Public e-Learning 1-9-24 – John

Uncertainty

Markets finished mostly lower in a choppy Tuesday session as CPI uncertainty ruled the day. The QQQ outshined the rest with the tech giants providing the majority of the bullish effort. Optimism grew among businesses yet remains below the 50-year average of 98.8 continuing to indicate small business uncertainty. Today investors will look for inspiration in Mortgage Apps, Inventories, Petroleum Status, and Fed speak as we hurry up and wait on Thursday’s CPI report. A lot is riding on this inflation report with so much bullish sentiment so plan carefully as big point moves are possible before the market opens tomorrow.

While we slept the Nikkei broke the 34,000 level for the time since 1990 while at the same time, the Chinese CSI 300 declined to near 5-lows as Asian markets closed the day mostly lower. European markets trade mostly lower this morning with modest gains and losses in a caution session waiting on inflation data. However, U.S. futures are mixed this morning the Nasdaq leading the way higher as the tech giants dominate buying interest.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include only, KBH.

News & Technicals’

X, a social media platform, said on Tuesday that it has finished a preliminary investigation into the hacked account of the U.S. Securities and Exchange Commission (SEC) that showed a fake post. The post claimed that the SEC was investigating a major company for fraud. X said that the hack was not caused by any flaw in X’s systems, but by an unknown person who gained access to a phone number linked to the @SECGov account through another service. X said it has taken steps to secure the account and prevent further incidents.

A major attack by Iranian-backed Houthi rebels on commercial ships in the Red Sea has triggered a response from the U.S. Navy, which has deployed four warships from Operation Prosperity Guardian to the area. The operation is a maritime security mission that aims to protect the vital waterway from Houthi threats. According to CNBC, about 50 merchant vessels are in the vicinity of the attack, which is the largest of its kind by the Houthi militants. The attack poses a serious risk to global trade and stability in the region.

HPE, a technology company that provides hardware, software, and services, announced on Tuesday that it will buy Juniper Networks, a network equipment maker, for $14 billion in cash. The deal will expand HPE’s portfolio of networking products and solutions, and strengthen its position in the cloud and edge computing markets. Juniper’s stock soared on Tuesday after the Wall Street Journal reported on Monday night that the deal was imminent. HPE is paying $40 per share for Juniper, which is 32% higher than Juniper’s closing price on Monday before the news broke.

Uncertainty ruled the day on Tuesday as stocks ended mostly lower, as investors look ahead to the December CPI inflation data and the Friday kick-off of earnings season. The Nasdaq did better than both the S&P 500 and Dow Jones with the tech giants doing most of the lifting. The NFIB Small Business Optimism survey rose a bit for December to 91.9, but was still lower than its 50-year average of 98.0, showing that small business confidence is low. Meanwhile, WTI crude oil recovered, rising over 1.5% to around $72, after falling over 4% on Monday, as oil markets faced more geopolitical and supply challenges. Today it’s likely more of the same hurry-up and wait choppy price action with a chance Mortgage Apps, Inventories, Petroleum Status, and more Fed pontification could provide some bullish or bearish inspiration. With so much bullish sentiment a lot is riding on tomorrow’s CPI number so plan your risk carefully as big price moves are possible before the bell.

Trade Wisely,

Doug

Waiting On CPI and Earnings

Markets gapped lower Tuesday as the Bears tried hard to deny the Bulls any follow-through on the Monday candles. SPY opened 0.56 lower, DIA opened 0.54% lower, and QQQ opened down 0.74%. However, the Bulls stepped in right at the open to lead a rally (at least in the QQQ and SPY) that lasted until shortly after 1 p.m. QQQ had recrossed the opening gap by 11:55 a.m. and continued higher while SPY recrossed its by 1 p.m. After that, both traded sideways with a slight bearish trend. Meanwhile, DIA just treaded sideways after the open, with a very slight bullish trend. The action gave us white-bodied candles in the QQQ and SPY (both retesting and staying above their T-line) as well as a white-bodied Spinning Top in the DIA (which gapped below and did not cross back above its T-line).

On the day, eight of the 10 sectors were in the red again with Energy (-1.31%) out in front leading the way lower while Consumer Defensive was dead flat and Technology (+0.09%) was the lone green spot on the board. At the same time, the SPY lost 0.17%, DIA lost 0.44%, and QQQ gained 0.20%. Meanwhile, VXX fell 2.30% to close at 14.84 and T2122 dropped back into the center of its mid-range at 45.00. 10-year bond yields were basically flat at 4.021% and Oil (WTI) climbed 2.05% to close at $72.22 per barrel. On the day, we saw the significant gap lower but from that point forward the Bulls were in control all day. This all happened on below-average volume in the SPY, DIA, and QQQ.

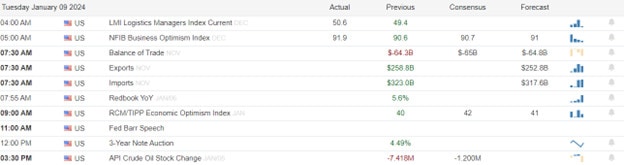

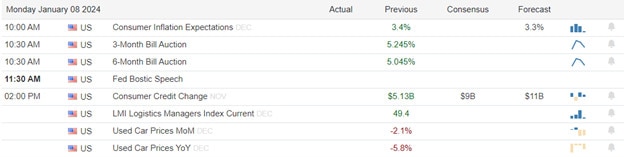

The economic news on Tuesday included November Imports were down, at $316.90 billion (compared to the October value of $323.10 billion, meaning there was a $6.20 billion reduction). At the same time, the Nov. Exports were down a bit less at $253.70 billion (versus the October $258.60 billion, a $4.90 billion reduction). This resulted in a Nov. Trade Balance that was a bit better than anticipated at $63.20 billion (compared to a forecast $65.00 billion deficit and an October deficit of $64.50 billion). Then, after the close, API Weekly Crude Oil Stocks showed a much larger drawdown than was expected at -5.215 million barrels (versus a forecasted 1.200-million-barrel draw but not as much as the prior week’s 7.418-million-barrel drawdown).

In Fed news, Vice-Chair Barr announced the end of the bank’s Term Funding Program (emergency loans initiated during the regional bank crisis). Barr said financial stress s has been successfully eased and there is no immediate crisis in the banks sector. He acknowledged concerns about banks coming to rely on the program as rates are cut later this year. The program ends on March 11, a year after it was launched. In a related story, GS analysts said Tuesday that they expect major bank profits to decrease 10% for Q4 when they begin reporting Friday. GS attributed the decline in the forecast to a 15% fall in trading profits, higher payouts to depositors, and an unspecified increase in reserves for loan defaults.

After the close, PSMT beat on both the revenue and earnings lines. At the same time, WDFC reported a massive miss on revenue and, at the same time, a huge beat on earnings ($140 million revenue versus $576 million forecast and $1.28/share earnings versus $1.00/share consensus forecast).

In stock news, SSREY (Swiss Re, a major insurer of insurers) announced Tuesday that US insurers accounted for the bulk of 2023’s $95 billion in insured losses. (The 30-year average of insured losses is $57 billion while the 10-year average is up to $90 billion due to climate change impacts). At the same time, GE announced they have signed a record-setting deal to supply 674 large wind turbines to Canadian wind project developer Pattern Energy. (Financial details of the “record-setting” deal were not disclosed.) Later, Reuters reported that HPE is near to a $13 billion deal to buy JNPR with the deal to be announced as early as the next few days. (JNPR ended the day 21.81% higher.) At the same time, amidst all its problems related to the 737 MAX 9, BA announced its 2023 deliveries reached 528 aircraft, the most since 2018 (before its 737-MAX debacle of multiple crashes). Elsewhere, UNP said Tuesday it is expecting a 24–48-hour delay in shipments as blizzards in the Midwest impact railroad operations. In a related story, TSN announced it had closed meat processing plants in KS due to the storm. Later, STLA, BB, and AMZN unveiled a collaboration product that allows “infotainment” to be streamed to vehicles 100 times faster than current methods. At the same time, BLK announced the cut of roughly 600 jobs (3% of its workforce) but said the company expects a higher headcount by the end of 2024. After the close, BA CEO Calhoun acknowledged the company’s “mistake” when speaking about the explosive decompression of an ALK flight on Sunday and subsequent loose bolts found on multiple airlines’ 737 MAX 9 jets.

In stock government, legal, and regulatory news, Reuters reported Tuesday that TSLA has lowered its guidance range, citing new tighter US vehicle-testing regulations. As a result, TSLA cut the range estimates on all of its models. (In the past, TSLA rigged the in-car algorithm to misreport miles left on a battery charge to assume absolute optimal conditions. This stood in stark contrast to the stricter mileage standards traditional internal combustion vehicles have to follow. In addition, in 2023 it was discovered that TSLA had created an internal team to suppress thousands and thousands of customer driving-range complaints.) At the same time, 12 members of the UK parliament sent a public letter to the Chairman of the SEC, arguing that the US market regulator should block to listing of JBSAY (now pink sheet) on the NYSE. Their reason is that the company is allegedly slowing efforts to curb global warming via deforestation. Later, GOOGL presented its case in a Boston federal court to argue against computer scientists’ claims that the company should be forced to pay $1.67 billion for infringing patents related to the processors GOOGL uses to power AI applications. At the same time, META announced it will hide more content from teens as regulators in the EU and US have pressed the company to protect children from harmful content. (META says teens will, now, by default be placed under the most restrictive of their content-control settings.) Elsewhere, Reuters reported that EU antitrust regulators are examining MSFT’s investment into OpenAI related to the EU merger rules. (Interested parties have until March 11 to provide input and feedback related to the matter and its impact on competition before the investigation starts in earnest.) Interestingly, China announced late Tuesday that one of its state-backed institutions has devised a way to identify users who send messages via AAPL’s AirDrop Bluetooth feature. (It was not known what benefits China would get by announcing this crack, but the release could hurt AAPL since this feature is used globally by protesters, activists, and general iPhone users.)

Overnight, Asian markets were mostly red with only two of 12 exchanges in the green. However, by far the biggest mover in the region was Japan (+2.01%). Malaysia (-0.80%), South Korea (-0.75%), and Australia (-0.69%) paced the losses in the region. Meanwhile, in Europe, a similar picture is taking shape at midday with only two of 15 bourses in the green. However, again, by far the biggest mover is Portugal (+1.80%). The CAC (-0.15%), DAX (-0.09%), and FTSE (-0.31%) lead the region lower in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a mixed, flat start to the day. The DIA implies a -0.13% open, the SPY is implying a -0.04% open, and the QQQ implies a +0.07% open at this hour. At the same time, 10-year bond yields are back down a bit to 3.998% and Oil (WTI) is up one-third of a percent to $72.45 per barrel in early trading.

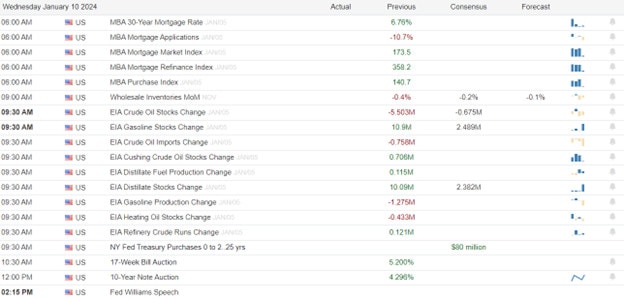

The major economic news scheduled for Wednesday is limited to EIA Weekly Crude Oil Inventories (10:30 a.m.) and Fed member Williams speaks at 3:15 p.m. There are no major earnings reports scheduled for before the open. However, after the close, KBH reports.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Dec. Core CPI, Dec. CPI, Dec. Federal Budget Balance, and the Fed’s Balance Sheet. On Friday, Dec. Core PPI, Dec. PPI, and the WASDE Ag report are delivered.

In terms of earnings reports, the main thrust does not start again until the end of the week. On Thursday, INFY reports. Finally, on Friday, we hear from BAC, BK, BLK, C, DAL, JPM, UNH, WFC, and WIT.

In miscellaneous news, on Tuesday the CME announced it is rolling out new longer-horizon e-mini futures for both the S&P-500 and Nasdaq-100. The new products will begin trading on January 29 and are intended to allow traders to trade around longer-term economic cycles. They will feature quarter-end and year-end expirations. Elsewhere, Moody’s reported that US office space vacancies rose to a record level in Q4 as 25 million square feet of new space came online, more people continue to work from home since the pandemic, and companies downsize operations to reduce costs. The survey found that 19.6% of office space was empty in Q4. (The prior record was 19.3% set twice in the past.) Meanwhile, the SEC confirmed that its official X (formerly Twitter) account had been “compromised” (not due to a hack of X systems) and then a bogus tweet announcing the approval of Bitcoin ETFs had been sent. While the real approval is widely expected sometime this week, the news caused a brief spike and the rebuttal caused a brief plunge in Bitcoin prices. (The SEC specifically saying it was not due to a hack, tends to imply that this was just an early release of news that will come very soon.) Finally, in societal news, the UK publication The Guardian reported that newly released data shows that US police agencies killed a record 1,232 people in 2023. (It is worth noting the statistics have only been gathered since 2013.) Oddly, the increase in police violence comes even as US violent crime and especially murder rates declined a whopping 13% in 2023. The increase in police killings was driven by disproportionate increases in rural geographic areas.

In government shutdown news, Republican Senators told reporters Tuesday that a “short-term continuing resolution” will be needed to avoid a government shutdown on January 19. Senator Thune had told reporters that a CR through sometime in March would be needed for negotiators to finish and the Senate to act on the results. House Speaker Johnson said he (and his House GOP caucus) would have a hard time swallowing that. However, later, Senate Majority Leader McConnell told reporters “It was obvious.” He went on to say, “The simplest things take a week in the Senate. So, I think the House doesn’t understand how long it takes to get something through the Senate.” McConnell continued, “We’re going to have to pass a CR,” McConnell said. “We need to prevent a government shutdown.”

In mortgage news, loan demand spiked 10% last week as rates for 30-year, fixed-rate, conforming loans (20% down) dropped from 6.81% to 6.76%. (Closing points remained unchanged at 0.61%.) Applications for new home purchase loans rose 6% but were still 16% lower than a year prior. At the same time, applications for refinance loans jumped 19% from the prior week and were 30% higher than a year prior.

With that background, it looks like markets are indecisive this morning with all three major index ETFs printing candles in the premarket that are mostly wick. With that said, the QQQ did gap a bit higher and the body of those indecisive candles are white. DIA is also retestings its T-line (8ema) from below in the early session. So, the Bulls still have control of the short-term trend (again, mostly on the back of Monday’s strong white candles). However, it is not a done deal with the move not decidedly bullish yet. The longer-term bullish daily trend lines remain broken but there is no Bearish trend established yet. So, technically we are not yet in a downtrend. In terms of extension, none of the three major index ETFs are far from their T-line (8ema). At the same time, the T2122 indicator is now sitting in the middle of its mid-range. So, both the Bulls and Bears do have room to run if they can gather the momentum to do it. Continue to keep an eye on the Tech Big Dogs. After a week of seeming rotation out of those names, we saw money flood back into them Monday as a slew of new product announcements came out of the CES trade show in Las Vegas. For that matter, watch CES as Tuesday saw a slew of non-Big Dog product announcements such as a new EV line of cars from HMC. Either way those seven Big Dog to ten stocks decided to go, it will be hard for the market to do anything but follow.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Strong Rally

The indexes enjoyed a strong rally and a big reversal in the Dow as buyers rejected the early selling move but it should be noted that volume was a bit anemic at the same time. Big tech names surged sharply as buyers rushed in while defensive sector names also rallied hinting at a possible institutional rotation. Today we have another light day with only International Trade and a Fed speaker left on the economic calendar. However, do have a few more notable earnings reports as a warm-up to the big bank reports beginning on Friday. Keep in mind choppy, volatile price action is likely as we wait for Thursday’s inflation data.

Overnight Asian markets finished mixed with modest gains and losses overall despite the NIKKEI stretching to a 33-year high. European markets see modest declines across the board this morning as they cautiously await the inflation data. U.S. futures also point to a bearish open with the uncertainty of the pending data setting the stage for a big point range-bound choppy consolidation or maybe even a whipsaw as we wait for the CPI numbers.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AYI, ACI, AZZ, NEOG, PSMT, SGH, SNX, TLRY, and WDFC.

News & Technicals’

A safety issue with Boeing 737 Max 9 planes prompted the Federal Aviation Administration (FAA) to order a temporary grounding of dozens of these planes on Saturday. The FAA’s decision came after Alaska Flight 1282 experienced a midair panel blowout, which was caused by loose hardware in the engine. United Airlines and Alaska Airlines, which operate 737 Max 9 planes, conducted inspections and found similar problems in some of their planes. Boeing, the maker of the planes, said it issued guidance to airlines on how to check and fix the hardware issue.

Samsung Electronics, the world’s leading producer of dynamic random-access memory (DRAM) chips, announced on Tuesday that it expects a sharp decline in its operating profit for the fourth quarter of 2023. The company said that it anticipates an operating profit of 2.8 trillion won for the last three months of the year, which is 35% lower than the 4.31 trillion won it earned in the same period a year ago. The company attributed the drop in profit to weak demand and price competition for its DRAM chips, which are used in various consumer devices such as smartphones and computers.

Unity Software, a company that develops tools and platforms for creating and running interactive content, announced on Monday that it will cut 25% of its staff, or about 1,800 workers, as part of a reorganization plan. The company said that the layoffs are necessary to streamline its operations and focus on its core business, but it could not provide an estimate of the costs and charges associated with the reduction, which it expects to incur mostly in the first quarter of 2024. The layoffs come after a leadership change at Unity, as John Riccitiello stepped down as CEO in October and was replaced by James Whitehurst, the former CEO of Red Hat, as interim CEO.

Stocks ended the trading day with a strong rally on lower-than-average volume, after staying flat for most of the day. The S&P 500 rose 1.4%, recovering much of last week’s losses aided by a surge of buying in big tech names. Technology and growth stocks led the gains, with the Nasdaq rising 2%, while the Dow trailed with a 0.6% increase, dragged down by Boeing shares. The day was quiet in terms of news and economic data, despite the higher close. Expect the markets to be choppy and volatile as we wait for the crucial consumer price index (CPI) data out Thursday morning. Today we have another light day of economic data but a few more notable earnings to inspire the bulls or bears. Plan your risk carefully and try to avoid over-trading with the pending inflation data and big bank earnings beginning on Friday. Anything is possible!

Trade Wisely,

Doug

Contractor Def Tightened and CES Underway

On Monday, the Bulls took a little revenge for last week. The SPY opened a bit higher at +0.07%, DIA gapped down 0.33% (as BA weighed heavily on the Dow), and gapped up 0.29%. However, after the opening bell, QQQ rallied sharply until 10:50 a.m. and then began a slower, 45-degree rally that lasted the rest of the day. At the same time, the SPY steadily rallied along a 45-degree angle all day long. DIA was the laggard as it had to overcome the terrible BA move and it took the Dow 30 minutes to reverse the selling before starting a wavier 30-degree rally that finally filled the gap by 2 p.m. and continued slowly North. All three major index ETFs closed very near their highs of the day. This action gave us large, white, near-Marubozu candles in the SPY and QQQ (some might call it a Trader’s Best Friend…gap up from a Doji to a Marubozu) and a large white candle with a lower wick in the DIA. All three also crossed back above their T-line (8ema).

On the day, nine of the 10 sectors were in the green again with Technology (+2.57%) far out in front leading the way higher while Energy (-1.13%) was the lone laggard in the red. At the same time, the SPY gained 1.43%, DIA gained 0.59%, and QQQ gained 2.07%. (The QQQ’s huge day came on the back of many product introductions by several QQQ members at the annual CES conventions. Among these were MRVL (+6.99%), NVDA (+6.43%), and AMD (+5.48%).) Meanwhile, VXX fell 2.32% to close at 15.19 and T2122 climbed the top of the mid-range (to just outside of the overbought territory) at 78.45. 10-year bond yields backed off but remain above four percent to 4.013% and Oil (WTI) plummeted 3.78% to close at $71.02 per barrel. On the day, we saw the Bulls in control all day on what was slightly above-average volume in the DIA and below-average volume in the SPY and QQQ.

The economic news on Monday was limited to NY Fed 1-Year Consumer Inflation Expectations came in at 3.00%. This continued a steady decline since July 2022. The December value was 3.40%. So, the decline was significant. Then later, Consumer Credit (requiring installments) for November was reported much higher than predicted at $23.75 billion (versus a forecast of $9.00 billion and October’s perhaps artificially low $5.78 billion). On the Fed side, Atlanta Fed President Bostic spoke Monday afternoon. Bostic said that as long as inflation remains above 2%, his bias is for monetary policy to remain tight. However, he also said overall risks in the economy have become balanced between the risk of inflation and the risk of slower economic growth. Bostic went on to say he does anticipate rate cuts later this year, but said “I don’t think that’s where we are today.” (Seeming to push back against the idea of a March rate cut.) In the end, he said he was focused on his discussions with business leaders, and as of now, he is not hearing them say they are planning layoffs (which he implied would be the tipping point where risk was more on the economic slowdown side than the inflation side). Later, Fed Governor Bowman (traditionally very hawkish) retreated from her recent stances, telling a Bankers Assn. event that the current Fed rate policy appears to be “sufficiently restrictive.” Bowman said, “My view has evolved to consider the possibility that the rate of inflation could decline further with the policy rate held at the current level for some time.” She continued “Should inflation continue to fall closer to our 2 percent goal over time, it will eventually become appropriate to begin the process of lowering our policy rate to prevent policy from becoming overly restrictive.”

After the close, JEF missed on revenue while beating on earnings. JEF cited a Q4 lull in merger and acquisition deals as the reason for its revenue miss.

In stock news, BAC announced Monday that it will be taking a $1.6 billion charge in Q4 related to the bank no longer being able to use Bloomberg’s interest rate benchmark. (Apparently, the Bloomberg LIBOR index which is being discontinued was the basis for large commercial loan interest rate calculations. Although it is unclear why this would cost the bank so much money if the loans had a different interest rate basis.) Later, MRK announced it would buy cancer drug developer HARP for $680 million ($23/share or 118% premium on Friday’s close). At the same time, BCS announced it would cut 5,000 jobs globally as the bank undergoes an efficiency drive. Later, JNJ announced it would acquire AMAM for $2 billion ($28/share or a 106% premium on Friday’s close). Elsewhere, NVDA, AMD, and many other tech names announced a slew of new products at the CES trade show. Many of them squeezed “AI” into the announcements one way or another, but NVDA and AMD had legitimate AI product launches. (NVDA touting a “not quite high-end” AI chip to skirt US bans on sales to China and AMD touting AI capabilities in new consumer CPUs as well as even mid-tier graphics cards.) For its part, AAPL announced its new VR headset will go on sale starting Feb. 2. (It is not expected to have much in the way of sales with a staggering $3,499 price tag.) Meanwhile, apparel retailers LULU, ANF, CROX, and AEO all raised their Q4 guidance on Monday signaling a stronger-than-expected holiday shopping season. At the same time, ZEAL announced it had secured $214 million in funding through private placement on Monday. Later, VLKAF (Volkswagen) announced its cars will begin conversing with drivers via ChatGPT by the middle of 2024. (VLKAF partnered with CRNC on this technology.) At the same time, in a regulatory filing, videogame maker U said it was laying off 1,800 workers between now and the end of March.

In stock government, legal, and regulatory news, BRKB reached an agreement with the Haslam Family (former owners of Pilot Travel Centers aka Flying J Fuel stations) in the dispute over the accounting for the value of the remaining 20% owned by the Haslam family. As a result, a Delaware federal court officially ended the lawsuit which had been scheduled to start Monday. At the same time, Reuters reported that JNJ had reached a tentative agreement to pay $700 million to more than 40 states for having wrongfully marketed its talc-based baby products. The agreement avoids stating any link between the talc and various cancers. Later, the US Supreme Court refused to hear an appeal by XOM (and other petroleum interests) of an Appeals Court ruling that the company had engaged in decades of deceptive marketing and other tactics aimed at undermining climate science and government efforts to reduce the impacts of fossil fuels. This throws the case back to the MN state court where XOM had used federal appeals to block the case. Elsewhere, KKR said it intends to notify EU antitrust regulators of its plan to buyout Telecom Italia. KKR said the notification will be made by the end of January. Later, NFLX defeated a federal shareholder lawsuit that alleged the company had hidden the extent to which “account sharing” had been hurting company growth. The ruling said there was no evidence the company was aware of the extent of the problem during the period the plaintiffs had claimed. At the same time, the US Supreme Court also rejected an appeal by BTI and other tobacco makers seeking to block a CA state ban on flavored tobacco products. The ruling said the state law did not conflict with federal regulations on the matter. Finally, early Tuesday the Dept. of Labor issued a final rule that will curb the use of contract workers (not treated as employees and responsible for their own benefits and taxes). The move will have major implications across much of the economy from trucking to automaking, to UBER and LYFT. This is the exact opposite of the previous administration rules that made it easy for companies to classify workers as contractors and save up to 30% per worker according to multiple studies.

Overnight, Asian markets were mixed but leaned toward the green side. Japan (+1.16%) and Australia (+0.93%) paced the gainers while South Korea (-0.26%) and Thailand (-0.25%) led the losses. In Europe, the bourses are mostly in the red at midday. The CAC (-0.50%), DAX (-0.54%), and FTSE (-0.10%) lead the region on volume as always while Athens (+0.88%) leads three smaller exchanges in the green in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a gap-down start to the day. The DIA implies a -0.46% open, the SPY is implying a -0.47% open, and the QQQ implies a -0.65% open at this hour. At the same time, 10-year bond yields are up to 4.046% and Oil (WTI) is up 2.32% to $72.41 per barrel in early trading.

The major economic news scheduled for Tuesday includes Nov. Imports, Nov. Exports, and Nov. Trade Balance (all at 8:30 a.m.), EIA Short-Term Energy Outlook (noon), and API Weekly Crude Oil Stocks (4:30 p.m.). The major earnings reports scheduled for the day are limited to AYI, ACI, MSM, and SNX before the open. Then, after the close, PSMT and WDFC report.

In economic news later this week, on Wednesday, EIA Weekly Crude Oil Inventories are reported and Fed member Williams speaks. Then Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Dec. Core CPI, Dec. CPI, Dec. Federal Budget Balance, and the Fed’s Balance Sheet. On Friday, Dec. Core PPI, Dec. PPI, and the WASDE Ag report are delivered.

In terms of earnings reports, the main thrust does not start again until the end of the week. On Wednesday, we hear from KBH. On Thursday, INFY reports. Finally, on Friday, we hear from BAC, BK, BLK, C, DAL, JPM, UNH, WFC, and WIT.

In miscellaneous news, on Monday the issuers of Bitcoin spot-price ETFs started a price war on fees. All the potential ETFs announced their fees at significantly below the average for ETF management fees. (The average ETF charges 0.54% with the proposed Bitcoin ETFs coming in around 0.25%.) One even lowered its fees from 0.80% to 0.25% during the day. BLK remains on the high end, saying it will charge 0.30%. Elsewhere, Reuters reported that China has lifted the ban on net selling by mutual fund managers. (The previous ruling stated the managers had to buy more shares than they sold each day, artificially propping up Chinese stocks.) Meanwhile, the inspections of 737 MAX jets ordered by the FAA following Sunday’s ALK mid-air loss of part of the fuselage and explosive decompression has now found many jets with loose bolts on their bodies. This is another setback for BA and SPR (maker of BA fuselages). However, no determination has been made yet on whether this is a design or manufacturing issue. BA was down more than 8% Monday while SPR was down more than 11%.

In Oil news, Saudi Arabia’s unexpected price slashing Monday (cutting their price to $2 below the regional benchmark price) led to a large ripple-effect drop in US Oil (WTI) prices. As a result, oil majors like XOM, CVX, COP, OXY, MRO, etc. saw a greater than one percent drop in share prices. Elsewhere, after the close, a US federal judge granted a large group of Venezuela’s creditors the right to participate in the proceeds of the coming auction of Citgo Petroleum (Venezuelan-owned). OI and HII were among the companies approved to participate. (COP reached a separate settlement with Venezuela that precludes their participation.)

So far this morning, AYI reported beats on both the revenue and earnings lines. At the same time, MSM missed on both the top and bottom lines. (SNX and ACI report closer to the opening bell.)

With that background, it looks like the Bears are trying to mount a comeback this morning before the Bulls can get a second day of momentum started. All three major index ETFs opened the premarket lower with SPY and DIA putting in indecisive, Spinning Top-type candles. However, the QQQ opened lower and continued, now showing a larger, black-bodied candle that is the only one of the three retesting its T-line (8ema) at this point. So, the Bulls still have control of the short-term trend (mostly on the back of Monday’s strong white candles). However, it is not a done deal with the move not decidedly bullish yet. The longer-term bullish daily trend lines remain broken but there is no Bearish trend established yet. So, technically we are not yet in a downtrend. In terms of extension, none of the three major index ETFs are far from their T-line (8ema). However, at the same time, the T2122 indicator is just outside of its over-bought range. So, both the Bulls and Bears do have room to run if they can gather the momentum to do it, but it is the Bears that have the most slack to work with right now. Continue to keep an eye on the Tech Big Dogs. After a week of seeming rotation out of those names, we saw money flood back into them Monday as a slew of new product announcements came out of the CES trade show in Las Vegas. Either way those seven to ten stocks go, it will be hard for the market to do anything but follow given their massive daily volumes.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Public e-Learning 1-8-24 – John

Public e-Learning 1-8-24 – John

BA In Trouble Again and Big Bitcoin Week

The markets opened around the flat line on Friday. SPY opened up 0.05%, DIA started down 0.08%, and QQQ opened up 0.03%. At that point, all three major index ETFs began a rally that lasted until 10:15 a.m. in the DIA, until 11 a.m. in the SPY and until 11:20 a.m. in the QQQ. From there, all three sold off until 1:20 p.m. Then we saw a new wave up for about an hour followed by down wave down wave that lasted another hour and finally a 30 minute up wave to end the day. This action gave us White-bodied Spinning Top candles in all three major index ETFs. The DIA again retested its T-line (8ema) but failed to close above it. This happened on above-average volume in the DIA, less-than-average volume in the SPY, and average volume in the QQQ.

On the day, nine of the 10 sectors were in the green with Communications Services (+0.76%) out front leading the way higher while Consumer Defensive was the lone laggard in the red. At the same time, the SPY gained 0.14%, DIA gained 0.03%, and QQQ gained 0.12%. The VXX fell 3.30% to close at 15.55 and T2122 rose but still remained in its midrange at 45.71. 10-year bond yields rose back above four percent to 4.05% and Oil (WTI) spiked 2.4% to close at $73.92 per barrel. On the day, we saw a volatile seesaw action that really ended up not far from where Thursday had closed.

This ended a string of nine up weeks in a row in the SPY, DIA, and QQQ. On the week, SPY lost 1.55% (on average volume) and DIA lost 0.59% (on above-average volume). However, QQQ lost 3.12% (on less-than-average volume) in what seems to have been at least a short-term rotation out of the big dog tech names that have pulled markets higher for more than a year. TSLA fell 4.42%, AAPL dropped 5.90%, MSFT fell 2.20%, AMZN dropped 4.41%, AMD plummeted 5.99%, GOOGL fell 2.83%, and INTC plummeted 6.69% on the week. However, of these, only AAPL recorded even average volume for the week.

The economic news on Friday included Dec. Avg. Hourly Earnings (year-on-year) which came in higher than expected at +4.1% (compared to a forecast of +3.9% and the Nov. reading of +4.0%). On a month-on-month basis this was +0.4% (versus a forecast of +0.3% but in line with November’s +0.4% value). At the same time, Dec. Nonfarm Payrolls were much stronger than expected at +216k (compared to a forecast of +170k and the Nov. reading of +173k). On the private side, Dec. Private Nonfarm Payrolls were also much stronger than predicted at +164k (versus a forecast of +130k and the Nov. value of +136k). These resulted in a Dec. Unemployment Rate that was lower than anticipated at 3.7% (compared to a forecast of 3.8% but in line with the November reading of 3.7%). The Dec. Participation Rate was lower than predicted at 62.5% (versus a forecast and November reading of 62.8%). So, the jobs market remains strong and workers saw real wage growth (compared to inflation) again last month. Later, Nov. Factory Orders were also much stronger than expected at +2.6% (versus a +2.1% forecast and far better than the November 3.4% decline). At the same time, Dec. ISM Non-Mfg. Employment was far below predicted at 43.3 (compared to a forecast of 51.0 and the November value of 50.7). Meanwhile, Dec. ISM Non-Mfg. PMI was also below expectations at 50.6 (versus the forecast of 52.6 and November’s 52.7 reading). Finally, Dec. ISM Non-Mfg. Prices were slightly above anticipated at 57.4 (compared to a forecast of 57.3 but down from November’s 58.3 value).

In stock news, STLA announced it would not advertise during next month’s Super Bowl, citing a challenging US auto market. (GM made the same announcement in November.) STLA has often been a significant advertiser at the event. At the same time, the Wall Street Journal reported that SNPS is in advanced discussions to buy ANSS for around $35 billion in cash and stock. Later, a large US medical study was reported in the peer-reviewed journal Nature Friday, which found NVO’s hit weight-loss drugs are not linked to an increase in suicidal thoughts. Elsewhere, Reuters reported that CHK and SWN are very close to a $17 billion merger agreement. After hours, Reuters reported that the UAW has reached a tentative deal with ALSN. Meanwhile, LLY announced a new website offering telehealth prescriptions and direct-to-home delivery of drugs on Friday. This move alone may not dramatically impact the pharmacy industry but other drugmakers are expected to follow suit, which could put pressure on grocery and pharmacy chains currently filling prescriptions. At the same time, the Insurance Journal reported Friday that AUR (driverless trucking technology) along with two other competing private firms intend to drop their human copilots from their semi-truck shipments, starting in Texas. (AUR carries freight for WMT, KR, FDX, TSN, and other major shippers.) On Saturday, ALK grounded its entire fleet of 65 BA 737 MAX 9 planes after a midnight flight Friday had an entire section of the fuselage blown out, causing explosive decompression of the cabin at 16,000 feet during a flight.

In stock government, legal, and regulatory news, in China, the State Administration for Market Regulation said Friday that TSLA would be recalling and fixing all 1.62 million vehicles (all sold in the country) equipped with the full self-driving feature. (This is for the same reason as the US recall of all TSLA vehicles sold in the US in December.) Later, MSFT and OpenAI were hit with a new lawsuit in federal court in NY Friday. The suit alleges the companies misused the works of nonfiction authors to train their AI models. At the same time, Reuters reported that India’s Antitrust Regulator launched an investigation into UPS, FDX, and Germany’s DHL for alleged collusion on discounts and tariffs. Elsewhere, the FDA approved a new topical gel treatment for the highly contagious skin disease molluscum contagiosum produced by LGND. (The disease impacts 6 million Americans per year with up to 73% of patients not receiving treatment.) During the afternoon, the New York Times reported that the US Dept. of Justice is preparing an antitrust lawsuit against AAPL. (The suit purportedly attacks the way AAPL watches only work with iPhones as well as exclusivity restrictions for the iMessage app as well as distribution of iPhone apps.) At the same time, the NASDAQ announced it will delist LMDX on January 9th. Later, two groups representing the auto dealers filed a lawsuit challenging the FTC consumer protection regulations finalized in December which ban “bait and switch” advertising tactics and prohibit dealerships from charging add-on costs without prior customer approval. (The groups are supported by GM, TM, VLKAF, and other automakers.) On Saturday, following the ALK incident with a BA 737 MAX 9 jet (see above), the FAA grounded some of the same model jets nationwide and ordered the immediate inspection of all BA 737 MAX 9 jets. (There are 215 in service worldwide and the FAA order impacts 171 of them.)

Overnight, Asian markets were mixed. Hong Kong (-1.88%), Shenzhen (-1.85%), and Shanghai (-1.42%) paced the losses while Malaysia (+0.54%), Taiwan (+0.31%), and Japan (+0.27%) led the gainers. In Europe, we see a similar picture taking shape at midday with only five of the 15 bourses in the green. The CAC (-0.02%), DAX (+0.15%), and FTSE (-0.25%) are typical of the region. Athens (+1.27%) and Portugal (-1.13%) are the outliers in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a mixed open with the Dow was an outlier. The DIA implies a -0.42% open, the SPY is implying a -0.05% open, and the QQQ implies a +0.07% open at this hour. At the same time, 10-year bond yields are back up to 4.061% and Oil (WTI) is down by 2.82% to $71.75 per barrel in early trading.

The major economic news scheduled for Monday is limited to the NY Fed 1-year Consumer Inflation Expectations (11 a.m.) and November Consumer Credit (3 p.m.). The major earnings reports scheduled for the day are limited to CMC and HELE before the open. Then, after the close, JEF reports.

In economic news later this week, on Tuesday we get Nov. Imports, Nov. Exports, Nov. Trade Balance, EIA Short-Term Energy Outlook, and API Weekly Crude Oil Stocks. On Wednesday, EIA Weekly Crude Oil Inventories are reported and Fed member Williams speaks. Then Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Dec. Core CPI, Dec. CPI, Dec. Federal Budget Balance, and the Fed’s Balance Sheet. On Friday, Dec. Core PPI, Dec. PPI, and the WASDE Ag report are delivered.

In terms of earnings reports, the main thrust does not start again until the end of the week. In the meantime, on Tuesday, AYI, ACI, MSM, SNX, PSMT, and WDFC report. Then Wednesday, we hear from KBH. On Thursday, INFY reports. Finally, on Friday, we hear from BAC, BK, BLK, C, DAL, JPM, UNH, WFC, and WIT.

In miscellaneous news, the NY Fed reported Friday that global supply chain issues eased in December. The report said the Fed’s proprietary supply chain pressure index came in a -0.15 for December, down from a November reading of +0.13. (The gauge peeked at +4.33 in December 2021.) Elsewhere, several major investment firms including BLK and FNF updated their filings Friday and hope that their Bitcoin spot price ETFs will be approved this week. This comes after the SEC asked the fund managers to submit written requests to accelerate approval.

In government funding news, the first of two cliffs (partial shutdowns) is scheduled for January 19. On Sunday afternoon, Congressional leaders (Senate Majority Leader Schumer and House Speaker Johnson) announced a $1.59 trillion agreement on the top-line spending number. The only details agreed are that this will be divided between $886 billion for Defense and $704 billion in non-defense spending. The deal does give a few more concessions to the MAGA types, allowing the GOP to renege on the June 2023 agreement. However, it doesn’t give specifics for any of the 12 appropriations bills and it is still unclear whether Speaker Johnson even has the power to get this agreement passed in his own House with the GOP majority now down to two votes (there is no tie-breaker in the House and so a tie vote fails).

So far this morning, CMC reported beats on both the revenue and earnings lines. At the same time, HELE beat on revenue while missing on earnings.

With that background, it looks like Mr. Market is indecisive so far this morning. The DIA opened the premarket with a gap lower and this has put in a small black-bodied candle that is about half wick. The other two major index ETFs are also giving no clear direction with the QQQ gapping down, but putting in the strongest whit-body of the two candles while SPY prints a true Doji type inside of Friday’s candle so far in the early session. So, the Bears remain in control of the short-term trend and the longer-term bullish daily trend lines remain broken. However, no new lower-high has presented itself in any of the three major index ETFs. (We are technically not yet in a downtrend.) In terms of extension, the two large-cap index ETFs are not far from their T-line (8ema), but the QQQ is getting a bit stretched below its T-line. At the same time, the T2122 indicator remains in its mid-range. So, both the Bulls and Bears do have room to run if they can gather the momentum to do it. Continue to keep an eye on the Tech Big Dogs. If we are seeing a rotation out of those names (which have dragged markets along for a year or more), it will be hard for markets to do anything except retreat.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Strong Labor Market

The Employment Situration report continues to not only indicate a strong labor market along with rising wages raised some worries about inflation as the dollar rallied and the 10-year bond yield rose back above 4%. We kick off the new week with a light earnings and economic calendar and it pretty much stays that way until until Thursday we we get the next reading on CPI. So as we hurry up and wait don’t be surprised to see just about anything in the price action including range bound chop as we wait in anticipation.

Asian markets closed the day mostly lower with the tech heavy Hong Kong leading the selling down 1.88% followed by Shanghai down 1.42%. Europeian markets trade mostly lower this morning with modest gains and losses in a cautious session waiting on pending inflation data. However, the U.S. futures point to a mixed open with as tech tries to bounce back with Dow under pressure due to the bad news for Boeing.

Economic Calendar

Earnings Calendar

Notable reports for Monday ACCD, HELE, & JEF.

News & Technicals’

Boeing, the aerospace giant, saw its shares plunge 8% in pre-market trading at 4:30 a.m. ET on Monday. The drop came after the Federal Aviation Administration (FAA) issued an emergency order on Saturday, requiring 171 Boeing planes around the world to undergo inspections before they can fly again. The order was triggered by an incident on Friday, when an Alaska Airlines flight suffered a blowout in one of its engines, forcing it to make an emergency landing. The National Transportation Safety Board (NTSB) is investigating the cause of the engine failure.

Audacy, a leading company in radio and podcasting, has announced that it will file for Chapter 11 bankruptcy protection to deal with its heavy debt burden. The company said that it has reached a restructuring agreement with its creditors, which will enable it to cut its total debt by 80%, from about $1.9 billion to about $350 million. The company said that the bankruptcy process will not affect its operations or its content offerings.

A $1.59 trillion spending deal was reached by congressional leaders on Sunday, as the government tries to prevent a possible shutdown. The deal sets the overall budget for the 2024 fiscal year, dividing $1.59 trillion between defense and non-defense spending, with $886 billion for the former and $704 billion for the latter. The deal shows that Johnson and Schumer, the leaders of the Senate, are cooperating, but it does not guarantee a funding agreement, as there are still policy disputes between the parties.

Cosco, a Chinese state-owned shipping company, has stopped its services to Israel via the Red Sea, amid rising conflicts in the vital waterway. The Red Sea connects the Mediterranean Sea and the Indian Ocean, and is a key route for global trade. Israeli state media reported that Cosco’s decision was based on security concerns, but did not reveal any further details. According to Globes, an Israeli financial news source, Cosco’s move could affect Israel’s imports and exports.

On Friday The U.S. employment data revealed a strong labor market, causing major indexes to swing between ups and downs. Job growth picked up, boosting the economy, but wage growth was higher than expected, raising inflation fears. The 10-year Treasury yield rose above 4%, hurting the defensive sectors, which are more affected by interest rates. However, today’s market changes were not very significant, and despite stocks finishing the first week of the year lower, only slightly correcting from the parbolic nine week bullish run. The FAA grounding sozens of 737 Max9s aircraft has the market feeling a bit bearish but little on the earnings and economic calendar anything is possible. In fact as we continue to wait for the official kickoff of earnings and the CPI and PPI reports later this week traders should consider the possibility of choppy range bound consolidations through mid week.

Trade Wisely,

Doug