I plan My Trades – I pay myself

(It’s Friday) Because I plan my trades, I can pay myself, on Fridays. Friday is my favorite day of trading because it’s the day I get rewarded from a hard work week. Yep, every Friday I write a paycheck to myself from my trading account.

(It’s Friday) Because I plan my trades, I can pay myself, on Fridays. Friday is my favorite day of trading because it’s the day I get rewarded from a hard work week. Yep, every Friday I write a paycheck to myself from my trading account.

►Friday is the day we count our money and reflect on our weeks trading. How did we do? How can we improve? Take time today to pause on trading and consider education. Reevaluate your trading goals, are your goals on track?

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 9:10 EST AM every morning. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

Give us a try If you would like to learn what and how we do it click here to give us a try, cancel at any time.

►Eyes on The Market

Tax Reform is revving up – Futures are up, and the bullish trend continues. Yesterday the SPY gapped down and then recovered nicely. Follow the trend and Price Action – The way of the Ninja LOL.

Rick’s Swing Trade Ideas • MEMBERS ONLY

[button_2 color=”green” align=”center” href=”https://hitandruncandlesticks.com/hit-and-run-candlesticks/” new_window=”Y”]Learn With Us • Earn With Us[/button_2]

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Focus on your rules and trade plan.

The October rally has been a full-on Bull party that has lasted 15 days in Dow. As with all great parties they eventually come to an end and the hangover begins. I’m sure there are many looking at the futures this morning might be feeling some panic, but try to put this pullback into perspective. As it stands right now, Dow 23,000 is holding and the sky is not falling. All healthy rallies must take a break or pullback to test trends or price support. It’s the natural progression of price action. So, try to avoid knee jerk emotional decision making today. Focus on your rules and trade plan. They are there to protect you but only if you allow them to do so.

The October rally has been a full-on Bull party that has lasted 15 days in Dow. As with all great parties they eventually come to an end and the hangover begins. I’m sure there are many looking at the futures this morning might be feeling some panic, but try to put this pullback into perspective. As it stands right now, Dow 23,000 is holding and the sky is not falling. All healthy rallies must take a break or pullback to test trends or price support. It’s the natural progression of price action. So, try to avoid knee jerk emotional decision making today. Focus on your rules and trade plan. They are there to protect you but only if you allow them to do so.

On the Calendar

The Thursday Economic Calendar begins with Jobless Claims and the Philly Fed Business Outlook Survey at 8:30 AM Eastern. With the hurricane effects still a bit of a wild card, forecasters expect the weekly claims coming in at 243K this week. The Philly Fed Survey remains incredibly strong last month coming in at the highest level in the 50-year history of the report. The consensus for October is 20.2 vs. 23.8 last month. We have one Fed Speaker at 9:45 AM followed by the Leading Indicators report at 10:00 AM. The Treasury Budget is at 2:00 PM but would be highly unlikely to move the market.

Today is the biggest day of the week on the Earnings Calendar with more than 120 companies reporting. Stay on your toes as ramp up the numbers of reports because it’s not unusual for the market to become quite bumpy. Individual stock can have violent moves that carry over into the indexes in the premarket and aftermarket sessions making it very challenging for the retail trader.

Action Plan

While the DIA and SPY managed to close at new record highs yesterday the QQQ and the IWM seemed content to just consolidate. The DIA leaving behind a big gap at a new market high always concerns me and it would appear that concern is valid looking at the futures this morning. The 160 points gained in the DOW yesterday may now be mostly taken back with gap down at the open. A clear reminder that chasing a rally can be a very painful lesson.

As usual I will be more focused on taking profits as we head into the weekend than looking for new risk. With the gap down keep a close eye on current trades cutting losing positions and taking profits as per your trade plans. Try to avoid emotional decisions and stay focused on your rules because they will protect you from you.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/th4zSNNKORc”]Morning Market Prep Video[/button_2]

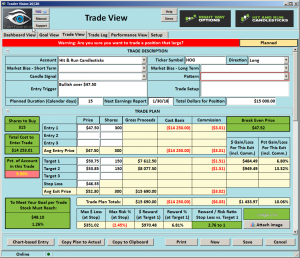

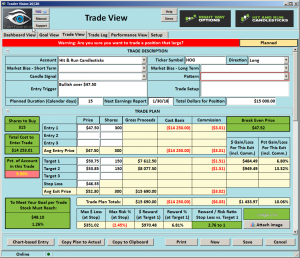

HOG – RBB Strategy Above The 50-SMA

HOG (Harley Davidson), The HOG Chart, is now an (RBB) Rounded Bottom Breakout strategy above the 50-SMA. We have a double bottom in the $45.50 area and a Bullish Cradle pattern that pushed HOG into the (RBB) chart strategy. Over $47.50 the chart has a Bullish chance to see $53.85 [Tip] wait for the breakout and low-risk entry.

HOG (Harley Davidson), The HOG Chart, is now an (RBB) Rounded Bottom Breakout strategy above the 50-SMA. We have a double bottom in the $45.50 area and a Bullish Cradle pattern that pushed HOG into the (RBB) chart strategy. Over $47.50 the chart has a Bullish chance to see $53.85 [Tip] wait for the breakout and low-risk entry.

►Candle Pattern

Bullish Engulf • Doji Continuation

Low-risk entries • Trade with us • Learn more with us • Profit with us •. You will not find a better trading support group, up to you.

► Ticker Update (GGG) –

You could have profited about 9.27% or about $1076.00, with 100 shares when we posted to our members on August 1st.

If you are interested in the next level of trading profits • Rick Saddler founder of Hit and Run Candlesticks offers private coaching • LEARN MORE

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 8:45 EST AM every morning with the HOG and then Rick at 9:10 EST. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

► Eyes On The Market (SPY)

This past year I have introduced the T-Line Bands and how to use them, this past Tuesday evening we had a Members e-Learning webinar on them. You may find them very useful in the next few days. The SPY, IWM, QQQs, IYT may challenge the Lower Purple Band. I will be using the Lower Band to help with the attitude of charts that test the band.

Rick’s trade ideas for the day – MEMBERS ONLY

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/hit-and-run-candlesticks/” new_window=”Y”]Low-risk entries • Trade with us • Learn more with us Profit with us[/button_2]

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Member’s Webinar

Member’s Webinar

In this webinar, we discussed the Blue Ice failure and Bearish “h” Patten AND Bullish Breakout patterns using the T-Line Bands

[video_player type=”embed” width=”560″ height=”315″ align=”center” margin_top=”0″ margin_bottom=”20″] [/video_player]

[/video_player]

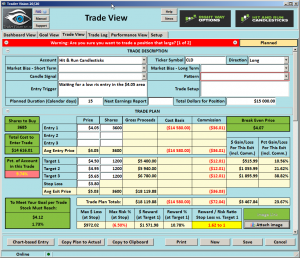

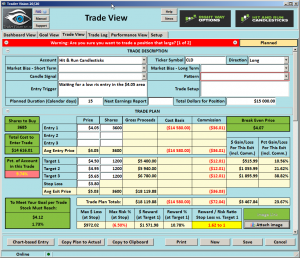

CLD – Broke Out, Bullish J-Hook Pattern

CLD (Cloud Peak Energy), The CLD Chart, broke out of a Bullish J-Hook Pattern after completing an RBB pattern. Price dipped and now has broken back over the upper T-Line Band and a 5-month base on good volume. [Tip] wait for a low-risk entry.

CLD (Cloud Peak Energy), The CLD Chart, broke out of a Bullish J-Hook Pattern after completing an RBB pattern. Price dipped and now has broken back over the upper T-Line Band and a 5-month base on good volume. [Tip] wait for a low-risk entry.

►Candle Pattern

PBO, Inverted Hammer on support

Low-risk entries • Trade with us • Learn with us • Profit with us •. You will not find a better trading support group, up to you.

► Ticker (GLUU) – You could have profited about 60% or about $175.00, with 100 shares when we posted to our members on August 3rd. If you would like to see a 3-5 minute video on how to trade GLUU, please contact Rick

Good Trading – Hit and Run Candlesticks

Learn more about Hit and Run Candlesticks, and today’s trade idea and plan plus the 10 or more members trade ideas, starting at 8:45 EST AM every morning with the HOG and then Rick at 9:10 EST. Every day we teach and trade using the T-Line, Candlesticks, Support and Resistance, Trends, chart patterns and continuation patterns.

► Eyes On The Market

DJ-30 hits 23K – What a great year this has been to trade! The market has been tuned up and purs like a kitten.

Follow a few simple steps, and the charts will treat you right. [Example] following the price action and the T-Line together can be eye-opening when you leave your baggage at the door. If you were at the member’s e-learning last night, you saw first hand how using the T-Line Bands can help with success.

The SPY remains bullish • IWM gives me concern • Transports gives me concern • T2122 indicator looks to be dropping and below the 34-EMA

Rick’s trade ideas for the day – MEMBERS ONLY

[button_2 color=”green” align=”center” href=”https://hitandruncandlesticks.com/hit-and-run-candlesticks/” new_window=”Y”]Subscribe • Cancel Anytime[/button_2]

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

The Bulls are firmly in control.

The Bulls are firmly in control and the Bears are either running for their lives or have gone into hibernation. The news of the 23K Dow print spread like wild fire yesterday afternoon. The President even chimed in on the subject as he was pushing for the tax reform legislation. Those sitting out are really feeling the pressure of missing out right now and are likely to charge in pushing us even higher. It may seem completely irrational and nonsensical to you but for goodness sake don’t try and fight this move. To do so would be akin to trying hold back the tide. Also don’t become complacent or chaise. Focus on price and have a plan!

The Bulls are firmly in control and the Bears are either running for their lives or have gone into hibernation. The news of the 23K Dow print spread like wild fire yesterday afternoon. The President even chimed in on the subject as he was pushing for the tax reform legislation. Those sitting out are really feeling the pressure of missing out right now and are likely to charge in pushing us even higher. It may seem completely irrational and nonsensical to you but for goodness sake don’t try and fight this move. To do so would be akin to trying hold back the tide. Also don’t become complacent or chaise. Focus on price and have a plan!

On the Calendar

We begin the hump day Economic Calendar today with Housing Starts at 8:30 AM Eastern. The September consensus is 1.170 million annualized starts and 1.238 million permits which constitutes a slight slowing in both metrics. At 10:30 AM the EIA Petroleum Status report will be released. I think most are expecting to see demand growth and supplies continuing to decline slowly. Then at 2:00 PM is the Beige Book and the Treasury Budget which come out about 2 weeks prior to the next FOMC meeting. It’s unlikely they will move the market.

The number of reports continue to shuffle around a bit but today the Economic Calendar has about 80 companies reporting today. AXP, AA, EBAY, UAL, UTI, KMI are just some of the notable reports today. Please make sure to check reporting dates as part of your daily preparation.

Action Plan

Although I was sitting in a doctor’s office I caught the close on my phone and was not surprised to see new record highs once again. For a moment the Bulls push the Dow over 23,000. On my drive 2-hour home I was flipping through the radio stations and heard at least 3 reports on the 23k print and even a sound bite from the President. I thought to myself the “Fear of Missing Out”, crowd will likely gap the market higher tomorrow. As of now, that thought seems appears correct, with the Dow futures pointing to more than a 50-point gap up.

Don’t chaise but stay with the trend. The bulls are firmly in control and as long earnings report continue to be mostly positive higher prices are likely. Remember to take some profit along the way to relieve pressure on trades.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/ikJyC0z8lhY”]Morning Market Prep Video[/button_2]

The Trend is Strong

Just when you think the market is about to take a breath and rest the Bulls step up and drive us even higher. Once again new record highs ring out inspiring more and more buyers to enter the market. With earnings session underway anything is possible, but so far they have been coming in strong that could continue fueling the Bulls to push even higher. The trend is strong and clearly very bullish.

Just when you think the market is about to take a breath and rest the Bulls step up and drive us even higher. Once again new record highs ring out inspiring more and more buyers to enter the market. With earnings session underway anything is possible, but so far they have been coming in strong that could continue fueling the Bulls to push even higher. The trend is strong and clearly very bullish.

Don’t try and fight or just might find yourself under the hooves of charging bulls. There was a time in my trading career when I believed I had gained so much knowledge and skill I could predict the market. I would find myself often trying to fight the market trend allowing my bias to control my decisions. Long story short, my accounts suffered tremendous damage as a result. Whether it seems rational or not work within the trend as long as it continues.

On the Calendar

The Economic Calendar starts off with Import and Export Prices at 8:30 AM Eastern. Conseensus sees a 0.5% gain vs. 0.5% percent last month. At 9:15 AM is the most important number of the day, Industrial Production. Forestasters are calling for a 0.4% September gain in production numbers. Then at 10:0 AM the Housing Market Index is expected to hold unchanged at 64. Then at 2:00 PM is the Treasury Budget wihich is calling for a 3.0 billion surplus. Then at 4:00 PM is the Treasury International Capital which tracks financial instrments in and our of the the country.

The Earnings Calendar has bumped up to more than 50 companies expected to report results today. JNJ, IBM, GS, PGR, CREE, HOG, MS are some of the notables reporting. NFLX reported good results after the close yesterday.

Action Plan

I sometimes feel a little like Bull Murray in “Goundhog Day,” when everyday I repeat the market has once again set new records. As is case for yesterday with the DIA, SPY and QQQ’s all closing at new record highs once again. The IWM lagged behind choosing instead to remain in a tight consolidation range. The VIX continues to hover just above record lows and hanging on to its sub ten reading.

Although this run seems to be a bit long in the tooth, the Bears seem to be no where in sight. At this time there also seems to be no Fear of their return at the moment. Common sense keeps telling me this can’t go on forever. However betting against or standing aside in a wildly bullish market such as this would be a mistake. If earnings begin to roll in showing that most companies can support these lofty price levels, then the trend up could continue much longer. Set aside your bias and trade the charts in front of your with a focus on price action.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/sNoQX0i-l9s”]Morning Market Prep Video[/button_2]

(It’s Friday) Because I plan my trades, I can pay myself, on Fridays. Friday is my favorite day of trading because it’s the day I get rewarded from a hard work week. Yep, every Friday I write a paycheck to myself from my trading account.

(It’s Friday) Because I plan my trades, I can pay myself, on Fridays. Friday is my favorite day of trading because it’s the day I get rewarded from a hard work week. Yep, every Friday I write a paycheck to myself from my trading account.