Personal Trade Plan Is Essential To Trading Wealth

Personal Trade Plan Is Essential To Trading Wealth

[video_player type=”embed” width=”560″ height=”315″ align=”center” margin_top=”0″ margin_bottom=”10″ border_size=”5″ border_color=”#000000″]

(It’s Friday) A personal trade plan is essential to trading wealth and Fridays are a good day to evaluate your trade plan. Do you have a 12-month goal? Do you know how much per trade, per week so you need to meet the 12-month goal? Do you know what trade set ups are best for you? We have found from our coaching that those that live by a trade plan profit more money and have a much higher success rate of increasing their wealth.

Friday is the day we count our money and reflect on our weeks trading. How did we do? How can we improve? Take time today to pause on trading and consider education. Reevaluate your trading goals, are your goals on track?

Good Trading – Hit and Run Candlesticks

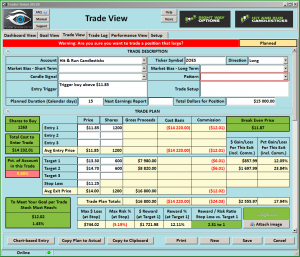

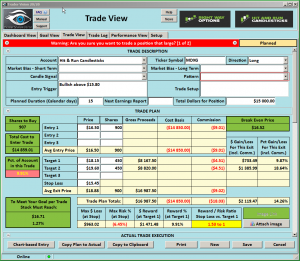

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

►Trade Updates – Hit and Run Candlesticks

What a crazy week! We are still holding our shorts and 1 long. I can’t remember the last time I was only in 3 positions. It is a good feeling going into the weekend.

We have closed 31 positions in the past 31-days and a 55.17% win rate. Over the past 180 days, we are running a 68.91% win rate.

Are you having trouble putting together a winning trade? Not sure what scans to use? So near to having multiple winning trades, but something always goes wrong. Maybe a couple hours with a trading coach could make all the difference in the world. Hit and Run Candlesticks has 4 trading coaches – Learn More about the Coaches

With on-demand recorded webinars, eBooks, and videos, member and non-member eLearning, plus the Live Trading Rooms, there is no end your trading education here at the Hit and Run Candlesticks, Right Way Options, Strategic Swing Trade Service and Trader Vision.

►Eyes on The Market

In Thursdays pre-market blog we warned everyone and WOW! The Bear really woke up. Yesterday we closed below the 50-SMA in a big way, so I suspect we see some kind of relief rally. I do believe this is going to hurt and there will be more downside and of course there will be minor rallies. There is no shame in sitting on your hands until this market cools down. And cash is a position

►What is a Trade Idea Watch-list?

A trade idea watchlist is a list of stocks that we feel will move in our desired direction over a swing trader’s time frame. That time could be one to 15 days for example. From that watch list, we wait until price action meets our conditions for a trade.

Rick’s personal trade ideas for the day MEMBERS ONLY

Start your education with wealth and the rewards of a Swing Traders Life – Click Here

Investing and Trading involve significant financial risk and are not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.