Member e-Learning 12-21-23 – Ed

Yesterday reminded us that bears still exist with the sharp drop at the end of the day that cascaded into traders running for the door to protect profits. Perhaps the quick selling also indicated an acknowledgment of the very overextended condition of the indexes as well as buyer exhaustion. Today as we run through a handful of notable earnings reports along with GDP, Jobless Claims, and the Philly Fed Mfg. numbers plan for an extra dose of price volatility due to the added uncertainty. Big point swings are possible and remember volumes could quickly decline as folks head out for holiday plans.

Asian markets closed the day mixed but mostly lower with the HSI and Shanghai recovering just slightly from the earlier selloff. However, European markets traded red across the board perhaps also recognizing the extended condition of the indexes. U.S. futures work to shake off yesterday’s selling indicating another gap up open trying to keep the exuberant buying spree going ahead of market-moving data. Buckle up it could be a wild morning of emotional price action.

Notable reports for Thursday AIR, APOG, AVO, CCL, CTAS, NKE, & PAYX.

Citigroup, one of the largest banks in the world, is shutting down its global distressed-debt unit, according to CNBC. The unit, which traded bonds and loans of companies in financial trouble, was part of the bank’s markets division. The move is part of a broader restructuring plan by Citigroup’s CEO Jane Fraser, who took over in February. Fraser is aiming to improve the bank’s profitability and efficiency by exiting low-performing businesses and focusing on its core strengths.

Toyota, the world’s largest automaker, saw its shares drop sharply on Thursday after it announced a massive recall of about a million vehicles in the U.S. The recall affected certain 2020-2022 models of Toyota and Lexus, its luxury brand, due to a potential defect in the fuel pump that could cause the engine to stall. The recall was the latest in a series of quality issues that have plagued Toyota in recent years, denting its reputation for reliability and safety.

China has announced that it will impose tariffs on 12 chemical compounds imported from Taiwan, starting from Jan. 1, 2024. The move is seen as a punitive measure against Taiwan, which Beijing accuses of breaching a trade agreement. The affected chemical compounds include vinyl chloride, dodecyl benzene, and ethylene-propylene copolymer, which are used in…

The U.S. military said it intercepted 14 drones that were launched by the Houthi rebels from Yemen in the Red Sea over the weekend. The drones were part of a coordinated attack on shipping lanes in the strategic waterway, which connects the Mediterranean Sea and the Indian Ocean. The attack prompted many tankers and cargo ships to avoid the Suez Canal, which is the shortest route between Europe and Asia, and take the longer and more costly route around Africa. The Houthi rebels, who are backed by Iran, have threatened to target Israeli ships and any ships that are linked to Israel, in response to Israel’s war with Hamas in Gaza.

U.S. stocks ended Wednesday with a sharp drop as traders ran for the door in unison to protect profits in this very extended market condition. The S&P lost 1.5% and the Dow fell 476 points. The decline began with no trigger other than perhaps some exhaustion after the strong rally in the past few weeks. As a result, traders should plan for an extra dose of price volatility that could create some big point whips due to the uncertainty. Expect the GDP, Jobless Claims, and Philly Fed data to add to this morning’s emotional price sensitivity as well as the handful of notable earnings. Keep in mind after the reaction to data volume could decline into a choppy afternoon as traders extend holiday plans.

Trade Wisely,

Doug

The bulls tacked on more gains Tuesday as the Fed pivot bet continued to inspire the fear of missing out as the DIA and QQQ inked the 9th straight day of gains. Bond yields continued to decline while oil, one of the main contributors to the decline in inflation continued to rally as the Middle Eastern war spilled out into the Red Sea threatening the supply chain. Today traders have a handful of notable earnings along with Consumer Confidence, Existing Home Sales, and Petroleum figures to digest. Remember volumes could soon begin to decline as holiday vacations begin and keep in mind we could see a hurry-up wait choppy afternoon with the GDP report Thursday morning.

While we slept Asian market mostly gained in reaction to the dovish decision from the BOJ, though Shanghai declined after a hold of benchmark lending rates. Across the pond, European markets trade mixed but mostly higher with modest gains and losses a day after the FTSE inked a three-month high. However, U.S. futures suggest a modestly bearish open to being Wednesday ahead of earnings and economic reports.

Notable reports for Wednesday BB, GIS, TTC, MLKN, & WGO.

FedEx, the global delivery giant, saw its shares drop 9% after it reported disappointing results for its fiscal second quarter. The company missed analysts’ expectations for both revenue and earnings, as it faced lower demand for its Express service, which accounts for more than half of its sales. The company also cut its guidance for the full year, citing challenges from the pandemic, labor shortages, and supply chain disruptions.

A study by Lending Tree revealed that Tesla drivers had the highest accident rate in the U.S. in the past year, with 24 accidents per 1,000 drivers from mid-November 2022 to mid-November 2023. Tesla drivers were followed by Ram and Subaru drivers, who also had high accident rates. The study also found that BMW drivers were the worst offenders when it came to driving under the influence, with 3 DUIs per 1,000 drivers in a year, which was double the rate of Ram drivers, who ranked second in this category. The study warned that accidents, DUIs, speeding, and other violations could result in higher insurance premiums for drivers.

U.S. Bank, one of the largest banks in the country, faced a hefty penalty of almost $36 million from federal authorities for breaking consumer protection laws. The bank blocked access to prepaid debit cards for hundreds of thousands of people who relied on them to receive unemployment benefits during the Covid-19 crisis. The bank also received a separate fine of $15 million from the Office of the Comptroller of the Currency, which oversees national banks.

The former CEO of Stimwave Technologies, Laura Tyler Perryman, is facing charges from the SEC for allegedly scamming investors out of $41 million. According to the SEC, Perryman lied about one of Stimwave’s products, claiming that it had FDA approval when it did not. The SEC’s lawsuit comes after Perryman was criminally indicted by the U.S. Attorney’s Office in New York in March for the same scheme.

The equity markets extended the positive streak from the previous weeks as the Fed pivot bet continues to inspire the bulls to play chase. The main economic data that investors watched were U.S. housing starts and Canadian CPI inflation. U.S. housing starts beat expectations by increasing more than 14% from the previous month, while Canadian CPI inflation was slightly higher than anticipated. The market was led by a mix of sectors, with both growth sectors like communication services and cyclical sectors like energy and materials doing well. IWM continued to play catch up, surging 2% on Tuesday and has now risen about 20% since October 31. Oil prices continued to climb, reaching over $74 per barrel as the Red Sea tensions added risk to the supply chain. Today bulls and bears will look for inspiration in Mortgage Apps, Current Accounts, Consumer Confidence, Existing Home Sales, Petroleum Status, and a 20-year bond auction. We also have a handful of notable earnings to keep traders guessing. Keep in mind that volume could begin to drop quickly after the morning reaction to data as traders begin holiday vacation plans and wait for the Thursday GDP report. Plan carefully.

Trade Wisely,

Doug

Stocks started the day modestly higher as SPY opened 0.09% higher, DIA opened 0.05% higher, and QQQ opened 0.10% higher. From that point, all three major index ETFs rallied until 11:30 a.m. and then spent the rest of the day grinding sideways in a fairly tight range. All three then rallied the last 10 minutes of the day, going out very near the highs. This action gave us large-body, white candles with very small upper wicks. As a result, DIA and QQQ closed at another new all-time high close while SPY closed less than half of a percent shy of an all-time high close. All three remain well above their T-line (8ema) with at least QQQ getting stretched. This all happened on slightly below-average volume in DIA, below-average volume in the QQQ, and well below-average volume in the SPY.

On the day, all 10 sectors were in the green with Healthcare (+1.70%) and Basic Materials (+1.67%) out front leading the way higher while Communication Services (+0.58%) lagging behind the other sectors. At the same time, the SPY gained 0.61%, DIA gained 0.68%, and QQQ gained 0.51%. The VXX gained 1.48% to close at 16.42 and T2122 spiked up to the top of its overbought territory to close at 96.25. 10-year bond yields fell slightly 3.933% and Oil (WTI) gained 1.53% to close at $73.58 per barrel. So, the Bulls said “not so fast” to the chorus that had observed how far the rally had run and concluded the market had to pull back.

There was no major economic news reported Tuesday including November Building Permits, which came in below expectations at 1.460 million (compared to a forecast of 1.470 million and the October 1.498 million). This was a 2.5% decrease month-on-month. At the same time, November Housing Starts came in significantly higher than predicted at 1.560 million (versus a forecast of just 1.360 million and an October value of 1.359 million). This amounted to a 14.8% increase month-on-month. Later the Oct. TIC Net Long-Term Transactions were reported as dramatically lower than anticipated at +$3.3 billion (compared to a forecast of +$45.8 billion and a September reading of +0.9 billion). Finally, after the close, the API Weekly Crude Oil Stocks report showed oil inventories surprisingly increased by +0.939 million barrels (versus a forecast calling for a 2.233-million-barrel drawdown and the prior week’s 2.349-million-barrel drawdown). This must mean oil production is higher than ever since oil exports are also at all-time highs (5+ million barrels per day).

After the close, SCS reported a miss on revenue while beating on earnings. At the same time, WOR beat on revenue while missing on earnings. However, FDX missed on both the top and bottom lines. (FDX, in particular, sold off hard in post-market trade and influenced the entire market lower.)

In stock news, MBGAF (Mercedes), STLA, and VLKAF (Volkswagen) have increased their own subsidy programs (lowered prices) following the termination of the German subsidies for EV purchases. (The program was ended due to drastic budget cuts when a court ruled the German government could not use unused COVID funding for other purposes.) The move will cost the car-makers about $5k per electric vehicle sold in 2024. At the same time, BA announced Lufthansa had ordered 40 BA 737 MAX 8 planes with the option to buy 60 more later. (EADSY also announced the airline ordered 40 Airbus A220-300 planes with Lufthansa having the option to buy 20 more later.) Later, XPEV announced that it would cut prices on its electric SUV by 5%. (The move follows competitor BYD cutting prices by 8% on December 1.) At the same time, ADM announced a second acquisition in two days, purchasing UK-based flavor and ingredient firm FDL for an undisclosed amount. (FDL is set to book about $120 million in sales for 2023.) Reuters reported AFRM has begun offering “buy now, pay later” loans at WMT self-checkout kiosks in 4,500 WMT stores. The loans only apply to purchases of more than $144 and up to $4,000 and exclude grocery purchases. The term of the loans is three payments over 24 months. Elsewhere, MULN announced a 1-for-100 reverse split effective at 12:01 a.m. on December 21. (The move is intended to help the company come back into compliance with NASDAQ rules requiring a price above $1.00.) Late in the day, China auto industry analysts said that TSLA saw an impressive 18.83% increase in car registrations last week in China. This amounted to 18,000 new vehicle registrations. At the close, LUV announced it reached an agreement in principle with its Pilot’s union. The new 5-year contract would be worth $12 billion under the terms of the tentative deal. (The union board still needs to accept and send the contract to union members for approval.) After the close, GOOGL said it would restrict the types of election-related queries to its Bard AI chatbot. On Tuesday evening, TSLA canceled its annual merit-based stock awards according to Bloomberg. However, the automaker did give modest cost-of-living increases as an adjustment to base salary. Finally, Tuesday night, CNBC reported that TGT has been lying and making excuses. The financial outlet reported that when the retailer closed nine stores in NY, Portland, and San Francisco it had claimed that theft and violence were driving factors in the decision. However, CNBC reporting found that theft and violence were higher at stores in those areas that were not closed. So, the company was just latching onto a political (GOP) narrative as reasoning to hide otherwise poor performance (in merchandising, marketing, and service).

In stock government, legal, and regulatory news, a US district judge granted a motion from KVUE to exclude expert testimony on whether the active ingredient in Tylenol causes Autism or ADHD in a class-action suit against KVUE. At the same time, Reuters reported that TSLA prevailed in a lawsuit from a woman who alleged TSLA continued to give her abusive husband access to vehicle location data despite a court order of protection. The court ruled that TSLA was not liable despite prior knowledge of the threat and the protective order since his name was listed as a co-owner on the vehicle title. Later, TSLA asked a US judge to halt a trial brought by the EEOC alleging the company severely harassed black workers at a CA plant. TSLA said that two similar cases should “play out” before the EEOC suit goes forward. Elsewhere, Reuters reported that the FAA has no “specific timetable” in mind for the certification of the BA 737 MAX 7 in an article citing the FAA’s top official. (BA previously said it expects the certification to come this year. However, the public comment period on a proposed exemption for certification for engine inlet and anti-icing system does not end until December 26. The largest BA 737 MAX 7 customer, LUV, says it expects FAA to certify the plan by April. At the same time, USB agreed to pay $36 million to settle allegations the bank illegally blocked unemployed consumers from accessing their unemployment benefits during the COVID-19 pandemic. (USB has contracts with 19 states and the District of Columbia to deliver unemployment benefits.) Tuesday night, major automakers GM, TM, and VOLKAF (Volkswagen) opposed a bid by the NHTSA to force a recall of all 52 million airbag inflators produced by ARC Automotive (as opposed to just the millions already recalled).

Overnight, Asian markets were mixed. Shenzhen (-1.41%), India (-1.41%), and Shanghai (-1.03%) paced the losses. Meanwhile, South Korea (+1.78%), Japan (+1.37%), Hong Kong (+0.66%), and Australia (+0.65%) led the gainers. In Europe, we see a similar picture taking shape at midday with seven of 15 bourses in the red, seven in the green, and one unchanged. The CAC (+0.08%), DAX (-0.07%), and FTSE (+0.56%) lead the region on volume as usual. In the US, as of 7:30 a.m., Futures are pointing toward a red start to the day. DIA implies a -0.18% open, the SPY is implying a -0.20% open, and the QQQ implies a -0.26% open at this hour. At the same time, 10-year bond yields are down to 3.879% and Oil (WTI) is up 1.37% to $74.94 per barrel in early trading.

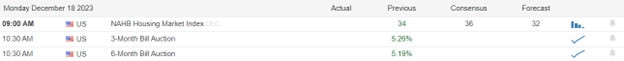

The major economic news scheduled for Wednesday includes Q3 Current Account (8:30 a.m.), Conf. Board Consumer Confidence and Nov. Existing Home Sales (both at 10 a.m.), and EIA Crude Oil Inventories (10:30 a.m.). The major earnings reports scheduled for before the open include GIS, TTC, and WGO. Then, after the close, MU and MLKN report.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q3 GDP, Q3 GDP Price Index, Philly Fed Mfg. Index, and the Fed Balance Sheet. Finally, on Friday, Nov. PCE Price Index, Nov. Core PCE Price Index, Nov. Durable Goods, Nov. Personal Spending, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Expectations, Michigan 5-year Inflation Expectations, and Nov. New Home Sales are reported.

In terms of earnings reports later this week, on Thursday, KMX, CCL, CTAS, PAYX, AIR, NKE and WS report. There are no earnings reports on Friday.

In miscellaneous news, the Fed’s Bank Term Funding Program (BTFP) has become increasingly popular in the last week. The program which loans to banks against their Treasury and agency debt for up to one year at a rate slightly above Fed Funds swaps price has increased nearly 25% in size since the Fed meeting last week. The reason is that Fed swaps are now pricing in (indicating) that the market expects 1.40% of rate cuts in 2024. This means the BFTP loan rate is 4.96%, which is more than half a percent lower than the Fed discount window rate of 5.5%. So now $124 billion of BTFP loans are on the Fed balance sheet compared to $100 billion prior to the last Fed meeting. In essence, the market has cut the Fed rates by half a percent already, even as the FOMC stands pat.

In China news, Reuters reported the Chinese economic analysts have noted disturbing strategy shifts by that country’s retailers, that risk entrenching deflation in the economy. The shift by retailers is toward carrying only or primarily lower-priced goods and services. This is seen in a proliferation of bargain stores and major companies offering primarily (or only) cheaper scaled-down versions of their products and services. This move en masse is drawing comparisons to Japan, which suffered “lost decades” due to deflationary trends. (As company revenues fall, they cut costs by reducing payrolls and offer cheaper price. This lowers consumer price expectations and makes it ever harder to sell premium products or raise prices.) The Reuters report cited many examples and quoted several analysts all predicting a painful economic spiral unless there is massive stimulus or other unforeseen economic good news.

In late-breaking news, inflation in the UK came in softer than expected at 3.9%, which boosted British trader’s hopes for a rate cut soon. Before that, Richmond Fed President Barkin suggested the Fed would cut rates if progress on inflation continued. (That was what markets wanted to hear as opposed to other Fed members who have pushed back on speculation that the FOMC will cut rates soon.) Elsewhere, demand for mortgages in the US fell slightly, despite another decrease in loan rates. This may be due to homebuyers (as well as traders) anticipating better rates in the new year. The rate for a 30-year, fixed-rate, conforming loan fell from 7.07% to 6.83% last week. Despite this, demand for refinance loans fell 2% and applications for new home purchase loans were down 1% versus the prior week.

With that background, it looks like the Bears are in control of all three major index ETFs so far in the premarket action. All three opened the early session flat to slightly lower and are giving us larger, black-bodied candles so far in the early session. All three remain well above their T-line (8ema) this morning. So, overall, the Bulls remain well in control of both the longer-term trend and the short-term trends. However, the Bears seem in control of premarket trading. In terms of extension, the three major index ETFs were too far extended above their T-lines last night. However, the early morning move (possibly in reaction to FDX) is taking them back into a less extended state. At the same time, the T2122 indicator is now in the upper part of its overbought range. So, strictly speaking, both the Bulls and Bears have some room to run if they gather the momentum to do it, but the Bears have much more slack to work with if they get going.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Markets opened higher on Monday as SPY gapped up 0.33%, DIA gapped up 0.20%, and QQQ actually opened just on the red side of flat at -0.03%. At that point, SPY and QQQ traded sideways the rest of the day with a very modest bullish trend to the action. Meanwhile, DIA wobbled sideways along the open level with a very slight bearish trend after 11 a.m. to end up in the gap. This action gave us three different candles among the three major index ETFs. DIA printed a gap-up black-bodied Doji. At the same time, SPY printed a gap-up small, white-bodied candle with a significant upper wick. And to round things out, QQQ opened just shy of flat and printed a larger-body white candle with a small upper wick. This happened on well-below-average volume in the SPY and QQQ as well as modestly-below-average volume in DIA.

On the day, nine of the 10 sectors were in the green with Energy (+1.13%) way out front leading the way higher while Utilities (-0.24%) lagged behind the other sectors and was the only sector in the red. At the same time, the SPY gained 0.56%, DIA gained 0.09%, and QQQ gained 0.43%. The VXX gained slightly to close at 16.18 and T2122 climbed back up out of the mid-range and into its overbought territory to close at 86.13. 10-year bond yields rose to 3.945% and Oil (WTI) gained 1.68% to close at $72.63 per barrel. So, QQQ kept up the rally, closing at another all-time-high-close again. DIA did the same but in a much more indecisive way. Meanwhile, SPY made up all the ground it lost last Friday, closing at exactly the same price as Thursday.

There was no major economic news reported Monday. Elsewhere, Chicago Fed President Goolsbee said Monday he was confused by the stock market’s reaction after last week’s FOMC meeting. Goolsbee told CNBC, “It’s not what you say or what the (Fed) Chair says, it’s what do they hear and what do they want to hear?” He continued saying, “I was confused a bit … was the market just imputing ‘Here’s what we want them to be saying.’ I thought there seemed to be some confusion about how the FOMC even works. We don’t debate specific policies speculatively about the future.” Earlier in the day, Cleveland Fed President Mester told the Financial Times, “The next phase is not when to reduce rates, even though that’s where the markets are at. It’s about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2%.” Later, San Francisco Fed President Daly told the Wall Street Journal that the FOMC must make sure “we don’t give people price stability but take away jobs.” She went on to say that rate cuts are likely to be appropriate in 2024. (She did not get more specific on timing.)

After the close, HEI reported beats on both the revenue and earnings lines. This included 54% earnings growth quarter over quarter.

In stock news, Reuters reported Monday that GS is facing a painful and costly exit from its credit card partnership with AAPL. Other lenders find the program too risky and expensive, which is driving down what GS can get from selling the partnership. In fact, key potential buyers of GS’s position include SYF, whose CEO said “You’ve got to have a really good risk-return (for credit card deals)” at a conference early this month. At the same time, UL announced it will sell its Elida Beauty (which includes the Q-top brand) to private equity firm Yellow Wood. Terms of the deal were not disclosed, but the unit generated $1.02 billion in 2022. Later, Reuters reported that JPM, YUM, AAL, LOW, KTB, and BLK had all changed their Diversity, Equity, and Inclusion policies after intimidation from right-wing groups who threatened lawsuits to stop any affirmative action. Elsewhere, IBM announced the purchase of SWDAF’s integration platform for $2.33 billion. The deal will increase IBM’s capabilities in cloud and AI markets. Later the Wall Street Journal reported that AMZN is in talks to invest in Diamond Sports Group (a broadcasting network owned by SBGI). At the same time, WH asked its shareholders to reject a hostile acquisition bid from CHH. WH management cited that the deal would tie the company up for up to 24 months in regulatory review of the deal, which they claimed would hurt the company’s valuation. Late in the day, ENPH said it would cut 10% of its workforce (total including employees and contractors). After the close, CMCSA announced it had found a four-day unauthorized access to its internal systems in October. The breach likely exposed usernames, passwords, contact details, and partial social security numbers of customers among other data. Also after the close, ADM announced it had agreed to buy Revela Foods for an undisclosed sum. Finally, late Monday evening TSLA announced it will increase the pay of workers at its NV plant by 10% starting in early January. The company did not say so but this was likely a bid to hold off a bid by the UAW union to organize the plant.

In stock government, legal, and regulatory news, the FDA approved the use of ARTQ’s treatment for a skin condition Monday (for patients 9 years and older). The disease impacts 10 million Americans and this is the first approved treatment. Later, ADBE announced formally that it is scrapping its $20 billion deal to buy cloud-based designer platform Figma after receiving pushback from EU and UK antitrust regulators. ADBE will pay a $1 billion termination fee to end the deal. At the same time, AAPL announced it is halting the sale of some (higher end) of its Apple Watches in the US after the ITC ruled against the company in a patent dispute over included medical sensors. Later, SPWR made an SEC filing that raised doubts about the company’s ability to stay in business. The filing said lenders made a demand for immediate repayment of $65.3 million in debt after the company failed to report Q3 earnings on time. (SPWR stock fell 31% on the day of this revelation.) At the same time, the SEC launched a major lawsuit against TIO, alleging the fintech company fabricated billions of dollars worth of transactions through Nigerian subsidiaries and falsely reported hundreds of millions of fake revenues and assets. Later, COIN petitioned a federal appeals court to review and overturn the SEC’s denial of the company’s request for new rules covering the digital asset sector. (The SEC contends no new rules are needed.) Elsewhere, 21 members of the US House (including at least one Democrat) wrote a letter to President Biden, urging him to launch an investigation of the EU, alleging that the EU Digital Markets Act harms the competitive ability of GOOGL, AMZN, AAPL, META, and MSFT. Separately, another bipartisan group of lawmakers asked the Dept. of Justice to launch an investigation into whether AAPL violated antitrust laws when it disabled third-party Apps that allowed Android devices to message with the AAPL iMessage application. Later, the state of TN (GOP-run) sued BLK alleging the company breached consumer protection laws by making “misleading” statements about its environmental, social, and corporate governance investment strategies. A utility subsidiary of BRKB has agreed to pay a $250 million settlement to timber companies in Oregon over wildfires. After the close, a WA state jury ordered BAYRY (Bayer) to pay $857 million to seven former students and volunteers of a Seattle school district after the company’s PCB chemicals leaked from light fixtures making the plaintiffs sick.

Overnight, Asian markets leaned heavily to the green side with only two exchanges in the red. Japan (+1.41%) and Australia (+0.84%) led the gainers with most other stock exchanges close to flat. In Europe, only four of 15 bourses are in the red as the Bulls lead the way at midday. The CAC (-0.06%), DAX (+0.38%), and FTSE (-0.11%) lead the region on volume as Scandinavian exchanges lead the price moves in early afternoon trade. In the US, as of 7:30 a.m., Futures point toward a modestly green start to the day. The DIA implies a +0.16% open, the SPY is implying a +0.13% open, and the QQQ implies a +0.12% open at this hour. At the same time, 10-year bond yields are down a touch to 3.905% and Oil (WTI) is off by three-tenths of a percent to $72.26 per barrel in early trading.

The major economic news scheduled for Tuesday is limited to Nov. Building Permits and Nov. Housing Starts (both at 8:30 a.m.), TIC Net Long-Term Transactions (4 p.m.), and the API Weekly Crude Oil Stocks (4:30 p.m.). The major earnings reports scheduled for before the open include ACN and FDS. Then, after the close, FDX, SCS, and WOR report.

In economic news later this week, on Wednesday, Q3 Current Account, Conf. Board Consumer Confidence, Nov. Existing Home Sales, and EIA Crude Oil Inventories are reported. On Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q3 GDP, Q3 GDP Price Index, Philly Fed Mfg. Index, and the Fed Balance Sheet. Finally, on Friday, Nov. PCE Price Index, Nov. Core PCE Price Index, Nov. Durable Goods, Nov. Personal Spending, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Expectations, Michigan 5-year Inflation Expectations, and Nov. New Home Sales are reported.

In terms of earnings reports later this week, on Wednesday we hear from GIS, TTC, WGO, MU, and MLKN. On Thursday, KMX, CCL, CTAS, PAYX, AIR, NKE and WS report. There are no earnings reports on Friday.

In miscellaneous news, US antitrust regulators (US Dept. of Justice and FTC) released their finalized new guidelines for tougher merger and acquisition scrutiny. The 51-page set of guidelines expanded the definition of “highly concentrated markets” (which had last been updated in 2010). The new standards lay the groundwork for challenging big tech mergers by companies like AMZN, GOOGL, AAPL, MSFT, NVDA, etc. among other industries and companies. Elsewhere, BAC said Monday that they expect the Fed to cut rates four times in 2024 (March, June, September, and December). As a result, BAC now predicts faster growth and lower inflation in the economy next year. In supply chain news, the US Dept. of Defense launched an operation to safeguard the Red Sea for commercial traffic in conjunction with the UK Navy and eight other minor contributing countries.

In oil news, Reuters reports that US oil exports hit another record last week and will continue that way the rest of the year. The driving reason for this increase is oil companies trying to drive down inventories to avoid year-end tax liability. (This is especially true for storage in the state of TX.) So far in 2023, US oil exports have averaged 4 million barrels per day (about 500k barrels per day more than 2022’s record exports). However, exports from the Gulf Coast have averaged more than 5 million barrels per day in the last two weeks.

In late-breaking news, GOOGL agreed to pay $700 million and allow more competition in its Google Play app store. $630 million will go into a settlement fund for consumers and $70 million to be used by states. The settlement still requires approval of the court. (Eligible consumers would get at least $2 and may get more depending on their spending in the GOOGL app store between August 2016 and September 2023.) All 50 states, Washington DC, Puerto Rico, and the Virgin Islands are part of the settlement.

With that background, it looks like all three major index ETFs are looking to move modestly higher again this morning in premarket action. All three opened the early session higher and are giving us small white-bodied candles so far. All three remain well above their T-line (8ema) this morning. So, overall, the Bulls remain well in control of both the longer-term trend and the short-term trends. In terms of extension, none of the three major index ETFs are too far extended above their T-lines. However, QQQ is starting to get close to extended once again and the T2122 indicator is now in the lower half of its overbought range. So, strictly speaking, both the Bulls and Bears have some room to run if they gather the momentum to do it. The Bears obviously have much more slack to work with if they get going.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Monday began with enthusiasm gapping higher but then quickly faded into a low-volume consolidating session ending in mixed results. The Mag7 stocks garnered the majority of yesterday’s energy pushing the QQQ toward an all-time high breakout as the SPY squeaked out a small win adding to its seven-week run. Today traders will have a few notable earings as well as a Housing Starts and Permits report to find inspiration. The attacks in the Red Sea risk affecting the global supply chain so keep an eye on oil as it seems particularly sensitive to the situation.

During the night Asian markets closed mostly higher with only the HSI moving lower after Japan kept its rate policy unchanged creating a steep decline in the yen. European markets trade mixed but mostly lower this morning as they monitor the G7 meeting of finance with central bank officials. However, U.S. futures continue to pump the premarket higher working to achieve the headlines of the Nasdaq and SP-500 all-time highs.

Notable reports for Wednesday ACN, FDS, FCEL FDX, SCS. WOR.

The Red Sea, a vital waterway for global trade, is under threat from Iran-backed Houthi militants who have launched a series of attacks on ships in the area. The attacks have coincided with the ongoing war between Israel and Hamas, raising fears of a wider regional conflict. As a result, several major shipping lines, including BP and Maersk, have halted their services through the Red Sea, disrupting the supply chain of goods and commodities. To counter the Houthi threat, the U.S. and its allies have initiated Operation Prosperity Guardian, a maritime security operation that aims to protect the ships and deter further attacks. The operation is an extension of the U.S. naval force in the Red Sea, which has been facing increasing challenges from the Houthi rebels.

Tesla, the electric car maker, is reportedly raising the hourly wages of some of its employees at its Nevada battery plant by 10% or more, according to CNBC. The company, which has faced labor disputes and unionization efforts in the past, may be trying to appease its workers and prevent them from seeking a collective bargaining agreement in the U.S. The wage hike, which was revealed in internal documents obtained by CNBC, could affect thousands of workers at the Gigafactory, where Tesla produces batteries and powertrains for its vehicles.

Enphase Energy, a solar company that produces microinverters, announced that it will cut 10% of its staff as part of a restructuring plan. The company has been struggling with low demand for its products, as high-interest rates have made solar installations less attractive. Enphase’s stock price has plummeted 53% this year, reflecting its poor performance. The company expects to incur $16 million to $18 million in costs related to the layoffs and the impairment of some of its assets.

The stock market indexes ended Monday with mixed results in a calm low-volume consolidating session. That said the S&P 500 and the Nasdaq added small gains to its seven-week winning streak thanks mostly to the push in the Mag7 stocks. Interest rates rose a bit, but the 10-year Treasury yield stayed below 4% and close to its July low. Today traders will look for inspiration in the Housing Starts and Permits report coming in before the bell and some Fed speeches in the afternoon. We also have a few notable earnings reports that could add a bit of price volatility. In this parabolic condition plan carefully as a pullback could begin at any time so try to avoid the fear of missing out chaising already extended names.

Trade Wisely,

Doug

On Friday, markets were essentially dead all day but bookended by volatility. SPY gapped down 0.50%, DIA gapped down 0.41%, and QQQ opened 0.11% higher. At that point, all three major index ETFs waffled sideways in a fairly tight range. SPY spent its day along the opening level. DIA spent most of the day inside its morning gap. Meanwhile, QQQ floated sideways above its gap-up open level. Then the last 10 minutes of the day saw huge volatility as a 5-minute burst higher followed immediately by a 5-minute plummet lower, both on heavy volume, took the market out not far from where it started the day. This action gave us a gap-down Doji in the SPY, a gap-down white-bodied Spinning Top in the DIA, and a small white-bodied candle with an upper wick in the QQQ. QQQ gave us an all-time high close with both the large-cap index ETFs closing within a percent of their own all-time high closes.

On the day, nine of the 10 sectors were in the red with Utilities (-1.64%) way out front leading the way lower while Technology (+0.17%) lagged behind the other sectors. At the same time, the SPY lost 0.57%, DIA lost 0.19%, and QQQ gained 0.48%. The VXX gained 3.33% to close at 16.14 and T2122 dropped down to just outside its overbought territory to close at 79.52. 10-year bond yields fell again to 3.921% and Oil (WTI) was up slightly to close at $71.79 per barrel. So, on Friday, the large caps relieved some over-extension while the QQQ kept melting higher. This was punctuated by volatility that was likely caused by triple witching options expiration day. This happened on heavier-than-average volume in DIA and QQQ while volume in SPY was average. It is also worth noting that last week was the seventh-straight strongly bullish week in a row in all three major index ETFs. So, we are due for at least a rest.

The major economic news reported Friday included the NY Fed Empire State Mfg. Index which came in far below expectations at -14.50 (compared to a forecast of +2.00 and a November value of +9.10). Later, November Industrial Production (month-on-month) came in a tick lower than predicted at +0.2% (versus a forecast of +0.3% but well above the October reading of -0.9%). On a year-on-year basis, Nov. Industrial Production was lower but well up from one year ago at -0.39% (compared to the 2022 reading of -0.96%). Later the S&P Global Mfg. PMI was reported lower at 48.2 (versus a forecast of 49.3 and a prior reading of 49.4). At the same time, S&P Global Services PMI came in higher than anticipated at 51.3 (compared to a forecast of 50.6 and the prior value of 50.8). This combined into an S&P Global Composite PMI of 51.0 (up from the prior reading of 50.7).

In Fed talk news, on Friday NY Fed President Williams pushed back against rate cuts, saying “we aren’t really talking about rate cuts right now.” Williams went on to tell CNBC it was “premature” to speculate about cuts at this time. However, later, Atlanta Fed President Bostic said he believes the FOMC will begin reducing rates during the third quarter of 2024. Bostic told Reuters, “I’m not really feeling that this is an imminent thing.” Still, he then went on to say, “The risk that inflation is going to spike has really, I think, declined significantly. It is not zero, but it is lower.” He also told the interviewer that he expects a soft landing, saying “no one is talking to me as if large job losses are imminent.” Lastly, he indicated that his current outlook call for two quarter-point rate cuts in 2024 and that this is less than the three cuts envisioned by many colleagues.

In stock news, on Friday, NIO announced they will launch a cheaper brand of their electric vehicles to Europe in 2025. At the same time, Bloomberg reported that HCSG and ELV are in a bidding war, competing to buy CI’s Medicare Advantage unit. Later, in an interview with Bloomberg, BLK said it is adapting to the Fed’s recent shift toward easing in 2024 by moving its fixed-income bond investments toward longer-duration positions. At the same time, PLTR announced it had received a $115 million contract extension from the US Army. Elsewhere, FSR said it had begun the final over-the-air software update for their electric vehicles in 2023. Later, the Wall Street Journal reported that DOCU is in the early stages of exploring a sale. Potential bidders were said to be both private equity as well as technology firms. After the close, Reuters reported that KKR had purchased a $7.2 billion portfolio of recreational vehicle loans from BMO. (The price of the deal was not disclosed.) After the close, Bloomberg reported that China’s ban on AAPL phones by government agencies/contractors has accelerated and expanded. It said the new policies forbid people from bringing any such phones or devices to their offices. The article said the policy also included “other foreign device makers” but none were specifically mentioned.

In stock government, legal, and regulatory news, Reuters reported Friday that XOM’s income tax rate has dropped more than 3% over the last 5 years due to massive deductions passed by the Trump Administration. In fact, accelerated depreciation deductions lowered its rate to 2.5% in last year. At the same time, the Dutch vehicle authority said that no recall of TSLA vehicles is currently planned in Europe despite the concerns that caused the massive US recall. Later the NHTSA said it has started an investigation into NSANY (Nissan) related to 455k vehicles over engine failure reports where vehicles have lost power while in motion, raising safety concerns. Elsewhere, Republicans in the House of Representatives subpoenaed BLK and STT in their effort to prove corporate ESG policies violate antitrust laws. (BLK responded by saying “Having already produced more than 7,700 documents and 91,000 pages, a subpoena was not necessary but we understand this is the Committee’s practice, and we will continue to cooperate.” Meanwhile, STT said, “We remain confident that we have not violated any anti-trust laws.” After the close, Reuters reported that FDA investigators found quality control lapses at MRNA’s main factory, including equipment issues on machines used in the production of COVID-19 vaccines. The inspections were in September and disclosed Friday as part of a Freedom of Information request. Later, on Friday evening, a US court struck down the FTC’s order against ILMN’s purchase of Grail (a cancer diagnostic test maker). The three-judge panel ordered reconsideration of the deal. Finally, Friday night, Reuters reported that ATVI will pay $50 million to settle a 2021 lawsuit by a CA regulator that alleged the company discriminated against women employees. (The company paid $18 million to settle similar claims brought by the US EEOC.)

Overnight, Asian markets leaned toward the red side with only three of 12 exchanges in the green. Shenzhen (-1.13%) and Hong Kong (-0.97%) were by far the biggest movers in the region. In Europe, markets are mixed but also lean toward the red at midday. The CAC (-0.28%), DAX (-0.30%), and FTSE (+0.59%) lead a region with six bourses in the green and nine in the red in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a start to the day on the green side of flat. The DIA implies a +0.18% open, the SPY is implying a +0.22% open, and the QQQ implies a +0.09% open at this hour. At the same time, 10-year bond yields are down a bit to 3.911% and Oil (WTI) is up three-quarters of a percent to $71.97 per barrel in early trading.

There is no major economic news scheduled for Monday. There are also no major earnings reports scheduled for before the open. Then, after the close, HEI reports.

In economic news later this week, on Tuesday we get Nov. Building Permits, Nov. Housing Starts, TIC Net Long-Term Transactions, and the API Weekly Crude Oil Stocks. Then Wednesday, Q3 Current Account, Conf. Board Consumer Confidence, Nov. Existing Home Sales, and EIA Crude Oil Inventories are reported. On Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q3 GDP, Q3 GDP Price Index, Philly Fed Mfg. Index, and the Fed Balance Sheet. Finally, on Friday, Nov. PCE Price Index, Nov. Core PCE Price Index, Nov. Durable Goods, Nov. Personal Spending, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Expectations, Michigan 5-year Inflation Expectations, and Nov. New Home Sales are reported.

In terms of earnings reports later this week, on Tuesday, ACN, FDS FDX, SCS, and WOR report. Then Wednesday we hear from GIS, TTC, WGO, MU, and MLKN. On Thursday, KMX, CCL, CTAS, PAYX, AIR, NKE and WS report. There are no earnings reports on Friday.

In positive miscellaneous news, Quiver Quantitative reported Friday that the Fed pivot during 2024 will unlock an enormous $6 trillion in cash currently stashed in money markets and short-term bonds. The analyst suggests that this could be the driver for another leg of rally as “dry powder” is put to work seeking higher returns. BLK data shows that this has been the case in post-hike periods. In other somewhat hopeful news (in terms of keeping consumers, the engine of the economy, above water), gasoline prices have reached a new low since early 2021. In addition, mortgage rates are heading in the same downward direction, albeit much more slowly than gas, which could help home buyers.

In negative miscellaneous news, mining magnate Friedland (who founded IVPAF and IVN.TO) told Bloomberg Friday that copper prices need to reach $15,000/ton before mining firms will build new mines to expand the supply. He expects demand from new cleaner energy transitions to increase copper prices to $9000 per ton in 2024. (Up from the current $8470/ton.) However, according to Friedland, this is nowhere near what is needed to justify expanding operations. Elsewhere, in the wake of recent Houthi missile attacks, shipping giants AMKAF (Maersk) and HLAGF (Hapag-Lloyd) have suspended shipping through the Red Sea (meaning also through the Suez Canal). This means shipping routes become longer, slower, and more expensive as ships are now being routed around the horn of Africa instead. (It is worth noting, that prior to the Israel-Hamas war, 12% of global trade passed through the Red Sea.) In late-breaking news, oil giant BP joined the list of companies rerouting all shipments away from the Suez Canal and Red Sea to reduce risk (at the cost of greatly increased shipping expense and time).

In last-minute news, overnight Japan’s Nippon Steel announced it had agreed to buy X for $14.9 billion. That amounts to $55 per share. X has skyrocketed in premarket trading but remains $5 below the offer price at this point. Elsewhere, LUV has agreed to pay a $35 million fine and $115 million in passenger compensation for last December’s massive spate of thousands of flight cancellations which left two million passengers stranded.

With that background, it looks like all three major index ETFs are looking to move modestly higher in premarket action. The SPY and QQQ are giving us very small, white-bodied candles so far in the early session. However, DIA is printing by far the largest and black-bodied candle, having faded most of its premarket gap up. All three remain well above their T-line (8ema) this morning. So, overall, the Bulls remain well in control of both the longer-term trend and the short-term trends. In terms of extension, none of the three major index ETFs are too far extended above their T-lines. However, the T2122 indicator sits just barely outside of its overbought range. This could mean the Bulls need more rest and consolidation to avoid exhaustion. However, strictly speaking both the Bulls and Bears have some room to run if they gather the momentum to do so.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Friday’s market was light and choppy as investors seemed to rest after seven straight weeks of buying pushing equity charts into parabolic patterns. That said, there is still nothing in the price action that would suggest the bears are waking up but we should not be surprised if profit-taking begins at any time. With light earnings an economic calendar and the gap up open suggested in the futures market watch for the possibility of a pop-and-drop as Asian and European markets pull back slightly.

Overnight Asian markets mostly declined with only South Korea squeaking out a positive close on defense sector gains. European markets trade mostly in the red this morning with only the FTSE higher after five straight weeks of gains. U.S. Futures, however, wants to keep the buying party going into the new week but after seven consecutive weeks of gains and a holiday just around the corner profit-taking could begin at any time.

The only notable report for Monday is HEI.

Nippon Steel, the largest steelmaker in Japan, is eyeing to acquire United States Steel, the second-largest steel producer in the U.S., in a deal that could be worth more than 1 trillion yen ($7.01 billion), according to the Nikkei newspaper. The report, which was published on Monday, did not receive any confirmation from Nippon Steel, as its spokesperson refused to comment on the matter. The report said that Nippon Steel views the U.S. as a promising market that can compensate for the shrinking demand in Japan, where the population and the economy are aging. The report also said that Nippon Steel intends to make U.S. Steel a fully owned subsidiary, as part of its global expansion strategy.

Southwest Airlines, the largest domestic carrier in the U.S., agreed to pay a $35 million fine and a $140 million settlement to end a federal probe into its massive flight disruptions in December 2022. The airline had canceled thousands of flights and left more than 2 million travelers stranded over the holidays, due to a combination of bad weather, staffing shortages, and operational issues. The settlement will mostly be used to reimburse future passengers, as the U.S. Department of Transportation wants to encourage Southwest to prevent such chaos from happening again. The government said that this was the biggest penalty it has ever levied on an airline for breaking consumer protection laws.

The former head of the Federal Deposit Insurance Corporation (FDIC), Sheila Bair, has warned that the Fed is fueling a false sense of optimism in the markets by signaling possible rate cuts in 2024. Bair, who oversaw the FDIC during the worst financial crisis since the Great Depression, criticized Fed Chair Jerome Powell for being too soft on inflation and fostering a climate of “irrational exuberance” among investors. She argued that the Fed should focus more on keeping inflation under control, rather than stimulating the economy with lower interest rates.

The equity markets mostly chopped on Friday perhaps needing a rest as after seven straight weeks of rally producing parabolic patterns but no sign of the bears or profit-takers stepping up just yet. Small-cap stocks outperformed the rest, surging over 5% this week and about 11% in December, as investors became more hopeful about the economic recovery, and a Fed rate pivot next year. Interest rates held steady Friday, as bond yields held near July lows. Today we have a very light day of data with only one notable earnings report coming after the bell and the Housing Market Index report on the economic calendar. Traders should bear in mind with Christmas next Monday volume could begin to quickly decline by mid-week as folks extend holiday vacations.

Trade Wisely,

Doug

Markets gapped higher at the open on Thursday. The SPY gapped up 0.44%, DIA opened 0.31% higher, and QQQ gapped up 0.40%. At that point, SPY wobbled sideways around that opening level, visiting the highs of the day again at 1 p.m. At the same time, QQQ sold off and then bounced back to the open level at about 12:50 p.m. DIA actually trended modestly higher all morning reaching the high of the day at about 12:50 p.m. From there, all three major index ETFs sold off sharply reaching the low of the day at 2 p.m. Then all three rallied the remainder of the day. This action gave us gap-up, indecisive Doji or Spinning Top candles in all three. All remain well above their T-line (8ema). The action also left the DIA at another all-time high and all-time high close, QQQ within 1.3% of its all-time high, and SPY within 1.7% of its all-time high.

On the day, eight of the 10 sectors were in the green with Basic Materials (+2.65%) and Energy (+2.47%) out in front leading the way higher while Consumer Defensive (-0.79%) lagged behind the other sectors. At the same time, the SPY gained 0.32%, DIA gained 0.43%, and QQQ lost 0.09%. The VXX fell another 0.57% to close at 15.62 and T2122 ticked down but remained in the top end of its overbought territory to close at 97.90. 10-year bond yields fell again to 3.921% and Oil (WTI) spiked another 3.15% to close at $71.65 per barrel. So, on Thursday, the market was very stretched and the Bulls needed rest. However, we gapped higher again at which time markets became undecided as traders realized the market was very stretched. This all came on above-average volume in the DIA and QQQ, as well as average volume in the SPY.

The major economic news reported Thursday included Weekly Initial Jobless Claims, which came in lower than expected at 202k (compared to a forecast of 220k and the prior week’s 221k). Meanwhile, Weekly Continuing Claims rose to 1,876k (versus a forecast of 1,887k and the previous week’s 1,856k). At the same time, Nov. Export Price Index came in better than expected a -0.9% (compared to the -1.0% forecast and the October reading of -0.9%). On the other side, the Nov. Import Price Index also fell less than predicted at -0.4% (versus a forecast of -0.8% and October’s -0.6%). At the same time, November Retail Sales remained strong at +0.3% (compared to a forecast calling for -0.1% and October’s -0.2%). Later, October Retail Inventories were right in line with the anticipated at -0.9% (versus a forecast of -0.9% and much better than the September +0.4%). At the same time, Oct. Business Inventories were better than we predicted at -0.1% (compared to a 0.0% forecast and a Sept. +0.2%). Finally, after the close, the Fed Balance Sheet actually GREW by $3 billion this week as it was reported at $7.740 trillion (versus the prior week’s $7.737 trillion).

After the close, COST, LEN, and NASB all reported beats on both the revenue and earnings lines. Meanwhile, SCHL missed on both the top and bottom lines. It is worth noting that LEN raised its forward guidance while SCHL lowered its own guidance. It is also worth noting that COST announced a special $15/share dividend for holders of record on 12/28 to be payable on 1/15/24.

In stock news, on Thursday, GM fired nine executives and 900 employees (24% of its workforce) from the Cruise autonomous taxi unit amidst a continuing investigation of safety following an Oct. 2 incident where one of the taxis ran over and dragged a pedestrian 20 feet. At the same time, C announced it would close its municipal business unit (which underwrites loans to state and local governments). Meanwhile, INTC announced a new line of high-end AI products to be released in 2024, which they claimed were more powerful than the current pure performance leader from NDVA. Later, T announced they would add RIVN electric vehicles to their corporate fleet in 2024. (Financial details were not disclosed.) Elsewhere, a coalition of Nordic institutional investment funds sent a letter to TSLA on Thursday, “expressing concern” that the company has refused to enter into collective bargaining, specifically with Swedish mechanics. (The letter stopped short of threatening to divest but that may be implied given the large funds involved and the region’s social and economic climate.) Later, Reuters reported that WH franchise operators are expressing concern that the hostile takeover bid launched by CHH could hurt their business. (80% of the franchisees surveyed said the merger would hurt their individual business.) Late in the day, BP announced it had restarted a gasoline pipeline in WA state. The pipeline had been closed after it leaked 25,000 gallons on Sunday. After the close, GM announced it would lay off 1,300 workers at two MI plants in January.

In stock government, legal, and regulatory news, the FDA approved an MDT treatment for atrial fibrillation (irregular heartbeat), which is a major market niche. At the same time, Italian police seized $94.5 million from UPS over alleged tax fraud and illegal labor practices. Later, the NRLB released a complaint against SBUX, alleging the coffee company closed 23 stores to discourage unionization as well as eight stores that had recently unionized. This is now subject to a lawsuit. At the same time, the FTC announced it would issue its decision on the KR acquisition of ACI for $24.6 billion on January 17. However, sources reported that the agency is already working on a lawsuit that will be filed to stop that deal as soon as early January. Later, the FDA issued a warning to CHWY and four other companies for selling (and in some cases making) unapproved animal antibiotics. At the same time, the NHTSA announced it was opening an investigation into 447k VLKAF (Volkswagen) Golf and Audi A3 cars over fuel leaks. (Some of these cars were subject to a 2016 recall that was supposed to solve the issue.) Elsewhere, a judge in San Francisco ruled Thursday that Elon Musk must testify again in the SEC investigation of his $44 billion takeover of Twitter.

Overnight, Asian markets were mixed but mostly in the green. Hong Kong (+2.38%) and India (+1.29%) led the gainers while Shanghai (-0.56%) and Shenzhen (-0.35%) paced the losses. In Europe, we see a similar picture taking shape with 10 of the 15 exchanges in the green at midday. The CAC (+0.60%), DAX (+0.28%), and FTSE (-0.28%) lead the region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward another green start to the day. The DIA implies a +0.26% open, the SPY is implying a +0.24% open, and the QQQ implies a +0.33% open at this hour. At the same time, 10-year bond yields continue to fall and are at 3.902% while Oil (WTI) is up a half of a percent to $71.97 in early trading.

The major economic news scheduled for Friday includes NY Empire State Mfg. Index (8:30 a.m.), Nov. Industrial Production (9:15 a.m.), S&P Global Mfg. PMI, S&P Global Services PMI, and S&P Global Composite PMI (all at 9:45 a.m.). The major earnings report scheduled for before the open is limited to DRI. There are no major earnings reports scheduled for after the close.

In miscellaneous news, the International Energy Agency (IEA) revised the 2024 oil demand forecast Thursday, increasing the projected demand for oil upward by 130k barrels per day in the US. In total, the IEA increased the global demand forecast by 1.1 million barrels per day. This revised forecast reflected a more positive outlook on the US economy. (This was the proximate cause of Thursday’s spike in oil prices.) At the same time, the US average mortgage rate fell below 7% for the first time in four months. Meanwhile, Bloomberg reported that US car dealer inventory of electric vehicles grew to a 114-day supply. (This compares to a 71-day supply of cars overall and a 53-day supply of EVs one year ago.)

In geopolitical news, the European Union began formal talks with Ukraine over that country’s admission into the EU. This was a surprise decision and well ahead of the planned schedule. However, Putin-lackey Victor Orban of Hungary vetoed a critical EU aid $55 billion aid package for Ukraine. This comes the same week as Republicans blocked another attempt to pass more US aid to Ukraine over their domestic political agenda. As one result of the loss of outside support for Ukrainian sovereignty and democracy, Russia’s Putin told a 4-hour live Q/A panel that Ukraine’s support is crumbling, his forces remain on the offensive on all fronts, and he has no intention of ending the war until he has conquered all of Ukraine, disarmed then, and installed a neutral (read Russia obedient) government. In Israel, the defense minister told the press that the war will continue for about seven months according to their projections. Having already extracted a 30-40:1 retribution, and now publicly ruled out both the Palestinian Authority (from the West Bank), Hamas, and foreign troops as post-war governance for the area, the options in Gaza are bleak. (Only annihilation, subjugation, annexation, or diaspora come to my mind.) So, it seems Autocracy is all the rage on the political right across the world.

So far this morning, DRI missed on revenue (slightly = 0.4%) while beating on earnings (significantly = 9.7%).

With that background, it looks like all three major index ETFs are looking to follow through on again. All three major index ETFs opened the premarket a bit higher. However, they are printing small, indecisive (Doji-like) candles so far in the early session. All three remain well above their T-line (8ema) this morning. So, overall, the Bulls remain well in control of both the longer-term trend and the short-term trends. In terms of extension, all three major index ETFs remain extended above their T-lines. The T2122 indicator also remains in the top of its overbought range. This means the Bulls need rest and consolidation to avoid exhaustion in order to keep the rally healthy. We just have to remember that the market can remain stretched too far in either direction a lot longer than we can stay solvent betting on a reversal that hasn’t happened yet. Also remember this is Friday, payday, and a two-day weekend news cycle lies ahead. So, prepare your account by taking profits, hedging, buying insurance, and/or lightening up positions. And keep in mind that chasing a bull after he’s been running is a good way to get gored.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service