Retail Earnings Start Strong Plus M&A

Friday was an up-and-down day in the stock market. SPY opened 0.07% lower, DIA gapped down 0.28%, and QQQ opened 0.10% higher. All three major index ETFs then sold off for 30 minutes, rallied much more slowly for two hours, sold off again for 75 minutes, rallied again for an hour, sold off sharply for 30 minutes, and then traded sideways in a tight range for 45 minutes before selling off the last few minutes of the day. This action gave us black-bodied, Bearish Harami, Spinning Top candles in the SPY and DIA. Both remained above their T-line (8ema). However, the QQQ printed a large, black-bodied Bearish Engulfing candle that could be seen as an Evening Star pattern if you squint. It also completed the first down week in any of the three major index ETFs following five straight weeks of gains.

On the day, seven of the 10 sectors were in the red Technology (-1.16 %) was way out in front (by half of a percent) leading the way lower Basic Materials (+0.35%) and Healthcare (+0.31%) holding up better than other sectors. Meanwhile, the SPY lost 0.50%, the DIA lost 0.53%, and tech-heavy QQQ dropped 0.91%. VXX fell 0.28% to close at 14.38 and T2122 dropped back out of the overbought territory to the very top of the mid-range at 78.15. 10-year bond yields spiked back up to 4.283% and Oil (WTI) gained 1.56% to close at $79.22 per barrel. So, Friday was a volatile day that swung up and down as PPI data came in hot, monthly options expired, and traders got ready for the three-day weekend. The net result was a down day. This happened on lower-than-average volume in all three major index ETFs, especially low in the DIA.

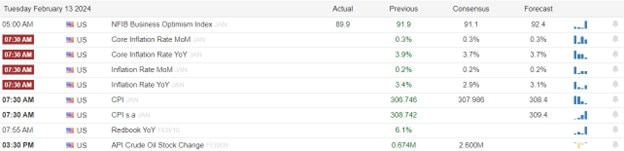

The major economic news released Friday included January Building Permits, which came in low at 1.470 million (compared to a forecast of 1.509 million and a December value of 1.493 million). At the same time, January Housing Starts were down sharply at 1.331 million (versus a forecast of 1.450 million and December 1.562 million value). Meanwhile, January Core PPI was hotter than expected at +0.5% (compared to a +0.1% forecast and a December reading of -0.1%). This resulted in a January PPI that was +0.3% (versus a forecast of +0.1% and a December -0.1% reading). Later, the Michigan Consumer Sentiment was up but just shy of predictions at 79.6 (compared to an 80.0 forecast and a January 79.0 value). At the same time, Michigan Consumer Expectations were stronger than anticipated at 78.4 (versus a 76.5 forecast and a 77.1 January reading). Meanwhile, the Michigan 1-Year Inflation Expectations ticked up to 3.0% (versus a 2.9% forecast and January value). Finally, Michigan 5-Year Inflation Expectations also held at 2.9% (compared to the forecast of 2.8% and January reading of 2.9%)

After the close, Monday, RIG beat on both the revenue and earnings lines. Meanwhile, JELD missed on revenue while beating on the earnings line. Unfortunately, DOOR missed on both the top and bottom lines.

In stock news, on Friday, NKE clarified its Thursday night announcement of job cuts. NKE says it will eliminate more than 1,600 jobs, which is about 2% of the company workforce. Later, LSDI announced it would implement a one-for-ten reverse stock split effective at the open on Monday, February 26. The move is being made to maintain compliance with NASDAQ rules that require listed stocks to stay above $1.00/share. (LSDI closed at $0.22 on Friday.) At the same time, UAW workers at the F truck plant in KY, the company’s largest and most profitable plant, announced they will strike next Friday unless local (plant-specific) issues are resolved. (These are mostly health and safety issues.) DB released a research study Monday on the “Magnificent 7” (AAPL, AMZN, GOOGL, META, MSFT, NVDA, and TSLA). DB’s study found that if the seven traded as a separate exchange, their combined market cap would make it the second-largest stock exchange in the world. In addition, if they were their own country, their combined revenue would put them in a dead heat for third amongst the world’s top GDPs, behind the US, China, and in a virtual tie for third with Germany and Japan. In Tuesday morning news, WMT announced it had agreed to buy display maker VZIO for $2.3 billion (all cash) to bolster its in-store ad revenue. Meanwhile, COF announced it will buy DFS for $35.3 billion in an all-stock deal. (DFS stockholders will receive 1.0192 shares of COF in the exchange, which is a 26% premium on Friday’s DFS closing price.)

In stock legal, governmental, and regulatory news, Bloomberg reported Friday that OpenAI has met with the US Commerce Dept. and other agencies looking to gain approval for their plans to make their own AI chips using at least significant investment from Middle Eastern sources. These cuts began Friday with a second phase coming at the end of Q1. Later, AMZN joined the companies claiming the NLRB regulatory proceedings were unconstitutional. (The claim seems to be that Federal agencies should only be allowed to sue in Federal court rather than finding facts, enforcing federal laws, and assessing penalties.) At the same time, the FDA approved the AMTAGVI from IOVA. That is the first T-cell therapy for solid cancer tumors. After the close, Reuters reported that JPM has agreed to pay $350 million to two US regulators while negotiations with a third regulator are in an advanced stage. The charges stem from the bank’s trading practices and providing incomplete trade data to the regulators. On Monday, the Financial Times reported that the European Commission is set to fine AAPL $539 million over breaches of EU competition laws. (The case alleges that AAPL hindered third-party music services on its devices and favored its own iTunes service and began after a 2019 complaint was filed by SPOT.) If eventually paid, this would be AAPL’s largest fine with the previous record $1.23 billion anti-trust fine ordered in France being eventually beaten down through years of appeal to “just” $400 million.

Overnight, Asian markets were mixed but leaned toward the green side with only four of the 12 exchanges in the red. (Note that this was after an eight-day, holiday closure for mainland Chinese markets.) Malaysia (+1.10%), Taiwan (+0.63%), Hong Kong (+0.57%) and Singapore (+0.56%) led the region higher. South Korea (-0.84%) was by far the biggest loser of the session. In Europe, we see a similar picture taking shape with just five of the 15 bourses in the red at midday. The CAC (+0.38%), DAX (-0.12%), and FTSE (+0.23%) lead the region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a gap down to start the day. The DIA implies a -0.32% open, the SPY is implying a -0.29% open, and the QQQ implies a -0.41% open at this hour. At the same time, 10-year bond yields are down a bit to 4.269% and Oil (WTI) is off 0.45% to $78.83 per barrel in early trading.

The major economic news scheduled for Tuesday is limited to the January US Leading Economic Indicators Index (10 a.m.). The major earnings reports scheduled for before the open include ALLE, BCS, CNP, DAN, EXPD, FLR, GGB, HD, KBR, LGIH, MDT, MIDD, OMI, MD, SCL, TPH, UFPI, VC, WMT, AND WLK. Then, after the close, ANDE, BCC, BKD, CZR, CE, CHK, CYH, CSGP, CWK, CVI, FANG, ESI, ENLC, FLS, GFL, GMED, GPK, IFF, JBT, KEYS, LZB, MTDR, MATX, PANW, PSA, QUAD, O, RNG, SUI, TDOC, VIV, TX, TOL, and WSC report.

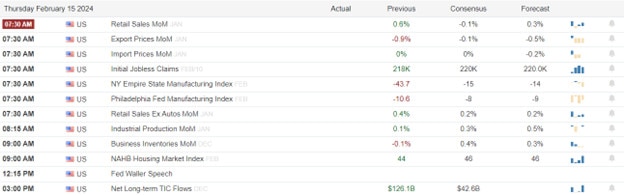

In economic news later this week, on Wednesday, we get the FOMC Meeting Minutes and API Weekly Crude Oil Stocks report. We also hear from Fed members Bostic and Bowman. Then Thursday, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, S&P Global Mfg. PMI, S&P Global Services PMI, S&P Global Composite PMI, January Existing Home Sales, EIA Weekly Crude Oil Inventories, and Fed Balance Sheet are reported, and Fed member Waller speaks. Finally, on Friday there is no major economic news scheduled.

In terms of earnings reports later this week, on Wednesday, ALIT, ADI, AVA, BLCO, CLH, CSTM, EXC, GRMN, GIL, DINO, HSBC, NI, OGE, PRG, TNL, UIS, UTHR, VRSK, VRT, WWW, AGI, ANSS, APA, AGR, BTG, BALY, CWH, CENX, CAKE, CHRD, CHDN, ETSY, EXAS, FG, FNF, HST, HUN, ICLR, JACK, JXN, KALU, MRO, VAC, MOS, NEXA, NDSN, NTR, NVDA, OGS, OUT, PAAS, RRC, RIVN, RYI, SM, SU, RUN, SNPS, TS, TCOM, TBI, VMI, and WES report. Then, on Thursday, we hear from AMBP, BHC, BLDR, LNG, D, DRVN, ETR, FCN, GFI, GRAB, GVA, HNI, IBP, IRM, KDP, LAUR, LKQ, MRNA, NMRK, NEM, NICE, OPCH, PCG, PXD, POOL, PRMW, PWR, STWD, FTI, TECK, TFX, TEF, TRN, UPBD, VAL, W, AGCO, AEE, COLD, ACA, BMRN, SQ, BKNG, CVNA, CTRA, CPRT, EIX, EOG, WTRG, EVH, EXPI, FND, INTU, LYV, MELI, MODV, NE, NOG, NU, OII, ZEUS, PBA, RKT, RHP, SEM, SWN, SFM, SPXC, VALE, VICI, and WKC. Finally, on Friday, AER, ALIZY, BLMN, CLMT, SSP, FMX, FYBR, GTN, HBM, LAMR, RBA, TAC, and WBD report.

So far this morning, HD, MDT, TPH, and WMT reported beats on both the revenue and earnings lines. Meanwhile, ALLE, CNP, FLR, KBR, MIDD, OMI, and VC all missed on revenue while beating on earnings. Unfortunately, BCS, DAN, LGIH, MD, SCL, and WLK all missed on both the top and bottom line. It is also worth noting that HD lowered its guidance.

In miscellaneous news, Bloomberg reported Friday that the US is purchasing missed mortgage payments, for military veterans who had used the Covid-19 mortgage forbearance program. The program is intended to stem a spike in foreclosures on veterans. Elsewhere, China reported a surge in travel over its week-long Lunar New Year holiday season. 474 million trips were made inside mainland China, which was up 34% compared to 2023 and up 19% from pre-covid 2019. The Chinese Ministry of Culture and Tourism said total spending by domestic tourists over the holiday season was $87.9 billion. (However, it should be noted that the holiday was an 8-day event this year, which is one more day than previous Lunar New Year celebrations.) At the same time, US Natural Gas prices fell sharply again Monday as the commodity faces record US production and also the warmest winter ever recorded (since the 1950s). This has resulted in a 53% decrease in the price of Natural Gas in just the last 30 days. Finally, a little trivia. Monday was the 292nd anniversary of the birth of George Washington.

In geopolitical news, on Saturday, the US Navy said it had carried out five self-defense strikes, taking out three anti-ship missiles, a drone boat, and an underwater drone, all launched from Yemen. Then Sunday Iranian-backed Houthis claimed responsibility for an attack on a British cargo ship (sailing under a Belize flag) in the straight off of Yemen’s coast. The crew of the vessel abandoned the ship after the attack and the Houthi claim it is at risk of sinking. (The ship was bound from Saudi Arabia to Bulgaria.) Finally, on Monday, a US-owned (Greek flagged) bulk carrier called for assistance, saying it was under missile attack in the Gulf of Aden (South of the Red Sea, but near Yemen and en route to it). Elsewhere, the MAGA House ducked out of town, shirking US leadership of the free world (again), to preserve a political issue for their party’s disgraced leader. At the same time, that disgraced leader attacked the NATO alliance and threatened to violate US treaty obligations, if elected. In that vacuum, Russian dictator Putin’s army captured Avdiivka, which was formerly a small Ukrainian city of 33,000 in the Donetsk region. Meanwhile, showing the US what real leadership looks like, Denmark announced Sunday it is sending its entire stockpile (every single shell) of artillery to Ukraine. The Czech Republic also stepped up by offering 800,000 artillery shells from its tiny military.

With that background, it appears the Bears are starting the holiday-shortened week in charge. All three major index ETFs are looking to gap lower with the SPY testing its T-line from above, DIA trying to hang on to its own T-line, and QQQ gapping well down through its 8ema. All three are printing indecisive, Dojio-like candles so fat in the premarket. So, the short-term trend has reverted to bearish while the longer-term steep bullish trend has been violated or is being tested now. However, no downtrend has been confirmed…although we do have a lower high in place now. In terms of extension, none of the three major index ETFs is too far from its T-line and the T2122 indicator sits at the top of its mid-range. So, either side has room to run if they can gather the energy to do so. Continue to watch those 10 Big Dog tech names. As mentioned above, they represent a huge portion of the market and if they move together in one direction, it’s hard for indexes to go the other way. Right now, nine of the 10 are bearish with only a massive INTC outlier (+3.26%) in the green.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service