The Bulls Stampede Forward.

The Bulls Stampede Upward

With hurricane Irma, continuing to create damage in Florida the Bulls stampede upward. I guess the market wants to pick up the pieces and tally the costs later. If you ever had a question as to whether the market has a concern for people, then clearly that answer is No! The futures gap up this morning has the potential of creating whipsaw price action so plan accordingly. Let’s also not forget the poison pill running around in North Korea. I doubt our days of high volatility of over just yet. Big moves like this create a lot of emotion. Guard yourself by planning your trades carefully. I can tell you chasing the market with the feeling I was missing out ended up costing a lot of money over the years. Wait, plan, maintain your rules because that is where your edge lies.

With hurricane Irma, continuing to create damage in Florida the Bulls stampede upward. I guess the market wants to pick up the pieces and tally the costs later. If you ever had a question as to whether the market has a concern for people, then clearly that answer is No! The futures gap up this morning has the potential of creating whipsaw price action so plan accordingly. Let’s also not forget the poison pill running around in North Korea. I doubt our days of high volatility of over just yet. Big moves like this create a lot of emotion. Guard yourself by planning your trades carefully. I can tell you chasing the market with the feeling I was missing out ended up costing a lot of money over the years. Wait, plan, maintain your rules because that is where your edge lies.

On the Calendar

A very light Economic Calendar today with only one bill announcement and three bond auctions.

The Earnings Calendar is also very light with only 17 companies reporting result today. A quick scan through them and I see nothing that would be market moving.

Action Plan

The last three days of market price action was nothing more than light volume chop in the indexes. However, there were a remarkable number of good-looking charts and setups. DIA, SPY, and QQQ are all successfully held important levels while IWM remained below the 50-SMA. With North Korea remained quiet over the weekend the futures are pointing to an unbelievably strong open today. As Irma continues to move through Florida leaving behind untold billions in damage in its wake, I’m honestly shocked by the market reaction.

Perhaps the market believed it was going to be much worse. Over the long haul, the hurricane’s damage will likely boost the economy with all the rebuilding efforts and materials consumption. The Dow is looking to gap up more than 100 points retail traders have a difficult decision to make. Do they chase in risking potential whipsaws or do they wait for some of this emotion to subside. Please keep in mind North Korea could upset the apple cart in about half a heart beat once again reversing the market. It’s easy to forget that when we are looking at a 100 point gap.

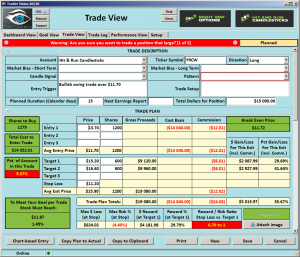

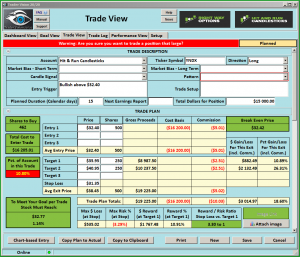

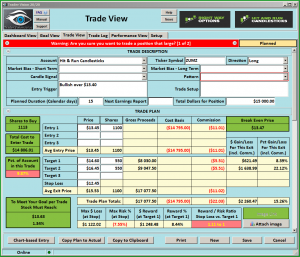

As for me, I will continue to trade with the up trend, but I refuse to chase a gap near market highs. The RWO portfolio has several long trades that should benefit from this gap up, so there is no need to chase. Don’t get caught up in the emotion. Wait for proper low-risk entries that fit your risk tolerance. That way if the market does turn, your risk is manageable. Make sure to plan each trade carefully. If the market has decided it’s going to breakout to new highs, there will be more good entries than we could trade. There is no need to rush.

[button_2 color=”green” align=”center” href=”https://youtu.be/yBcrgLV0SkE”]Morning Market Prep Video[/button_2]Trade Wisley,

Doug