan EV until 2024. After the close, BA announced it is assessing a claim made by a cybercrime gang (Lockbit) that the group had “a tremendous amount” of sensitive BA data and would dump the data to the public if the company did not pay a ransom by Nov. 2. Then on Friday evening, GOOGL announced it is investing $2 billion in Anthropic (a competitor to MSFT-backed OpenAI) to further its presence in the AI market.

In stock government, legal, and regulatory news, On Friday, GOOGL announced its CEO would testify today in the US antitrust case against the tech giant. Later, ABBV said it is taking a $2.1 billion charge related to and ahead of its negotiations with Medicare over its leukemia drug. Elsewhere, NSC announced it has begun installing AI-based safety inspection portals at a dozen locations on its tracks. The portals will use high-speed cameras and AI software to do safety inspections while trains keep moving. This comes in response to EPA and FRA pressure following the railroad’s Feb. derailment and mass chemical spill in East Palestine OH. Later, Reuters reported that the Argentine government had filed a motion with a US District judge asking that the judge stay the enforcement of a $16.1 billion judgment over the nationalization of a then minority state-owned oil company (YPF). The judgment was due to REPYY, which had a 51% stake in the company. By mid-afternoon, ANF was sued for ignoring a sex-trafficking ring run by former CEO Mike Jeffries, who allegedly lured young men in using the promise of becoming models for the ANF brand. After the close Friday, JNJ announced that the Dept. of Justice has sought documents and information related to the drugmaker’s eye surgery products in connection with a DOJ civil (not criminal) investigation. Finally, early today President Biden announced a new executive order aimed at putting some guardrails on AI. The order calls for the Commerce Dept. to create safety and security standards covering AI. The order also aimed at protecting consumer data, watermarking AI-created content, and providing guidance to landlords and federal contractors to avoid unfair discrimination based on AI model training deficiencies.

Overnight, Asian markets were mixed but leaned toward the green side. Shenzhen (+1.61%) was far and away the leader for the bulls while Japan (-0.95%) paced the four losing exchanges. Meanwhile, in Europe, the bourses are nearly green across the board at midday. Only Portugal (-0.07%) is in the red as the CAC (+0.71%), DAX (+0.58%), and FTSE (+0.76%) lead that region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a gap higher at the open. The DIA implies a +0.58% open, the SPY is implying a +0.64% open, and the QQQ implies a +0.77% open at this hour. At the same time, 10-year bonds are at 4.886% and Oil (WTI) is down 1.37% to $84.37 per barrel in early trading.

There is no major economic news scheduled for Monday. The major earnings reports scheduled before the open include ACDVF, BGC, CHKP, CAN, DQ, HSBC, JKS, MCD, ON, RVTY, SOFI, WDC, and XPO. Then, after the close, AMKR, ACGL, ANET, CACC, CWK, CVI, FMC, PEAK, KMPR, LEG, MATX, MPWR, NEXA, PINS, PSA, QGEN, RYI, SPG, THC, RIG, VFC, and WELL report.

In economic news later this week, on Tuesday we get Q3 Employment Cost Index, Chicago PMI, Conf. Board Consumer Confidence, and API Weekly Crude Oil Stocks Report. Then Wednesday, ADP Oct. Nonfarm Employment Change, S&P US Mfg. PMI, ISM Oct. Mfg. Employment, ISM Oct. Mfg. PMI, ISM Oct. Mfg. Price Index, Sept. JOLTs Job Openings, EIA Crude Oil Inventories, FOMC Rate Decision, FOMC Statement, and the Fed Chair Press Conference are reported. On Thursday, we get Weekly Initial Jobless Claims, Preliminary Q3 Nonfarm Productivity, Preliminary Q3 Unit Labor Costs, Sept. Factory Orders, and Fed Balance Sheet. Finally, on Friday Oct. Nonfarm Payrolls, Oct. Private Nonfarm Payrolls, Oct. Participation Rate, Oct. Unemployment Rate, Oct. Avg. Hourly Earnings, S&P Global Services PMI, S&P Global Composite PMI, Oct. ISM Non-Mfg. Employment, Oct. ISM Non-Mfg. PMI, and Oct. ISM Non-Mfg. Price Index are reported.

In terms of earnings reports later this week, on Tuesday we hear from AGCO, ALLE, AME, AMGN, BUD, ARES, BCC, BP, CCJ, CAT, CEIX, DORM, ETN, ECL, EPD, BEN, GEHC, GVA, GPK, GPRE, HNI, HUBB, INCY, NSP, IGT, JBLU, LDOS, LGIH, MPC, MPLX, MSCI, PFE, PEG, ST, SIRI, SFM, STLA, SYY, BLD, UFPI, WEC, XYL, and ZBRA, AMD, AMCR, AIZ, EQH, BXC, CZR, CGAU, CHK, ENLC, EQR, FSLR, HUN, HY, JBSS, LBTYA, LFUS, LUMN, MTCH, MCY, MTH, OI, OKE, SON, TX, UNM, VOYA, and YUMC. Then Wednesday, ALIT, APO, AXTA, BLCO, EAT, BIP, BLDR, CDW, CHEF, CLH, CVS, DRVN, DTE, DNB, DD, ETR, ESAB, EL, FTDR, FYBR, GRMN, HUM, IDXX, IQV, JHG, KMT, KHC, LPX, MLM, NMRK, NI, NCLH, PSN, QUAD, SGEN, SITE, SPR, SUN, SPWR, TEL, TRI, TKR, TT, TRMB, TTMI, UTHR, VRSK, W, YUM, AFL, ABNB, ALB, ALL, ATUS, AFG, AIG, AWK, APA, ACA, CAR, AVT, AXS, BALY, BMRN, BKH, BXP, BFAM, BWXT, CHRW, CRC, CPE, CWH, CF, CAKE, CLX, COKE, CTSH, CW, DASH, DXC, EIX, EA, ET, NVST, ETSY, EXAS, EXEL, GFL, THG, HLF, HST, IR, LNC, MTW, MRO, VAC, MCK, MELI, MET, MKSI, MOD, MDLZ, MUSA, NOG, NUS, NTR, PYPL, CNXN, PRU, PTC, QRVO, QCOM, QDEL, RRX, RNR, REZI, ROKU, SIGI, SCI, SBGI, SEDG, SUM, RUN, SMCI, TS, TYL, VSTO, WTS, WERN, WES, WMB, WSC, and Z report. On Thursday we hear from GOLF, ADT, WMS, ATI, ALGT, AMR, AEP, APG, APTV, ARW, AVNT, BALL, GOLD, BHC, BAX, BCE, BDC, BWA, BR, CNQ, FUN, CVE, LNG, CI, CIGI, COP, COR, CPG, CROX, CMI, DLX, XRAY, DUK, LLY, ENTG, NVRI, EPAM, EXC, RACE, FOXA, GIL, DINO, HWM, HII, H, NSIT, ICE, IRM, ITRI, ITT, JLL, KBR, KTB, LAMR, DRS, MKL, MAR, MDU, MRNA, TAP, MUR, NVO, DNOW, NRG, OGE, OGN, PLTR, PZZA, PARA, PH, PBF, MD, PTON, PENN, PNW, PBI, PPL, PRMW, PWR, RCM, REGN, ROK, SPGI, SABR, SNDR, SEE, SHEL, SHOP, SO, STGW, TRGP, TFX, TPX, TRN, UPBD, VNT, WEN, WCC, WLK, ZTS, ACHC, ACCO, AES, AGL, ASTL, LNT, COLD, AMN, AAPL, TEAM, BECN, SQ, BKNG, CVNA, CVCO, COIN, CODI, ED, BAP, DKNG, DBX, EVH, EXPI, EXPE, FND, FTNT, GDDY, ACFI, LYV, MTZ, MCHP, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PBA, PXD, RGA, RKT, RYAN, SBAC, SEM, SWKS, SM, SWN, SBUX, SYK, and VTR. Finally, on Friday, AMCXM AXL, BSAC, BLMN, BBU, BEPC, BEP, CAH, CBOE, CHD, CNK, CRBG, D, ENB, EOG, FLR, FWONK, FWONA, IT, GTES, IEP, KOP, LSXMK, LSXMA, MGA, OMI, PAA, PAGP, PRVA, QRTEA, QSR, SRE, TDS, TIXT, USM, WPC, and TSE report.

In interesting real estate news from North of the border, Canadian PM Trudeau has been under pressure about the tight housing market in Canada. As a result, Trudeau introduced measures to tighten the criteria colleges apply to their international students starting in the fall of 2024. Colleges that meet the higher criteria will be given priority in the processing of student visas requested by their international students. In effect, the idea is to reduce the number of international students in Canada, thereby freeing up housing for native Canadians.

In miscellaneous news, Israel expanded its ground invasion of Gaza on Friday and the expansion of that attack continued Saturday and Sunday. Meanwhile, on an interesting side note, since 1950, October 28 has statistically been the best single day of the year in terms of bullish market gains. So, of course, October 28 came on a Saturday this year. (For the record, the worst market day of the year is statistically Oct 19…just nine days prior to the best day.) Elsewhere, tonight (8 p.m. Eastern) Bloomberg reports AAPL will unveil eight M3 CPUs (built on TSM’s 3nm process fab) with eight, 12, or 16 processing cores (both efficiency and performance cores) and 10, 18, or 40 graphics processing cores. They will also launch a 24-inch iMac using the new M3 chips and a new MacBook Pro.

So far this morning, ACDVF, BGC, CHKP, CAN, JKS, L, MCD, SOFI, and XPO all reported beats on both the revenue and earnings lines. Meanwhile, HSBC missed on revenue while beating massively on earnings (+194% quarter-on-quarter). However, DQ and RVTY missed on both the top and bottom lines. (ON and WDC report at 8 a.m.) It is worth noting that SOFI raised its forward guidance. In addition to the HSBC growth, JKS had 59% earnings growth on just 4% revenue growth.

With that background, it looks like the Bulls are in control in the premarkets this morning. All three major index ETFs gapped higher at the open of the early session with the large-cap indices printing small, white-bodied candles. However, the QQQ gapped higher and the Bulls have continued to run, giving us a large, white-bodied candle with very small wicks this morning. With that said, keep in mind that all three remain well below their T-line (8ema) and also down 9%-10% from the summer highs. Once again, we have no really major economic news today and with the Fed and Q3 Payrolls later in the week, it would not be surprising for markets to drift while they wait on more news. In terms of that extension, all three major index ETFs are back a bit extended down below their T-line (8ema). The T2122 indicator is also in the lower end of its oversold territory. So a pause or relief rally may well be in order. Just remember that the market can remain extended longer than we can stay solvent betting that it has to turn. Finally, the only thing we can say for sure is the Bears maintain control of the trend.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Middle East Tensions

The bears ran roughshod over Friday’s market as Middle East tensions worried investors with oil prices surging and bond yields holding steady. This week will be very busy with market-moving job numbers, a FOMC rate decision, and a huge number of earnings events as we slide into November. The T2122 indicator is in a short-term very oversold condition so watch for a relief rally and a possible short squeeze to get it moving. However, don’t rule out a retest of lows, and expect challenging price volatility so plan your risk carefully.

Overnight Asian markets closed mixed but mostly higher ahead of Japan’s central bank decision. European markets trade green across the board this morning reliving some of last week’s selling despite Middle Eastern worries. U.S. futures suggest a substantial gap up hoping for a relief of some of the short-term oversold conditions as we wrap up October and slide into the holiday’s highly anticipated rally.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AGNC, AMKR, ACGL, ANET, BCC, CHGG, CHKP, CRK, CWK, DENN, PLOW, FMC, FWRD, HTLF, IRT, KMPR, KFRC, LSCC, LEG, MPWR, ON, OGS, OTTR, PDM, PINS, PCH, PSMT, PCH, PSA, RMBS, SPG, SOFI, THC, RIG, VFC, VRNS, VNO, WELL, WDC, WOLF, XPO, & ZI.

News & Technicals’

Stellantis, the parent company of Chrysler, is facing a national labor strike in Canada, just days after it reached a tentative deal with the United Auto Workers union in the U.S. The strike, which started on Monday, affects two assembly plants in Ontario that produce some of the company’s popular models, such as the Chrysler 300 sedan and Pacifica minivan and the Dodge Challenger and Charger muscle cars. The workers, who are members of the Unifor union, are demanding better wages, benefits and working conditions. The strike could disrupt the production and supply of Stellantis vehicles in North America and hurt the company’s sales and profits.

The United Auto Workers union and Ford have reached a tentative agreement that includes $8.1 billion in new investments by the automaker and $5,000 bonuses for the workers. The tentative deal, which was approved by the local union leaders on Sunday, will now be presented to the 57,000 UAW-Ford members for regional meetings and voting, the union said on Sunday. The tentative agreement was achieved after the union launched selective strikes against Ford, General Motors, and Stellantis, as the three companies failed to meet the union’s demands by the Sept. 14 deadline. The union is seeking higher wages, better benefits, and more job security for its members.

Evergrande, the troubled Chinese property developer, saw its shares plummet to a record low on Monday, as it faced a possible liquidation by a Hong Kong court. The company’s shares dropped more than 20% from last Friday’s close of 23.6 Hong Kong cents to 18.8 Hong Kong cents in early Monday trading, before recovering slightly to 22.2 Hong Kong cents. The company is facing a winding-up order from a group of bondholders who claim that Evergrande has defaulted on its debt obligations. A Hong Kong judge said that the Dec. 4 hearing would be the last one before a decision is made on the order, according to Reuters. Evergrande is the world’s most indebted property developer, with more than $300 billion in liabilities. The company’s financial woes have sparked fears of a contagion effect on the Chinese and global economy.